By Matthew Sigel, Head of Digital Property Analysis

VanEck assumes no legal responsibility for the content material of any linked third-party web site, and/or content material hosted on exterior websites.

- El Salvador’s presumptuous bitcoin gambit attracts an IMF rebuke

- Mining BTC from volcanos

- Paraguay courts crypto with the bottom energy prices within the area

- Context on sovereign defaults: the Neiman Marcus analogy

- Latin America: sturdy structural setup for digital asset adoption

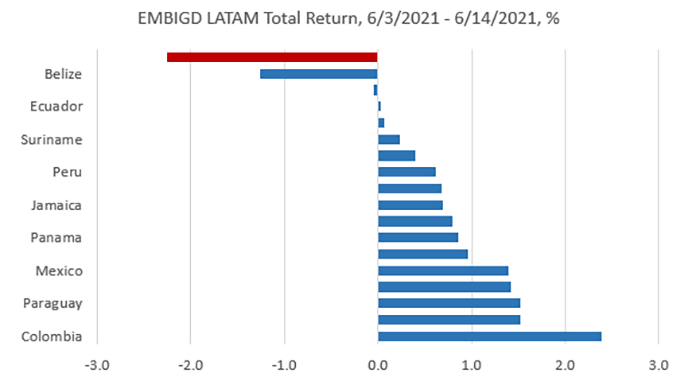

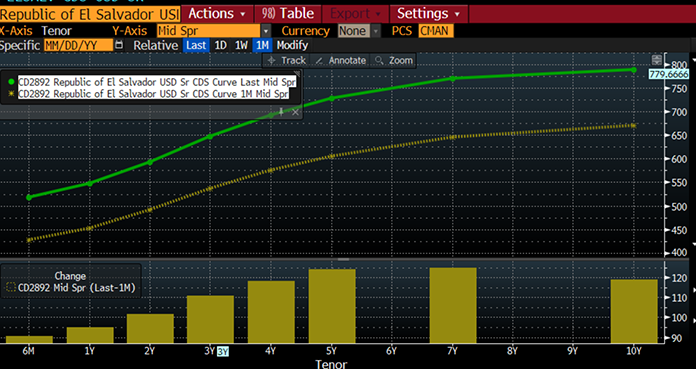

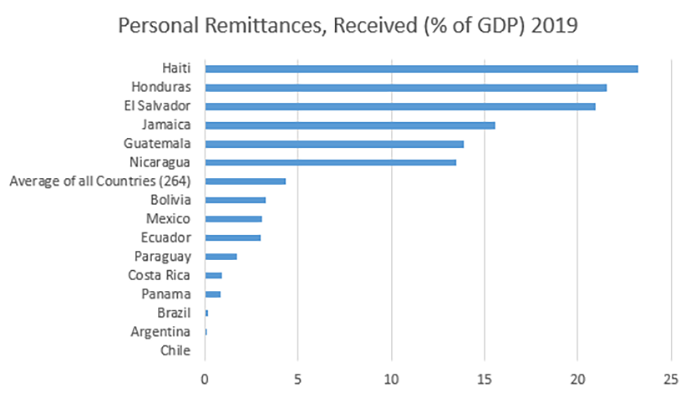

El Salvador has introduced a presumptuous try to partially de-dollarize itself by accepting bitcoin as authorized tender.1 In response, the Worldwide Financial Fund (IMF), within the midst of negotiating a $1B bailout with the closely indebted Central American nation, declared its opposition.2 The market has since punished President Nayib Bukele for his impudence with increased USD funding prices. With complete gross home product (GDP) of countries at present borrowing from the IMF at $4.8T, or 5.5% of world GDP3, a possible El Salvadorian default could be an essential check case for a way susceptible frontier nations strategy financial sovereignty within the age of bitcoin.

Supply: Bloomberg, VanEck. EMBIGD LATAM is the J.P. Morgan Rising Markets Bond World Diversified Index, an unmanaged, market-capitalization weighted, total-return index monitoring the traded marketplace for U.S.-dollar-denominated Brady bonds, Eurobonds, traded loans, and native market debt devices issued by sovereign and quasi-sovereign entities.

