Amid fears that the Delta variant of the coronavirus might stymie the reopening commerce and put a cap on financial development, U.S. shares tumbled Monday, with the S&P 500 shedding 1.59%.

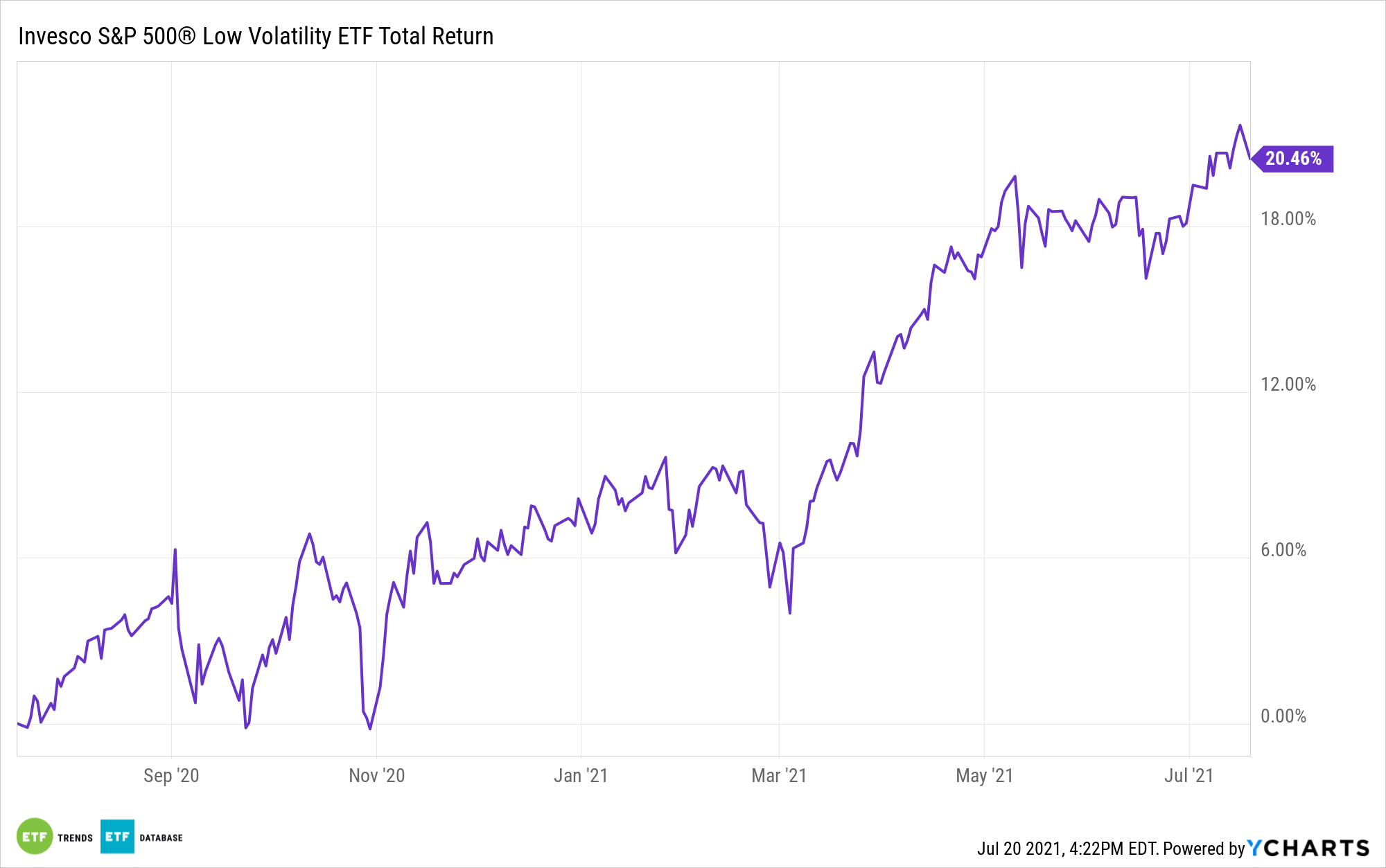

Granted, that is simply sooner or later of market motion and broader fairness benchmarks have lately been robust, but when COVID-19 case counts and hospitalization charges proceed rising, volatility might turn out to be a difficulty market contributors want to deal with. That may very well be a recipe for inspecting trade traded funds just like the Invesco S&P 500 Low Volatility ETF (SPLV).

SPLV, which tracks the S&P 500 Low Volatility Index, affords buyers a basket of the 100 least-turbulent members of the S&P 500 primarily based on trailing 12-month volatility. Once more, Monday is simply sooner or later, SPLV did its job although, performing 46 foundation factors much less poorly than the S&P 500.

“Extra conventional defensive performs had additionally been gaining energy. JC O’Hara, chief market at technician at MKM Companions, identified in a notice to shoppers that defensive performs had outperformed in latest days,” stories Jesse Pound for CNBC.

SPLV’s Defensive Credibility

In simply over 10 years available on the market, SPLV has amassed practically $eight billion in property beneath administration, confirming its standing as one of many beloved defensive concepts amongst large- cap fairness ETFs. Talking of enjoying protection, indicators have been brewing that buyers are shifting into defensive shares and sectors.

“For instance, Duke Power jumped greater than 5% and NextEra rising 4.9% in that point interval” over the previous two weeks, stories CNBC. Duke Power is a member of the SPLV roster.

Whereas SPLV is a sector-agnostic technique, some sectors usually and persistently sport decrease volatility traits than others. Not surprisingly, these teams typically embody client staples and utilities, which at the moment mix for nearly 38% of SPLV’s weight, in accordance with issuer knowledge.

Maybe one other perk of SPLV ought to volatility turn out to be elevated and development increased is what’s excluded from the fund. The ETF has no publicity to the power sector, arguably one of many group’s most susceptible to adverse COVID-19 information. In actual fact, oil’s latest stoop has turn out to be so extreme that on Monday, power ceded its standing as this yr’s best-performing sector within the S&P 500 to actual property. Actual property shares account for five.11% of SPLV.

Backside line: SPLV may very well be able to have a second over the near-term, however buyers ought to keep in mind the first position of a low volatility ETF: ship much less draw back when shares falter, not seize all the upside in a powerful bull market.

For extra information, info, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.