Cannabis sector-related alternate initially surged this yr on hopes that laws would assist legalize marijuana, however the lack of additional federal impetus has left hopeful traders disenchanted.

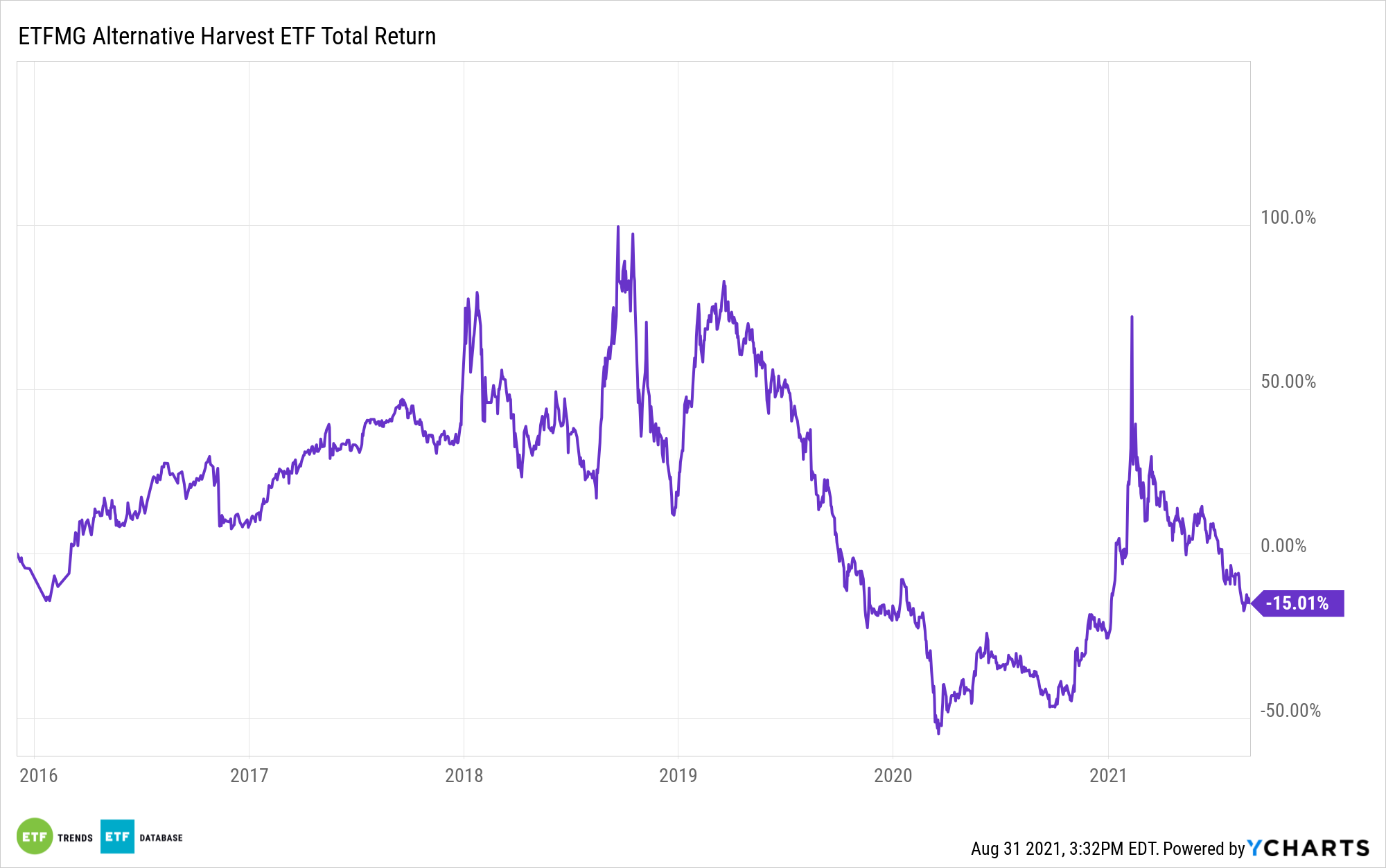

For instance, the ETFMG Different Harvest ETF (MJ), the most important cannabis-related ETF, declined 49.5% from its early 2021 excessive, however the ETF continues to be up 14.2% year-to-date.

Marijuana shares grew this yr following Democrats seizing management of each the Senate and the Home of Representatives, which fueled hopes of federal legalization. Moreover, the rally gained momentum as corporations like Tilray Inc. and Sundial Growers Inc. joined the rising meme-stock surge, Bloomberg studies.

The falloff in hashish shares and sector-related ETFs has additionally been mirrored in diminishing funding demand. Throughout the top of the mania, traders purchased greater than $2.5 billion in pot shares over the course of every week, in keeping with Vanda Securities knowledge. Nevertheless, inflows since slowed to as little as $73 million for the week of August 16, Ben Onatibia, senior strategist on the analysis home, stated.

The dearth of federal initiative for the reason that preliminary enthusiasm could mirror the low precedence of hashish within the Biden administration agenda. In the meantime, lawmakers are extra targeted on the continued COVID-19 pandemic and the huge infrastructure spending package deal.

“There’s been an absence of tangible headlines and progress out of Capitol Hill,” Vivien Azer, hashish analyst at Cowen & Co., instructed Bloomberg.

Whereas Senate Majority Chief Chuck Schumer has introduced a dialogue draft of a invoice to legalize marijuana, Azer’s colleague Jaret Seiberg warned of “little actual progress this yr.”

Whereas marijuana shares have have fallen sufferer to the latest increase and bust cycle of investor mania, the trade’s fundamentals stay robust, particularly amongst these with operations in a number of U.S. states — multistate operators or MSOs. These operators have loved higher legalization on the state stage, with extra anticipated to hitch the authorized gross sales of leisure pot.

“A lot of the U.S. MSOs delivered low-to-mid-teens sequential income progress, which could be very wholesome, and most of them posted accelerating income progress within the second quarter,” Azer added. “At a minimal, it makes the valuations that rather more fascinating, that the businesses proceed to develop their revenues and earnings no matter what occurs on Capitol Hill.”

For extra information, data, and technique, go to ETF Traits.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com