By John van Moyland, Managing Director, S&P World Head of S&P Kensho Indices, S&P Dow J

By John van Moyland, Managing Director, S&P World Head of S&P Kensho Indices, S&P Dow Jones Indices

Introducing the S&P Kensho Moonshots Index – Subsequent-Era Innovators

Innovation threat ranks as one of the important existential threats confronted by corporations immediately. The Fourth Industrial Revolution, and the attendant widespread disruption to the worldwide financial system, has considerably amplified an already established development: accelerating change and the ever-decreasing lifespans of corporations, or what the economist Joseph Schumpeter aptly described as ”inventive destruction.” To wit, in line with Innosight, the common tenure of an organization within the S&P 500® is forecast to be simply 12 years in 2027, down from 24 years in 2016—many corporations are merely unable, or unwilling, to adapt quick sufficient to remain forward of the curve.

Given this backdrop of exponential innovation and disruption, it has develop into extra important than ever for market contributors to undertake a quantifiable framework with which to grasp and measure innovation—not simply when it comes to figuring out next-generation services and the businesses producing them (for these, please evaluate the S&P Kensho New Economies), but in addition to evaluate an organization’s propensity for innovation. This can be thought-about from three views:

- How “innovation-oriented” the corporate’s mission and tradition are;

- What number of sources the corporate is allocating to innovation; and,

- How profitable the corporate is in executing its innovation technique.

Utilizing a rules-based, proprietary framework, now we have developed innovation components that quantify every of those components, offering market contributors with a singular and important instrument for navigating the quickly altering company and technological panorama.

The S&P Kensho Moonshots Index is the primary in a sequence of indices to leverage these novel innovation components. This index seeks to seize essentially the most modern corporations which can be nonetheless comparatively early of their gestation. It consists of the 50 U.S.-listed corporations with the very best Early-Stage Innovation Rating that produce next-generation services. The Early-Stage Innovation Rating1 is the product of innovation components 1 and a couple of listed above and gives a quantitative measure for a corporation’s dedication to innovation, however that it could be early in its lifecycle and nonetheless within the means of creating its product portfolio. Giant corporations are additionally screened out, emphasizing the concentrate on rising innovators.

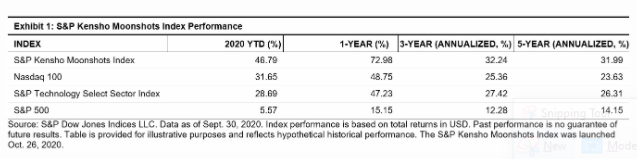

The efficiency traits of the S&P Kensho Moonshots Index (see Exhibit 1), and its relative outperformance, replicate the dynamic nature of its constituents; it’s according to the upper threat/return profile sometimes anticipated, however hardly ever seen, in personal fairness or hedge funds.

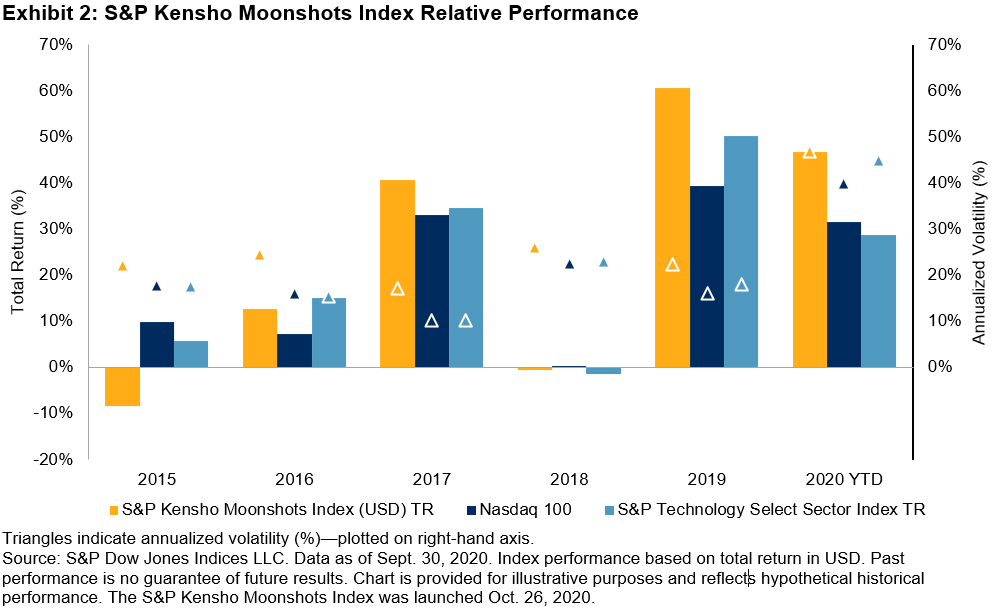

Exhibit 2 illustrates the consistency of outperformance over the previous 5 years, one other high quality hardly ever present in both lively or personal fairness or hedge funds.

