By Kevin Nicholson, CFA

By Kevin Nicholson, CFA

Because the starting of the yr, the yield on the ten-year Treasury has risen by roughly 80 foundation factors, delivering a return of -6.37%, which brings to the forefront that bonds can lose worth when yields rise, particularly when yields begin at such low ranges (see desk beneath). Whereas this isn’t the primary time that bonds have underperformed in historical past, the transfer up in yield of the 10-year Treasury resembles that of the Taper Tantrum that started in Might 2013. The Taper Tantrum was a response to the Federal Reserve (Fed) saying that it was going to scale back its bond shopping for program referred to as Quantitative Easing (QE). In only a month, the 10-year Treasury yield went from 1.63% to 2.13%, finally peaking in September at 3.00%. It’s usually said that historical past is our information and if we have no idea our historical past, we’re doomed to repeat it. Subsequently, as fastened revenue buyers we should know our fastened revenue neighborhood; whether or not our bonds have lengthy or quick maturities.

[wce_code id=192]

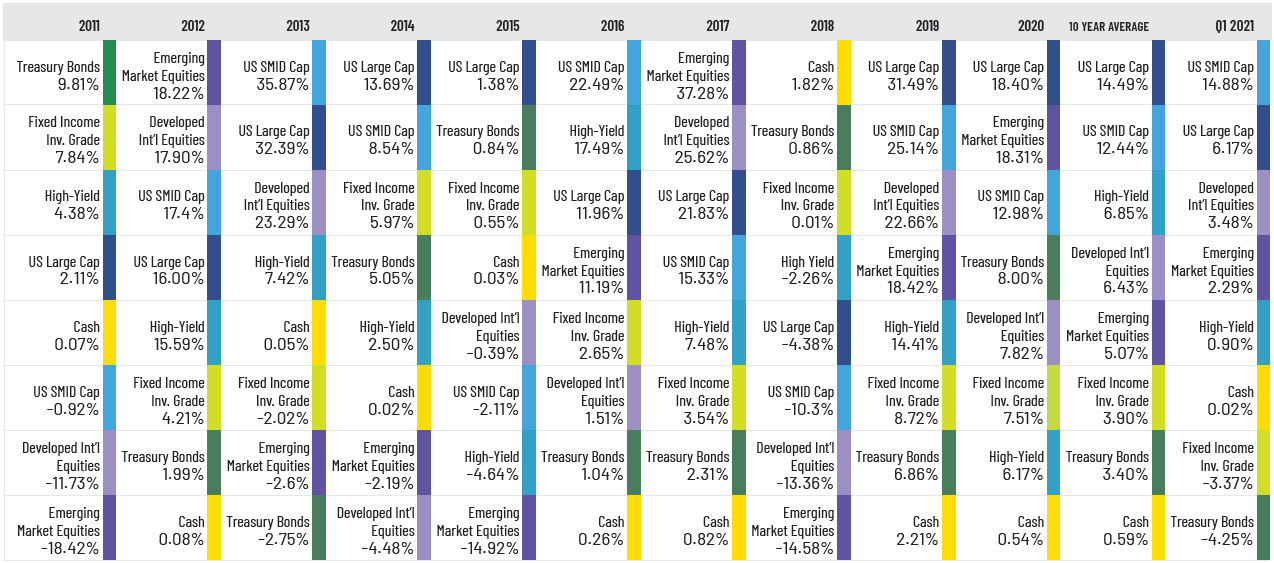

Returns of Asset Courses by Calendar 12 months (as of 03.31.2021)

Supply: Morningstar Direct, RiverFront. 10-year common is the common of the annual returns listed for every class. Previous efficiency isn’t any assure of future outcomes. Diversification doesn’t assure a revenue or eradicate the chance of loss. Index returns are supplied for informational functions and should not indicative of RiverFront portfolio efficiency. Q1 2021 information by means of March 31, 2021.

Traditionally, fastened revenue has performed an vital function in buyers’ portfolios. For some, fastened revenue served because the revenue automobile in portfolios that allowed buyers to retire and reside comfortably, receiving the curiosity funds with out touching their principal. For others, fastened revenue was used to assist offset the chance within the fairness portion of their portfolio. Proudly owning bonds supplied peace of thoughts for buyers who purchased prime quality US Treasuries. Sadly, occasions have modified because the bull market in bonds drove yields to historic lows and indicators of yields reversing course create added danger for bond buyers. We imagine that it will be significant for buyers to grasp the influence of yield actions previous to investing within the asset class, as we’ve seen a major transfer up in charges to begin 2021.

Eight years have handed for the reason that Taper Tantrum however in some way it looks like déjà-vu, because the 10-year Treasury at present yields close to 1.70% and the US economic system is accelerating after a yr of pandemic lockdowns. Extra strain on bonds will doubtless come from the rising fiscal coverage that has added practically $Three trillion of stimulus over 5 months and proposed a $2.25 trillion infrastructure deal in live performance with the Fed’s $120 billion per 30 days in financial stimulus. These circumstances are main some analysts to foretell that the Fed will be unable to stay to their zero-interest coverage and must increase rates of interest sooner than the 2023 timeframe that almost all count on. Whereas yields have already moved up significantly over the primary Three months of the yr, utilizing the Taper Tantrum as our information, we might see yields rise one other 50 foundation factors to round 2.20%.

