One of the largest incentives with midstream vitality belongings and grasp restricted partnerships (MLPs) is the large yields discovered within the phase.

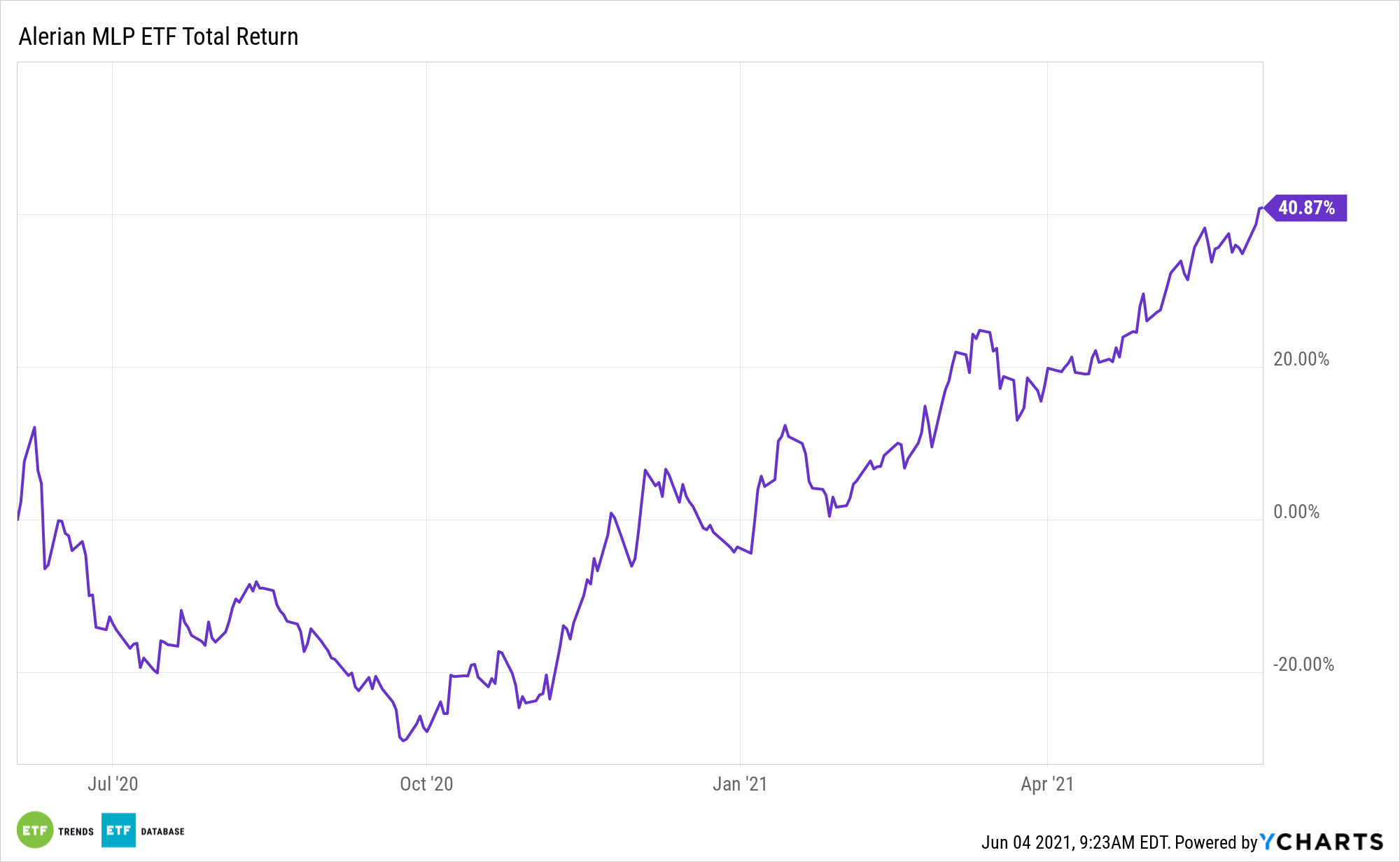

For instance, the ALPS Alerian MLP ETF (NYSEArca: AMLP) yields 9.73% as of June three and that is with the advantage of a year-to-date acquire of virtually 40%. Dividend yields and fairness costs transfer inverse of one another so when AMLP’s value rises, its dividend yield declines.

If there is a rub, it is that when midstream dividend cuts arrive, these actions are sometimes painful for buyers. The truth is, some midstream payout cuts in 2020 have been as excessive as 50% owing to the coronavirus pandemic. Buyers contemplating AMLP wish to know that payouts are regular.

It seems that’s occurring, as midstream firms have emphasised prudence and stability sheet power following the oil bear market attributable to the pandemic.

“With decrease capital expenditures in comparison with prior years, midstream firms are starting to generate extra free money move, which offers monetary flexibility to keep up or develop dividends,” writes Alerian analyst Roxanna Islam. “Throughout the previous few quarters, a number of constituents have positioned an emphasis on constructive free money move (FCF) after dividends.”

An Bettering Dividend Outlook for ‘AMLP’

Within the first quarter, no AMLP parts diminished dividends. None pared payouts within the fourth quarter, and some even boosted dividends. One – Western Midstream Companions LP (NYSE: WES) – modestly elevated its payout within the the January by way of March interval. That MLP accounts for 9.59% of AMLP’s roster.

See additionally: Contemplate Dividend ETFs in an Inflationary Market

With loads of midstream names, forecasting recoveries in free money move (FCF) this yr, the atmosphere might be proper for elevated shareholder rewards, together with buybacks and dividends.

“Larger free money move offers firms extra choices to both repay debt or pay for dividends/repurchases,” provides Islam. “Though repurchases are rising in popularity, dividends are nonetheless the first technique of returning capital to shareholders inside the midstream area.”

Thankfully, some AMLP parts have been FCF-positive in 2020, even after paying dividends. Couple that with rising oil demand and costs, and the stability sheets of midstream operators can proceed bettering, supporting payout progress alongside the best way.

Different funds with publicity to income-generating vitality belongings embody the VanEck Vectors Power Earnings ETF (EINC) and the World X MLP ETF (NYSEArca: MLPA).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.