By Michael Venuto

By Michael Venuto

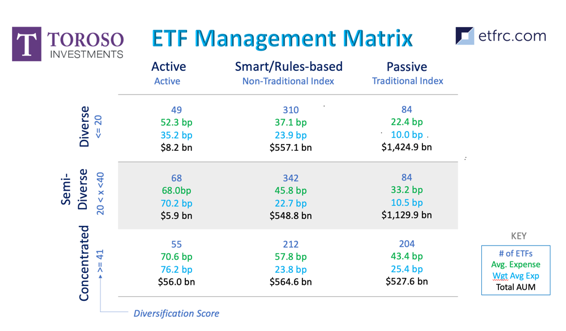

Just a few weeks in the past, we launched the ETF Administration Matrix in partnership with ETF Analysis Middle. On the ETF Assume Tank, we’re devoted to the training and progress of advisors and buyers using the advantages of ETFs. The aim of the ETF Administration Matrix is additional training round ETFs. It’s pushed by our safety grasp, which seeks to supply a typical language for discussing and researching ETF information. This week we dive into the higher left nook of the matrix and concentrate on the smallest class: Lively & Various ETFs (AD).

The AD class has the least quantity of listed funds with solely 49 out of 1,408 non-leveraged fairness ETFs coated. The AD class represents solely 3.5% of fairness ETFs and 28.5% of lively fairness ETFs. What does stand out is the common expense ratio, which is lower than half of the extra concentrated lively ETFs. As we famous within the weekly KPI, Lively ETFs characterize 10.17% of ETF business income, however as a result of low expense ratios, the AD class solely represents 5.8% of the income generated by Lively ETFs. Surprisingly, there are extra property in AD class than within the Lively Semi-Various class. Now, let’s discover the AD ETFs with probably the most property.

[wce_code id=192]

Previous Canines, New Tips

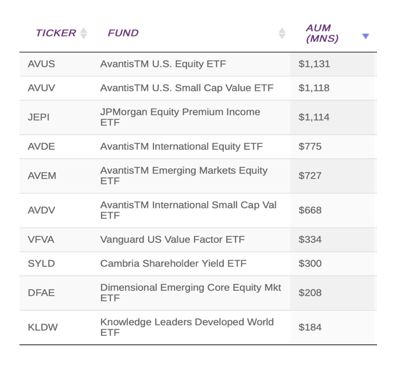

The AD class is dominated by property from Avantis, JP Morgan and Vanguard. Most of those funds are associates to American Century and their wholesaling machine. The property have seemingly come from intermediaries and advisors fairly than particular person buyers. These ETFs, though filed as lively, appear to be extra like low-tracking error-style box-focused methods.

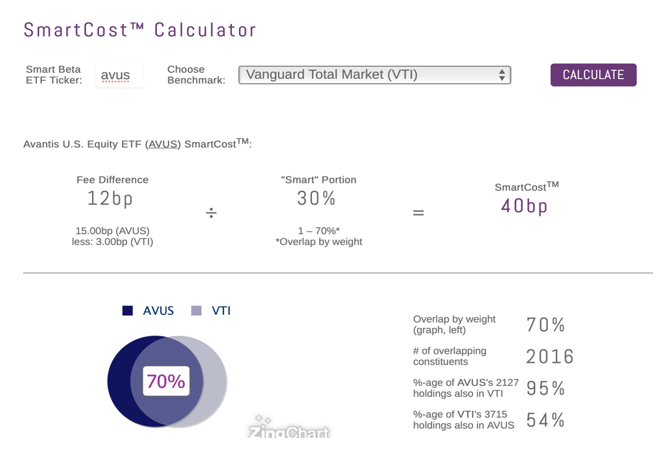

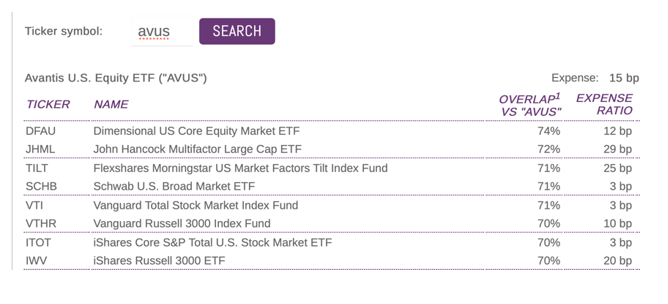

As you possibly can see from our ETF Assume Tank Good Price Calculator, AVUS captures 95% of the securities within the Vanguard Whole US Fairness ETF (VTI). By weighting these securities in another way the place overlap drops to 70%. Additional, when trying on the closest 10 ETF opponents by overlap, 90% are passive. This suggests that the first shopper of those AD ETFs are conventional type field mutual fund buyers that at the moment are embracing the advantages of the ETF construction.

Innovation Diversified

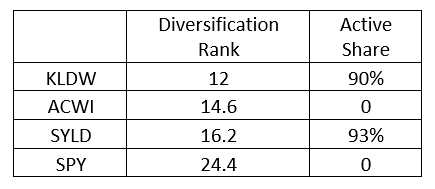

From an asset gathering, income producing and charge standpoint, it’s apparent why issuers are specializing in extra concentrated lively ETFs. That stated, there are two attention-grabbing standouts within the high ten ETFs of the AD class: Information Leaders Developed World ETF (KLDW) and Cambria Shareholder Yield (SYLD).

The desk above exhibits that regardless of these two funds providing extra diversification than the standard index, they each present lively share at or above 90%. This implies that there’s room within the market for AD ETFs that really present a differentiated portfolio.

ETF Assume Tank members can entry these instruments by requesting a log in right here.

Initially revealed by ETF Assume Tank, 5/12/21

Disclosure

The knowledge offered right here is for monetary professionals solely and shouldn’t be thought-about an individualized suggestion or personalised funding recommendation. The funding methods talked about right here will not be appropriate for everybody. Every investor must overview an funding technique for his or her personal specific scenario earlier than making any funding determination.

All expressions of opinion are topic to vary with out discover in response to shifting market circumstances. Information contained herein from third social gathering suppliers is obtained from what are thought-about dependable sources. Nonetheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never supposed to be reflective of outcomes you possibly can anticipate to attain.

All investments contain threat, together with attainable lack of principal.

The worth of investments and the revenue from them can go down in addition to up and buyers might not get again the quantities initially invested, and could be affected by modifications in rates of interest, in change charges, normal market circumstances, political, social and financial developments and different variable elements. Funding includes dangers together with however not restricted to, attainable delays in funds and lack of revenue or capital. Neither Toroso nor any of its associates ensures any charge of return or the return of capital invested. This commentary materials is on the market for informational functions solely and nothing herein constitutes a suggestion to promote or a solicitation of a suggestion to purchase any safety and nothing herein ought to be construed as such. All funding methods and investments contain threat of loss, together with the attainable lack of all quantities invested, and nothing herein ought to be construed as a assure of any particular consequence or revenue. Whereas we now have gathered the knowledge introduced herein from sources that we imagine to be dependable, we can not assure the accuracy or completeness of the knowledge introduced and the knowledge introduced shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to supply revised opinions within the occasion of modified circumstances.

The knowledge on this materials is confidential and proprietary and will not be used aside from by the supposed person. Neither Toroso or its associates or any of their officers or staff of Toroso accepts any legal responsibility in anyway for any loss arising from any use of this materials or its contents. This materials will not be reproduced, distributed or revealed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.