By Stephen Cucciaro, President & Chief Funding Officer

“When life seems like Simple Avenue, there’s hazard at your door.”

― Grateful Lifeless

Indicators of market euphoria are in every single place. Speculative “story” shares, penny shares, IPOs, SPACs, millennial “stonk” buying and selling, margin lending, CCC junk bonds, sports activities buying and selling playing cards and different collectibles, Dogecoins and investor sentiment surveys are all showcasing excessive market froth. Animal spirits are working hotter now than over the last market peak simply earlier than the coronavirus-induced lockdowns started. On February 11, 2020, we printed a paper titled “The Subsequent Bear Market” whereas U.S. inventory costs had been additionally at all-time highs and climbing each day to new information. At the moment, the prospect of a bear market appeared distant. Eight days later the steepest inventory market descent in historical past started, with the S&P 500 Index falling 34% throughout a five-week interval. Since that point, we now have been experiencing one of many sharpest inventory market rallies in historical past. Whereas the present inventory market rally might proceed for a while, it’s not too early to establish the warning indicators that will tip the onset of the subsequent bear market. To paraphrase Warren Buffett, ‘Be grasping when others are fearful, and be fearful when others are grasping.’ A bear market in equities is outlined as a lack of at the least 20%. Some bear markets have skilled declines in extra of 80% earlier than recovering. Evaluating present market situations in a historic context can add perspective and assist to see the forest from the bushes.

[wce_code id=192]

There are similarities but additionally essential variations between immediately’s setting and previous durations of ultra-low rates of interest, extreme authorities debt and excessive wealth inequality. Reviewing centuries of inventory market historical past, the world has skilled quite a few cycles through which wealth inequality naturally will increase during times of financial progress, turns into excessive, then contracts attributable to a market crash, melancholy, warfare, revolution or some mixture of the above. Earlier than the contraction, the inventory market was usually surging to new highs; company borrowing and authorities debt reached harmful ranges; and financial coverage had been strongly accommodative with wealth inequality usually resulting in political discord/ and an increase in populist actions.

Immediately we now have a inventory market that by our estimation is exceedingly overvalued, wealth inequality is at excessive ranges final seen in 1929, international rates of interest are at or close to all-time lows and central banks have by no means been so accommodative. As well as, company borrowing ratios are at all-time information and authorities debt to GDP ratios are above thresholds past which governments traditionally have been unable to pay their manner out of their debt, both via financial progress or tax hikes. Wanting default, the everyday authorities response has been to inflate away its debt, usually via foreign money devaluation.

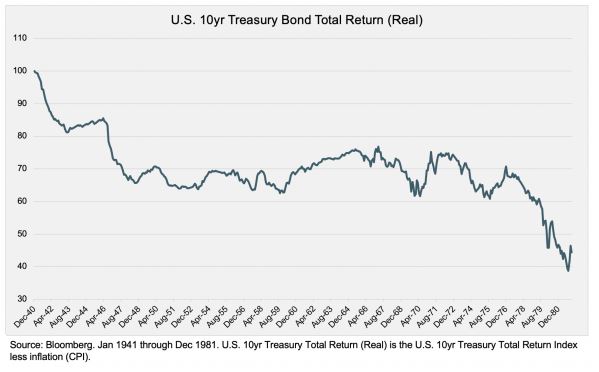

An essential distinction within the U.S. between the present cycle and previous cycles (pre-1971) is that the U.S. Greenback was as soon as backed by gold. Consequently, the Federal Reserve Board (“Fed”) was extra constrained in its means to advertise financial stimulus. By confiscating buyers’ gold in 1934, then instantaneously resetting its value from $20.67 per ounce to $35 per ounce, a right away 69% foreign money devaluation was realized ending an prolonged interval of deflation. In 1969, President Nixon broke the $35 per ounce gold peg and let the worth of gold float freely, hoping to unleash financial progress main as much as his 1972 presidential reelection bid. The extremely inflationary 1970s adopted, together with hovering actual asset (gold and commodities) costs. Within the present setting, we imagine that governments/central banks will most definitely determine to deal with the debt burden via monetary repression. By making an attempt to reflate the economic system whereas holding rates of interest at suppressed ranges, bondholders will successfully be subsidizing debtors by being compensated with a damaging funding return after inflation. This occurred from World Battle II till the late 1970s, when Treasury bondholders misplaced about half the worth of their funding when measured after subtracting inflation (see Determine 1 – U.S. 10yr Treasury Bond Complete Return (Actual) 1941-1981).

