Online purchasing is not a dist

Online purchasing is not a distinct segment part of the retail sector, and merchants can maintain enjoying its progress with leveraged funds such because the Direxion Every day Retail Bull 3X ETF (RETL).

The pandemic solely accelerated that progress, particularly throughout the previous yr. Social distancing measures have pushed beforehand hesitant consumers into adopting on-line retail.

“After we take into consideration the COVID-19 pandemic’s influence on how individuals store — and on how retailers cater to their wants — it’s necessary to acknowledge that client preferences to ‘purchase on-line, decide up in retailer’ and to benefit from different digitally enabled options are usually not merely short-term shifts,” a MIT Sloan Administration Overview article famous. “In reality, the present interval is extra probably a tipping level within the digitization of retail and within the shifting energy dynamics between purchaser and vendor.”

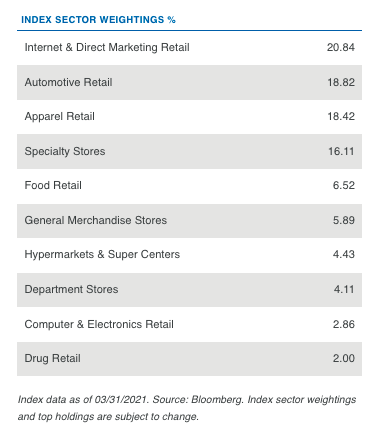

Sector weightings for the fund are under:

Total, RETL seeks each day funding outcomes of 300% of the each day efficiency of the S&P Retail Choose Business Index. With its triple leverage, RETL provides buyers the power to:

- Amplify short-term perspective with each day 3X leverage;

- Go the place there’s alternative, with bull and bear funds for either side of the commerce; and

- Keep agile, with liquidity to commerce by way of quickly altering markets.

Altering Client Habits

The adoption of on-line purchasing is shapeshifting client conduct. Not solely are customers buying items and companies on-line, they’re using the web in new methods.

“The standard business-to-consumer retail mannequin has unraveled in recent times, and COVID-19 has accelerated a push towards a brand new period of consumer-to-business relations,” the MIT article stated additional. “On this new mannequin, customers have change into retailers in their very own proper, shopping for from a broad spectrum of retail channels, curating and selling their very own array of merchandise by way of their social media accounts, reselling used items by way of digital platforms, and setting the phrases for the way their purchases get to their doorsteps.”

“Customers not depend on retailers the identical means they did within the conventional mannequin,” the article added. “Relatively than trusting the identical retailer for the very best costs and the broadest choice, individuals are extra more likely to skip from supply to supply, powered by peer suggestions and value comparability purchasing as they go.”

For extra information and data, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.