The world financial system is altering, but many buyers appear to have static portfolios. The continued recognition of the so-called “secular growers” regardless of the shares’ significant underperformance because the financial system has began to alter signifies buyers usually haven’t understood the highly effective secular macroeconomic forces fueling these shares. Whereas most buyers have targeted on firms’ supposed distinctive enterprise fashions, the fact is macro tendencies had been the predominant catalyst for longer-term outperformance.

Secular tales change because the macroeconomy modifications, however buyers usually are hesitant to welcome change and have a tendency to cling to yesterday’s story. In the present day, for instance, buyers appear to downplay the continued change in management as merely a short-lived worth cycle in hopes the outdated management returns.

Historical past exhibits modifications in market management are likely to last more than buyers anticipate and if the current cyclical/worth/small cap management does certainly final, momentum buyers may very well be shopping for vitality, supplies, and different worth/cyclical investments in a 12 months or so.

[wce_code id=192]

Progress Corporations vs. Progress Shares

In a 1956 version of the Harvard Enterprise Evaluation, Peter Bernstein (no relation) wrote a landmark essay known as “Progress Corporations vs. Progress Shares” by which he identified buyers mistakenly use the 2 phrases interchangeably. He outlined there are important variations between development firms and development shares.

Progress shares are these shares with superior development charges as a result of the businesses efficiently reply to one thing happening within the macroeconomy. Bernstein urged, if many firms in the identical business or sector had been outperforming then they doubtless are development shares as your entire business or sector was being propelled by financial occasions. In different phrases, the macroeconomic backdrop fuels a development inventory’s success. The instance he used, given

that it was 1956, was metal shares. The financial setting was fueling the efficiency of your entire metal business main buyers to characterize metal shares as development, however the macroeconomy and never the businesses themselves was primarily liable for the success of those firms.

Progress firms, however, are firms that change the financial system fairly than react to it. Not like his description of development shares by which a complete business or sector outperformed, Bernstein described a development firm as one which places its competitors out of enterprise. Your entire sector doesn’t outperform; just one firm outperforms as a result of it’s destroying all the opposite firms in its sector.

In the present day’s development buyers appear to have confused development shares for development firms. The median variety of holdings amongst 5 widespread “disruptor” ETFs is 68 shares with a median 57% of belongings of their high Three industries. The broad variety of shares inside a slender business focus suggests these firms aren’t true disrupting development firms, however fairly are development shares being influenced as a gaggle by macroeconomic tendencies.

We’ve got repeatedly emphasised the post-2008 interval of sub-5% nominal GDP development gave rise to a secular interval of long-duration development shares. If the subpar nominal development interval involves an finish, which it seems to be within the means of doing, then it appears unrealistic to anticipate the identical development shares to proceed their run.

It’s patently false that worth cycles are at all times short-lived

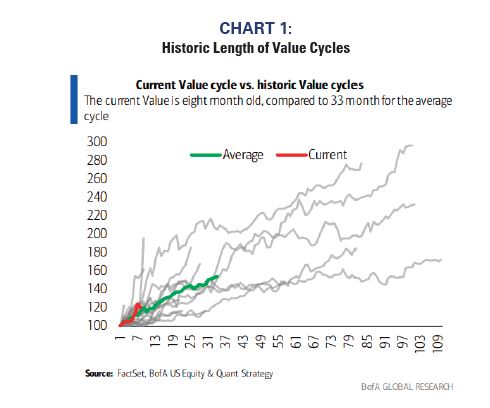

Some development buyers have tried to defend proudly owning Know-how and different “secular” development shares by claiming worth cycles are short-lived and untradeable. Nonetheless, that flatly isn’t true. Current analysis by BofA US Fairness & Quant Technique exhibits the typical size of a price cycle is 33 months and the present one is just eight months outdated. Maybe extra vital, 5 modern-day worth cycles have lasted greater than 6 years! (See Chart 1)

Strongly reflecting investor’ sentiment, we’re requested on a regular basis what inning the worth rally may be in as buyers are fearful to spend money on what they understand to be a brief interval of worth outperformance. Nonetheless, we’ve by no means as soon as been requested in what inning is the expertise/innovation/disruptor theme.

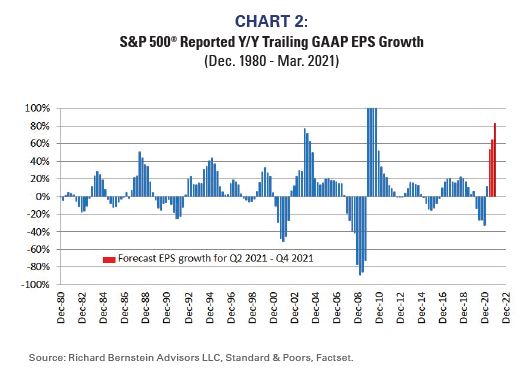

Our early-1990s analysis confirmed worth tends to outperform development when income cycles speed up. The present quarter is just the primary quarter in a income growth we see lasting no less than for a 12 months extra. Due to the simple comparisons versus 2020’s pandemic, one ought to anticipate development to sluggish to extra regular charges, however such an earnings sample is typical originally of main cycles. (See Chart 2)