El Salvador Credit score Default Swap Curve Now vs. 1 Month In the past, Unfold (bps)

Supply: Bloomberg

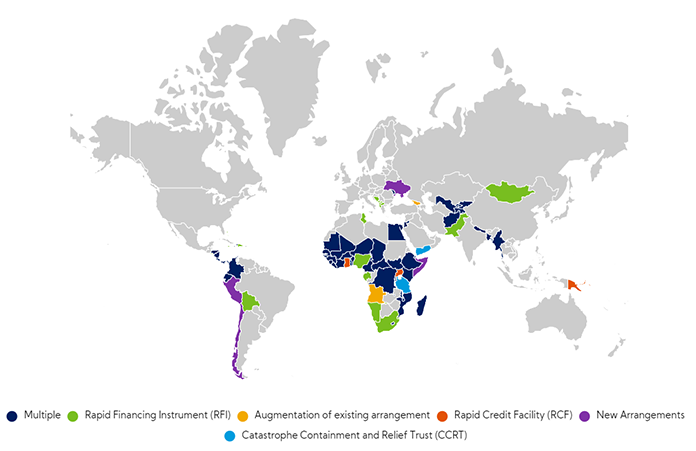

Nations At the moment Receiving IMF Help and Debt Service Aid

Supply: IMF as of 6/14/2021.

