Already driving the wave of rising Treasury yields,

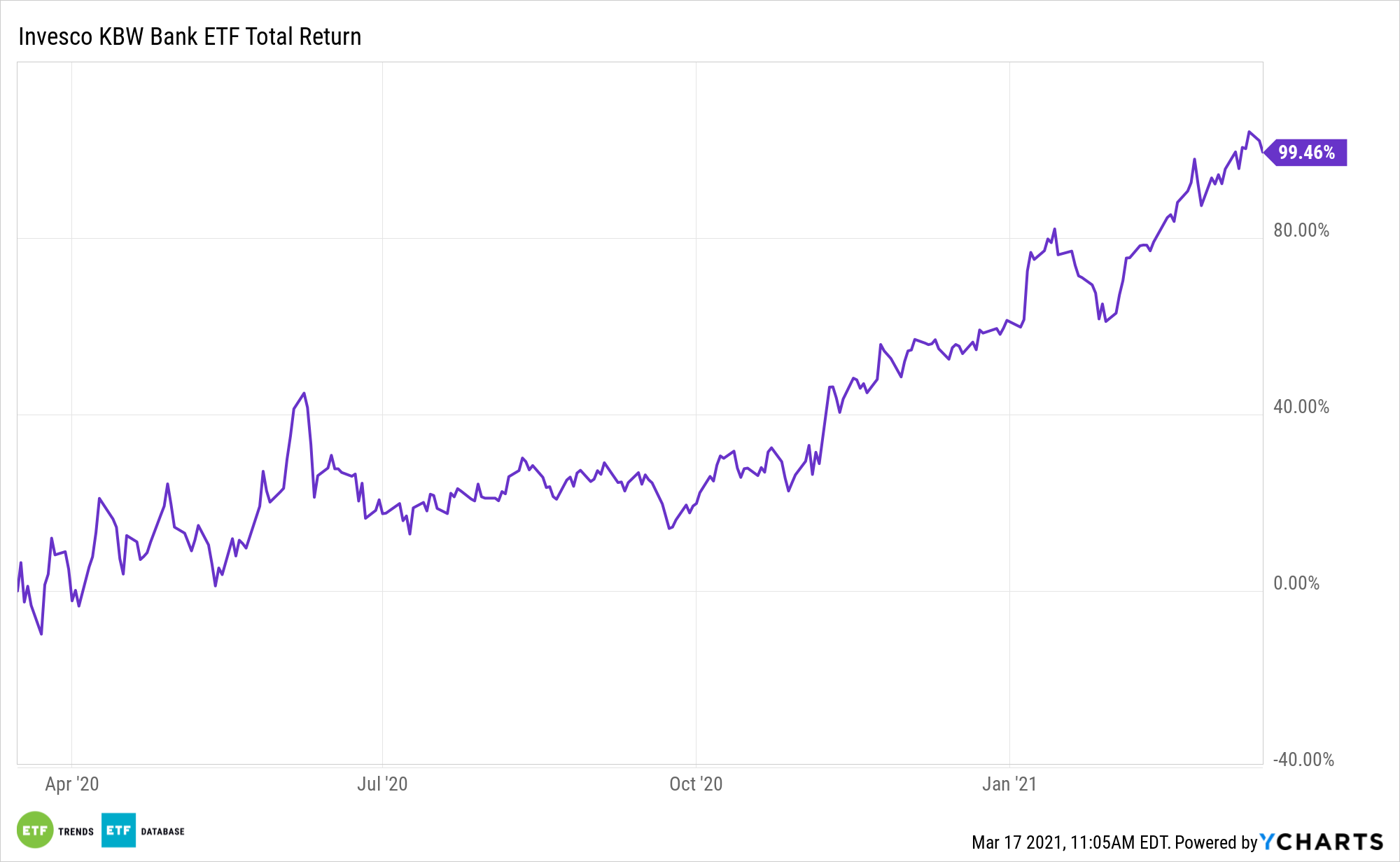

Already driving the wave of rising Treasury yields, ETFs holding financial institution shares, together with the Invesco KBW Financial institution ETF (NASDAQ: KBWB), produce other upside catalysts.

KBWB tracks the broadly adopted KBW Nasdaq Financial institution Index.

“The Index is a modified-market capitalization-weighted index of firms primarily engaged in US banking actions. The Index is compiled, maintained and calculated by Keefe, Bruyette & Woods, Inc. and Nasdaq, Inc. and consists of huge nationwide US cash facilities, regional banks and thrift establishments which can be publicly traded within the US,” in line with Invesco.

An vital issue within the 2021 case for funds akin to KBWB is the discharge of money put aside final 12 months to cowl dangerous loans.

“Within the coming months, banks are anticipated to release tens of billions of {dollars} in reserves they put aside to cowl soured loans—losses that also haven’t materialized a 12 months right into a pandemic that shut down swaths of the U.S. financial system,” studies David Benoit for the Wall Avenue Journal. “In 2020, banks rushed to construct up their stockpiles to cowl losses on the belief that customers and companies would default on their loans after authorities stimulus ran out. U.S. banks had $236.6 billion in complete reserves in December, in line with the Federal Deposit Insurance coverage Corp., practically double their degree from earlier than the coronavirus upended the financial system and despatched unemployment up sharply.”

A Huge Inflow of Money Is Coming

Some analysts imagine financial institution inventory efficiency is about to take a flip for the higher after falling behind on low rates of interest and weak mortgage development, together with credit score issues. Plus, there are some near-term catalysts for KBWB and mates, together with stable credit score high quality.

The issue with banks setting apart massive chunks of money to cowl dangerous loans is that the technique weighs on earnings. These reserves come immediately out of income, but when the financial system improves, KBWB holdings might not must cowl as many dangerous loans as anticipated, which means these reserves will finally be became income.

“Banks set their loan-loss expectations utilizing broad financial gauges, significantly gross home product and unemployment charges. From that place to begin, they consider tons of of different variables, with some leeway in-built for a way optimistic or pessimistic executives really feel,” provides the Journal. “Because the begin of the pandemic, financial institution executives have tended towards pessimism when setting apart loan-loss reserves. In consequence, their inner fashions supply a extra muted outlook than broader financial forecasts.”

For extra information, data, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.