Cyclicals stay “uncared for”

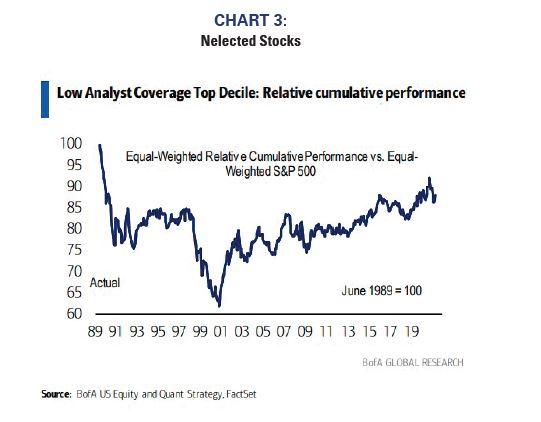

Analyst protection is a normal measure of “neglect” and might be an attention-grabbing gauge of investor enthusiasm as a result of sell-side companies are likely to observe firms whose shares they’ll promote and about which there are funding banking alternatives. In different phrases, scorching shares with excessive valuations/low-cost value of capital are typically adopted extra often than are out-of-favor shares with extra conservative valuations.

Chart 3 (courtesy of BofA) highlights the relative efficiency of uncared for shares. The technique was outperforming during times by which the road is rising throughout the chart. The technique didn’t carry out effectively throughout very odd durations (just like the aftermath of the S&L Disaster or through the Tech Bubble) and there have been regulatory modifications that might have affected historic efficiency (i.e., Reg FD), however a method primarily based on shares with much less analyst protection has usually tended to outperform over the past 20 years.

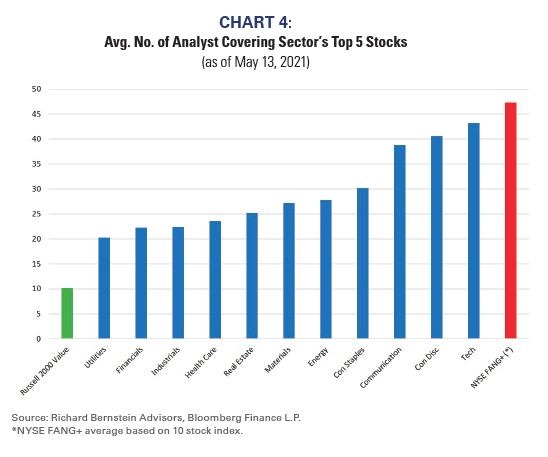

The current cyclical/worth management is certainly comparatively “uncared for.” Chart four exhibits the typical variety of analysts following the 5 largest firms inside every S&P 500 sector. As well as, we embody the 5 largest shares throughout the Russell 2000 Worth Index and throughout the NYSE FANG+ Index1. Whereas the Know-how sector’s 5 largest firms have almost 45 analysts protecting the shares, the biggest shares inside Financials, Industrials, Supplies, and Power are significantly much less effectively adopted. The 5 largest firms throughout the Russell 2000 Worth Index have lower than ¼ of the protection among the many shares within the NYSE FANG+ Index.

Fed insurance policies scream for a change in management

The secular development shares had been largely fueled by an prolonged interval of sluggish nominal development, however current Fed coverage means that period may quickly finish. The actual Fed Funds price is now decidedly damaging and actual charges had been extra damaging solely twice within the final 50 years. (see Chart 5)

The primary interval was within the early-1970s. The Fed allowed the true price to stay damaging for a comparatively lengthy interval, and that free financial coverage helped exacerbate the 1970s inflation spiral. The second interval was through the early-1980s. The Fed realized their mistake and shortly tightened to an extent by no means seen earlier than or after.

The actual Fed Funds price was additionally damaging for an prolonged time frame after 2008 and it didn’t ignite accelerating nominal development or inflation. There are a number of variations between that precedent days and right now. First, fiscal coverage was truly contractionary for a number of years as Washington’s political battles led to the “sequester” that constrained authorities spending. Second, cash development post-2008 was lower than half of right now’s traditionally excessive development price. Third, banks had been significantly much less keen to lend in 2008 than they’re right now as mirrored within the Fed’s Survey of Senior Lending Officers. Due to these variations, we’re not positive a comparability to the post-2008 expertise is an efficient one.

The Fed has broadly acknowledged it’s keen to tolerate extra inflation, so the 1980s instance appears irrelevant. To make clear, we’re not suggesting that the present Fed is fueling the early phases of a 1970s inflation spiral, but it surely may nonetheless be prudent to err on the aspect of extra inflation fairly than much less.

Efficiency drives momentum investing

We had been lately requested what it’s going to take to get buyers to change from previous market management to new market management. Our reply was momentum. For many buyers value motion and never basic enchancment defines a horny funding.

