By Raymond McConville, Communications, Americas, S&P D

By Raymond McConville, Communications, Americas, S&P Dow Jones Indices

On Sept. 4, 2020, S&P DJI’s U.S. Index Committee introduced that Etsy, Teradyne, and Catalent had been being added to the S&P 500®, changing H&R Block, Coty, and Kohl’s.

The adjustments attracted important market consideration and sparked a dialogue across the names being added to the index, in addition to those who weren’t. These updates additionally coincided with the S&P 500’s scheduled quarterly rebalancing. Modifications to the index will be made at any time—they don’t have to occur throughout quarterly rebalances. Nevertheless, given the higher-than-usual consideration, it’s value revisiting the S&P 500’s goal and goal, what the Index Committee does, and the way the committee helps make sure that the index is doing its job.

What Is the S&P 500’s Goal?

The S&P 500 is synonymous with U.S. fairness market efficiency and is referenced by traders, analysts, and the media daily. The index was up 1.5% in the present day? Nice, the S&P 500 is doing effectively! Did the market decline? Uh-oh, the S&P 500 did poorly. However whether or not the index is “doing a great job” has little to do with the course of its returns.

Per the S&P U.S. Indices Methodology, the target of the S&P 500 is to “measure the efficiency of the large-cap section of the U.S. market.” That’s it. The job of the Index Committee is to not add shares that it thinks will carry out effectively. As a substitute, it makes certain the index continues to supply a consultant reflection of the massive cap U.S. fairness market.

Rebalancing versus Reconstituting

The U.S. large-cap market has modified considerably through the years and there are a number of methods the Index Committee ensures that the 63-year-old S&P 500 displays that evolution. Considered one of them is by rebalancing the index.

Throughout a rebalance, S&P 500 constituents’ particular person weights are adjusted to mirror their newest share counts and float. Firm share counts are always altering as they problem inventory and carry out buybacks, so the S&P 500 is rebalanced each quarter to regulate every firm’s weighting primarily based on its newest share rely and float.

Whereas the Index Committee can even reconstitute the index throughout a rebalance by including or eradicating corporations, these adjustments to index membership will be made at any time—they don’t need to occur throughout a rebalance and a rebalance doesn’t have to incorporate a reconstitution.

For the reason that starting of 2017, 82 corporations have been added to the S&P 500.

So, Is the S&P 500 Doing Its Job?

This brings us again to our first query. Have all of the adjustments made through the years by the Index Committee helped the index precisely signify the U.S. large-cap market?

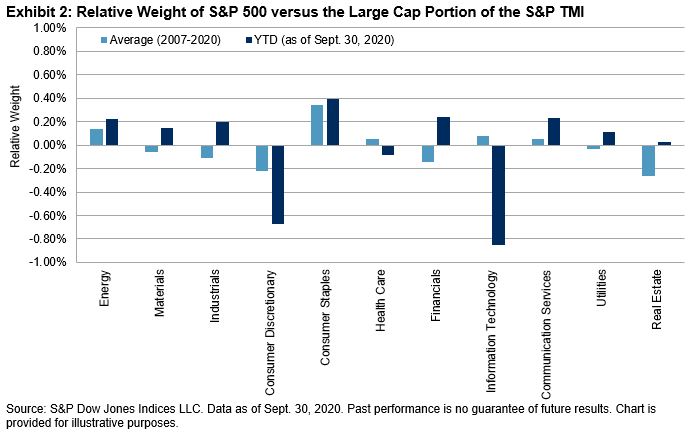

A technique we will grade the S&P 500’s efficiency is thru sector illustration. For the reason that index has a hard and fast rely of 500 corporations, not each eligible firm will be added to the index. One of many elements the Index Committee appears to be like at when contemplating adjustments to the index is sector composition. Per the index methodology, that is measured by a comparability of GICS® sector weights within the S&P 500 with the corresponding weights within the large-cap vary of the S&P Whole Market Index (TMI), which measures the efficiency of all U.S. shares.

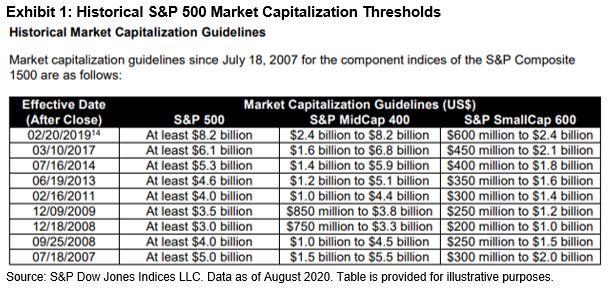

Utilizing the historic market capitalization thresholds from Appendix A of the S&P U.S. Indices Methodology doc, we will arrive on the GICS sector weights for the large-cap part of the S&P TMI.

Exhibit 2 reveals the relative sector weights of the S&P 500 towards the large-cap portion of the S&P TMI. The common distinction relies on year-end weights between 2007 and 2020.

Clearly, the S&P 500 GICS sector weights have usually been just like the large-cap portion of the S&P TMI. And whereas some variations have emerged in 2020, the S&P 500 stays consultant of the large-cap U.S. fairness area. The index is doing its job.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.