Asymmetrical danger and reward has all the time been a dilemma for mounted revenue buyers, and the

Asymmetrical danger and reward has all the time been a dilemma for mounted revenue buyers, and the advantages are much more troublesome to evaluate within the present setting. When pondering of mounted revenue, there may be all the time extra potential draw back danger, and plain bond math would point out that the upside is proscribed when you’ve a safety with an outlined maturity at par worth. With restricted upside potential, buyers actually wish to know that they’re being compensated pretty when dangers are elevated as they’re presently. That’s the place the relative worth comes into play. Mounted revenue securities are typically priced primarily based on their yield relative to different bonds of comparable danger traits, comparable to length, credit score high quality, or dangers round optionality. Sectors inside mounted revenue can be assessed for worth relative to one another whereas making an allowance for the historic unfold ranges. Whereas every safety and sector have completely different dangers to be thought-about, one frequent danger is liquidity which has impacted most mounted revenue merchandise this yr as we noticed within the spring. Liquidity might be the largest danger of all of them and may ship bond costs in some sectors down nearly as a lot as equities.

Bond buyers are available many styles and sizes. To grasp this idea, we should always contemplate the completely different functions that mounted revenue can play in a portfolio. Revenue, diversification from fairness danger, and institutional asset-liability administration are good examples of mounted revenue utilization. Due to this, assessing worth might differ for every sort of investor. Historically, worth in mounted revenue is assessed on a relative foundation. Nevertheless, within the submit Nice Recession setting with fewer market makers and extra regulation, any bond investor can fall wanting their objective as a consequence of liquidity dangers.

[wce_code id=192]

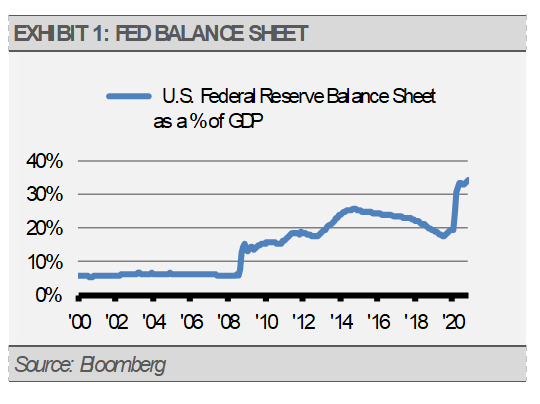

The long-discussed dangers as a consequence of an absence of mounted revenue market makers and regulation lastly got here to fruition lately and uncovered even probably the most strong and effectively researched bonds to significant draw back danger. Fortunately, the U.S. Federal Reserve (the Fed) jumped in to assist a number of bond market sectors, comparable to company bonds and municipals, with unprecedented purchases. The Fed even went so far as buying excessive yield bonds and stuck revenue ETFs. The chart under is an effective illustration of the Fed’s involvement in offering liquidity for mounted revenue markets this yr.

Now that issues appear to be settling down and markets are functioning once more, there may be nonetheless the query of whether or not or not a market that gives document low yields, restricted upside, and the potential for nearly fairness like draw back is smart in any respect. Some sectors of the bond market might not be the precise reply for buyers on the lookout for danger diversification. Assuming the Fed’s stance with respect to quantitative easing and asset purchases will not be impacted by a change of energy within the White Home, we anticipate the Fed to proceed purchases of U.S. Treasuries and company Mortgage-Backed Securities by way of the top of 2021 on the present tempo in accordance with the current FOMC minutes. These purchases ought to decelerate in 2022 and 2023. Purchases of company bonds, excessive yield bonds, non-agency MBS, and municipal bonds are set to run out on the finish of the yr, which can expose these unfold sectors to extra liquidity danger.

In contrast to the modifications after 2008, which allowed for the continual purchases of company Mortgage-Backed Securities, the liquidity services and instruments used to prop up unfold sector markets this time will expire. Within the case of COVID-19, there was no ethical hazard case making it simpler for Congress to move laws to assist credit score markets. Primarily, navigating this market might not be as simple because it was throughout earlier instances of disaster. Within the absence of the Fed, these sectors can be at increased danger for liquidity occasions and better correlations to equities.

On this setting, we stay comparatively benchmark impartial to obese in mortgage-backed securities and U.S. Treasuries inside our mounted revenue publicity. We’ve moved a few of our allocations to energetic administration within the hopes of higher navigating the opposite dangers related to optionality, credit score, and rates of interest.

Initially printed by Stringer Asset Administration

DISCLOSURES

Any forecasts, figures, opinions or funding strategies and methods defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought-about to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to alter with out reference or notification. The views contained herein are to not be taken as recommendation or a advice to purchase or promote any funding and the fabric shouldn’t be relied upon as containing enough data to assist an funding determination. It ought to be famous that the worth of investments and the revenue from them might fluctuate in accordance with market situations and taxation agreements and buyers might not get again the complete quantity invested.

Previous efficiency and yield might not be a dependable information to future efficiency. Present efficiency could also be increased or decrease than the efficiency quoted.

The securities recognized and described might not signify all the securities bought, offered or really useful for shopper accounts. The reader mustn’t assume that an funding within the securities recognized was or can be worthwhile.

Knowledge is offered by varied sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an impartial accountant.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.