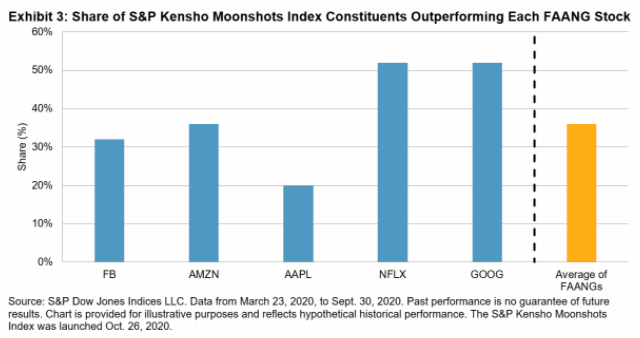

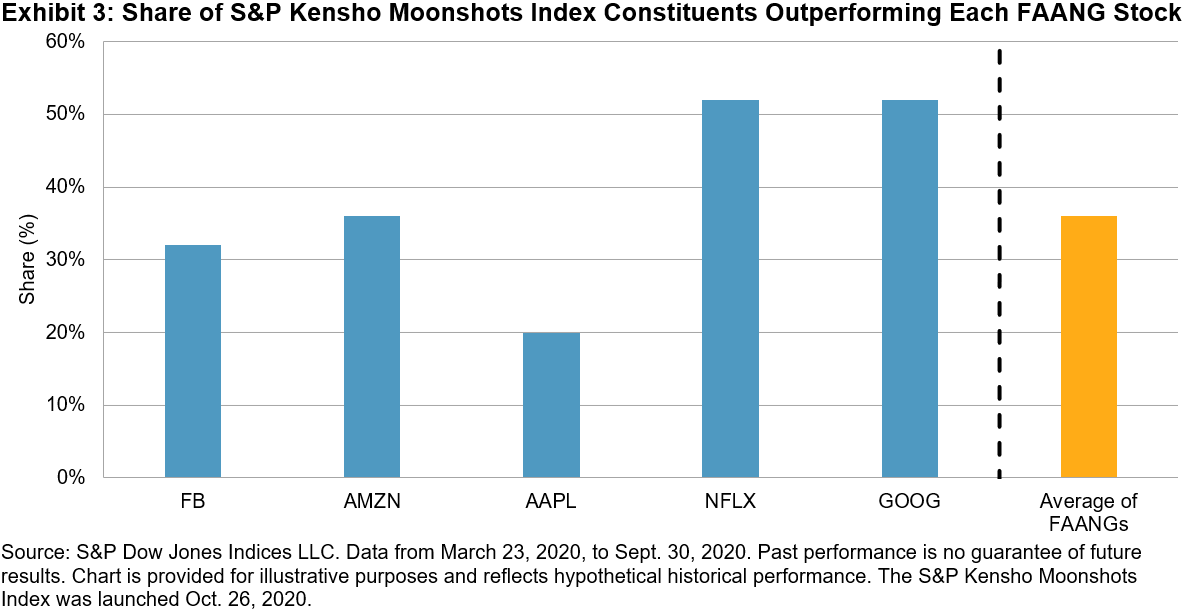

By building, the S&P Kensho Moonshots Index excludes the mega-cap tech names, as an alternative specializing in the subsequent era of innovators (90% of constituents have a market capitalization of lower than USD 10 billion); it is usually equal weighted, limiting focus threat. Whereas the mega-cap tech corporations are sometimes thought-about the bellwethers of innovation, it’s instructive to notice that 36% of constituents of the S&P Kensho Moonshots Index outperformed the common returns of the FAANGs for the reason that market backside on March 23, 2020 (see Exhibit 3).

Partially 2 of this weblog, we are going to discover the S&P Kensho Moonshots Index’s concentrate on smaller corporations, how efficient it’s at figuring out these ground-breaking corporations, and what occurs to them as soon as they depart the index.

The creator want to thank Adam Gould, Senior Director, Analysis and Quantitative Strategist, S&P World for his contribution to this weblog.

Initially revealed by Indexology, 11/12/20

1 To be taught extra in regards to the Early-Stage Innovation Rating, please go to the S&P Kensho Moonshots Index Methodology.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.