Like it or not, inflation is right here, and as transitory as it might be, advisors and traders are making ready for the worst. One inflation-advantaged asset class are actual property funding trusts (REITs).

Higher nonetheless may very well be the concept of embracing the actual property phase with lively administration by way of the ALPS Lively REIT ETF (NASDAQ: REIT). As an lively fund, REIT can probably provide superior inflation-fighting qualities with the potential for extra revenue than conventional index-based actual property funds.

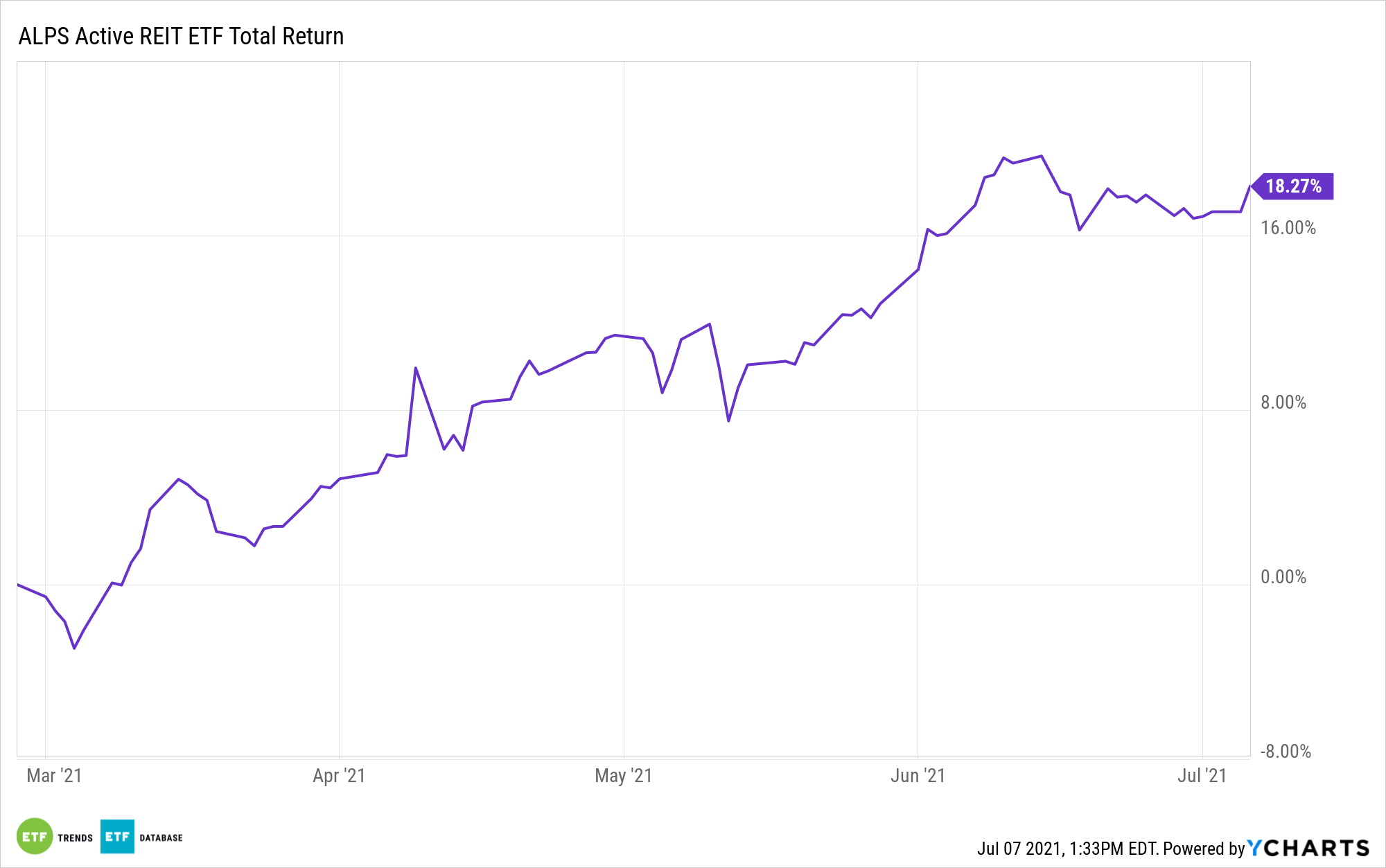

Though REIT is just some months outdated – it launched in March – the fund is up a formidable 16%. Mix that with its capacity to guard portfolios from the ravages of inflation and it may be mentioned that the fund is a major instance of a well-timed new ETF.

“Traditionally, when inflation has risen, shares and actual property have tended to fare comparatively effectively in contrast with bonds,” in line with Constancy analysis. “Whereas previous efficiency gives no ensures about what might occur sooner or later, the observe report of each shares and actual property might make this an excellent time to search out out extra about REITs, that are corporations that personal, function, or finance income-generating actual property together with places of work, flats, procuring facilities, resorts, and extra.”

The Proper Time for REIT?

When inflation perks up, REITs provide traders an alluring mixture of inflation hedging, above-average revenue, pricing energy, and the potential for capital appreciation.

Lively administration can also be an essential trait whatever the inflationary setting as a result of not all actual property shares carry out in lockstep with one another. Stated one other means, the sector is like another in that there are occasions when some business teams are main whereas others are lagging. Lively funds can keep away from the laggards or promote out of them rapidly.

“Whereas REITs general could also be enticing, although, would-be traders want to know that not each REIT is equally enticing. REITs usually concentrate on sure sorts of properties akin to retail or condo buildings and COVID-19 has accelerated tendencies which might be remodeling actual property markets, benefiting some sorts of properties and disfavoring others,” provides Constancy.

The communications, knowledge middle, and industrial REIT segments are trying significantly enticing at current.

Different REIT ETFs embody the Schwab US REIT ETF (NYSEArca: SCHH) and the Pacer Benchmark Information & Infrastructure Actual Property SCTR ETF (SRVR).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.