One 12 months in the past this month, our world mod

One 12 months in the past this month, our world modified in some fairly dramatic methods.

Take the inventory market. Caught at residence and $1,200 richer due to the primary coronavirus reduction invoice, thousands and thousands of millennials and Gen Zers tried their hand at investing for the very first time. It’s estimated that some 10 million new brokerage accounts have been opened in 2020, a document. Robinhood, the commission-free buying and selling app, signed up Three million new customers within the first 4 months alone.

There are indicators that these “beginner” traders aren’t going away any time quickly. In response to Credit score Suisse, retail traders now account for a 3rd of all U.S. inventory buying and selling quantity, or virtually as a lot as mutual funds and hedge funds mixed.

The Reddit-fueled “meme inventory” rally is proof constructive that this new formidable military of tech-savvy merchants has the firepower to maneuver markets and even kneecap multibillion-dollar hedge funds.

Early on in 2020, I believe a whole lot of seasoned, extra “subtle” market contributors have been too fast to dismiss these first-time millennial and Gen Z traders. Extra educated than previous generations and effectively related, they noticed the pandemic-triggered inventory pullback as a possibility to purchase shares of distressed journey and tourism firms.

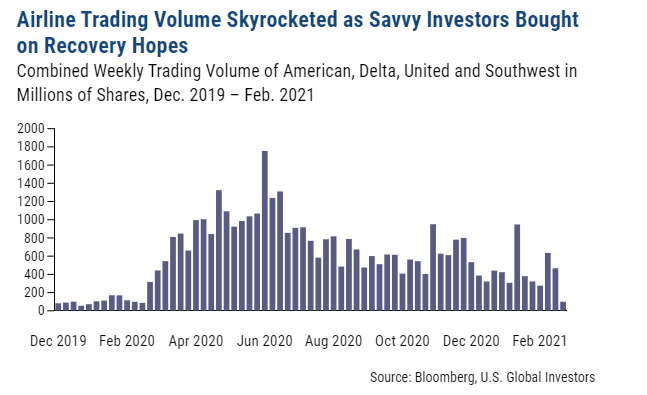

That features airways. Earlier than the pandemic, the mixed weekly buying and selling quantity of American, United, Delta and Southwest averaged about 100 million shares. On the finish of March 2020, weekly quantity hit 660 million shares. By early June, after Warren Buffett introduced he had bought all his airline positions, it was an enormous 1.eight billion shares.

However Have been They Good Trades?

See for your self.

American, United, Delta and Southwest have all greater than doubled since Buffett made the choice to promote his shares within the large 4 carriers. Buyers who put $10,000 in a basket of worldwide airline shares on Could 4, 2020, would have seen the worth of their portfolio develop to roughly $21,300, in response to Morningstar information.

No disrespect meant towards Buffett. He’s all the time been a numbers man, and at 90 years previous, his urge for food for danger is sort of a bit decrease than a thirtysomething Robinhood dealer.

These are exactly the varieties of traders who guess large on airways recovering—and have been rewarded for it.

Journey Rebound Has Already Begun

I consider there’s nonetheless loads extra upside potential.

We’re already beginning to see a considerable rebound in business flight demand, pushed primarily by leisure journey. In response to the Transportation Safety Administration (TSA), near 1.Four million passengers have been screened at U.S. airports on Friday, March 12, representing the best quantity for a single day since March of final 12 months. Within the first half of this month, almost 16.5 million complete passengers boarded business jets within the U.S., probably the most for any month since final March.

Earlier than the pandemic, roughly 2.2 million individuals have been cleared by the TSA per day, with worldwide arrivals and departures making up the majority of the quantity. A 12 months later, home leisure journey is starting to restoration whereas worldwide flights stay muted resulting from lockdowns in Canada, the European Union (EU) and elsewhere.

The speed at which vaccines are being administered is accelerating within the U.S., which is extremely constructive for journey and tourism usually and airways particularly. The Biden administration lately directed all 50 states to make each grownup aged 18 and over eligible to obtain the COVID-19 vaccine by Could 1 of this 12 months. Anticipating a summer season surge, a lot of home low-cost carriers, together with Southwest and Allegiant, have introduced plans to broaden their networks.