As we’ve repeatedly identified, the basics already strongly assist the shift in management from tech/innovation/disruption to cyclical/pro-inflation that seems to be underway. Buyers usually have remained skeptical although, as they do originally of most management shifts. Outdated habits die laborious.

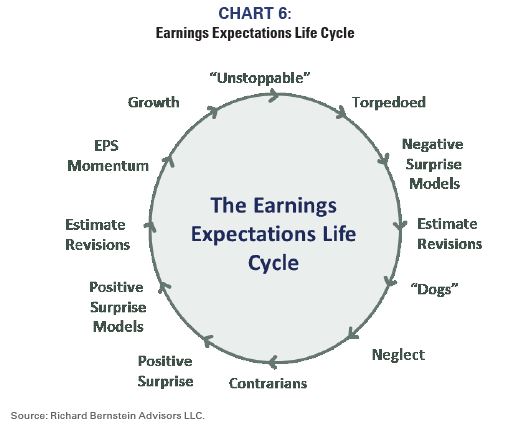

Chart 6 exhibits our Earnings Expectations Life Cycle which we first Chart 6 exhibits our Earnings Expectations Life Cycle which we first developed within the early-1990s. It highlights that fundamentals enhance earlier than momentum buyers acquire curiosity. Within the current case, momentum buyers are more likely to gravitate towards extra cyclical shares if their outperformance continues and as a common consensus begins to kind that “development” is shifting.

If the Earnings Expectations Life Cycle principle holds, and we see no cause why it shouldn’t, then momentum buyers will doubtless be shopping for vitality, supplies, industrials, and the like in a few 12 months.

Don’t miss out on future RBA Insights, subscribe right now.

To be taught extra about RBA’s disciplined strategy to macro investing, please contact your native RBA consultant.

About Richard Bernstein Advisors

Richard Bernstein Advisors LLC is an funding supervisor specializing in long-only, world fairness and asset allocation funding methods. RBA runs ETF asset allocation SMA portfolios at main wirehouses, impartial dealer/sellers, TAMPS and on choose RIA platforms.

Moreover, RBA companions with a number of companies together with Eaton Vance Company and First Belief Portfolios LP, and at the moment has $13.1 billion collectively underneath administration and advisement as of March 31st, 2021. RBA acts as sub‐advisor for the Eaton Vance Richard Bernstein Fairness Technique Fund, the Eaton Vance Richard Bernstein All‐Asset Technique Fund and likewise gives revenue and distinctive theme‐oriented unit trusts by way of First Belief. RBA can also be the index supplier for the First Belief RBA American Industrial Renaissance® ETF. RBA’s funding insights in addition to additional details about the agency and merchandise might be discovered at www.RBAdvisors.com.

Nothing contained herein constitutes tax, authorized, insurance coverage or funding recommendation, or the advice of or a proposal to promote, or the solicitation of a proposal to purchase or spend money on any funding product, automobile, service or instrument. Such a proposal or solicitation could solely be made by supply to a potential investor of formal providing supplies, together with subscription or account paperwork or kinds, which embody detailed discussions of the phrases of the respective product, automobile, service or instrument, together with the principal danger elements that may affect such a purchase order or funding, and which must be reviewed rigorously by any such investor earlier than making the choice to take a position. RBA info could embody statements regarding monetary market tendencies and/or particular person shares, and are primarily based on present market circumstances, which can fluctuate and could also be outdated by subsequent market occasions or for different causes. Historic market tendencies usually are not dependable indicators of precise future market habits or future efficiency of any specific funding which can differ materially,

and shouldn’t be relied upon as such. The funding technique and broad themes mentioned herein could also be inappropriate for buyers relying on their particular funding aims and monetary scenario. Data contained within the materials has been obtained from sources believed to be dependable, however not assured. You need to word that the supplies are supplied “as is” with none specific or implied warranties. Previous efficiency is just not a assure of future outcomes. All investments contain a level of danger, together with the danger of loss. No a part of RBA’s supplies could also be reproduced in any kind, or referred to in every other publication, with out specific written permission from RBA. Hyperlinks to appearances and articles by Richard Bernstein, whether or not within the press, on tv or in any other case, are supplied for informational functions solely and by no means must be thought-about a suggestion of any specific funding product, automobile, service or instrument or the rendering of funding recommendation, which should at all times be evaluated by a potential investor in session together with his or her personal monetary adviser and in mild of his or her personal circumstances,

together with the investor’s funding horizon, urge for food for danger, and skill to resist a possible loss

of some or all of an funding’s worth. Investing is topic to market dangers. Buyers acknowledge and settle for the potential lack of some or all of an funding’s worth. Views represented are topic to alter on the sole discretion of Richard Bernstein Advisors LLC. Richard Bernstein Advisors LLC doesn’t undertake to advise you of any modifications within the views expressed herein.

© Copyright 2021 Richard Bernstein Advisors LLC. All rights reserved. PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.