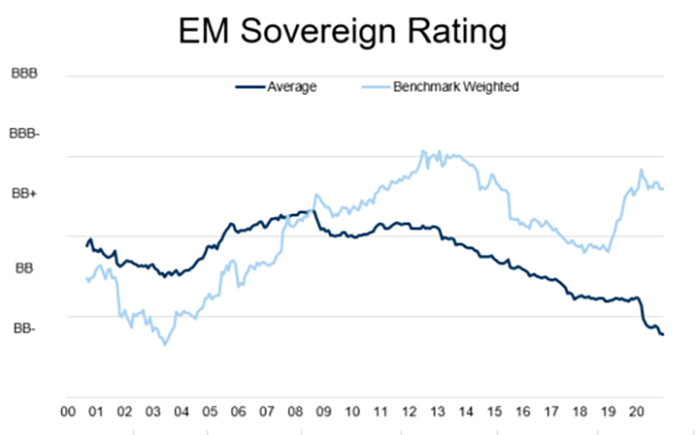

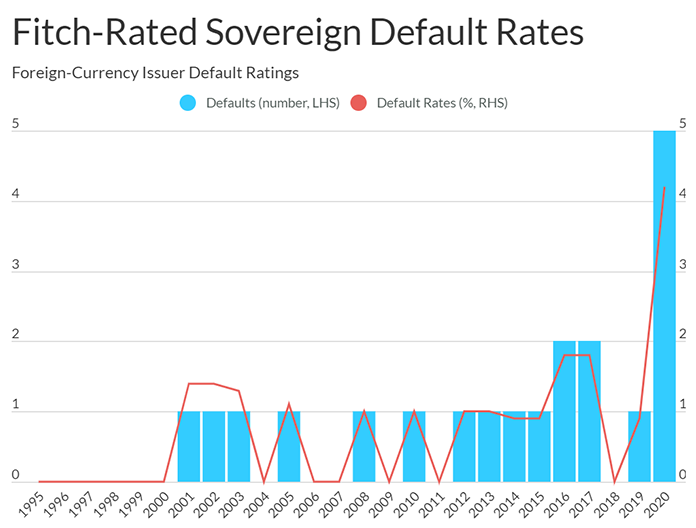

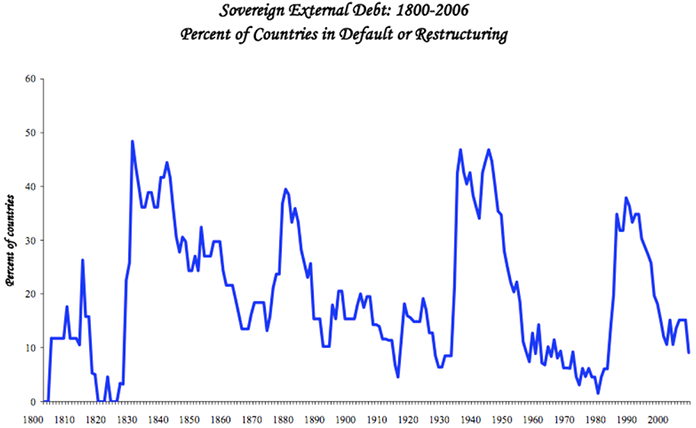

However whereas the headlines and preliminary value motion as proven within the chart above could learn unfavorable, El Salvador’s gambit is a captivating check of recreation principle that bitcoin bulls have lengthy predicted. With the Biden administration extra explicitly tying its overseas coverage to “human rights” than did President Trump, and China’s newfound deal with local weather change pushing bitcoin miners abroad, cryptocurrencies could also be an more and more enticing hedge for populist leaders on the fringes of the “Washington Consensus”.4 There may be additionally concern that the fringes are fraying: in keeping with an IMF weblog printed late final yr by Reinhard & Rogoff “[t]right here is brewing within the background a rising want for debt restructurings in numbers not seen because the debt disaster of the 1980s.” At the moment 5% of sovereign issuers are in default.5 The comparable 1980s ratio was 40%.6 A U.S. Federal Reserve (Fed) taper, ought to it happen, could improve the price of capital for the world’s extra susceptible debtors.

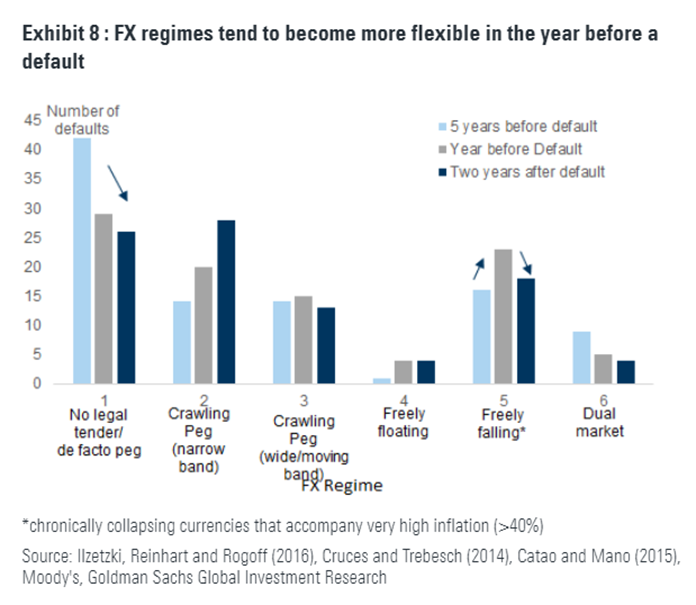

Supply: Goldman Sachs. A sovereign credit standing is an unbiased evaluation of the creditworthiness of a rustic or sovereign entity.

Supply: Fitch.

Supply: Harvard College, Ken Rogoff.

Sovereign defaults is a failure by a authorities in compensation of its nation’s money owed. No authorized tender/de facto peg: No personal sovereign forex. Instance El Salvador utilizing USD. Crawling Peg (slender band): Is when a forex steadily depreciated or appreciates at an virtually fixed fee in opposition to one other forex, with the trade fee following a easy development. Crawling Peg (extensive band): Similar as above. Wider band means the fixed fee in opposition to one other forex is wider than a slender band. Freely Float: A forex’s worth is allowed to fluctuate in response to foreign-exchange market mechanisms with out authorities intervention. Freely falling: already outlined in chart. Twin market: Twin trade fee setup the place a forex has a hard and fast official trade fee and a separate floating fee utilized to particular items, sectors or buying and selling circumstances.

(We must always word: VanEck’s rising markets debt crew emphasizes that that any defaults are finest predicted and analyzed on a case-by-case foundation. “Waves” of defaults aren’t a part of our baseline. In different phrases, being selective and analyzing every credit score by itself deserves is a greater response than avoiding EM debt as a result of some nations may get into hassle. As well as, a number of these extra susceptible bond markets commerce with these considerations already priced-in, in our view.)

So What Occurred in El Salvador?

