This month, Louis Vuitton turns 200 years previous. That’s Louis Vuitton the person, not the corporate. Born in Jura, France in 1821, the designer opened his first store in 1854 primarily as a maker of customized journey trunks.

At present, Louis Vuitton the corporate, also called LV, is probably the most priceless luxurious model on the earth based on the Kantar Group. Utilizing a proprietary methodology that features not simply company monetary information but additionally shopper analysis, the London-based information analytics agency valued the LV model at $75 billion as of 2020. That’s virtually $30 billion greater than the second-place luxurious model, Chanel, which was valued at $47 billion.

LV is now owned by LVMH Moet Hennessey Louis Vuitton, the largest European firm by market cap. The tremendous luxurious conglomerate controls round 75 manufacturers, together with Christian Dior, TAG Heuer and Bulgari, on high of LV. Its most up-to-date acquisition, of American jewellery retailer Tiffany, was accomplished in January of this 12 months.

The rationale I’m bringing this up is as a result of it’s been an excellent 12 months up to now for LV, and LVMH extra broadly.

LVMH Studies Document Numbers

The Paris-based conglomerate simply posted document income within the first half of the 12 months, producing a really noteworthy 28.7 billion euros ($34.Zero billion). That comes out to a hefty 56% improve from the identical six months in pandemic-impacted 2020 and a good 14% improve from 2019.

The enterprise group that noticed the biggest gross sales development was vogue and leather-based items, of which LV is a member. (LVMH notes that demand for LV merchandise is so excessive proper now, shoppers typically should get on a ready checklist.) The group generated document revenues of 13.Eight billion euros ($16.four billion) within the first six months, up 81% from 2020 and 38% from 2019. Earnings for vogue and leather-based items had been 5.6 billion euros ($6.7 billion), additionally a brand new document excessive for LVMH.

You get the purpose. Gross sales have been exceptionally sturdy for the reason that begin of the pandemic as economies have reopened. Shoppers look like spending the cash they saved up in the course of the months in lock-down.

The massive query buyers may need is whether or not the nice occasions can final. Was the primary half of 2021 a one-off, or have we reached a turning level?

I occur to be bullish for various causes, one of many largest being that customers’ buying energy has continued to broaden with the rising variety of high-net value people (HNWIs).

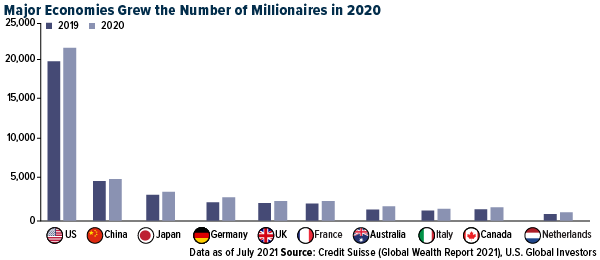

Millionaires Now Make Up 1% of the International Inhabitants

A HNWI is known to be somebody with a web value over $1 million, and on account of a powerful inventory market and near-zero rates of interest, the pandemic didn’t decelerate capital creation for a lot of in 2020. For the primary time ever, greater than 1% of the worldwide inhabitants can now be thought-about greenback millionaires, with the highest 10 economies minting 5.2 million new millionaires final 12 months alone, based on Credit score Suisse. This introduced the worldwide complete of adults with greater than $1 million to 56.1 million, probably the most in historical past.

Have a look beneath. In every of the highest 10 economies, the variety of HNWIs elevated from 2019 to 2020, with out exception. The U.S. added probably the most millionaires (+1.7 million) of any nation, adopted by Germany (+633,000) and Australia (+392,000).

click on to enlarge

It’s not simply the highest 1% who’ve expanded their buying energy, although. Adjusted for inflation, U.S. actual disposable private revenue in 2019 averaged $14,882, the best on document as much as that time. Disposable revenue is what somebody has to spend after revenue taxes have been deducted. The determine shot up once more in 2020 to $15,770, however the improve was doubtless a results of stimulus checks hitting People’ financial institution accounts. Quarantining households pocketed the financial savings of not going out to eat and spending on leisure.

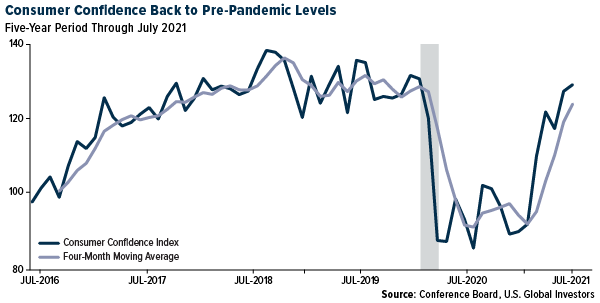

Households additionally look like extra desperate to splurge than at every other time for the reason that pandemic started early final 12 months. July’s Shopper Confidence Index (CCI), which measures how optimistic U.S. shoppers are about their private funds, rose to 129.1, the best studying since February 2020.

click on to enlarge

I imagine that is all very constructive for luxurious gross sales going ahead. Favorable financial and monetary circumstances might make shares of those firms enticing to buyers in search of publicity to the expansion in HNWIs.

