I‘m simply going to exit on a limb right here and admit one thing: I do not get volatility.

I imply, I get the mathematics, and I’ve learn the books, however there is a distinction between changing into conversationally fluent in a language and pondering in a language, like, in your goals. Heinlein brilliantly outlined this empathic, inside understanding with the phrase “grok” in Stranger in a Unusual Land.

Recognizing my failure, I’ve spent the higher a part of 2021 studying, speaking, and actually making an attempt to “grok” what we imply by “volatility” in markets by reaching out and asking questions of a gaggle of teachers and traders typically loosely lumped collectively in an enormous bucket known as “lengthy vol.”

Half 1: A Drawback of Definitions

After I began down this rabbit gap, I assumed I understood what the phrase volatility meant, at the least. Boy, was I fallacious.

This is what I do know: in monetary markets, we are likely to imply one of many following three issues once we hear the phrase “volatility”:

- Realized Volatility — The precise measurement of worth actions noticed traditionally.

- Implied Volatility — The volatility, effectively, implied by choices pricing fashions primarily based on the present clearing worth of choices.

- The VIX — An algorithmic summation of the implied volatility of a selected set of ever-changing places and calls, particularly on the S&P 500 Index.

The issue is that each one three of those measure very various things, and none of them are notably helpful in assessing what precise traders and advisors care about: the likelihood of experiencing a “significant” decline between now and a few level sooner or later. Let’s step via every in flip.

Realized Volatility

I realized about precise realized volatility in my remedial math class for enterprise faculty (significantly). To calculate, you are taking all of the observations in your information set (say, every day returns for the S&P 500); run them via your stats platform of alternative (MatLab, R, Excel, no matter); and calculate a imply every day return. Then, making the outrageous assumption that our observations needs to be usually distributed round that imply, you calculate the deviation of every information level from that imply, sq. it, common all of them, slap a sq. root over that to get “customary deviation.”

Customary deviation is helpful as a result of if our information was regular (which, once more, it most likely is not), we are able to anticipate that 66% of our outcomes ought to fall throughout the imply +/- the usual deviation.

In the event you’re already dropping consciousness, you are not alone. These particulars are a part of why even good funding people get misplaced within the weeds in the case of volatility.

