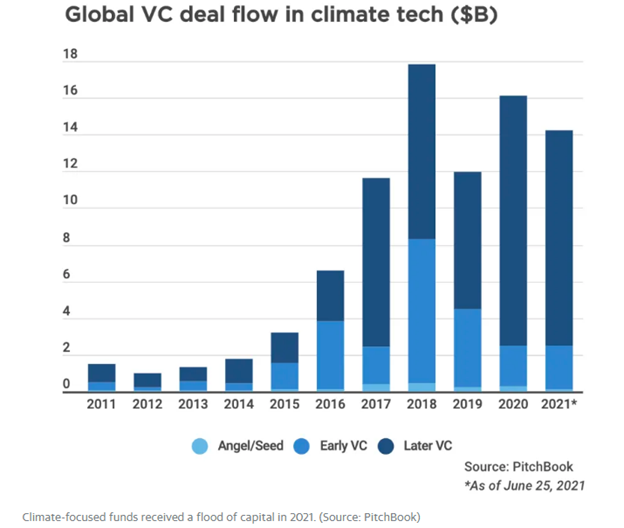

Venture capital is being more and more poured into ESG-centric corporations, and local weather tech ones specifically have skilled a increase. In line with Yahoo Finance, local weather tech corporations backed by enterprise capital raised $14.2 billion globally between January and June of this yr.

In a report accomplished by PwC, the authors acknowledged that yearly enterprise capital funding into local weather tech on a world scale grew 3,750% in absolute phrases. That’s 3 times what was invested by enterprise capitalists into AI throughout the identical time, reflecting altering pursuits in traders.

“I feel there’s simply a whole lot of tailwinds for the house,” mentioned Mike Winterfield, founder and managing companion of Energetic Impression Investments on Yahoo Finance Dwell.

Whereas some hearken again to the success after which collapse of unpolluted tech again within the early 2000s, local weather tech has just a few notable variations going for it. Local weather tech focuses on decreasing carbon and greenhouse gasoline emissions throughout industries and economies. Focusing on the first driver of worldwide warming makes it a precious, and very important, a part of a sustainable future.

One other main distinction between the 2 is that the place clear tech lacked main funding throughout its peak, local weather tech has the assist of governments and customers worldwide.

“What we’re seeing with a whole lot of the businesses that we’re investing in and that others are investing in within the house proper now could be that they are already proving to carry out,” Winterfield mentioned. “They’re reaching excessive ranges of profitability, money stream. We’re seeing acquisitions, IPOs occurring within the house, and traders are getting rewarded for transferring into the house proper now, and the extent of expertise and innovation that’s transferring into the house is completely astounding.”

Putnam Believes in Constructing a Sustainable Future

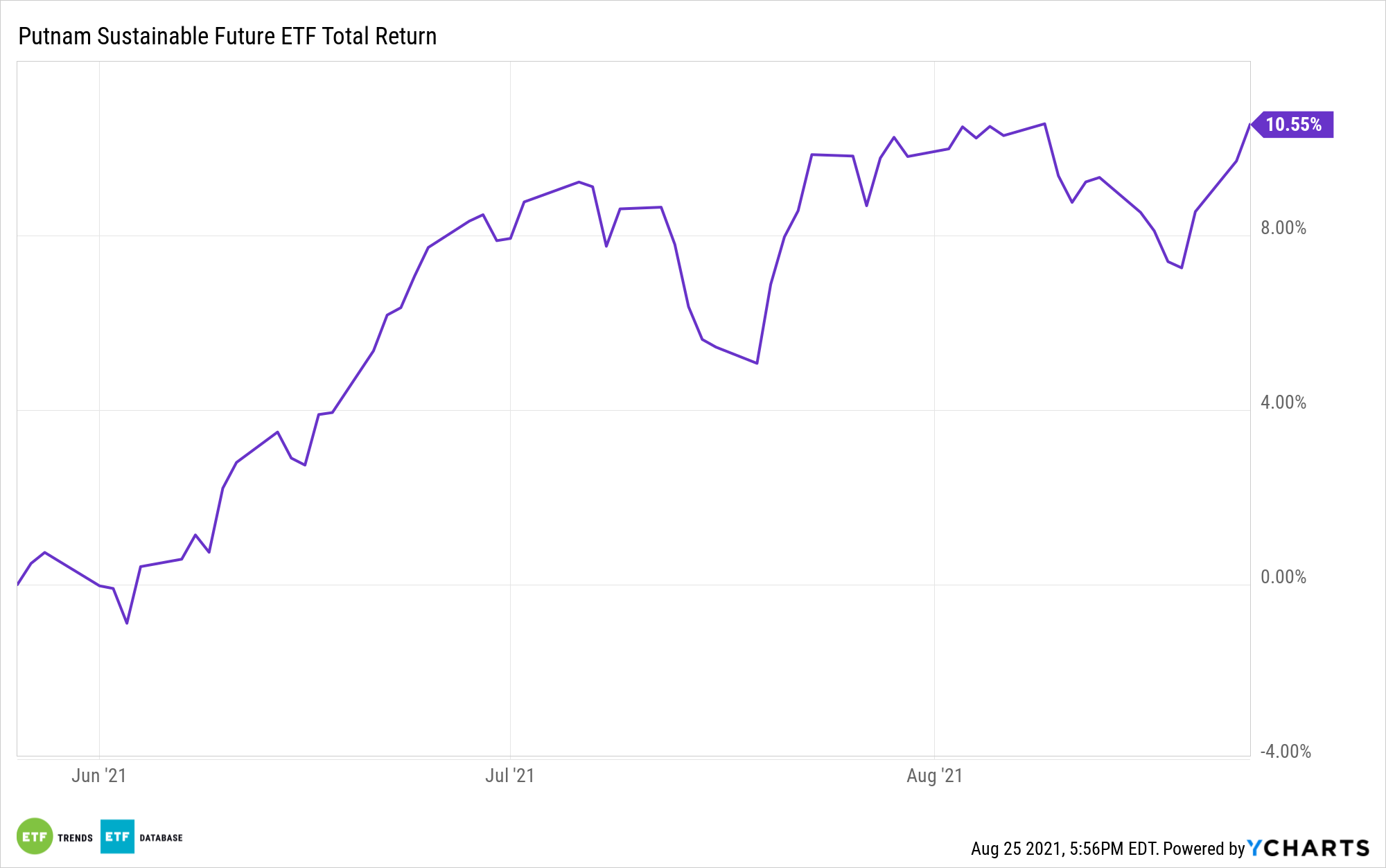

The Putnam Sustainable Future ETF (PFUT) is an inclusionary ETF that invests in corporations in search of to supply options to future sustainability challenges. It’s a forward-looking strategy as these corporations are serving to to develop ESG and clear up issues associated to sustainability.

PFUT focuses on influence corporations as recognized by its sustainability score system. It invests in corporations driving financial improvement, as Putnam believes that robust sustainability practices equate to robust monetary development.

As a semi-transparent fund utilizing the Constancy mannequin, PFUT doesn’t disclose its present holdings each day. As a substitute, it publishes a monitoring basket of beforehand disclosed holdings, liquid ETFs that mirror the portfolio’s funding technique, and money and money equivalents. The monitoring portfolio is designed to carefully monitor the precise fund portfolio’s general efficiency, and precise portfolio experiences are launched month-to-month.

PFUT’s prime sector allocations as of finish of July have been 32.43% in healthcare shares, 29.98% in data know-how, and 9.71% to client discretionary.

The ETF has an expense ratio of 0.64%.

For extra information, data, and technique, go to the Massive Concepts Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com