With an election week underway, gold simply might beat out each purple and blue. The commodity is a

With an election week underway, gold simply might beat out each purple and blue. The commodity is already seeing a powerful yr amid the pandemic and that would proceed, however traders must push by the volatility first.

“Properly, traders ought to look previous the elections already,” wrote in an OilPrice.com article. “They matter lower than many individuals consider. The 2016 presidential election is the most effective instance of that. The worth of gold certainly declined within the aftermath of Trump’s victory, however the downward development was finally reversed.”

“So, sure, you need to be ready for elevated volatility this week,” the article added. “In spite of everything, we’re about to witness not solely the elections but in addition the FOMC assembly and equally vital financial stories, together with the nonfarm payrolls. Nevertheless, as I’ve repeated many instances earlier than, gold’s responses to geopolitical occasions are comparatively short-lived. In the long term, what drives gold costs are the basic elements. And the basic outlook stays constructive for the yellow steel. Each the financial coverage and the fiscal coverage are extraordinarily dovish. The general public debt is ballooning, whereas the US greenback is weakening. The true yields stay damaging.”

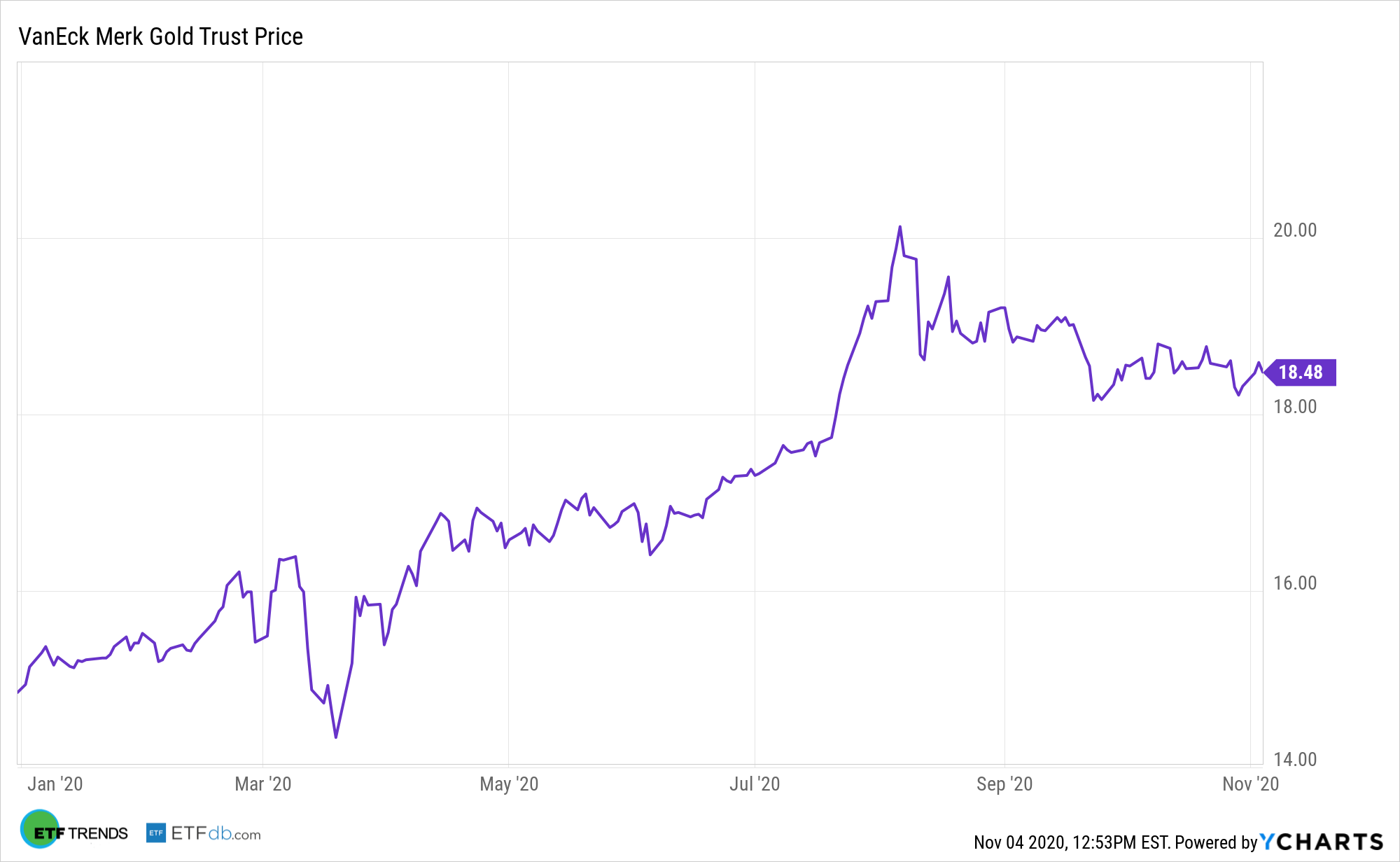

This all bodes effectively for gold ETFs just like the VanEck Merk Gold Belief (OUNZ). OUNZ seeks to supply traders with a possibility to spend money on gold by the shares and be capable of take supply of bodily gold in change for these shares. The Belief’s secondary goal is for the shares to replicate the efficiency of the value of gold much less the bills of the Belief’s operations.

Every share represents a fractional undivided useful curiosity within the Belief’s internet property. The Belief’s property consist principally of gold held on the Belief’s behalf in monetary establishments for safekeeping.

OUNZ gives traders:

- Deliverability: VanEck Merk Gold Belief holds gold bullion within the type of allotted London Bars. It differentiates itself by offering traders with the choice to take bodily supply of gold bullion in change for his or her shares.

- Convertibility: For the aim of facilitating supply, Merk has developed a proprietary course of for the conversion of London Bars into gold cash and bars in denominations traders might need.

- Tax Effectivity: Taking supply of gold is just not a taxable occasion as traders merely take possession of what they already personal: the gold.

As talked about, one of many key advantages of OUNZ is the power to change shares of the ETF for bodily gold. Per the fund’s web site, in the event you’re an “investor excited about taking supply of bodily gold in change in your OUNZ shares (Supply Candidates), you could submit a signed Supply Utility to Merk Investments LLC (the ‘Sponsor’).”

For extra information and data, go to the Revolutionary ETFs Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.