United Airways grew to become the primary U.S. provider to say it anticipated to be money circulate constructive this month for the primary time because the pandemic started. Different carriers have likewise signaled their optimism going ahead as vaccinations proceed to ramp up.

Will Millennials and Gen Zers Hold the Secular Bull Market Working?

Millennial and Gen Z participation within the inventory market will likewise proceed to ramp up. I see this as a extremely constructive factor.

Once more, this cohort is extremely educated. In comparison with earlier generations, they have an inclination to delay getting married and beginning households, which means they could have extra time to construct capital with which to take a position.

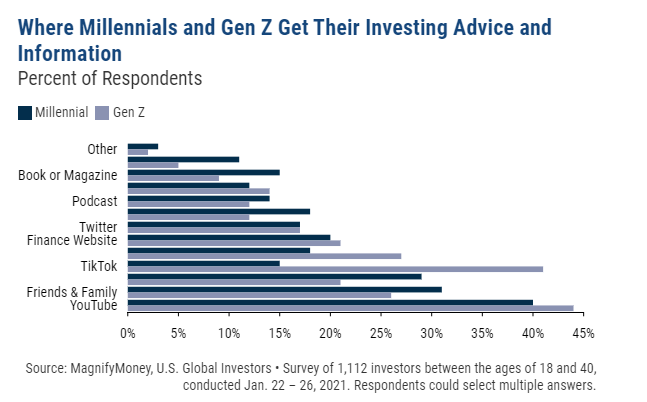

They’re effectively related and get a whole lot of their investing concepts from social media and family and friends. In response to a latest survey performed by MagnifyMoney, 40% of millennials and 44% of Gen Zers get investing recommendation and knowledge from YouTube, which I additionally incessantly use.

A few of you studying this will nonetheless image millennials as being simply out of highschool. The reality is that the oldest members of this group flip 40 this 12 months. Traditionally, Individuals attain their peak incomes years between 45 and 54, so it’s incumbent upon this era—the most important within the U.S. proper now at 72.1 million—to maintain the bull market working.

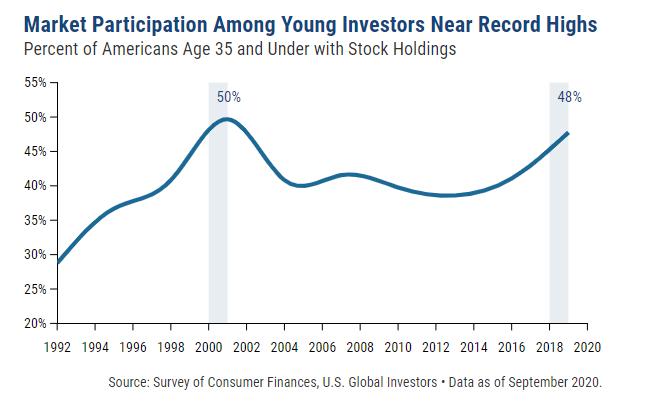

The excellent news is that market participation amongst younger Individuals is rising. In 2019, the newest 12 months for information, 48% of Individuals age 35 and beneath held shares. That’s close to the document of 50% set in 2001, across the time that the dotcom bubble burst.

With the unimaginable inflow of first-time traders final 12 months, I’m sure that effectively greater than half of this age bracket now has inventory holdings, both immediately or not directly.

Initially revealed by US Funds, 3/18/21

Some hyperlinks above could also be directed to third-party web sites. U.S. International Buyers doesn’t endorse all data provided by these web sites and isn’t chargeable for their content material. All opinions expressed and information offered are topic to vary with out discover. A few of these opinions might not be applicable to each investor.

Holdings could change day by day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. International Buyers as of (12/31/2020): American Airways Group Inc., Southwest Airways Co., Delta Air Strains Inc., United Airways Holdings Inc.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.