A new report revealed in Might says that international gross sales of luxurious items have a shot at totally recovering to 2019 ranges this 12 months. Consultancy agency Bain & Firm believes there’s a 30% chance that the luxurious market may meet or exceed $340 billion in gross sales of high-end gadgets resembling attire, purses and jewellery, which might be essentially the most in two years.

This marks an adjustment up from Bain’s prior forecast of a full restoration by 2022 or 2023. What’s modified, the Boston-based group says, is China and america’ unexpectedly robust financial rebounds, thanks largely to swift vaccine distribution.

Some might query Bain’s optimism. In spite of everything, the luxurious items market noticed its greatest annual decline on document in 2020, falling 23% on account of pandemic-related lockdowns and monetary uncertainty.

However a restoration has already begun. The French luxurious big LVMH Moet Hennessy Louis Vuitton introduced in April that it had returned to progress within the first quarter, with $16.75 billion in gross sales throughout its greater than 70 manufacturers. Style and leather-based items specifically had a superb begin to the 12 months, producing document income of $6.7 billion, or 37% larger than the identical interval in 2019.

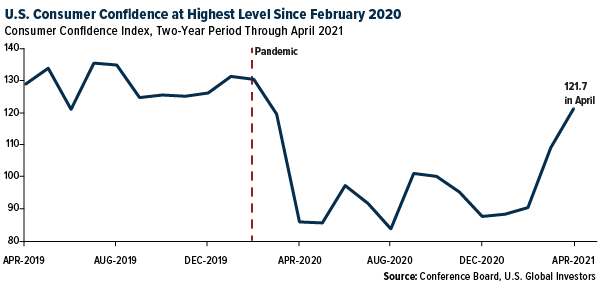

Like Bain, I’m very bullish and consider that U.S. and Chinese language customers are well-positioned to keep up this momentum. Vaccines proceed to be administered, although at a barely slower tempo than earlier than, whereas stimulus checks helped U.S. disposable incomes bounce an unheard-of 29% in March in comparison with the identical month final 12 months. Over $17 trillion sit in U.S. business banks at a time when shopper confidence has climbed to its highest degree since quickly earlier than the pandemic.

click on to enlarge

Asia Projected to Contribute $10.three Trillion in New Spending by 2030

Shoppers in China have likewise proven unimaginable resilience. In line with the Nationwide Bureau of Statistics, retail gross sales of shopper items rose 17.7% in April in comparison with the identical month in 2020, 8.8% in comparison with April 2019. As robust as this progress sounds, it’s a slight slowdown from February and March, when gross sales elevated 33.8% and 34.2%, respectively, over final 12 months.

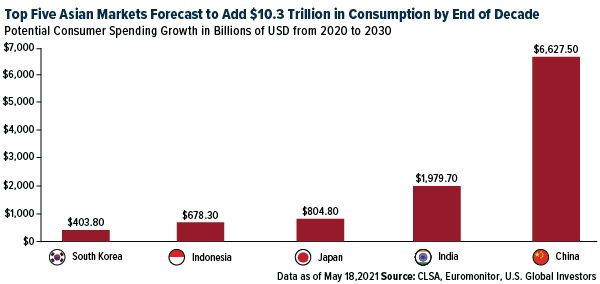

Wanting forward, China is about to contribute an extra $6.6 trillion in international consumption between now and the top of the last decade, based on Hong Kong funding financial institution CLSA. When mixed with 4 different massive Asian markets—India, Japan, Indonesia and South Korea—the whole quantity quantity in new shopper spending may very well be as a lot as $10.three trillion.

click on to enlarge

If correct, this may very well be extremely supportive of the luxurious items market, which already is determined by a robust Asian shopper base. As CLSA analysts write, Asian members of Era Z—these born between 1995 and 2009—characterize the biggest shopper base within the area by 2030 at almost 1 billion robust. They’re extra prosperous and higher educated than older demographic teams, and their spending habits extra carefully resemble these of Western customers as incomes steadily rise.

A Strategy to Play the Luxurious Increase

I consider a lovely approach to play the restoration in luxurious gross sales is with our World Luxurious Items Fund (USLUX). As its ticker suggests, USLUX is really international, with half of the fund containing firms domiciled within the U.S. The opposite half consists of firms in Western European markets—primarily Germany, France and Switzerland—and Canada.

USLUX is well-diversified, with publicity to not simply conventional luxurious items producers (suppose LVMH, Burberry and Prada) but in addition carmakers (Tesla, BMW, Ferrari), retailers (Costco, House Depot) and even gold producers (Barrick, Newmont).

