Large-cap expertise equities would possibly get all of the fanfare in capital markets, however that

Large-cap expertise equities would possibly get all of the fanfare in capital markets, however that does not imply buyers ought to shrink back from small-caps. Getting small-cap publicity even in these unsure occasions can enable buyers to seize any potential upside that maximized large-caps might not have the ability to present.

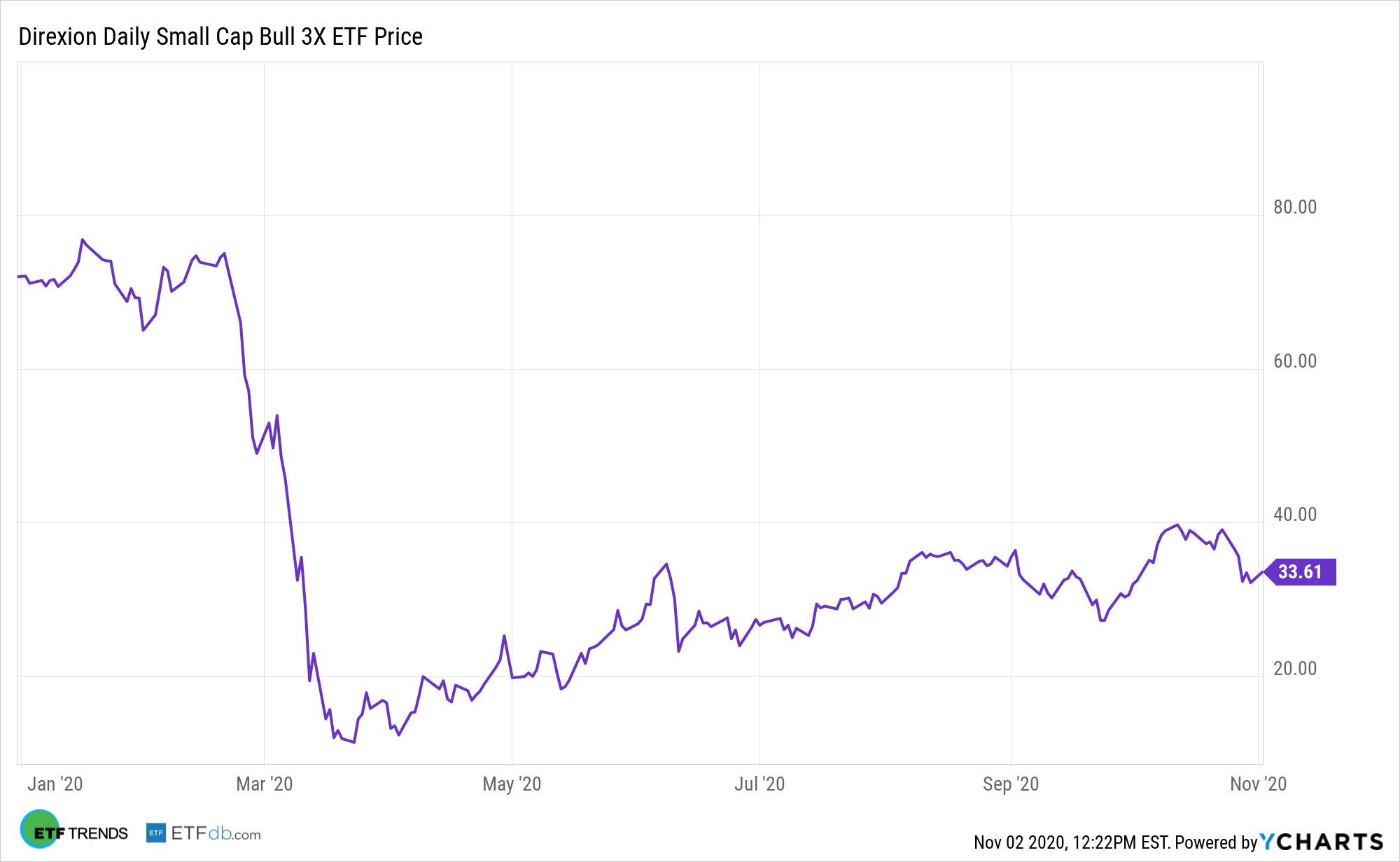

Merchants on the lookout for a bullish play on small-caps can use ETFs just like the Direxion Every day Small Cap Bull 3X Shares (TNA). TNA seeks day by day funding outcomes, earlier than charges and bills, of 300% of the day by day efficiency of the Russell 2000® Index.

A latest article in Enterprise Insider gave three explanation why small cap-stocks are value contemplating. The identical logic needs to be utilized to small-cap-focused ETFs.

“The COVID-19 pandemic jolted buyers with mounting uncertainty in 2020, which is just being exacerbated by an upcoming presidential election,” the article mentioned. “That uncertainty has largely favored large-cap shares, as their resilient earnings and robust stability sheets offered a degree of consolation for buyers daunted by the financial uncertainty. However now, the economic system is in a significantly better place right this moment than it was within the spring, main LPL to consider that now is an effective time to begin warming as much as small-cap shares, based on a Monday be aware from the agency.”

The article additionally talked about that small-caps might be the beneficiaries of an early financial restoration following the consequences of the COVID-19 pandemic.

“Given our view that we’re within the early phases of the enterprise cycle and a brand new bull market, we level out that small cap shares traditionally have carried out effectively relative to their massive cap counterparts popping out of recessions. The story is similar coming off of main bear market lows the place, on common, small caps have outperformed massive caps by about 15% in the course of the first yr of bull markets, based on a examine by Ned Davis Analysis,” LPL mentioned.

TNA invests at the very least 80% of its web property in monetary devices, similar to swap agreements, and securities of the index, ETFs that monitor the index and different monetary devices that present day by day leveraged publicity to the index or ETFs that monitor the index. The index measures the efficiency of roughly 2,000 small-capitalization corporations within the Russell 3000® Index, based mostly on a mix of their market capitalization and present index membership.

Direxion’s leveraged ETFs boast:

- Magnification your short-term perspective with day by day 3X leverage

- Alternative, with bull and bear funds for each side of the commerce

- Agility – liquidity to commerce via quickly altering markets

For extra information and knowledge, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.