Determine 1 – U.S. 10yr Treasury Bond Complete Return (Actual) 1941-1981

To this point, governments have been unable to achieve their inflation targets as a result of cash velocity (the speed at which cash modifications palms in the true economic system) has plunged, lately reaching record-low ranges. Nevertheless, many of the authorities stimulus over the last decade got here primarily from financial coverage. Following the onset of the coronavirus, the unemployment price soared, and central banks responded with probably the most extraordinary financial intervention in historical past. Whereas a few of this stimulus helped the federal government offset a part of the financial harm ensuing from the coronavirus, financial coverage is a blunt instrument and many of the ensuing financial inflation stayed out there system, inflating asset costs and exacerbating wealth inequality. The longest serving chairman of the Fed, William McChesney Martin, as soon as famously quipped: “The job of central bankers is to remove the punch bowl simply because the occasion will get going.” Because the Fed fights unemployment with its blunt devices whereas the inventory market races to new information, this Fed is spiking the punch bowl whereas the occasion is in full swing.

There may be now a renewed push to move the baton from financial to fiscal stimulus (authorities spending). Which means that governments might want to spend trillions they don’t have, resulting in extra extreme debt. Nevertheless, fiscal stimulus may discover its far more immediately into the true economic system, doubtlessly inflicting a rebound in cash velocity and the long-awaited rise in inflation. Whereas this may sometimes result in an increase in long-term rates of interest, governments might look to central banks to purchase the newly-minted debt to constrain rising charges. In any other case, authorities budgets may very well be crushed by hovering curiosity funds. This might result in the monetary repression and foreign money devaluation described above. Ought to this state of affairs come to fruition, central banks can be within the unenviable place of getting to determine for a way lengthy to proceed to carry rates of interest at ultra-low ranges. A untimely tightening of financial coverage may ship inventory markets right into a tailspin and halt financial restoration. Suppressing charges for too lengthy may lead to accelerating inflationary expectations that develop into embedded and harder to reverse. Both end result may hurt inventory market costs finally, and the severity of a subsequent downturn may depend on the inventory market’s diploma of overvaluation.

Is the U.S. Inventory Market Overvalued Immediately?

There may be a lot debate as as to if the U.S. inventory market is overvalued or pretty valued. Some argue that U.S. shares are pretty valued as a result of equities’ earnings and dividend yields are usually extra favorable than bond yields. Nevertheless, this comparability is unhelpful if bonds are additionally excessively overvalued.

