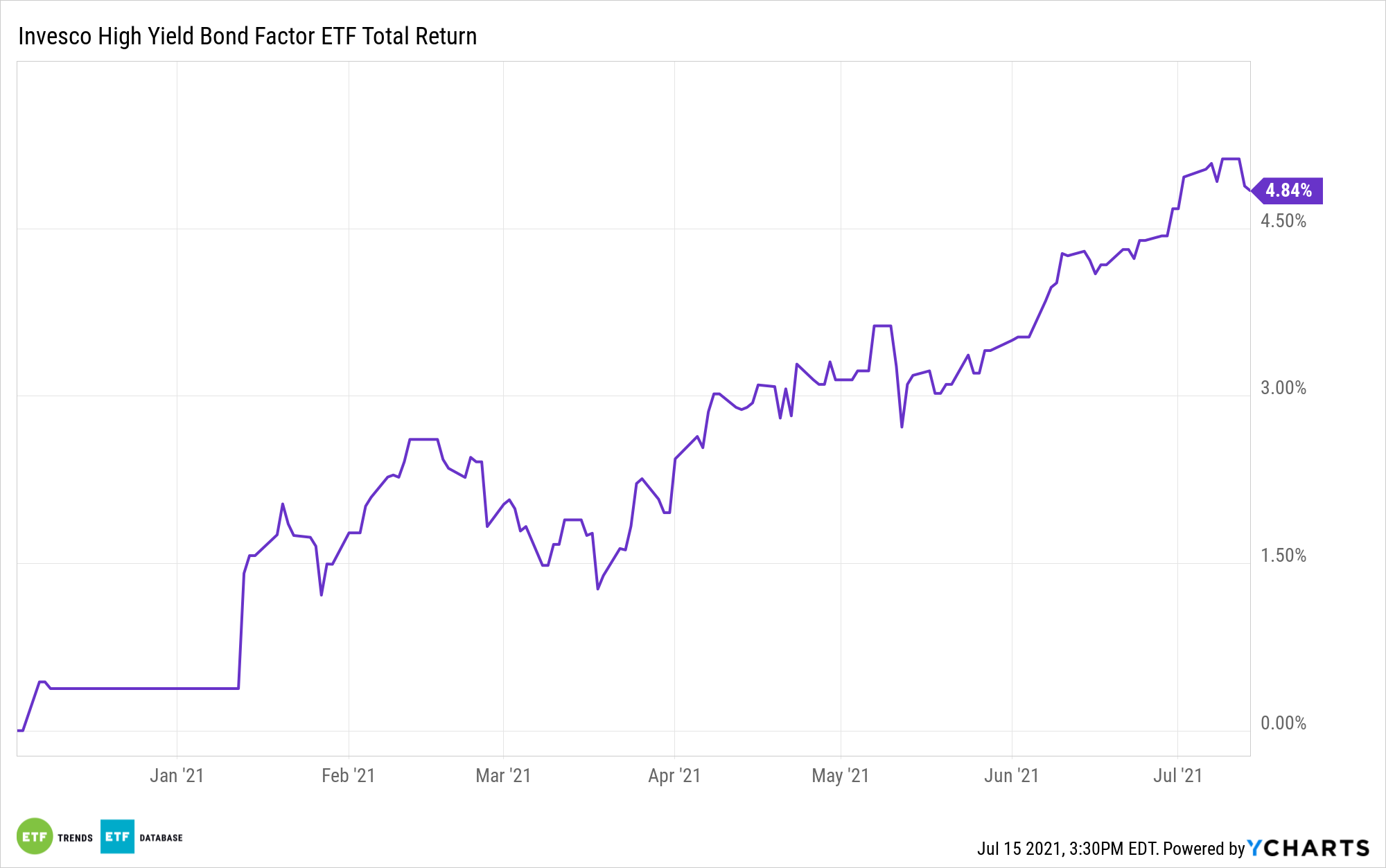

Surprisingly sturdy fundamentals, amongst different components, have high-yield bonds on a roll this 12 months, miserable yields within the course of.

Issue-based alternate traded funds just like the Invesco Excessive Yield Bond Issue ETF (IHYF) can assist buyers keep on the best facet of earnings and high quality within the junk bond house whereas concurrently capitalizing on credit score alternatives.

Actively managed, IHYF “makes use of a factor-based technique that seeks to outperform the Fund’s market-weighted benchmark index by systematically concentrating on securities within the benchmark index exhibiting quantifiable issuer traits that the funding workforce believes could have increased returns than different fastened earnings securities with comparable traits over market cycles,” based on Invesco.

That methodology may show alluring for buyers at a time when yields on some extensively adopted junk bond benchmarks hover round report lows.

within the IHYF ETF?

“Whereas the prospect of the poorest-rated corporations with the ability to pay lower than 4% to difficulty debt would possibly increase the specter of a bubble within the making, most bond execs don’t see any main issues brewing, at the very least not but,” experiences Jeff Cox for CNBC.

Default charges had been low within the first half of 2021, a development scores companies count on will proceed all year long. But even when defaults climb, IHYF may show sturdy by means of a mere 3% allocation to CCC-rated bonds. Conversely, 69% of the funds 302 holdings are rated BBB or BB, the upper ends of junk territory.

Concerning rate of interest threat, it is largely restricted in IHYF as over 59% of its holdings have short-term maturities and maturities as much as 5 12 months. The ETF’s efficient period is 3.97 years. The lively administration inherent to the fund can react extra nimbly in altering junk bond climates than a rival passive fund can.

Happily for buyers, the difficulty of credit score threat is probably going subdued for the near- to medium-term as a result of corporations are sitting on ample money piles.

“Corporations have constructed enormous money positions over the previous a number of years, with whole liquid property at nonfinancial corporations totaling $6.Four trillion via the primary quarter of 2021, based on the Federal Reserve. That’s up practically 50% simply since 2018,” based on CNBC.

About 31.5% of IHYF’s holdings are courtesy of shopper cyclical and power issuers. One other 24% are from both the communication companies or industrial sectors.

For extra information, info, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.