Investor fears introduced on by the Covid-19 Delta variant are resulting in a safe-haven scramble to bonds, which pushed gold greater throughout Monday’s buying and selling session—a attainable signal of extra upside forward.

Gold costs moved nearer to their 200-day transferring common for gold costs, which might point out long-term momentum. A Kitco Information report detailed the transfer to begin the week.

“The gold market has discovered a brand new bounce in its step, with the money market retesting its 200-day transferring common as bond yields proceed to drop,” the report mentioned. “Bond yields in New York ‘s afternoon session dropped to a session low of 1.16%, which in flip has pushed spot gold costs to $1,815.40 an oz., roughly unchanged on the day. Gold ‘s futures costs on Comex are nonetheless buying and selling below the 200-day transferring common however are close to session highs.”

A key mover for gold may very well be the infrastructure invoice that is trying to push via the Senate this week. The trillion-dollar plan may very well be an inflationary transfer pushing traders to go to gold as a countermeasure.

“Regardless of the place you look, inflation is right here, and the Federal Reserve goes to stay accommodative,” mentioned Daniel Pavilonis, senior commodities dealer with RJO Futures. “The infrastructure invoice goes to be extremely inflationary, and that will probably be good for gold.”

“Gold has managed to push again to its 200-day transferring common, and if it may possibly keep right here, we might see an enormous transfer to the upside,” Pavilonis added.

Gold Publicity through Miners

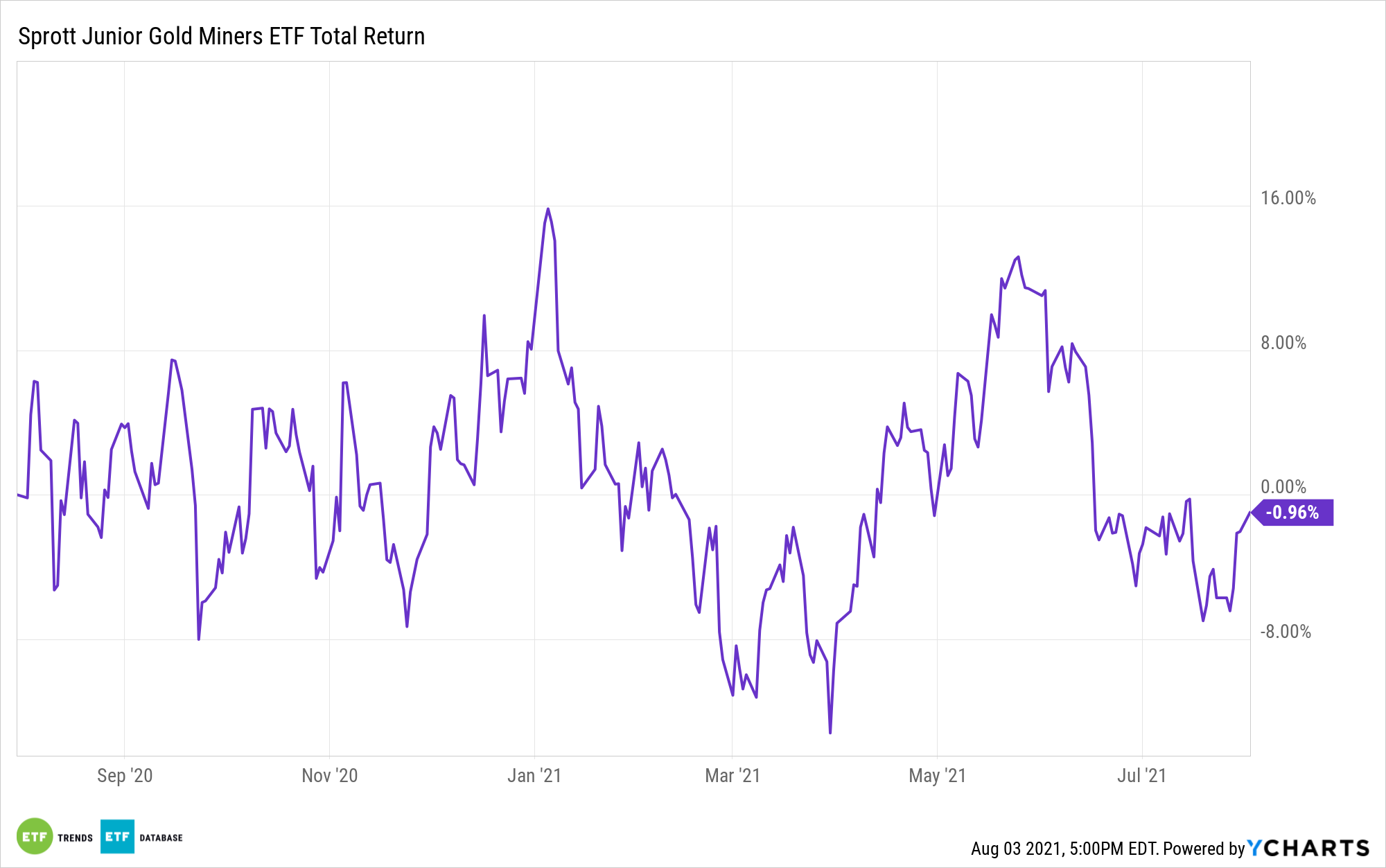

There are a number of methods traders can get in on the gold motion with out subjecting themselves to the heavy fluctuations of the gold market. A method is through ETFs just like the Sprott Junior Gold Miners ETF (SGDJ).

SGDJ seeks funding outcomes that correspond to the efficiency of its underlying index, the Solactive Junior Gold Miners Customized Issue Index. The index goals to trace the efficiency of “junior” gold corporations primarily situated within the U.S., Canada, and Australia whose frequent inventory, American Depositary Receipts (ADRs), or International Depositary Receipts (GDRs) are traded on a regulated inventory change within the type of shares tradeable for overseas traders with none restrictions.

For extra information, info, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.