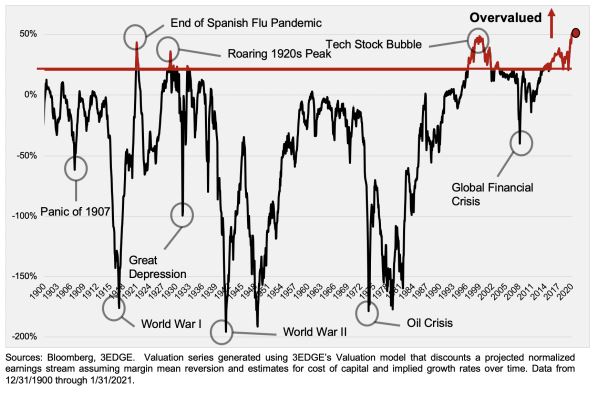

Assessing valuation relies upon upon making estimates about an fairness market’s future earnings streams and low cost charges. With out a crystal ball or clairvoyant to assist, affordable assumptions have to be made about how earnings are anticipated to develop over time and the suitable value of capital or low cost price to make use of. After estimating earnings progress utilizing affordable assumptions whereas assuming imply reversion of revenue margins over time, the valuation evaluation turns into extremely dependent upon the low cost charges utilized to the estimated earnings streams over the quick and long run. Using an fairness valuation mannequin that reductions the S&P 500 Index’s earnings stream a few years into the long run, we now have calculated that the one approach to conclude that immediately’s U.S. inventory market is pretty valued is to imagine that immediately’s ultra-low company bond yields (among the many lowest in historical past) stay at present ranges eternally. Given the unlikelihood that company bond yields stay at ultra-low ranges eternally, if we make what we imagine is a extra affordable assumption that rates of interest stay at ultra-low ranges for the subsequent 20 years then revert to their long-term imply, we estimate that the S&P 500 Index is about 50% overvalued immediately (see Determine 2 – S&P 500 Market Valuation 1900-2021). Whereas valuation is a poor predictor of inventory value habits over the quick time period, it is a wonderful predictor of inventory market returns over the following 10-year interval (see Determine 3 – Expectations for Future S&P 500 Returns 1946-2021). Consequently, whereas overvaluation itself wouldn’t constrain the U.S. inventory market from rising additional in worth, primarily based on our analysis findings it’s doubtless that extra positive aspects from immediately’s ranges would finally be given again. In distinction, the Japanese inventory market is pretty valued utilizing the identical valuation method. This isn’t shocking; Japanese shares had been extremely overvalued throughout the 1980s, peaking at the start of 1990. A brutal bear market ensued, dropping Japanese equities over 80% from their peak. The urge for food in Japan for investing in shares largely disappeared for many years, and Japan’s Nikkei 225 Worth Index continues to be about 25% under its peak of over 30 years in the past.

Determine 2 – S&P 500 Market Valuation 1900-2021

Determine 3 – Expectations for Future S&P 500 Returns 1946-2021

Over historical past, there are various examples of overvalued markets persevering with to climb increased for a lot longer than rational buyers would usually anticipate. Worth developments construct upon their very own momentum. Investor warning turns to irrational exuberance, investor euphoria and greed. Historical past teaches that durations of exuberance might be self-reinforcing, and consequently overvalued markets can develop into but extra overvalued for an prolonged time period earlier than correcting. Actually, a few of the sharpest positive aspects in inventory costs have occurred throughout the closing levels of a bull market, simply previous to the onset of the subsequent bear market. A power in movement usually stays in movement till a catalyst or exogenous occasion intervenes. Whereas it’s tough to foretell true “black swan” occasions, we discover a number of potential catalysts that might foreshadow the subsequent bear market.

Warning Indicators

Potential early warning indicators that might set off the subsequent bear market embody the next:

Our analysis mannequin has recognized the narrowing of company high-yield credit score spreads, or the distinction between yields on AAA (highest-quality) company bonds and Excessive-Yield (lower-quality) company bonds, as a key issue supporting fairness costs within the quick time period. Typically, the narrowing of the high-yield credit score unfold signifies investor confidence that lower-quality companies have improved their means to repay and / or roll over their money owed. Nevertheless, as credit score spreads slim, the yield on the Bloomberg Barclays U.S. Company Excessive-Yield Bond Index fell lately to under 4%, an all-time report low. This contrasts with 9% yields reached final March and 21% yields provided throughout the Monetary Disaster of 2008. The Fed particularly focused company bonds to be among the many recipients of its extraordinary market intervention, serving to to drive spreads decrease and offering companies with the power to borrow giant sums which may not have been out there in any other case. Given the close to report stage of company debt in relation to GDP and company money circulate, a sudden rise within the company credit score unfold may set off difficulties for corporations making an attempt to refinance their debt. An unwinding of company debt may very well be self-reinforcing, comparable in method to how housing and mortgage debt issues cascaded into the Monetary Disaster of 2008.