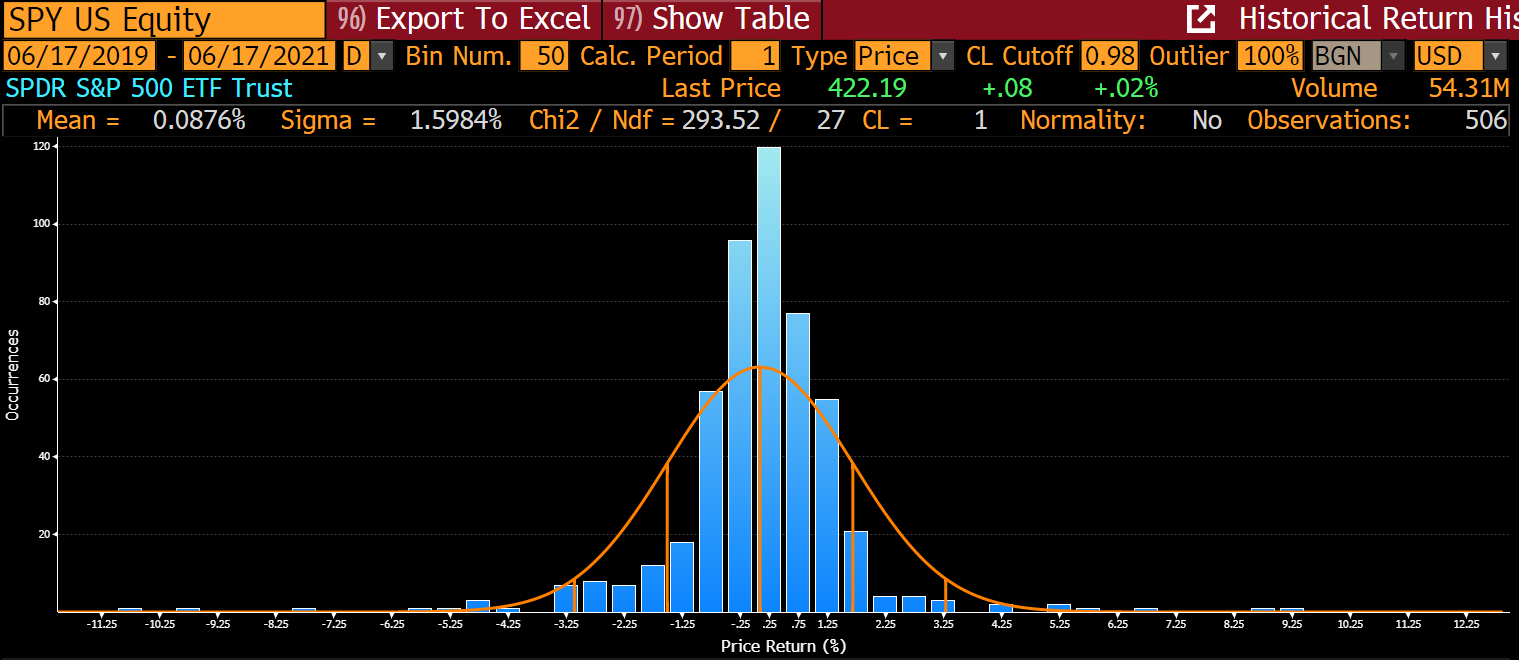

So let’s put it in context. This is a histogram of the every day returns of the S&P 500 for the previous two years, the place every column is the variety of buying and selling days in a given bucket of potential outcomes.

Supply: Bloomberg. Knowledge from Jun. 17, 2019 – Jun. 17, 2021

Over the previous two years, the imply every day return has been a whopping eight foundation factors, whereas the “sigma” (or the Greek image for traditional deviation) is 1.59%.

That implies that about 2/Three of the noticed every day S&P 500 returns fall inside that +/- vary round that eight foundation level imply. The purple vertical traces point out the place these brackets fall on the theoretical “bell curve.” You can even see a couple of days that have been +/- 10% or extra – huge days!

