Tlisted here are necessary dist

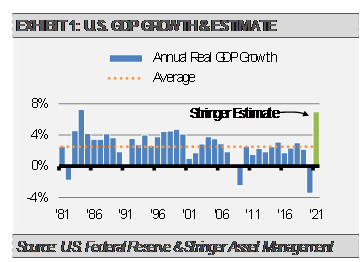

Tlisted here are necessary distinctions between the actual financial system and the monetary markets. We count on the course forward to make these variations extra apparent. A lot of the financial indicators we observe level to strong financial progress within the coming months together with vital provide constraints in all the things from microchips to constructing supplies to labor. These constraints will probably preserve the tempo of financial progress from reaching its full potential whereas additionally contributing to inflation. Nonetheless, we count on the strongest financial progress since 1984 with momentum carrying into 2022.

[wce_code id=192]

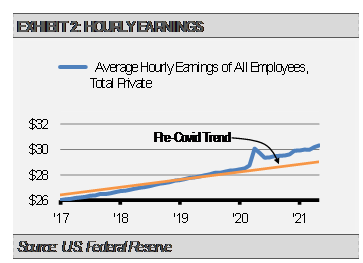

Our work additionally means that the inflationary tide is prone to be stronger and extra persistent than markets and coverage makers anticipate. The tempo of financial progress accelerated additional in Might with the ISM Companies Index rising to a brand new report excessive whereas the manufacturing sector additionally confirmed sturdy progress. In the meantime, job openings in April soared to a different new report at 9.Three million, which surpassed the earlier report 8.2 million in March. Moreover, the employment report for Might confirmed sturdy wage will increase as employers wrestle to fill job vacancies. That is particularly telling as a result of the quickest space of jobs creation was the leisure and hospitality business the place wages are typically beneath the nationwide common. Not like different transitory inflationary pressures, comparable to rising oil costs, wages are typically sticky, and these will increase are prone to persist for a while.

We’re prone to see sooner features within the month-to-month employment stories forward as jobless claims, which is a proxy for layoffs, proceed to say no. It is a constructive signal for future jobs progress as developments within the variety of layoffs have a tendency to steer jobs creation. Decrease numbers of jobless claims ought to lead to increased numbers of jobs features. There are a a number of elementary components that help extra jobs progress forward. With increased wages mixed with enhanced unemployment advantages being phased out over the approaching months, extra folks receiving the vaccines, colleges reopening within the fall, and the continuation of broader financial reopening, we count on jobs features to speed up.

Regardless of sturdy fundamentals, at these present market valuations we count on modest fairness market returns in comparison with above common financial progress.

Moreover, we expect bond markets will proceed to wrestle over the subsequent yr or in order long-term rates of interest push increased. Because the graph beneath illustrates, the extent of earnings yield on equities and yield to worst on bonds pertains to our ahead return expectations. With the S&P 500 Index earnings yield comparatively low at 3.36% and the Bloomberg Barclays Combination Bond Index yield to worst at 1.5%, which is on the low finish of the historic vary, our expectations for each inventory and bond market returns going ahead are slightly modest. In the meantime, our work means that markets could also be overly complacent and weak to a draw back shock. These components tilt our near-term bias to threat administration over alternative.

In consequence, we’re using our energetic threat administration instruments and have decreased our fairness threat whereas sustaining much less rate of interest sensitivity than the broad bond market. Moreover, now we have elevated our defensive postures as we anticipate higher market volatility and higher alternatives for features forward.

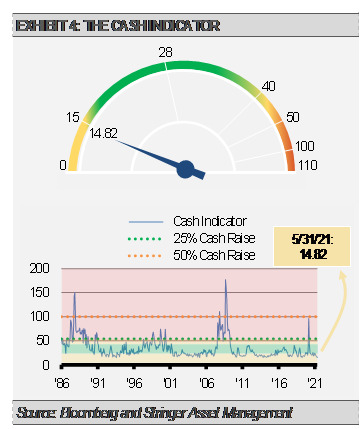

THE CASH INDICATOR

The Money Indicator (CI) has been helpful for serving to us decide potential volatility on each the excessive and low finish of the size. Those that observe our course of know that we’re sturdy believers within the impression of mean-reversion. Simply because the CI can alert us to black swans on the excessive finish of the size, it additionally supplies perception into potential volatility on the low finish of the vary. Not too long ago, the CI has fallen to a degree that implies markets are overly complacent. In our view, readings this low recommend that markets could also be susceptible to an sudden shock. That is according to our latest strikes to cut back fairness market threat.

DISCLOSURES

Any forecasts, figures, opinions or funding strategies and techniques defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought of to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to alter with out reference or notification. The views contained herein are to not be taken as recommendation or a advice to purchase or promote any funding and the fabric shouldn’t be relied upon as containing enough info to help an funding determination. It must be famous that the worth of investments and the revenue from them could fluctuate in accordance with market circumstances and taxation agreements and buyers could not get again the total quantity invested.

Previous efficiency and yield might not be a dependable information to future efficiency. Present efficiency could also be increased or decrease than the efficiency quoted.

The securities recognized and described could not characterize the entire securities bought, offered or really helpful for shopper accounts. The reader mustn’t assume that an funding within the securities recognized was or can be worthwhile.

Knowledge is supplied by varied sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an unbiased accountant.

Index Definitions:

Bloomberg Barclays U.S. Combination Bond Index – This Index supplies a measure of the U.S. funding grade bond market, which incorporates funding grade U.S. Authorities bonds, funding grade company bonds, mortgage pass-through securities and asset-backed securities which can be publicly provided on the market in the USA. The securities within the Index should have no less than 1 yr remaining to maturity. As well as, the securities should be denominated in US {dollars} and should be mounted price, nonconvertible and taxable.

S&P 500 Index – This Index is a capitalization-weighted index of 500 shares. The Index is designed to measure efficiency of a broad home financial system by way of adjustments within the mixture market worth of 500 shares representing all main industries.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.