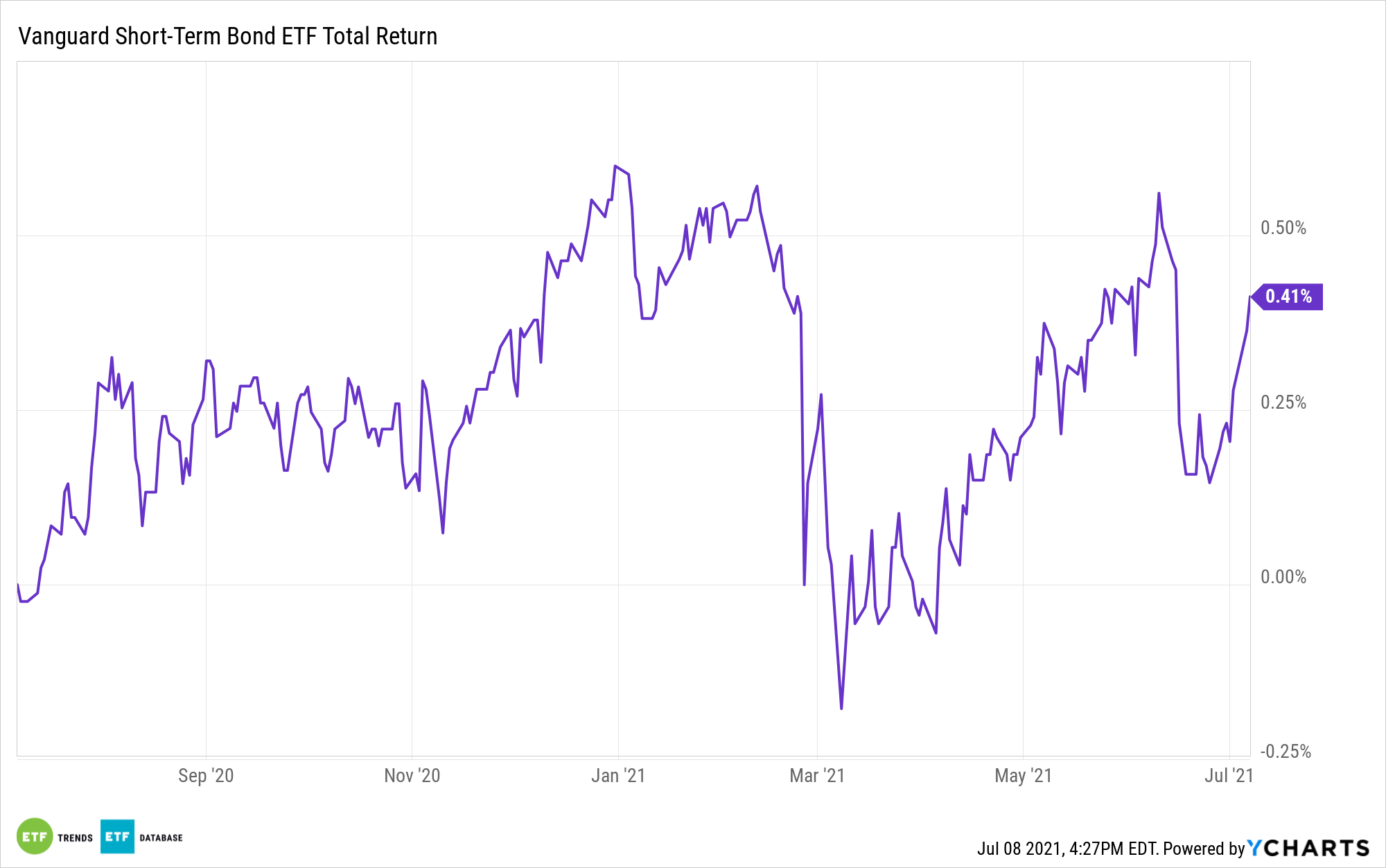

No person can predict what the Federal Reserve will do subsequent, which is why the Vanguard Quick-Time period Bond Index Fund ETF Shares (BSV) could also be an optimum selection within the present market setting.

Quick-term bonds will help diversify a set earnings portfolio, whereas limiting length danger. With inflationary pressures rising, the shorter length limits the harm if rates of interest rise within the interim.

“There’s a higher likelihood that rates of interest will rise (and thus negatively have an effect on a bond’s market worth) inside an extended time interval than inside a shorter interval,” an Investopedia article defined. “Because of this, traders who purchase long-term bonds however then try to promote them earlier than maturity could also be confronted with a deeply discounted market worth after they wish to promote their bonds.”

“With short-term bonds, this danger shouldn’t be as important as a result of rates of interest are much less more likely to considerably change within the brief time period. Quick-term bonds are additionally simpler to carry till maturity, thereby assuaging an investor’s concern concerning the impact of curiosity rate-driven modifications within the worth of bonds,” the article defined additional.

BSV seeks to trace the efficiency of the Bloomberg Barclays U.S. 1-5 Yr Authorities/Credit score Float Adjusted Index. This index contains all medium and bigger problems with U.S. authorities, investment-grade company, and investment-grade worldwide dollar-denominated bonds which have maturities between 1 and 5 years and are publicly issued.

The entire fund’s investments can be chosen by means of the sampling course of, and no less than 80% of its belongings can be invested in bonds held within the index.

BSV:

- Seeks to trace the efficiency of the Bloomberg Barclays U.S. 1–5 Yr Authorities/Credit score Float Adjusted Index, a market-weighted bond index that covers investment-grade bonds with a dollar-weighted common maturity of 1 to five years.

- Invests in U.S. authorities, high-quality (investment-grade) company, and investment-grade worldwide dollar-denominated bonds.

- Follows a passively managed, index sampling strategy.

A Lengthy-Time period Answer

For traders prepared to tackle further credit score danger through longer length debt, one ETF to think about is the Vanguard Lengthy-Time period Bond Index Fund ETF Shares (BLV). Longer length debt may give fastened earnings traders that added dose of yield, notably throughout this low-rate setting.

BLV seeks to trace the efficiency of the Bloomberg Barclays U.S. Lengthy Authorities/Credit score Float Adjusted Index. Bloomberg Barclays U.S. Lengthy Authorities/Credit score Float Adjusted Index contains all medium and bigger problems with U.S. authorities, investment-grade company, and investment-grade worldwide dollar-denominated bonds which have maturities of higher than 10 years and are publicly issued.

For extra information, info, and technique, go to the Fastened Earnings Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.