A sustained rise in inflation past expectations may alter the traditional knowledge that central banks will at all times experience to the rescue every time financial progress slows or the markets right. When anticipated inflation is low, central banks can extra simply justify terribly low rates of interest to assist markets and the economic system, serving to to assist and gas overvalued markets. Greater than anticipated inflation would most definitely restrain central banks from including extra stimulus, eradicating a significant prop to the bullish thesis. Throughout the mid-1940s, inflationary expectations had been equally low, with the identical lack of inflationary pressures over a lot of the previous 20 years. But after a interval of monetary repression, the U.S. inflation price climbed unexpectedly from beneath 2% to over 9% from March 1946 to August 1946 in live performance with the onset of a bear market. Extra involved with avoiding deflation, the Fed has been decided to drive inflation increased, in a mirror picture to the early 1980s when the Fed at the moment was decided to reverse double-digit inflation. Just like the Fed of the early 1980s, it might finally succeed. Provided that present inventory market valuations depend on immediately’s ultra-low rates of interest remaining low eternally, any significant rise in rates of interest brought on by rising inflation may lead to a contraction of company earnings multiples, adversely impacting the inventory market.

The newest wave of coronavirus peaked in January 2021 and is now receding attributable to Covid seasonality in addition to rising vaccinations. Because of this, many economists predict a resumption of progress particularly within the latter a part of 2021. Nevertheless, there are at the least two obstacles to attaining herd immunity: 1) the proportion of the inhabitants unwilling to be vaccinated; and a couple of) the likelihood that Covid antibodies present inadequate safety from variant mutations such because the b.1.351 (South Africa), b.1.1.7 (U.Okay.) and p.1 (Brazil) strains. Because the markets anticipate reduction from Covid, a brand new wave of coronavirus shouldn’t be priced into the markets. The Spanish Flu pandemic contaminated the world in 4 waves spanning a two-year interval from 1918 to 1920. The U.S. inventory market soared in anticipation of the pandemic’s finish, peaking in 1919. Rising inflation and rates of interest accompanied the tip of the pandemic, and the inventory market declined sharply in response, falling over 30% from its peak in 1919 to its trough in 1921.

Potential modifications in tax coverage current dangers to the present market setting. To deal with wealth inequality, the present administration might search to move laws by elevating taxes on companies in addition to the rich. The 2017 company tax price reduce from 35% to 21% created a right away enhance to company earnings; likewise, a partial reversal may produce a right away discount in company earnings. Additionally, buyers could also be inclined to promote equities prematurely of any modifications in private revenue, capital positive aspects, property and / or wealth taxes presently beneath dialogue.

Sometimes, bear markets start from what is usually described as wholesome profit-taking. A small damaging pattern turns into amplified by an rising variety of buyers who’re happy with latest positive aspects and determine to promote earlier than their positive aspects evaporate. A self-reinforcing vicious cycle can observe. By the point typical market momentum indicators detect the shift in pattern, it might be too late to keep away from vital losses. To deal with this problem, we analyze varied measures of market acceleration (the by-product or price of change of momentum) in addition to different behavioral algorithms which have the potential to function early warning indicators of an abrupt shift in investor habits.

Geopolitical uncertainties together with cyber threats proceed to rise. A harmful cyber or terrorist assault won’t solely create a way of panic and uncertainty however may additionally trigger a shock to the economic system, a situation not priced into an overvalued market. China / Taiwan, Iran, North Korea and Russia are sizzling spots presently, and acts of aggression can escalate into critical battle, even when unintentional. One concern: the world’s largest semiconductor chip manufacturing firm, TSMC, resides in Taiwan. Taiwan is presently in China’s crosshairs, and any disruption to its chip manufacturing functionality may wreak havoc on expertise, automotive, protection and different industries globally. Proponents of the longwave warfare cycle observe that over the previous few centuries, there was a significant warfare roughly each 80 years because the warfare era that swears by no means to enter one other main warfare passes on. 80 years from the final main warfare on this collection factors to 2021.

