Is The 60/40 Portfo

Is The 60/40 Portfolio Damaged?

If So, Then Repair It!

(Unique Put up August 2018, Up to date June 2021)

DOWNLOAD PDF

What Will Be Lined

Challenges to the Conventional Portfolio

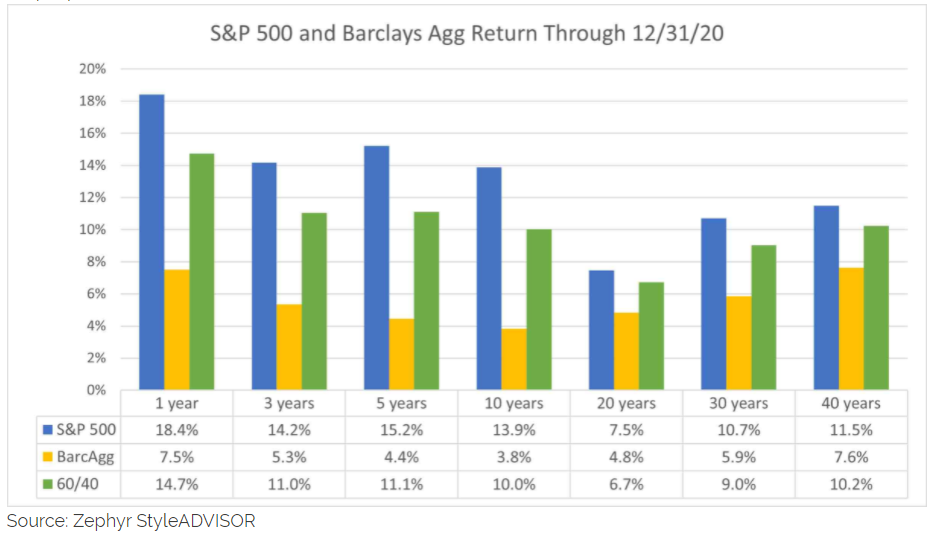

For many years, the usual illustration for a balanced portfolio has been the “60/40”- 60% equities, 40% bonds. Though most traders diversified past this mannequin and included small caps, overseas shares, excessive yield bonds, and maybe one thing extra unique like REITs or commodities, a easy mixture of 60% S&P 500 and 40% Barclays U.S. Combination Bond is usually the shorthand definition of a balanced portfolio.

[wce_code id=192]

The Attraction of the 60/40

For a technology, this easy strategy labored nicely. Shares offered capital appreciation and dividends, albeit with a dose of volatility. Bonds produced yield, capital appreciation as charges fell, and acted as a volatility dampener when shares went south. One might have met actuarial calls for of seven%, 8%, and even 9% through this easy portfolio.

Trying on the above numbers, one is perhaps tempted to say, “If it ain’t broke, then don’t repair it.” Nonetheless, such an strategy is dangerously naïve.

The straightforward reality is that the probability of bonds posting returns anyplace close to their historic ranges is near zero.

Protecting an Eye on the Yield Curve

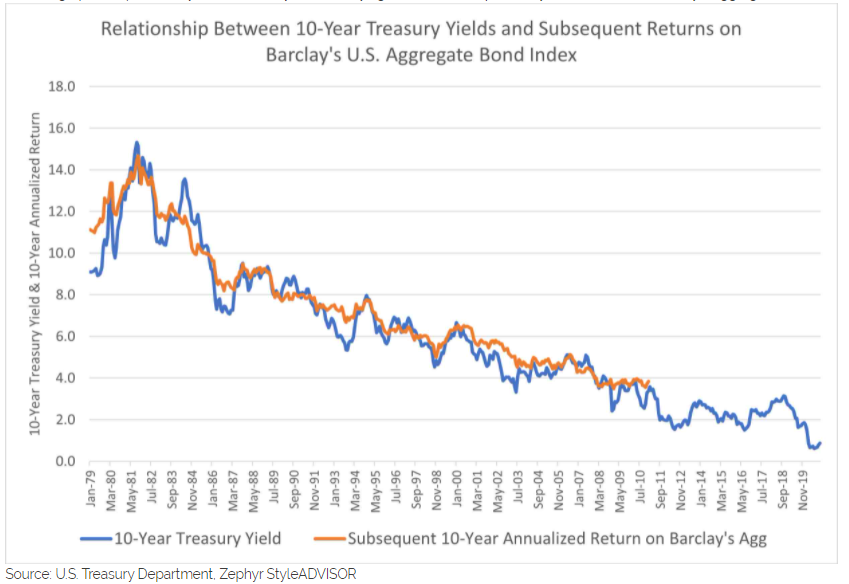

Within the graph under we are able to see how the present yield has been a really robust indicator of what future returns within the bond market is perhaps. The graph compares the yield on the 10-year Treasury in opposition to the next 10-year return on the Barclay’s Combination Index.