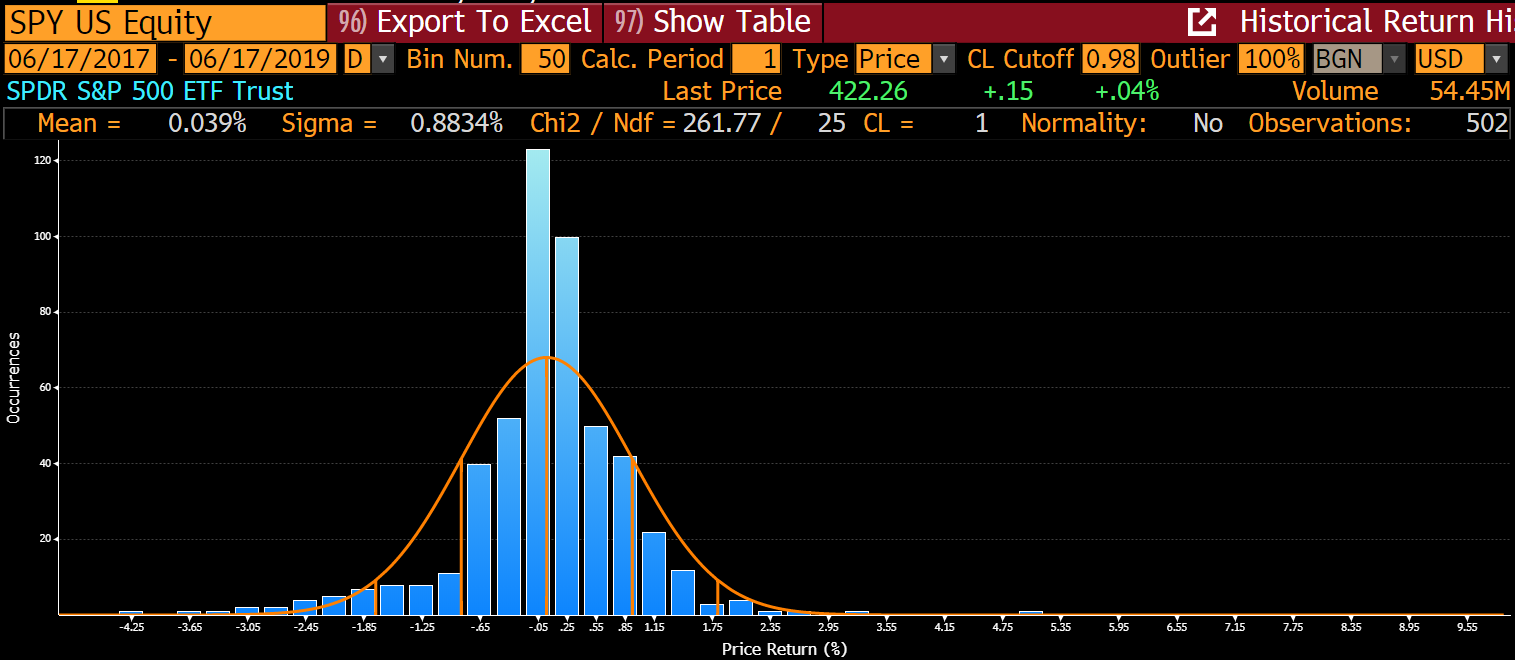

After all, this does not actually inform us something about what the subsequent two years value of returns will seem like, any greater than the earlier two years advised us concerning the above:

Supply: Bloomberg. Knowledge from Jun. 17, 2017 – Jun. 17, 2019

From June 2017 to June 2019, the imply of S&P 500 returns was fairly related, however the usual deviation again then was about half. So meaning at the moment’s market have to be twice as unstable because it was again then, proper?

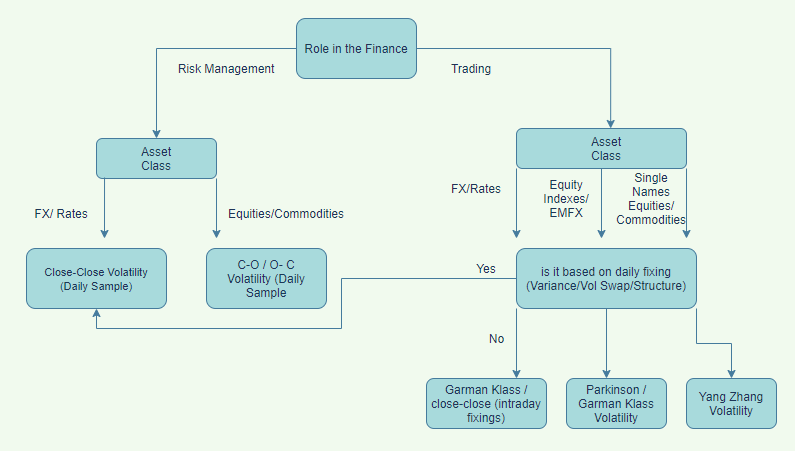

Effectively… probably not. As a result of all we ever actually care about is future volatility. To make issues worse, there are literally half a dozen methods of calculating realized volatility, with sufficient variation that this dude constructed a circulate chart for aspiring analysts to assist them work out which to make use of:

Supply: Harel Jacobson, “The Realized Volatility Puzzle”

To make issues a lot worse, even the idea of realized volatility could also be misapplied at greatest, irrelevant at worst.

By definition, volatility is the quantity of dispersion in some pattern set over some particular time frame. So once we describe one thing like “the usual deviation of the S&P 500 over the previous 30 days” and mentally apply that to our inside sense of “how dangerous” the market is true now, that is flawed reasoning. Many good folks have written on these flaws, from Ole Peters, who asserted that we incorrectly assume “ergodicity” in finance (shorthand: the ergodicity assumption implies that historic time averages can be utilized to make anticipated ahead assumptions), to the work Benoit Mandlebrot did on “The MultiFractal Nature of Buying and selling Time” again within the 1960s.