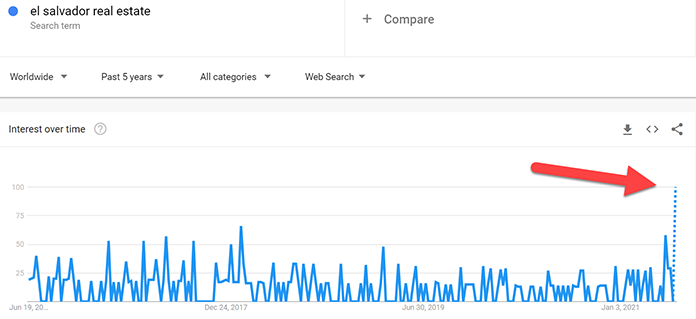

The Bitcoin regulation handed El Salvador’s congress final week, and President Bukele shortly thereafter marketed his plan to energy bitcoin mining from renewable geothermal energy.7 The CEO of U.S. bitcoin miner Marathon Digital (ticker: MARA, with a market capitalization of $2.6B8) chimed in with a request to collaborate.9 Google searches for El Salvador actual property reached an all-time excessive, significantly of bitcoin-friendly “El Zonte”, or “Bitcoin Seashore” as it’s now identified, a $200 million vacationer improvement an hour’s drive from the nation’s capital, San Salvador.10 This has attracted important Chinese language funding in recent times in keeping with World Occasions, together with $35 million in funding for a sewage and wastewater remedy plan as a part of a lately expanded “with out circumstances” $500 million Chinese language pledge to El Salvador.11 (Sugar exports to China rose 105% year-on-year in 2020, Torino Economics reported on June 11, 2021. With President Biden and President Bukele buying and selling diplomatic snubs over Mr. Bukele’s abstract firing of many of the nation’s Supreme Court docket after sweeping to energy in 2019, and IMF support on El Salvador’s $3B in debt due in 2022 now in jeopardy because of the Bitcoin regulation, Mr. Bukele has marshalled his 90% home approval ranking right into a check case for potential sovereign defaulters who could also be trying to play the U.S. and China off in opposition to one another.12

Supply: Google Traits.

Supply: World Financial institution.

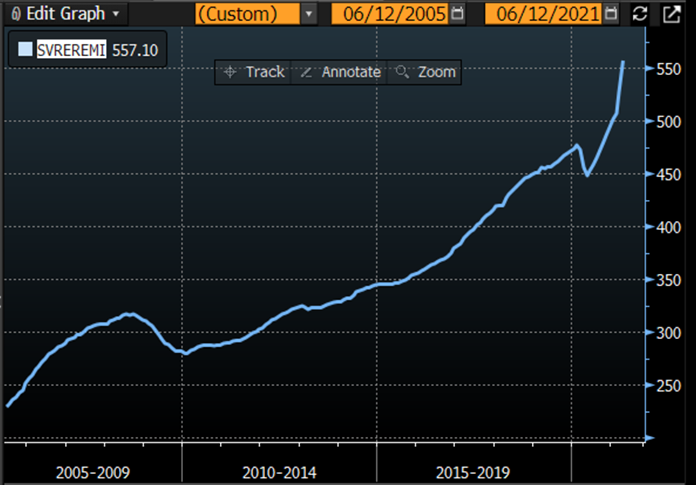

El Salvador Trailing 12-Month Remittances (Tens of millions of USD)

Supply: Bloomberg, VanEck.

Argentina: Excessive Inflation and Distorted Vitality Costs Encourage Mainstream Bitcoin Use

Bitcoin is already in widespread use amongst Argentinians who’ve a long time of expertise with unstable inflation and unreliable cash, and luxuriate in distortive state-subsidized energy prices that makes even family bitcoin mining enticing, in keeping with this South China Morning Publish piece. (As an apart, my NYC barber lives in a $900 rent-stabilized house with utilities included and his brother mines crypto in there.13 “That room is scorching!” he informed me. “Now we have to blast the AC.” Taxpayer funded bitcoin shouldn’t be solely a Latin American phenomenon!)