With yields at present within the sub-2% vary, the forecast for future bond returns in not good.

What affect does this have on the usual 60/40 combine?

Influence of Low Yields on Portfolio Return

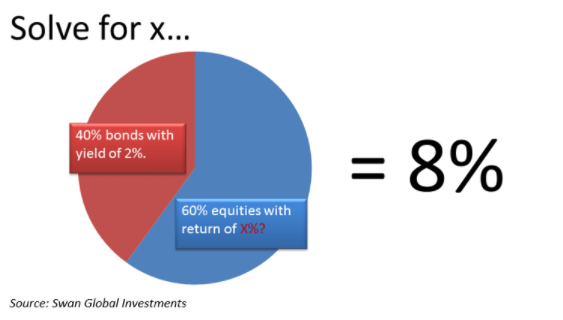

Let’s run a easy algebraic calculation. Assume we’ve a typical 60/40 combine and the goal return for the general portfolio is 8%. If we assume that the 40% place in fastened revenue will return 2%, what would the remaining 60% in equities need to return with the intention to carry the portfolio as much as 8%?

The reply could come as a nasty shock: 12%.

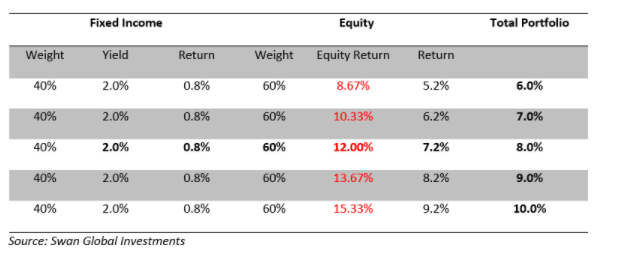

If bonds can solely ship a 2% return, then equities should return 12% with the intention to produce an total portfolio return of 8%. The desk under particulars the degrees of returns the 60% place in fairness should generate with the intention to obtain totally different ranges of whole portfolio returns, assuming the fastened revenue return is locked in at 2%.

Unappealing Choices

Given these circumstances, traders are left with an unappealing set of choices, which embrace:

- Reducing the return expectation for the general portfolio

- Taking over extra danger and growing the fairness portion

- Merely hoping that the capital markets will do higher than anticipated and ship excessive returns

Hoping that capital markets will do higher than anticipated is a harmful selection.

A forecasted return of two% on bonds would possibly really be too beneficiant. In any case, ten- yr yields are only one.58% as of Might 31st, 2021. Furthermore, ought to charges rise bonds might undergo losses.

Rising Charges Means Shedding Worth

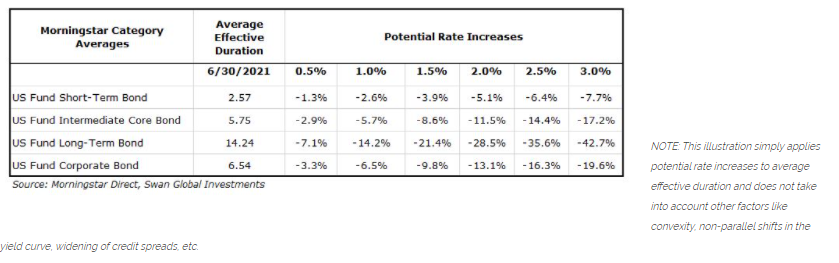

The common length of a number of Morningstar fastened revenue classes is listed under. Ought to charges rise the common fund in these classes could be anticipated to lose the next quantities.

Though bonds are sometimes assumed to play the “capital preservation” position in a portfolio if charges rise it’s extremely possible bonds will as a substitute ship losses.

A Higher Choice

At Swan World Investments, we consider there’s an alternative choice. We consider the normal 60% fairness/40% fastened revenue portfolio is essentially damaged and wishes assist.

Buyers are caught between a rock and a tough place, as each fairness markets and glued revenue markets are buying and selling at all-time highs. We consider that the Outlined Threat Technique is a greater resolution and helps repair the issues with conventional balanced portfolios.

Launched in 1997, the Outlined Threat Technique is a hedged fairness strategy that mixes lengthy publicity to the fairness market through ETFs, efficient hedging strategies, and volatility seize in a single technique designed to offer constant rolling returns all through rising, declining, or flat markets with none dependency on fastened revenue or rates of interest.

Click on to be taught extra about Swan’s DRS funding strategy and the way this strategy has fared previously.

For extra data please contact Swan at 970-382-8901.

Initially printed by Swan World Investments

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.