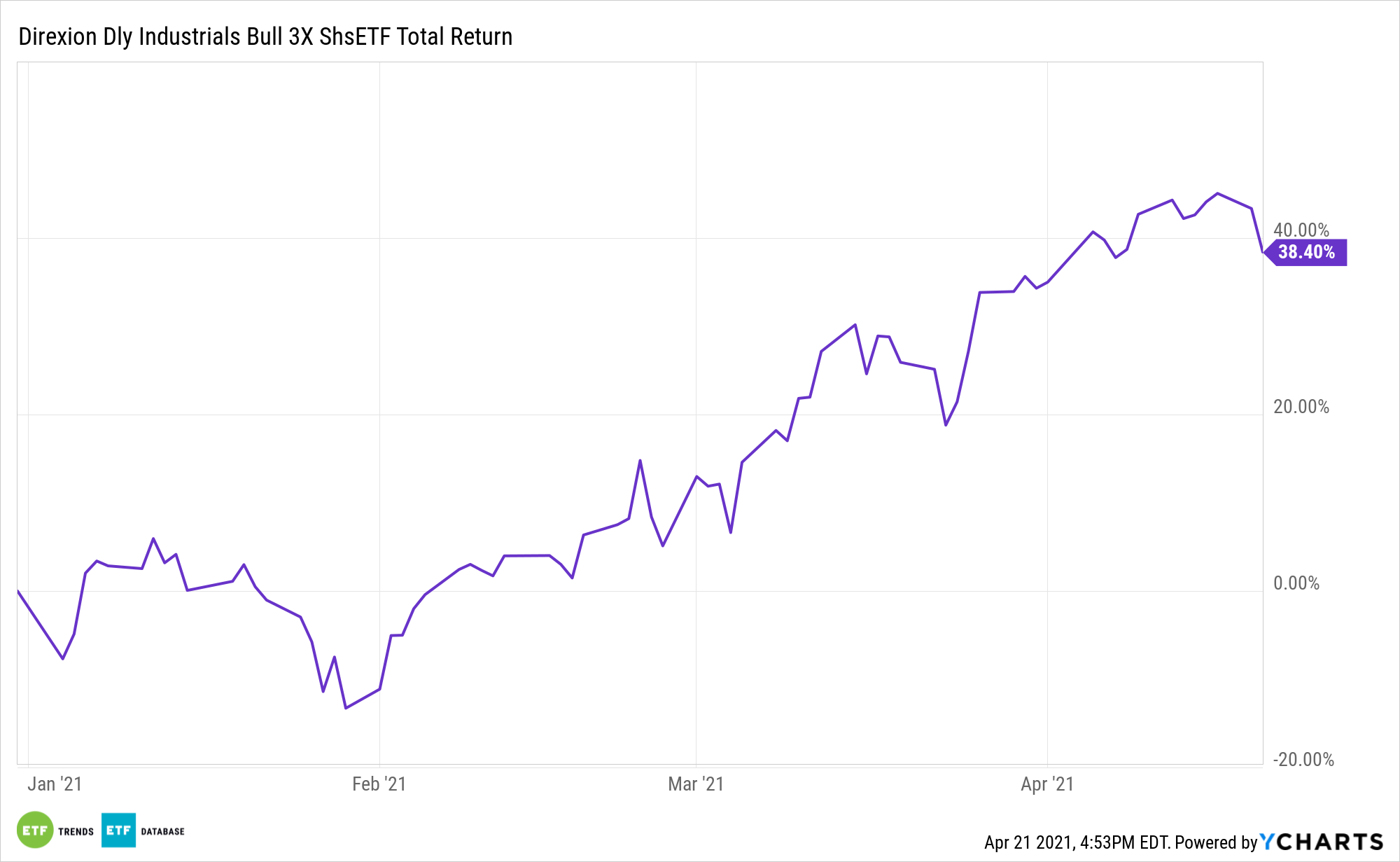

Since U.S. president Joe Biden debuted his infrastructure plan, the industrials sector has helped the Direxion Each day Industrials Bull 3X Shares (DUSL) climb to a year-to-date achieve of just about 43%.

With a give attention to bettering America’s roads, bridges, and different infrastructure initiatives, merchants are seeing a foreseeable rise within the demand for industrial supplies. Merchants can play that power with an added dose of leverage with ETFs like DUSL.

DUSL seeks day by day funding outcomes of 300% of the day by day efficiency of the Industrials Choose Sector Index. The fund, beneath regular circumstances, invests no less than 80% of its web belongings in monetary devices, corresponding to swap agreements, securities of the index, and ETFs that monitor the index and different monetary devices that present day by day leveraged publicity to the index or ETFs that monitor the index.

“President Joe Biden’s proposed $2 trillion infrastructure plan will lead to one other shot within the arm for corporations throughout the industrials sector if Democrats are capable of garner sufficient assist for once-in-a-generation spending on roads, bridges and broadband entry,” a CNBC report famous. “Industrials shares, which have handily outperformed the broader S&P 500 over the past three months, may very well be set for much more positive factors, in keeping with high trade analyst Nick Heymann.”

