Amid a powerful earnings growth, these needs to be go-go days for European equities. Value motion says in any other case, indicating buyers mulling publicity throughout the Atlantic would possibly wish to achieve this in non-dedicated kind.

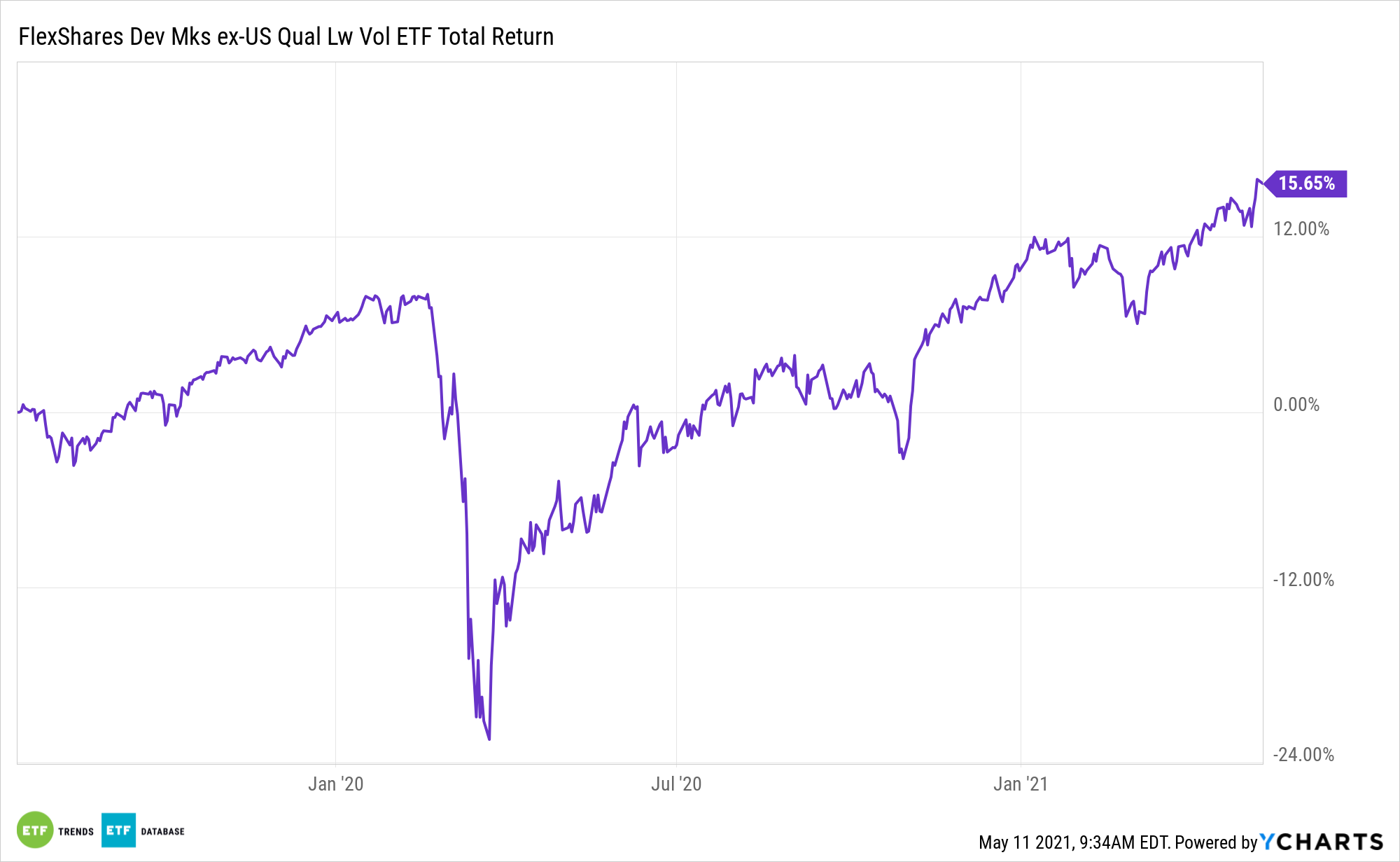

The FlexShares Developed Markets ex-US High quality Low Volatility Index Fund (NYSE: QLVD) is a sensible concept for buyers seeking to dip their toes into the waters of European equities with out the all-in dedication of a devoted Europe fund.

Knowledge affirm European earnings are sturdy, highlighting a supply of attract with QLVD.

“Thus far in earnings season, 60% of corporations within the MSCI Europe index have overwhelmed earnings per share (EPS) estimates by 5% or extra, with 19% lacking estimates—the most effective ever fee since Morgan Stanley started gathering knowledge in 2007. Financials and shopper discretionary corporations posted the broadest beats thus far in earnings season, they added,” stories Callum Keown for Barron’s.

QLVD: Simply Proper for European Publicity?

QLVD follows the Northern Belief Developed Markets ex US High quality Low Volatility Index and allocates over 43% of its weight to 6 European international locations, together with the U.Okay., Switzerland, and Germany.

Related to Europe by means of the QLVD thesis is the latest uptick in high quality in earnings on the continent.

“The earnings beats had been additionally ‘prime quality in nature’, citing vital latest upgrades earlier this 12 months throughout the board, and underpinned confidence in a powerful rebound in 2021,” Barron’s stories, citing Morgan Stanley.

High quality is some extent of emphasis for QLVD, which affords buyers greater than only a fundamental low volatility technique.

“Low-volatility methods is usually a useful defensive technique for buyers who wish to scale back potential portfolio declines throughout market downturns, whereas nonetheless capturing among the positive aspects that come throughout optimistic markets,” in accordance with the issuer. “We imagine that the FlexShares Developed Markets ex-US High quality Low Volatility Index Fund (QLVD), which contains our research-driven findings in regards to the position of high quality in a inventory’s potential volatility, may help buyers meet their threat administration and capital appreciation objectives.”

QLVD’s high quality inclusion is vital for an additional motive: European corporations which can be lacking earnings estimates are being punished.

“Nevertheless, share worth motion within the aftermath of earnings has been negatively skewed. Firms whose earnings have missed expectations have seen their shares underperform by a median of 1.5% on the day of outcomes, whereas these beating estimates have solely outperformed by 0.2%,” concludes Barron’s.

For extra on multi-asset methods, go to our Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.