Present Positioning

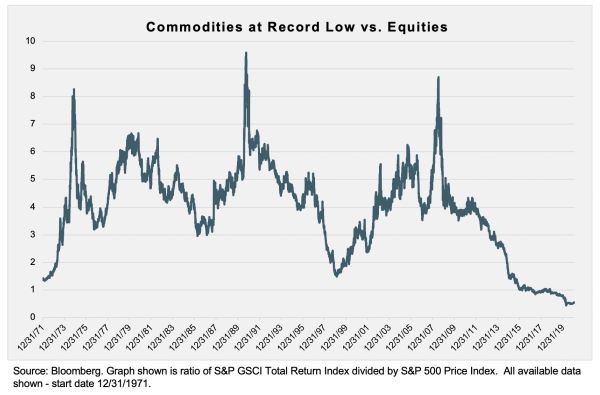

For the reason that Monetary Disaster of 2008, U.S. shares and bonds have significantly outperformed different main markets in a fashion that’s not supported by commensurate positive aspects in U.S. company earnings or gross sales. Based on our analysis, this outperformance has left U.S. shares and bonds among the many most overvalued asset lessons we monitor. But due to previous efficiency, many traditionally-managed funding portfolios largely encompass U.S. shares and bonds. We imagine it’s extremely unlikely that U.S. shares and bonds will proceed to outperform over the subsequent a number of years in addition to they’ve carried out during the last a number of years. Our focus has been to favor comparatively undervalued equities (e.g. Japan) and to scale back our allocation to what we imagine are extremely overvalued equities (e.g. U.S.). Given the ultra-low rates of interest that authorities and company bonds presently yield, particularly when put next with inflationary expectations, bonds signify sources of damaging after-inflation return with the potential for capital depreciation ought to rates of interest rise. An exception can be if we had been to enter a interval of deflation. Alternatively, actual belongings equivalent to gold and commodities provide the potential for appreciation whereas the chance value for holding belongings that don’t produce curiosity revenue equivalent to gold is especially low right now. Gold serves as a hedge in opposition to unconstrained financial inflation since not like fiat currencies, the availability of gold can’t be manipulated by central banks. Commodities skilled a extreme bear market from 2008 via mid-2020 and underperformed equities to a larger diploma than any time over the last 5 a long time (see Determine 4 – Commodities at Report Low vs. Equities 1971-2021). Our mannequin analysis has recognized commodities as poised for appreciation given their relative undervaluation, the prospect for U.S. greenback weak spot, the potential for elevated demand from Asia and total provide disruptions.

Determine 4 – Commodities at Report Low vs. Equities 1971-2021

Abstract

Historical past exhibits that it may be notoriously tough to foretell exactly when a market euphoria or inventory market bubble reaches its tipping level. Nevertheless, it’s simple to foretell primarily based on historical past that every one market bubbles finally burst as overvalued markets discover their manner again to truthful valuations. We make use of our analysis mannequin of the worldwide capital markets to research financial, valuation and behavioral elements to challenge risk-adjusted market returns and to establish when the dangers of a correction are heightened.

After significantly outperforming the remainder of the world for the reason that Monetary Disaster of 2008, U.S. equities have develop into exceedingly overvalued by our estimate. Overvalued markets can proceed to rise for a lot longer than rational buyers would usually anticipate till a catalyst intervenes, heralding the subsequent bear market. Our mannequin analysis identifies a number of potential catalysts together with: a widening of the company credit score unfold; a sustained rise in inflation and rates of interest past expectations; failure to realize herd immunity leading to a brand new Covid wave; company and private tax hikes; profit-taking which amplifies right into a vicious cycle; geopolitical conflicts together with cyber-attacks; and exogenous “black swan” occasions. To place for the present setting, we now have lowered publicity to overvalued equities, elevated publicity to fairly-valued equities and rotated allocations away from fastened revenue in favor of actual belongings that may act as a hedge in opposition to extreme financial inflation. Ought to the danger of a worldwide bear market in equities develop into elevated, we’re ready to scale back total fairness publicity and portfolio threat.

DISCLOSURES: This Commentary is offered to present and potential purchasers of 3EDGE Asset Administration (“3EDGE”) for informational functions solely. The opinions expressed above are these of Steve Cucchiaro of 3EDGE and are topic to vary with out discover in response to shifting market situations. 3EDGE’s opinions usually are not meant to supply private funding recommendation and don’t contemplate the funding goals and monetary sources of the reader. Info offered on this Commentary contains info from sources 3EDGE believes to be dependable, however the accuracy of such info can’t be assured. Investments together with frequent shares, fastened revenue, commodities, and ETFs contain the danger of loss that buyers must be ready to bear. Previous efficiency is probably not indicative of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.