Investing in International Luxurious Items

As I see it, buyers who’re concerned about luxurious names have two choices.

They will put within the time conducting analysis on a number of firms, pouring over financials, following value charts and extra.

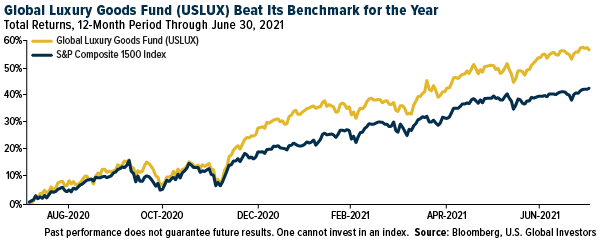

Or they will maintain issues easy and spend money on the International Luxurious Items Fund (USLUX), the one fund in North America that gives entry to luxurious firms around the globe. That features not simply LVMH but additionally Hermes, Kering, Prada, Burberry and extra. The fund additionally invests in luxurious automobile producers comparable to BMW and Ferrari, and it maintains publicity to treasured metallic miners that produce the supplies wanted to fabricate high-end jewellery.

USLUX got here on to the market in July 2020 after altering its title and funding technique. I’ve been very thrilled to see how nicely the fund has carried out within the 12 months since. As of June 30, 2021, USLUX was up greater than 56% for the 12-month interval, in comparison with its benchmark, the S&P Composite 1500 Index, which was up 42%.

click on to enlarge

Initially revealed by US Funds, 8/5/21

Previous efficiency doesn’t assure future outcomes.

Please think about rigorously a fund’s funding goals, dangers, costs and bills. For this and different vital data, receive a fund prospectus by clicking right here or by calling 1-800-US-FUNDS (1-800-873-8637). Learn it rigorously earlier than investing. Foreside Fund Companies, LLC, Distributor. U.S. International Buyers is the funding adviser.

| Complete Annualized Returns as of 6/30/2021: | ||||

|---|---|---|---|---|

| Fund | One-Yr | 5-Yr | Ten-Yr | Gross Expense Ratio |

| International Luxurious Items Fund | 53.27% | 14.53% | 8.54% | 1.58% |

| S&P Composite 1500 Index | 42.12% | 17.38% | 14.36% | n/a |

Efficiency information quoted above is historic. Previous efficiency isn’t any assure of future outcomes. Outcomes replicate the reinvestment of dividends and different earnings. For a portion of intervals, the fund had expense limitations, with out which returns would have been decrease. Present efficiency could also be larger or decrease than the efficiency information quoted. The principal worth and funding return of an funding will fluctuate in order that your shares, when redeemed, could also be value roughly than their authentic price. Efficiency doesn’t embody the impact of any direct charges described within the fund’s prospectus which, if relevant, would decrease your complete returns. Efficiency quoted for intervals of 1 12 months or much less is cumulative and never annualized. Receive efficiency information present to the newest month-end at www.usfunds.com or 1-800-US-FUNDS.

Foreside Fund Companies, LLC, Distributor. U.S. International Buyers is the funding adviser.

Mutual fund investing includes threat. Principal loss is feasible. Corporations within the shopper discretionary sector are topic to dangers related to fluctuations within the efficiency of home and worldwide economies, rate of interest modifications, elevated competitors and shopper confidence. The efficiency of such firms might also be affected by components referring to ranges of disposable family revenue, lowered shopper spending, altering demographics and shopper tastes, amongst others.

The Shopper Confidence Index (CCI) is a survey, administered by The Convention Board, that measures how optimistic or pessimistic shoppers are concerning their anticipated monetary scenario. The S&P Composite 1500 combines three main indices, the S&P 500, the S&P MidCap 400 and the S&P SmallCap 600, to cowl roughly 90% of U.S. market capitalization. It’s designed for buyers in search of to copy the efficiency of the U.S. fairness market or benchmark in opposition to a consultant universe of tradable shares.

Fund portfolios are actively managed, and holdings might change every day. Holdings are reported as of the newest quarter-end. Holdings within the International Luxurious Items Fund (USLUX) as a share of web belongings as of 6/30/2021: Hermes Worldwide SA 6.46%, LVMH Moet Hennessy Louis Vuitton SA 7.79, Bayerische Motoren Werke AG 3.86%, Kering SA 2.14%, Prada SpA 0.98%, Ferrari NV 0.93%, Burberry Group PLC 0.90%.

All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions will not be acceptable to each investor.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.