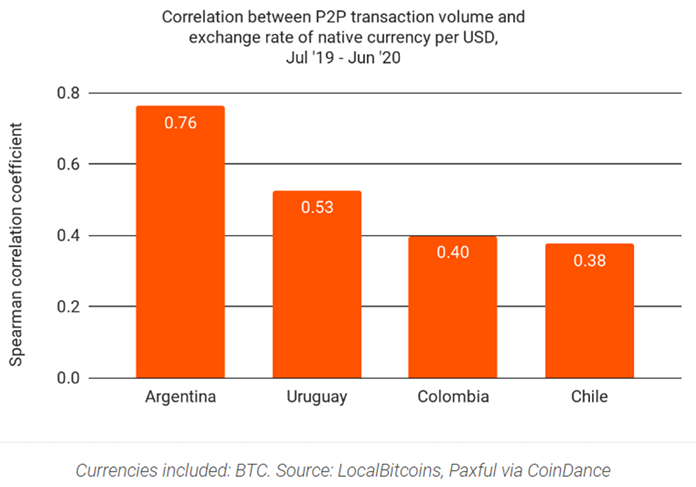

As well as, stranded energy in Patagonia additionally makes Argentina enticing for industrial miners: Canadian crypto miner Bitfarms (BITF CN, market cap of $700M14) introduced in April it was buying a 60MW web site with plans to scale to 210MW at a value of $0.02 MW/Hr.15 However there may be nonetheless appreciable uncertainty whether or not Argentina will proceed its hands-off regulatory strategy to crypto: on June 11 the Central Financial institution introduced an investigation into 9 home fintech firms suspected of “utilizing crypto belongings as a channel for financial savings, to find out if they’re conducting unauthorized monetary intermediation.”16 Nonetheless, in keeping with Chainalysis, a blockchain researcher, Argentina sports activities the very best correlation between native forex actions and peer-to-peer crypto transactions amongst Latin American nations. With the Client Worth Index (CPI) at present working at46% in Argentina, a “hard-money” different similar to bitcoin would appear intuitively enticing.17

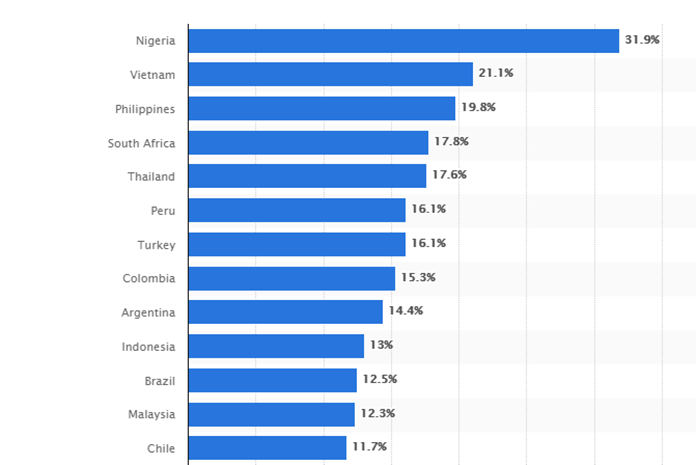

Share Who Owned/Used Cryptocurrencies in 2020

Supply: Statista.

Supply: Chainalysis weblog. Correlation is a statistic that measures the diploma to which two entities transfer in relation to one another.

Supply: Bloomberg. CPI is outlined because the Client Worth Index, which is a measure that examines the costs of a basket of shopper items and companies.

Do Argentina and El Salvador share another similarities? The VanEck Rising Markets Bond Technique’s crew chimes in:

“We consider crypto is of course interesting to rising markets savers. On the degree of the voting public, there may be reminiscence of inflationary and banking disaster outcomes from financial and financial indiscipline that makes them very receptive to personal cash. And governability considerations are prevalent in rising markets, particularly in Latam. Lack of belief in authorities and authorities cash is clearly a “factor” in Latam that predates crypto, so in our view, its take-up is sensible. However how can we start to consider EM economies and crypto in an organized method? We consider that their underlying debt dynamic could possibly be one good lens to make use of in enthusiastic about the sorts of nations that is perhaps particularly drawn to crypto.

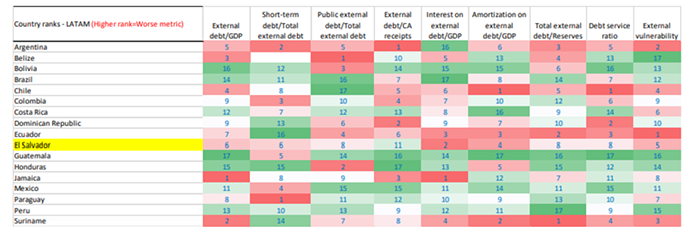

Unsustainable excessive exterior debt and debt service could create a “why not default” perspective. Should you take a look at the warmth maps for the chosen EM nations within the desk under, you’ll discover that El Salvador and Argentina have excessive ranges of presidency exterior debt and/or excessive ranges of exterior debt service. If debt and debt service are too excessive to be realistically serviced, it could turn out to be a “why not, as a result of I’m by no means gaining market entry anyway.” Argentina may by no means be capable of repay the greater than $60B it owes to the IMF, so why strive arduous to repay it? El Salvador has over $3B in debt funds due subsequent yr, which it can’t repay with out an IMF settlement and the market entry that gives. We consider if it’s not going to get an IMF deal, why not default, and take an opportunity with a brand new cash system? We aren’t recommending it, as defaults are very painful and dangerous. We’re merely explaining the story behind it.

