Following a sanguine June, shares are proving jittery within the early phases of July, and whereas volatility is not but at alarming heights, some market observers consider the same old summer season lull may give technique to some bumpy spots for riskier property.

That does not imply volatility will persist for prolonged durations, however advisors can act prudently to curb volatility in any case. A method to take action is with WisdomTree’s Volatility Administration Portfolio.

“This mannequin portfolio is designed in its place funding sleeve that displays decrease correlation to conventional fairness and glued revenue securities,” in accordance with WisdomTree. “This portfolio’s goal is to enhance a extra conventional fairness and glued revenue portfolio, whereas searching for to extend the variety of potential return drivers and enhance the general portfolio danger/return traits.”

The mannequin portfolio is comprised of 5 alternate traded funds, every with weights of 20%. As famous above, the goal is to cut back correlations to conventional property, corresponding to shares and bonds. That objective is fulfilled with a lineup that includes a number of distinctive various methods that may profit shoppers if materials volatility strikes larger.

One distinguished instance is the Quadratic Curiosity Fee Volatility and Inflation Hedge ETF (IVOL). IVOL is especially related immediately as a result of it takes an offensive posture in opposition to inflation whereas offering a buffer in opposition to sudden adjustments in rates of interest.

“IVOL seeks to guard buying energy, mitigate inflation danger, revenue from a rise in volatility and a steepening of the yield curve, and supply inflation-protected revenue,” in accordance with Quadratic Capital. “On the similar time, the fund seems to supply buyers with entry to the OTC rate of interest choices market – a market largely not beforehand out there to particular person buyers – to supply structured options that provide a horny danger/reward profile.”

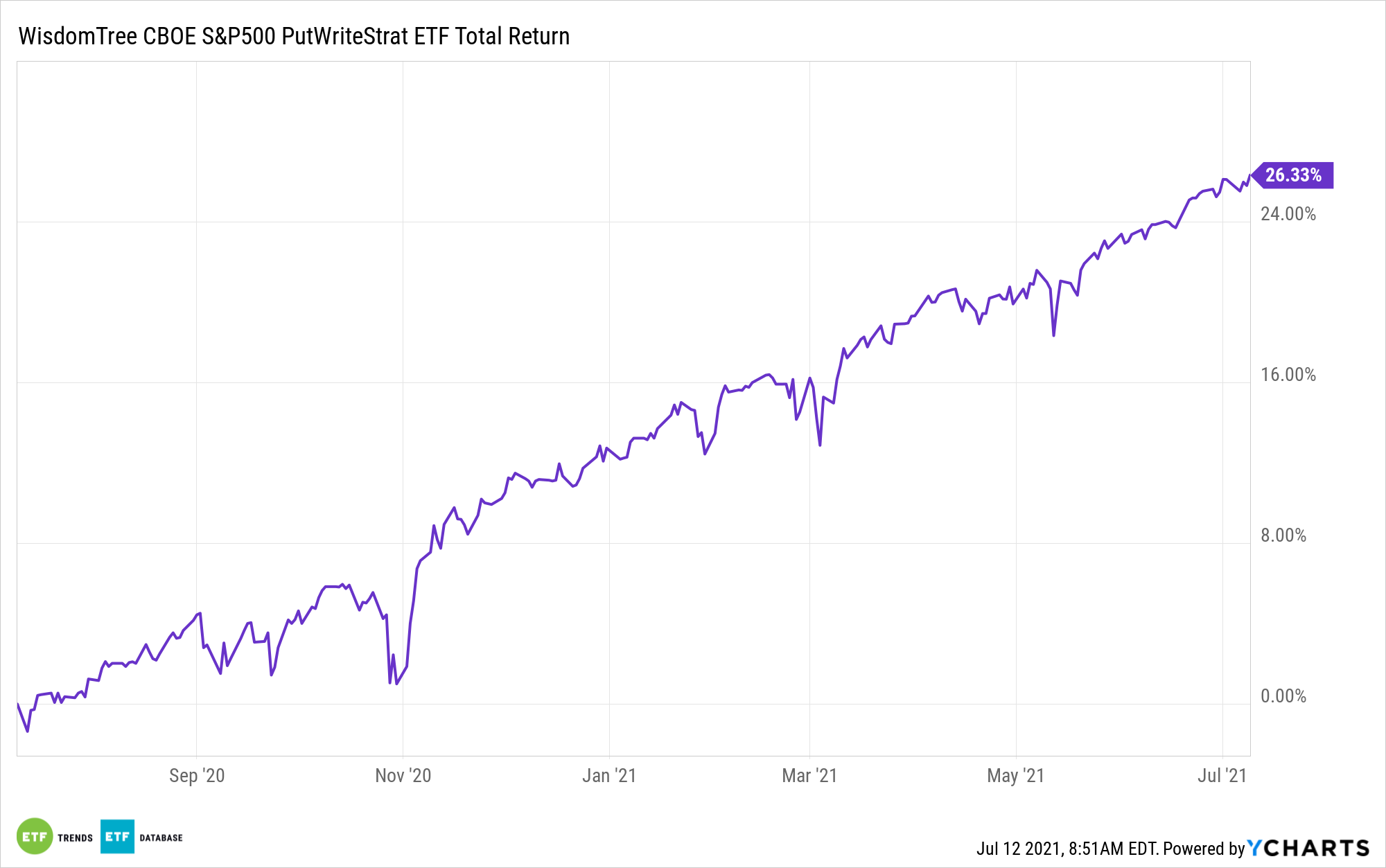

The mannequin portfolio provides to its correlation-reducing and income-boosting credibility with the WisdomTree CBOE S&P 500 PutWrite Technique Fund (NYSEArca: PUTW). Choices writing methods, together with these in ETF kind, usually thrive when volatility rises as a result of they are not extremely correlated to equities. Choices premiums additionally usually be part of volatility to the upside, probably creating extra revenue.

PUTW, which debuted in February 2016, follows the CBOE S&P 500 PutWrite Index and goals to cut back volatility and draw back publicity.

For extra on how one can implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.