By Michael Orzano, Senior Director, World Fairness Indices, S&P Dow Jones Indices

By Michael Orzano, Senior Director, World Fairness Indices, S&P Dow Jones Indices

For a U.S. investor, developed market publicity exterior of the U.S. is a core constructing block in forming a complete world portfolio. Partially due to its standing because the world’s first worldwide fairness index, MSCI EAFE enjoys a commanding market presence for worldwide fairness benchmarks. It additionally serves because the underlying index for most of the largest worldwide fairness ETFs and index funds. Nonetheless, what many don’t notice is that MSCI EAFE excludes Canadian securities fully, which can create an unintended hole in publicity or replicate an unfair efficiency benchmark for a supervisor centered on developed ex-U.S. equities.

In our third weblog in a sequence highlighting key options of the worldwide fairness benchmark panorama, we discover the restrictions of selecting MSCI EAFE as a regional illustration of the worldwide equities asset class.

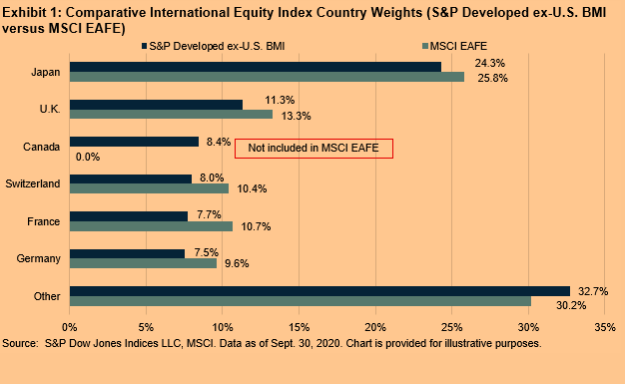

Exhibit 1 depicts the nation composition of MSCI EAFE in comparison with the S&P Developed ex-U.S. BMI, which incorporates all developed markets excluding the U.S. With an 8.4% weight, Canada was the third largest market out of the 24 international locations included within the S&P Developed ex-US BMI as of Sept. 30, 2020.

With out a separate, standalone allocation to Canada, a world fairness portfolio primarily based on the S&P 500®, MSCI EAFE, and an rising markets fairness index would exclude Canada, the world’s fifth largest fairness market, fully.

When evaluating worldwide fairness index exposures, it’s essential to completely perceive the underlying benchmark being tracked to make sure it’s overlaying all international locations you count on it to incorporate. Equally, an actively managed fund shouldn’t be benchmarked to an index that excludes Canada if its mandate is to spend money on all developed markets excluding the U.S. Bear in mind to look below the hood otherwise you may be inadvertently excluding main international locations out of your world fairness alternative set.

To be taught extra concerning the complete protection of the S&P World BMI Index Sequence, see The S&P World BMI: Offering Constant Insights into World Fairness Markets since 1989.

Initially revealed by Indexology, 11/5/20

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.