How lengthy to get better your losses – an instance:

Primarily based on the approximate yield on the 10-year Treasury of 1.70%, if bond yields rise to 2.20%, that equates to a decline within the value of the ten-year Treasury of roughly 4.75%. It could take 2.79 years of receiving revenue of $17 per $1,000 bond simply to cowl a 50-basis level transfer greater in yields as illustrated within the chart beneath.

Historically, investing in treasuries has been considered as a risk-free funding as a result of buyers obtained semi-annual curiosity funds and their principal again at maturity. Nevertheless, to suppose bonds are with out danger is a misnomer. As we’ve illustrated buyers can face the chance of principal erosion if yields transfer dramatically greater they usually elect to promote the bond previous to maturity. Below this state of affairs, curiosity funds are used to offset principal losses when calculating the whole return of the funding previous to maturity. For these buyers that select to carry the bond till maturity, they’re foregoing their true incomes potential as they are going to be incomes a beneath market rate of interest.

Whereas we’ve targeted on rates of interest transferring greater from present ranges, it’s attainable that charges might go decrease if the financial restoration hits a snag. Subsequently, it will be significant that we level out, if yields had been to fall by 50 foundation factors, there could be a optimistic 4.75% value return on the 10-year Treasury if offered previous to maturity however the investor wouldn’t be maximizing their revenue potential. We level out these nuances, in order that buyers perceive the implications of rate of interest strikes previous to investing.

Right here at RiverFront, we imagine that given the abundance of fiscal and financial stimulus it’s extra doubtless that the 10-year Treasury yield will rise to 2.20% than fall to 1.20%. Thus, we proceed to underweight fastened revenue as we count on equities to supply a greater whole return for our buyers. By realizing the fastened revenue neighborhood, we perceive the ramifications of our selections, and we imagine it will be significant for particular person buyers who’ve expertise varied elements of the bond bull market to do the identical.

Essential Disclosure Data

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency is just not indicative of future outcomes and diversification doesn’t guarantee a revenue or defend towards loss. All investments carry some stage of danger, together with lack of principal. An funding can’t be made immediately in an index.

Chartered Monetary Analyst is an expert designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of monetary analysts. Candidates are required to go three ranges of exams masking areas equivalent to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can turn into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Data or information proven or used on this materials was obtained from sources believed to be dependable, however accuracy is just not assured.

This report doesn’t present recipients with info or recommendation that’s adequate on which to base an funding resolution. This report doesn’t consider the precise funding aims, monetary state of affairs or want of any explicit shopper and will not be appropriate for every type of buyers. Recipients ought to contemplate the contents of this report as a single think about investing resolution. Extra elementary and different analyses could be required to make an funding resolution about any particular person safety recognized on this report.

In a rising rate of interest surroundings, the worth of fixed-income securities typically declines.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra info on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Investing in international firms poses further dangers since political and financial occasions distinctive to a rustic or area could have an effect on these markets and their issuers. Along with such basic worldwide dangers, the portfolio can also be uncovered to foreign money fluctuation dangers and rising markets dangers as described additional beneath.

Modifications within the worth of foreign exchange in comparison with the U.S. greenback could have an effect on (positively or negatively) the worth of the portfolio’s investments. Such foreign money actions could happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s house nation. Additionally, the worth of the portfolio could also be influenced by foreign money change management laws. The currencies of rising market international locations could expertise vital declines towards the U.S. greenback, and devaluation could happen subsequent to investments in these currencies by the portfolio.

Overseas investments, particularly investments in rising markets, could be riskier and extra risky than investments within the U.S. and are thought of speculative and topic to heightened dangers along with the overall dangers of investing in non-U.S. securities. Additionally, inflation and speedy fluctuations in inflation charges have had, and should proceed to have, unfavorable results on the economies and securities markets of sure rising market international locations.

Shares characterize partial possession of a company. If the company does properly, its worth will increase, and buyers share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, buyers can lose their total preliminary funding (i.e., the inventory value can go to zero). Bonds characterize a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a selected time period and expects to get their authentic funding again on the finish of that point interval, together with the curiosity earned. Funding danger is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to concentrate on these variations previous to investing.

A foundation level is a unit that is the same as 1/100th of 1%, and is used to indicate the change in a monetary instrument. The idea level is often used for calculating modifications in rates of interest, fairness indexes and the yield of a fixed-income safety. (bps = 1/100th of 1%)

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Alternate Fee. Registration as an funding adviser doesn’t suggest any stage of ability or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a advice to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and subsequently an oblique proprietor of RiverFront. BFC is the mother or father firm of Robert W. Baird & Co. Integrated, a registered dealer/supplier and funding adviser.

To evaluation different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1600238

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.