The desk under provides you a way of the kinds of debt pressures totally different EM nations are experiencing, as a lens on which nations could also be likelier to maneuver to crypto. As you’ll anticipate, an enormous query just like the one we’re asking can’t be answered with a easy desk—there are subjective components, and even contradictions (similar to massive liabilities not being an issue resulting from massive credibility). Anyway, because the crypto world expands, it is a doable formal lens.”

Supply: VanEck.

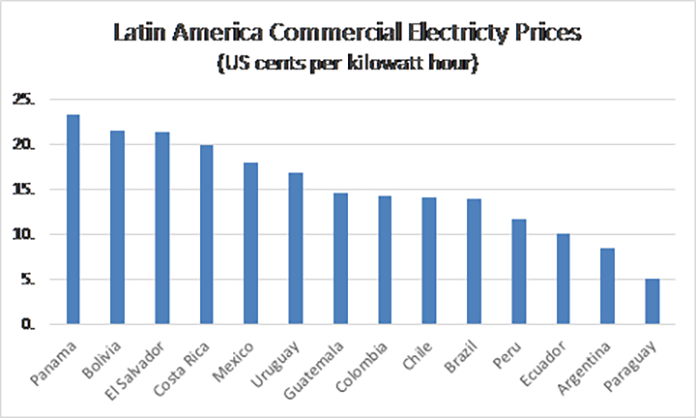

Paraguay: Trying to Exploit Low cost Vitality

Paraguayan congressman Carlitos Rejala tweeted a response to El Salvador President Bukele: “Our nation must advance hand in hand with the brand new era. The second has come, our second. This week we begin with an essential undertaking to innovate Paraguay in entrance of the world! The actual one to the moon 🚀#btc & #paypal.”18 The CEO of Paraguayan bitcoin mining firm Bitcoin.com.py then informed Coindesk TV that Paraguay is “a gorgeous nation to crypto traders” as a result of mining in Paraguay solely requires registration and cost of taxes, which he categorised as decrease than in the remainder of the area (10% enterprise earnings tax, 10% VAT and 10% private earnings tax). Paraguay affords no restrictions on overseas capital flows and the cost of dividends overseas and likewise sports activities the bottom energy electrical energy prices within the area. On the Itati hydroelectric plant, for instance, shared with Brazil, Paraguay solely takes 26% of the 6,067 megawatts19 it’s entitled to month-to-month, submitting the remaining to the neighboring nation, in keeping with congressman Rejala. “Now we have a number of power that we promote to Argentina and Brazil virtually at no cost as a result of we are able to solely promote to our neighbors,” stated Bitcoin.com.py CEO Benitez-Rickmann, who added that he spoke to numerous mining pool operators from China who requested for 100 megawatts of house, in keeping with Coindesk.

Latin America Industrial Electrical energy Costs

(US cents per kilowatt hour)

Supply: Statista. Information as of 9/24/2020.

Panama: No Tax Treaty with U.S.

Panamanian congressman Gabriel Silva tweeted in response to Bukele: “That is essential. And Panama can’t be left behind. If we need to be a real know-how and entrepreneurship hub, we’ve got to assist cryptocurrencies. We will likely be getting ready a proposal to current on the Meeting. If you’re concerned with constructing it, you may contact me.”20 Panama taxes capital good points at 10% and earnings at a max of 25% for residents and 15% for non-residents, in keeping with Buck Expat Tax Providers, a consultancy. The nation has no tax treaty with the U.S.

Mexico and Brazil: Modest Steps in Latam’s Two Largest Economies

Mexican senator Eduardo Hinojoso modified his Twitter profile to laser eyes on June Eight and wrote on the social media platform that he could be “selling and proposing a authorized framework for crypto cash” whereas including the hashtag #btc.21 “We’re going to lead the shift to crypto and fintech in Mexico,” stated Hinojosa. Mexican senator Indira Kempis Martinez additionally went laser eyes on Twitter.22 In the meantime in Latam’s largest economic system, Brazilian congressman Gilson Marques added laser eyes to his Twitter profile with the remark “tax is theft”.23 Whereas such sentiment could also be removed from mainstream, it’s value noting that the Brazilian SEC authorised a bitcoin ETF final month that can commerce on the São Paulo bourse.24

Nicaragua, Cuba and Guatemala: On the lookout for Leverage

Forward of Nicaragua’s election on November 7, Nicaraguan President Daniel Ortega has arrested 4 presidential hopefuls, a senior businessman, two opposition leaders and issued an arrest warrant for the president of the American Chamber of Commerce, a former central financial institution governor, who’s in hiding.

