A lithium sector-specific alternate traded fund jumped on Monday after Orocobre Ltd. (ORL) agreed to accumulate rival Australian miner Galaxy Sources Ltd. (GXY) in an all-stock deal.

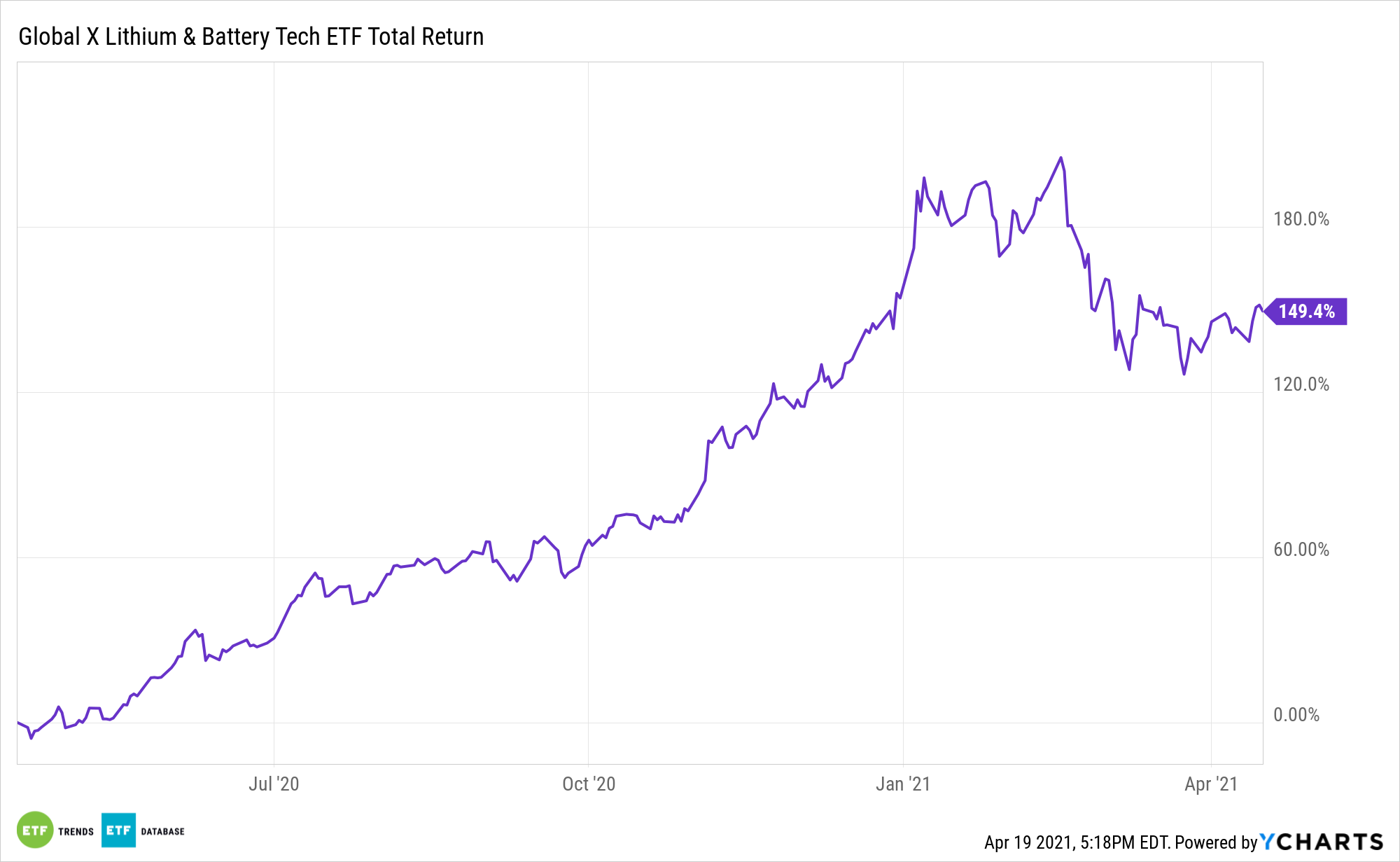

Among the many higher performing non-leveraged ETFs of Monday, the International X Lithium & Battery Tech ETF (NYSEArca: LIT) elevated 3.2%.

In the meantime, Orocobre Restricted shares jumped 8.4% and Galaxy Sources Restricted shares rose 3.4%. LIT features a 1.1% place in ORL and 0.8% in GXY.

Orocobre’s buyout of Galaxy Sources would create a $Three billion miner and one of many world’s greatest producers of lithium, which is usually utilized in batteries for electrical automobiles and different high-tech merchandise, the Wall Road Journal reviews.

The deal comes as lithium commodity costs are surging on provide considerations and a bigger-than-expected electrical automobile growth as extra nations give attention to decrease greenhouse gasoline emission targets.

Orocobre operates the Olaroz lithium mines in northern Argentina, whereas Galaxy runs the Mt. Cattlin mine in Australia and can be growing initiatives in Argentina and Canada.

If the deal goes by means of, the brand new mixed miner could be the fifth-largest world lithium producer.

Wanting forward, lithium costs are anticipated to proceed to extend within the coming years on account of rising demand for electrical automobiles, that are powered by lithium-ion batteries. Lithium would profit probably the most from the shift towards electrical automobiles for the reason that extensively used lithium-ion batteries require round 7% to 10% of lithium, whatever the total battery chemistry.

Moreover, the Australian financial institution not too long ago upwardly revised its worth expectations for lithium final week, pointing to a projected shortfall of lithium provides from 2022 that may widen as electrical automobile demand continues to choose up pace.

Lithium costs have already elevated this 12 months, notably in China, on account of a robust restoration in battery demand and disruptions to provides in Australia.

For extra information, info, and technique, go to the ESG Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.