In as we speak's market uncertainty, it is vital to get di

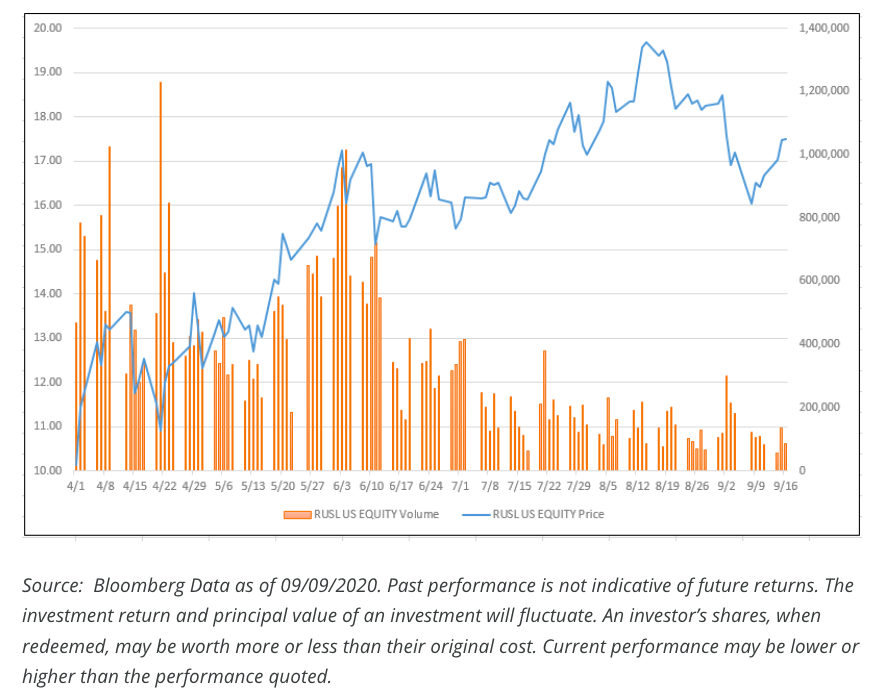

In as we speak’s market uncertainty, it is vital to get diversification from different elements of the globe for positive factors, however which nations ought to merchants deal with? One nation they might wish to give a better look is Russia and particularly, the Direxion Every day Russia Bull 3X ETF (NYSEArca: RUSL).

RUSL seeks each day funding outcomes that equal 200% of the each day efficiency of the MVIS Russia Index. The fund invests at the very least 80% of its web property in monetary devices and securities of the index, ETFs that monitor the index and different monetary devices that present each day leveraged publicity to the index or ETFs that monitor the index.

The index is meant to characterize the general efficiency of publicly traded firms which might be domiciled and primarily listed on an change in Russia or that aren’t Russian firms, however nonetheless generate at the very least 50% of their revenues in Russia.

“Having trended sideways by way of the primary half of the summer time, the Direxion Every day Russia Bull 2X Shares (RUSL) has proven renewed momentum by way of July and August, gaining about 25% from July 13th,” a Direxion Investments “The Xchange” article famous. “Whereas particular person shares have contributed to the expansion of RUSL in latest weeks (like web agency Yandex, which has surged because of broad enthusiasm for tech shares and its potential inclusion to the MSCI Russia Index), the broad efficiency of the ETF’s underlying MVIS Russia Index will be chalked as much as rising pure gasoline and mineral costs which have benefitted the nation’s huge array of power and mining firms.”

Feeding into energy for Russia can be energy–namely in pure gasoline.

“On the power entrance, Russia’s two largest pure gasoline companies are each experiencing a resurgence of their share worth because of a steep rebound in LNG costs of just about 50% following a July lull,” the article added. “State-owned Gazprom and privately-owned Lukoil have typically moved in sympathy with the fluctuating pure gasoline market, which in mid-August broke nicely above the $2.20 degree it had traded underneath since January.”

“An identical image is taking part in out among the many nation’s mining outfits as each valuable and base metals discover new yearly or — within the case of gold — all-time highs. Whereas this has reasonably helped increase shares of Norilsk Nickel, whose operations embody nickel and palladium mines, Russia’s fundamental valuable metallic miners, Polymetal Worldwide and Polyus, have garnered the lion’s share of the expansion, far surpassing their earlier all-time highs,” the article mentioned additional.

For extra market tendencies, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.