The purpose is that this: easy historic realized volatility is one thing few people can agree on and can also be as basically nugatory as a predictor of the likelihood that Dangerous Issues will happen.

Implied Volatility

As Buckaroo Banzai mentioned: “Do not tug on that. You by no means know what it is perhaps connected to.”

Whenever you learn media protection of volatility, you would possibly get the impression that implied volatility is a magic observable information level that good folks extract from the choices market.

In actuality, implied volatility is a plug determine that explains how a lot choices value. To calculate, you punch your noticed choices premium into the Black-Scholes choices pricing mannequin (which just about no one *really* makes use of un-modified day-to-day, and in itself is so stuffed with points that it is value total faculty programs on the subject); you place in all the opposite “knowns” (time-to-expiration, risk-free price, spot and strike costs); you then actually simply iterate again and again, till you have solved for the volatility you’d have to justify the premia which are being demanded.

Whereas this sounds spectacular, the reality is that “implied volatility” actually solely tells you the way low-cost or costly an possibility is, relative to some theoretical different possibility that may have the identical inputs. It tells you little or no concerning the precise likelihood that Dangerous Issues will occur.

The VIX Index

The “VIX” is a calculation finished by CBOE primarily based on the implied volatility of choices on the S&P 500 index. However it’s not a common abstract: it solely and particularly considers possibility contracts that may expire between 23 and 37 days from at the moment.

Moreover, it makes use of a unique sort of calculation for implied volatility, which is calculated from the variance of costs (that’s, the choices premia) for choices with totally different strike costs, however which all have the identical days to expiration (the concept being that if every part else is held the identical, then worth differentials can solely be defined by implied volatility). Many various possibility contracts are used within the VIX, primarily based on what’s buying and selling, and all these little sub-calculations are then averaged and changed into a volatility quantity. It is sort of like historic volatility, however imaginary!

That quantity is then multiplied by 100 (for no explicit purpose) to get the VIX metric. By all means, strive calculating it for your self—enjoyable for the entire household.

As difficult because the VIX is, it too is not that nice at describing “volatility,” at the least exterior its very slender mandate. And it undoubtedly does not inform you something useful about how probably a Dangerous Factor is to occur.

So the TL;DR right here is fairly easy: even in the most effective of occasions, finance is fairly dangerous at explaining what we imply by “volatility.” We (that means me) use the phrase casually and unskillfully more often than not.

On prime of which…

Half 2: People Are Messed Up About Danger

I spotted through the previous 12 months and alter of quarantine that there actually is not a previous or current. There’s solely the now. Irrespective of how a lot we plan for the long run, all we now have to work with at any given second in time is what’s in entrance of us.

Regardless of this inherent fact, as advisors, you are tasked with taking that current state of your consumer — say the $5 million nest egg they’ve socked away — and preserving and rising it for some unknowable future. And for essentially the most half, the one instruments we now have to work with are these constructed from deep evaluation of an irrelevant previous.

That is fashionable finance in a nutshell: we take a look at historical past, make observations, construct fashions — whether or not acutely aware or unconscious — of how the long run ought to go primarily based on all of the current-moment greatest guesses we are able to enter into these fashions.

The obvious drawback is that the previous is nearly all the time a horrible predictor of the long run. However barely much less apparent is that these of us in fashionable economics — in addition to the fashions we construct that everyone makes use of to foretell the long run — make a whole lot of actually big assumptions.

The largest assumption, most likely, is normalcy: that’s, any sample we analyze, from returns to well being outcomes, follows that good symmetrical bell-shaped curve we name a traditional distribution. The second is that we frequently assume that the efficiency of a single safety or metric over time (e.g., the common motion of 1 inventory over a 12 months) tells us one thing concerning the efficiency of an ensemble (e.g., the common motion of 500 shares over sooner or later). This “ensemble” vs. “time” approach of information is on the coronary heart of Ole Peters tackling the aforementioned ergodicity drawback.