Final weekend Cuba suspended U.S. greenback deposits in Cuban banks in a bid to evade U.S. sanctions.25 One ought to anticipate Cuba and Nicaragua to stay financially remoted, making bitcoin adoption an apparent temptation, in our view. In the meantime Guatemala is at present locked in a high-stakes negotiation with the Biden administration over a $4B support package deal meant to stem a migrant disaster on the U.S. border.26 However President Alejandro Giammattei simply abolished a number one anti-corruption unit, claiming leftist bias.27 U.S. Secretary of State Antony Blinken in flip expressed “deep concern”. One can simply think about bitcoin making an look in a few of these diplomatic cables as some extent of negotiation.

Context on Sovereign Defaults

There may be at present $147B in excellent IMF debt, of which El Salvador accounts for simply $389 million, or 22 bps.28 And but a possible El Salvadoran default carries huge implications. Particularly, if the nation defaults on its U.S. greenback debt, can collectors seize the belongings (“connect”, in authorized terminology) of the debtor nation’s crypto flows? Sometimes, in a default, that is the supply of creditor energy. Any move of cash to accounts owned by the “deadbeat” could be hooked up and put in escrow till a debt deal is agreed. So, the cash flows cease, which is why nations have traditionally tried to achieve voluntary agreements to reschedule debt. El Salvador stands out as the first check case of whether or not crypto could possibly be seized.

As a possible company parallel, we’d take into account the case of Neiman Marcus, which carved out its on-line web site MyTheresa throughout chapter final yr in an try to defend the fast-growing enterprise from collectors. The determined bondholders have been to be left with simply the corporate’s brick and mortar shops.29 “It’s like somebody takes your pockets out of your again pocket on the subway and stares at you proper within the face whereas doing it,” stated the hedge fund supervisor and Neiman creditor Dan Kamensky, who grew to become so alarmed by the prospect that he broke the regulation making an attempt to intervene and is now headed for six months in jail. Bitcoin bulls actually hope that the IMF and the U.S. don’t turn out to be equally “undone” ought to El Salvador’s potential end-run round their greenback liabilities achieve extra traction within the area and past.30

(For its half, MyTheresa spun out from Neiman and raised $407M in a January IPO. The corporate is valued at $2.7B. Neiman Marcus then again emerged from chapter final yr as a personal firm. Its bonds are rated CCC+ by S&P.)

Supply: Bloomberg.

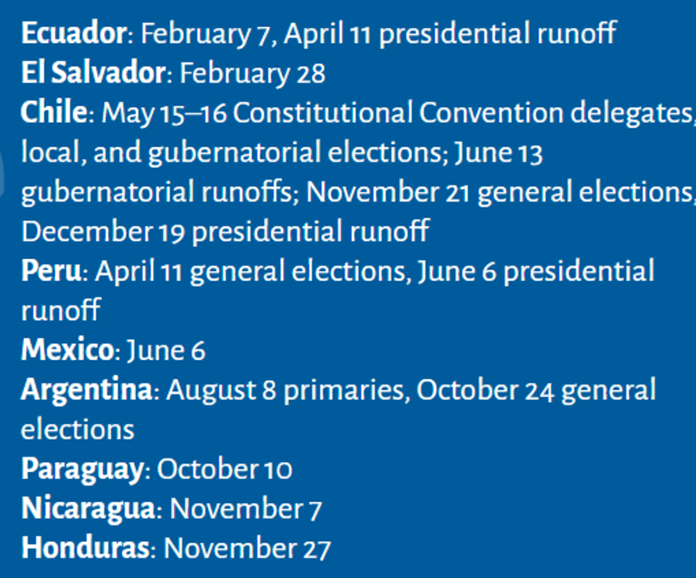

Conclusion

Macro and digital belongings traders ought to be laser-focused on the busy political calendar in Latin America this yr.31 Although the area is not any stranger to political polarization and regulatory volatility, El Salvador’s bitcoin ploy stands out as the starting of an anti-Washington consensus to undertake a financial different that may be manufactured with stranded CO2. You possibly can anticipate a value curve on volcano bitcoin mining from VanEck quickly sufficient.