Why gold producers, who may ask? Jewellery producers characterize the second largest supply of demand for bodily gold following funding, placing gold miners close to the entrance of the luxurious items provide chain.

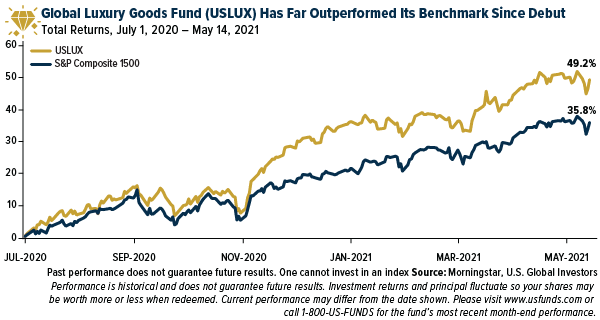

USLUX modified its funding technique on July 1, 2020, and since then, the fund has far outperformed its benchmark, the S&P Composite 1500 Index. USLUX was up near 50% as of Might 14 the place the index was up 35%.

click on to enlarge

Eager about studying methods to make investments with model? You’ll find every thing you’re in search of, from the USLUX reality sheet to historic efficiency, by clicking right here.

Please take into account rigorously a fund’s funding targets, dangers, expenses and bills. For this and different vital data, receive a fund prospectus by clicking right here or by calling 1-800-US-FUNDS (1-800-873-8637). Learn it rigorously earlier than investing. Foreside Fund Providers, LLC, Distributor. U.S. World Traders is the funding adviser.

| Funds | One-12 months | 5-12 months | Ten-12 months | Gross Expense Ratio |

|---|

| World Luxurious Items Fund (USLUX) | 72.12% | 12.12% | 7.40 | 1.70% |

| S&P Composite 1500 Index | 58.73% | 16.15% | 13.74% | N/A |

Expense ratios as said in the latest prospectus. Complete annual bills after reimbursement have been 1.58%. Efficiency knowledge quoted above is historic. Previous efficiency isn’t any assure of future outcomes. Outcomes mirror the reinvestment of dividends and different earnings. For a portion of intervals, the fund had expense limitations, with out which returns would have been decrease. Present efficiency could also be larger or decrease than the efficiency knowledge quoted. The principal worth and funding return of an funding will fluctuate in order that your shares, when redeemed, could also be price kind of than their unique value. Efficiency doesn’t embody the impact of any direct charges described within the fund’s prospectus which, if relevant, would decrease your complete returns. Receive efficiency knowledge present to the latest month-end at www.usfunds.com or 1-800-US-FUNDS.

Initially revealed by US Funds, 5/27/21

The fund modified its funding technique on July 1, 2020. Previous to that date, the fund invested in a diversified portfolio of fairness of equity-related securities of firms within the S&P Composite 1500 Index, with a concentrate on firms reaching excessive return on invested capital metrics and an emphasis on mid-capitalization firms. Totally different funding methods might result in completely different efficiency outcomes. The fund’s efficiency for intervals previous to July 1, 2020 displays the make investments technique in impact previous to the date.

Mutual fund investing concerned danger. Principal loss is feasible. Inventory markets might be unstable and share costs can fluctuate in response to sector-related and different dangers as described within the fund prospectus. International and rising market investing includes particular dangers resembling forex fluctuation and fewer public disclosure, in addition to financial and political danger. Firms within the shopper discretionary sector are topic to dangers related to fluctuations within the efficiency of home and worldwide economies, rate of interest adjustments, elevated competitors and shopper confidence.

All opinions expressed and knowledge offered are topic to vary with out discover. A few of these opinions is probably not applicable to each investor.

The Shopper Confidence Index (CCI) is a survey, administered by The Convention Board, that measures how optimistic or pessimistic customers are concerning their anticipated monetary scenario. The S&P Composite 1500 combines three main indices, the S&P 500, S&P MidCap 400 and S&P SmallCap 600, to cowl roughly 90% of U.S. market capitalization.

Fund portfolios are actively managed, and holdings might change every day. Holdings are reported as of the latest quarter-end. Holdings within the World Luxurious Items Fund as a proportion of web belongings as of three/31/2021: LVMH Moet Hennessy Louis Vuitton SA 5.80%, Tesla Inc. 4.54%, Costco Wholesale Corp. 4.29%, The House Depot Inc. 2.67%, Prada SpA 0.88%, Burberry Group PLC 0.85%, Ferrari NV 0.71%, Barrick Gold Corp. 0.38%, Newmont Corp. 0.35%.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.