These are simply two biggies. Choose any monetary mannequin, and there are some wild assumptions in it. I assure it.

On account of all these assumptions, our fashionable monetary fashions — maybe most significantly our inside, psychological fashions — are deeply flawed. That is most likely why I hold listening to from people repeatedly: the market feels much more unstable than the numbers point out.

The Lion within the Bush

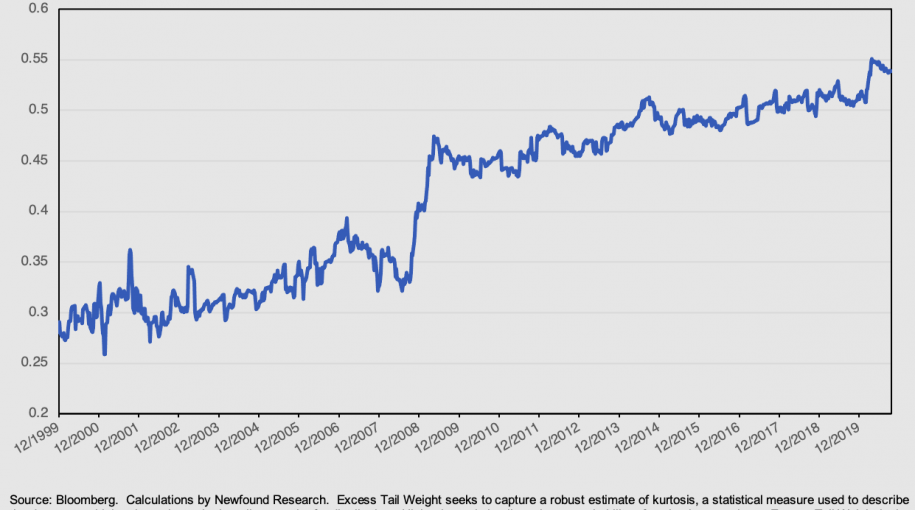

There are dozens of causes for this impression, past ergodicity and misconceptions round math: traditionally excessive valuations, wealth inequality, the winner-take-all nature of markets, liquidity considerations, Reg NMS, regulatory seize…you identify it. All these components appear so as to add tail danger to our anticipated outcomes, however you’ll be able to’t even see that tail danger in the event you’re simply chasing final week’s numbers. However it’s undoubtedly in there. This is how Newfound’s Corey Hoffstein described it in a latest electronic mail alternate:

Had been we to investigate weekly returns for the S&P 500 over time, considered one of issues we might discover over the past 20 years is that they’ve change into more and more fat-tailed In different phrases, extra excessive returns – each optimistic and unfavourable – are occurring with larger frequency.

There is a rising group of parents who’ve noticed that the tails of our experiences are extra than simply fat–they’re nearly irrevocably unpredictable, simply perturbed, and presumably unknowable. They’re additionally making an attempt to determine what, if something, traders can do about it.

Mike Inexperienced, a quant who moved just lately from the personal wealth facet of the stability sheet at Logica to upstart ETF supervisor Simplify, defined it to me this manner:

We’re wired from an evolutionary perspective to answer opposed data way more significantly than we’re wired to answer favorable data. Simply put your self again on the plains of Africa. If I say to you, “Hey buddy, there’s berries in that bush.” You will say “That is good, however I already ate not an enormous deal,” and perhaps footnote it. But when I say to you, “Hey, there is a lion in that bush,” your head goes to pivot and you are going to begin operating. And sort of what I am saying is: “there is a lion within the bush.”

After all, the lion within the bush is simply “the dangerous stuff” (nonetheless we outline it). It is very easy to place that in a market context and assume market crash — however the extra I’ve studied up on lengthy vol, the much less I feel it is sensible to consider this purely by way of “draw back safety.” As a result of the underpinning commentary is not one thing so simple as “we do not like when issues go down” (See Kahneman et al.). It has rather more to do with our basic psychological make-up.