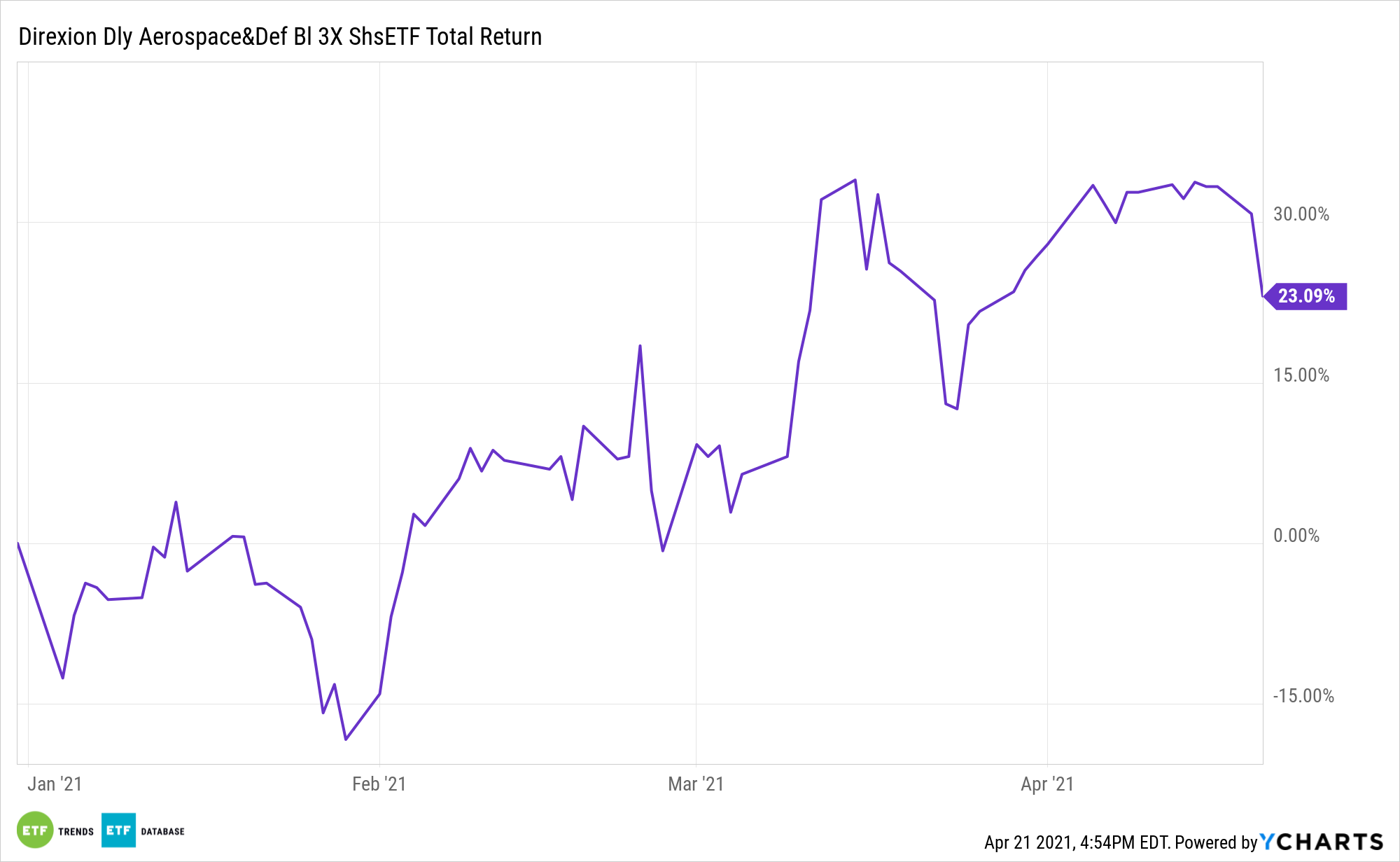

The Aerospace and Protection Sectors

The infrastructure plan can be placing aerospace and protection into play.

“Aerospace and protection, capital items, industrial know-how and constructing merchandise subsectors might all be due for an additional wave of shopping for if the American Jobs Plan is handed, Heymann advised purchasers in a notice earlier this week,” the CNBC report mentioned additional. “Heymann, the co-head of William Blair’s International Industrial Infrastructure analysis, narrowed down a listing of equities the agency believes might see essentially the most extra upside due to large infrastructure spending within the months forward.”

“Industrial corporations at the moment are on the forefront of traders’ focus as the economic sector of the economic system, which was severely impacted in 2020, is now main the U.S. economic system’s resurgence,” he wrote.

In related style, short-term merchants can flip to the Direxion Each day Aerospace & Protection 3X Shares ETF (DFEN). DFEN seeks day by day funding outcomes equal to 300% of the day by day efficiency of the Dow Jones U.S. Choose Aerospace & Protection Index, which makes an attempt to measure the efficiency of the aerospace and protection trade of the U.S. fairness market.

For extra information and data, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.