Tlisted here are increasingly more causes for advisors to assist shoppers perceive the advantages of worldwide equities, together with engaging multiples.

The WisdomTree Developed Worldwide Multi-Issue Mannequin Portfolio affords advisors an efficient approach to place consumer portfolios for extra upside in worldwide developed markets.

“This mannequin portfolio is designed for traders with a long-term horizon searching for publicity to a broad universe of Developed Worldwide equities primarily utilizing issue targeted ETFs,” in keeping with WisdomTree. “The chosen ETFs present sure issue tilts which have the potential to generate extra return relative to comparable cap-weighted benchmarks over longer-term holding intervals. The methods could use each WisdomTree and non-WisdomTree ETFs.”

This mannequin portfolio is a proper place/proper time idea.

“Shares outdoors america have proven some indicators of power these days. Within the fourth quarter of 2020, for instance, the Morningstar International Markets ex-US Index gained 17.4% in contrast with a 14.2% return for the Morningstar US Market Index,” famous Morningstar analyst Amy Arnott. “That quarter was a uncommon glimmer of hope amid an unusually lengthy efficiency stoop. Over the previous 10 years, annualized returns from worldwide shares have lagged these of their home counterparts by greater than 7 share factors per yr, on common. The brilliant aspect of this lengthy and painful efficiency stoop: Whereas few markets qualify as low cost, non-U.S. markets provide extra engaging valuations in relative phrases.”

The Large Advantages of Touring Overseas

Getting worldwide publicity is a good way to drag in uncorrelated market actions. However at a time when a pandemic has the entire world in its grasp, it turns into fairly the problem.

The WisdomTree portfolio affords high quality/worth tilts with a number of of its parts holdings.

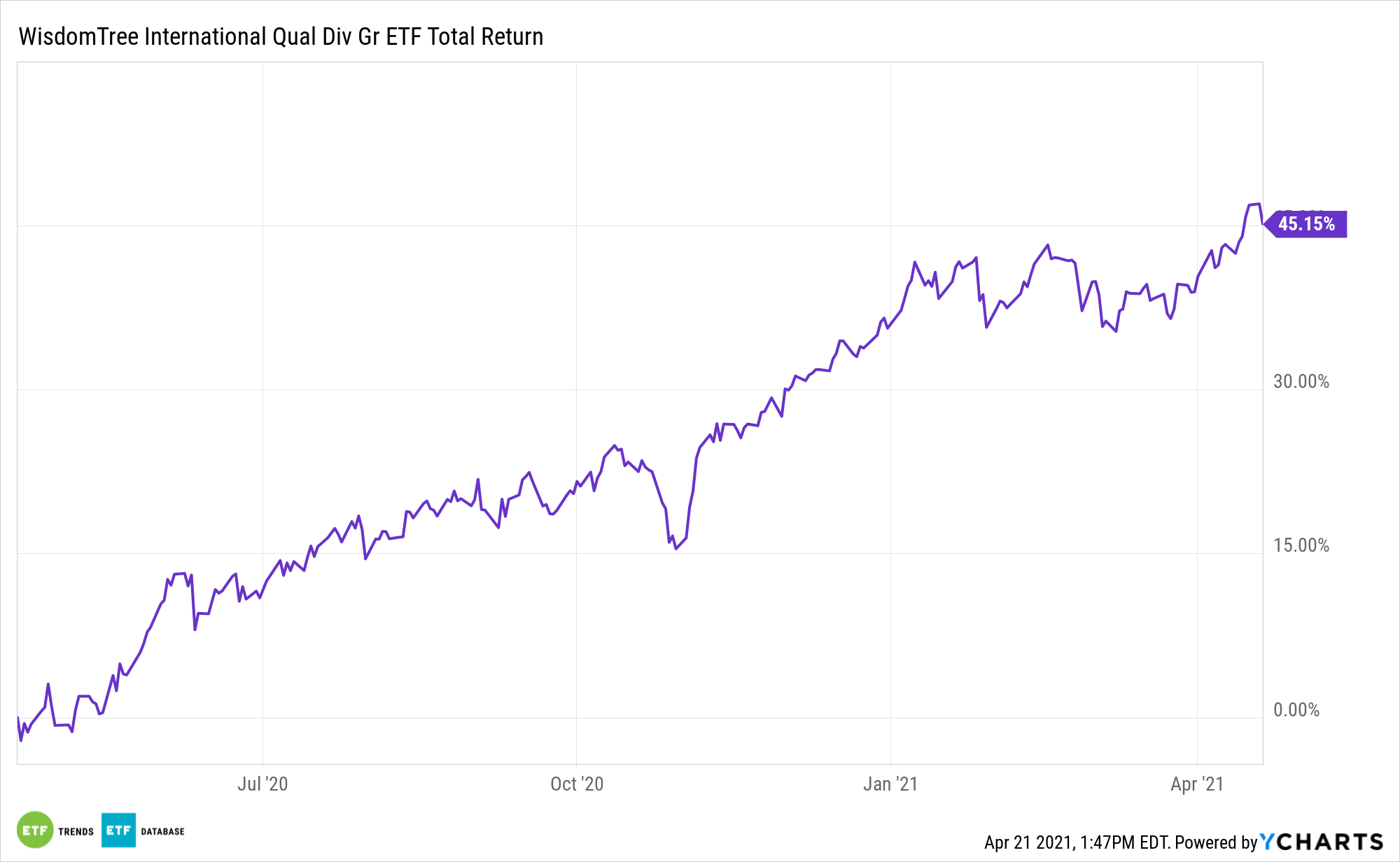

The WisdomTree Worldwide High quality Dividend Progress Fund (CBOE: IQDG) and the WisdomTree Worldwide Hedged High quality Dividend Progress Fund (NYSEArca: IHDG) characterize two high quality avenues for advisors in search of ex-U.S. developed markets publicity.

Ex-U.S. developed market dividend payers typically function bigger yields than their U.S. counterparts, an assertion confirmed by evaluating large- and mega-cap dividend shares from acquainted dividend sectors reminiscent of shopper staples, power, monetary companies, and telecommunications.

“On the constructive aspect, the lengthy dry spell for worldwide shares makes for extra engaging valuations. As proven within the chart under, conventional valuation metrics reminiscent of value/earnings, value/ebook, and value/gross sales are all considerably decrease for non-U.S. shares in contrast with the home market. Japan, some components of Europe, and the UK look notably low cost based mostly on conventional valuation metrics,” continues Arnott.

For extra on find out how to implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.