This is how Cem Karsan, famous vol-tweeter, emoji-lord, philosopher-trader, and Founder at Kai Volatility Advisors, defined it to me:

The world is lengthy. You eat, you breathe, you sleep lengthy. You reside in a home, you’re employed a job. As a result of all people’s lengthy, and individuals are alive, folks have worry: of demise or decline or poverty. And so they have all the time thought, for the reason that starting of time, to hedge that danger. It is the tail danger to being alive. As a result of folks need to hedge and since that tail does exist, there have to be any person who’s keen to be within the enterprise of insurance coverage.

So that is the setup: we measure volatility badly, our fashions are most likely worse than we predict, we’re inherently caught up in our personal danger aversion, and so we — that means, the collective “we” of human beings and asset homeowners — search safety. And that hunt for defense may very well have change into the dominant function of our markets.

Half 3: The Largest Insurance coverage Market within the Universe

“The enterprise of insurance coverage” on this ill-measured market is nearly completely now within the arms of the choices markets–specifically, equities and their derivatives (choices and futures contracts).

Cem once more:

Finally, how does any person who’s managing the chance on writing that insurance coverage handle that danger? There are methods to hedge. The insurers are short-put/long-call, they usually’re comfortable to be so. It is a very worthwhile commerce. As a result of they’re sitting on the opposite facet of a limitless demand machine, they usually get to set the worth to ensure it is worthwhile.

I need to pause right here and linger on these three sentences. Cem — and I feel he is an affordable proxy for the zeitgeist right here — is arguing that basically, there is no such thing as a restrict to the demand for hedging danger. And due to that, the pricing energy of the choices market makers is proscribed solely by their competitors amongst themselves. The best way they compete, long-term, is not nearly worth; it is about how effectively they will hedge. Which means the true competitors is occurring in on the chance administration facet of the enterprise.

In making an attempt to actually perceive this infinite demand engine, I leaned on Adam Butler, CIO at Resolve Asset Administration, who thinks even the infinite demand machine does not clarify the total nature of how the tail has come to wag the canine (emphasis mine):

Think about that choices are the last word supply of leverage, and have change into the instrument of alternative for a big and more and more dominant class of traders. Extra demand for leverage flows via choices fashions and is mirrored as larger implied volatility (amongst different issues).

In different phrases: as a person investor, I can get fairly substantial leverage out of the choices market, even when I personally do not care about hedging my draw back. Which suggests I would nonetheless be a big participant within the choices market, even when I am only a degenerate gambler who desires to be maximally levered always. The choices market makers are very happy to feed that beast too.

Adam continues:

Furthermore, many traders require common money flows to satisfy near-term liabilities. With yields on conventional devices so low, many traders have turned to promoting choices (or shopping for merchandise that implicitly promote choices) to generate extra yield. These volatility sellers suppress volatility.

Whereas we consider “the choices market” as being nothing however professionals, the “vig” (to make use of a playing time period, principally the minimize charged by a sportsbook for taking a guess) is so good on this enterprise that any investor with $100 of their Schwab account can basically be within the insurance coverage enterprise, too. That is all the varied ETF wrapped options-writing methods are: institutionalized and packaged entry to the insurance coverage market.

After all, within the absence of individuals seeking to “purchase safety,” these sorts of methods simply go into the opposite facet of the market makers stability sheet. Adam once more:

On the similar time, market makers facilitate the flows between these and different brokers, however they don’t want to carry danger on their books. In order that they offset these dangers by shopping for and promoting the underlying money devices in markets to take care of their hedge. The flexibility of markets to soak up these flows can also influence measures of implied volatility.

I am leaning on the dramatic daring right here for a purpose: that is the half the place the connection is important. Seize a espresso. Modify your glasses.

Crucial gamers out there proper now aren’t sovereign wealth funds or Calpers or meme lords and even conventional hedge funds. It is the individual sitting behind a display making an attempt to handle their fairness market publicity to offset the chance of their choices market-making ebook.

There are quite a lot of people on the market working to grasp this higher, from outsider-renegade Lily Francus’s work on choices flows to Corey Hoffstein’s work on liquidity. However they’re all coming to fairly related conclusions (from Hoffstein):

The “why” behind the information is closely debated, however one concept is that vital adoption of call- and put-overwriting methods by establishments has precipitated the order circulate from possibility seller hedging to change into more and more influential. Naively modeled, this hedging conduct is often mean-reversionary, which helps hold markets pinned. If the hedging quantity disappears, the market can all of a sudden transfer a lot additional, sooner.

That “a lot additional, sooner” is exactly what the market “feels” like, whereas on the similar time, these conventional measures of volatility we began with aren’t flashing huge purple indicators. If Components 1 and a couple of of this tried to point out “stuff’s weirder than we actually measure,” then right here I am making an attempt to get to the “why?” and maybe extra importantly, the “so what?”

Why Hedging Issues

To grasp WHY this choices hedging can matter a lot, I discovered I needed to go previous my primary understanding of choices (and heck, I used to WORK for CBOE) and actually attempt to grok-in-fullness what I personally must do if I used to be making an attempt to be on this insurance coverage market.

For instance I promote you a put that permits you to promote me the S&P 500 Index at a worth we determine on at the moment, a month sooner or later.

Since we agreed on the worth, I’ve change into frightened that the S&P will go down so much. As Adam Butler identified, I do not really need that danger, so I’ll brief the S&P 500 some quantity to not go bankrupt when issues go down.

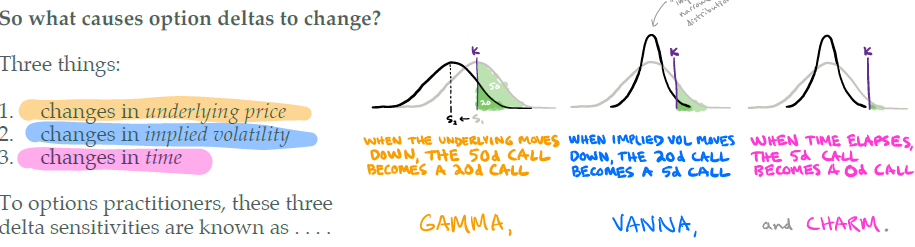

The quantity I hedge is usually my “delta” — one other options-related Greek image meaning “how a lot this feature will transfer primarily based on a transfer within the underlying worth.” A delta of 1 means “if the underlying strikes 1%, the choices worth strikes 1%,” and it is often quoted as factors to the appropriate of the decimal. So a 50 delta place means your place is uncovered 50% to strikes within the underlying.

The drawback is that delta —which I am utilizing to find out the quantity of that real-world brief place I placed on — continually adjustments, however in pretty predictable trend. The one-best factor I’ve ever learn explaining that is the paper: “The Implied Order E-book” from “Squeezemetrics.” This is the most effective chart:

I promise, there’s not going to be a quiz. The important thing level right here is that the quantity that usually-short hedge should change relies on THREE issues: motion of the underlying (gamma); adjustments in implied volatility (vanna, which is one other approach of claiming “how dangerous do I feel this insurance coverage is, and thus, how costly is it?”); and adjustments in time (attraction).

In the event you’re connecting dots right here, what this implies is that the hedging exercise of the choices sellers is definitely a procyclical drive. If most individuals need to hedge the draw back, Then as time passes, the index will rise. Whenever you get a peaceful week or two, the hedges roll off, which in flip turns into shopping for exercise, which additional helps the market.

That’s, till you get some exogenous shock to the system and people fats tails present up.

So the very instruments we now have to mitigate the “fats tails” are probably contributing to them — in each instructions. And other people surprise why the market feels “janky” most days.

Half 4: So Now What?

Importantly, if that is the character of the market, then what do you as an advisor really do with this data? This is Simplify’s Mike Inexperienced once more:

The truth is that this can be a solvable drawback, but it surely requires us to get previous a few of the deep misunderstandings … and shifting into the lengthy volatility area to guard your portfolio.

This is a extra direct reply from Chris Cole and the staff at Artemis Capital of their January 2020 consumer letter (which you need to learn, significantly):

Lengthy Volatility have to be differentiated from conventional Portfolio Insurance coverage (“Tail Danger Hedging”) as a result of it forgoes steady safety for a decrease carrying value. The idea is to sacrifice the primary transfer in an asset in alternate for decrease prices whereas capturing the explosive second and third strikes up or down.

I will be sincere, that is not the most satisfying reply. Six months in a effectively, and it seems all I have to do is… climb the ladder? What about all of the bushy “life is lengthy” stuff?

However the actuality is, even contemplating lengthy vol in a portfolio context is a fairly advanced approach of rethinking the overall portfolio, which in fact, means there’s now a cottage business in serving to join the dots.

Jason Buck, CIO of the volatility-centric Mutiny Fund (and Co-Host of Pirates of Finance, the most effective monetary content material on YouTube), offers this take:

We consider the world as volatility parity. Your shares and bonds, they’re all imply reverting or convergent methods, that are brief volatility. And you then mix these together with your lengthy volatility methods or your commodity development followers, that are all divergent methods, that are lengthy volatility. What we attempt to specific to folks is having the correlated, uncorrelated, negatively correlated all in the identical ebook, rebalanced often, is how one can compound wealth over time.

How “lengthy vol” people implement their methods are all around the map. Some stick with very tightly managed, at- or near-the-money straddles on a single index just like the S&P 500–essentially “gamma scalping,” as the worth actions create a lot of small alternatives to revenue. Others take extra vital out-of-the-money bets, opportunistically producing revenue from promoting choices in some instances, reinvesting in insurance coverage in others. In nearly each case, proprietary fashions and information units are feeding a often quite-active buying and selling technique.

That is genuinely new, even when the inspiration of “tails-centric” investing dates again to the 1960s, bearing on behavioral economics and fractal math (and possibly psychedelics, who is aware of). However adjustments in financial coverage and the rise of high-frequency buying and selling have modified the sport, to say nothing of the rise of ETFs and passive investing.

The precise observational work of how self-reinforcing techniques, by chance non-ergodic fashions, and fashionable coverage mix to create dangers and alternatives is being finished each single day: on weblog posts, on Twitter, at Epsilon Principle, on Actual-Imaginative and prescient, on Hedgeye…and, prefer it or not, within the moment-to-moment pricing of each fairness instrument in your portfolio.

As Buck put it:

If anyone has a backtest previous to 2015 on a protracted volatility technique, I nearly throw it out the window, as a result of the markets have modified that a lot. And so now you’ve gotten a flows primarily based world. After which now the by-product world is changing into so huge, it is the tail that wags the canine.

So what do we do?

Effectively, we are able to look to merchandise that bake within the “lengthy vol” facet of the commerce, from upstarts like Simplify and old-guard corporations like Nationwide. Most of them are nice instruments. However they’re additionally very, very positive instruments — sharpened and refined in a machine store that’s itself being rebuilt every day.

So what all of us ought to actually do is examine our preconceptions on the door about how markets used to work and wade deep, deep into the pool till we actually perceive how this flows-driven, risk-managed market is definitely influencing our portfolios.

I, for one, not assume what I realized within the 1980s and 1990s about economics and markets has actually any worth in anyway, aside from as a historic backdrop. However I additionally do not assume there is a one-size-fits-all reply to the “so what?” As market contributors, it is on us to remain curious, keep knowledgeable, and get our arms soiled.

Take a look at your portfolios. Query your assumptions. Reply for your self: “what occurs if I am fallacious, and each tails of my future returns are a lot fatter than I feel?”

There is not any “Groking-in-Fullness” in any other case.

[NOTE: Special thanks to all the folks mentioned here who gave me a lot of time answering my questions. I apologize to the few-dozen very good folks I just didn’t get a chance to chat with — all the “but you forgot!”s and any egregious errors here are entirely my own.]

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.