Supply: AS/COA Information to Latin America Elections.

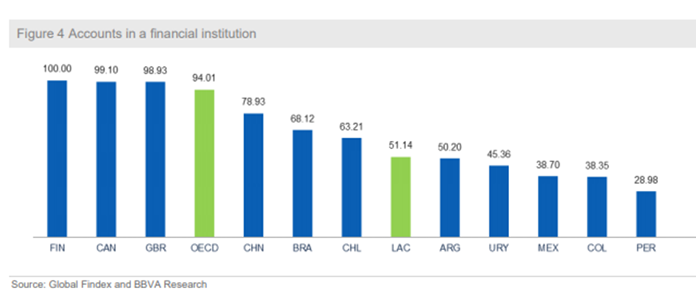

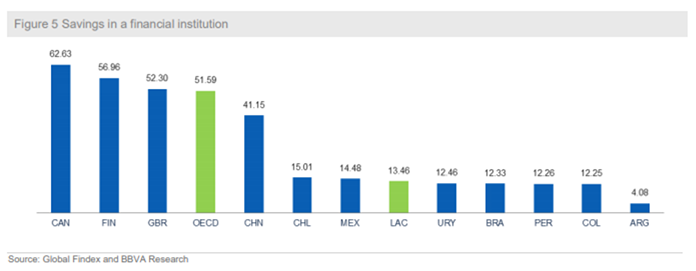

PS: Don’t neglect the structural story for digital belongings in Latam

Supply: BBVA, newest information 2018.

Initially printed by VanEck, 6/17/21

DISCLOSURES

1 Supply: Wall Road Journal.

2 Supply: Reuters.

3 World Financial institution, IMF and VanEck.

4 Supply: South China Morning Publish.

5 Supply: Fitch.

6 Supply: Harvard College.

7 Supply: Twitter.

8 Supply: Factset as of 6/11/2021.

9 Supply: Twitter.

10 Supply: USA Right this moment.

11 Supply: Reuters.

12 Supply: LA Occasions, El Salvador Data.

13 Supply: Twitter.

14 Supply: Factset as of 6/9/2021.

15 Supply: Bitfarms.

16 Supply: Central Financial institution of Argentina.

17 Supply: Bloomberg.

18 Supply: Twitter

19 Supply: Coindesk.

20 Supply: Twitter.

21 Supply: Twitter.

22 Supply: Twitter.

23 Supply: Twitter.

24 Supply: Coindesk.

25 Supply: Reuters.

26 Supply: Reuters.

27 Supply: VOA Information.

28 Supply: IMF.

29 Supply: Wall Road Journal.

30 Supply: Wall Road Journal.

31 Supply: Twitter.

VanEck assumes no legal responsibility for the content material of any linked third-party web site, and/or content material hosted on exterior websites.

The data herein represents the opinion of the writer(s), however not essentially these of VanEck, and these opinions could change at any time and infrequently. Non-VanEck proprietary data contained herein has been obtained from sources believed to be dependable, however not assured. VanEck doesn’t assure the accuracy of third social gathering information. Not meant to be a forecast of future occasions, a assure of future outcomes or funding recommendation. Historic efficiency shouldn’t be indicative of future outcomes. Present information could differ from information quoted.Any graphs proven herein are for illustrative functions solely. Not a advice to purchase or to promote any of the securities/ monetary devices talked about herein.

References to particular securities and their issuers or sectors are for illustrative functions solely.

Cryptocurrency is a digital illustration of worth that capabilities as a medium of trade, a unit of account, or a retailer of worth, however it doesn’t have authorized tender standing. Cryptocurrencies are typically exchanged for U.S. {dollars} or different currencies world wide, however they don’t seem to be usually backed or supported by any authorities or central financial institution. Their worth is totally derived by market forces of provide and demand, and they’re extra unstable than conventional currencies. The worth of cryptocurrency could also be derived from the continued willingness of market contributors to trade fiat forex for cryptocurrency, which can outcome within the potential for everlasting and complete lack of worth of a specific cryptocurrency ought to the marketplace for that cryptocurrency disappear. Cryptocurrencies aren’t lined by both FDIC or SIPC insurance coverage. Legislative and regulatory modifications or actions on the state, federal, or worldwide degree could adversely have an effect on the use, switch, trade, and worth of cryptocurrency.

Investing in cryptocurrencies comes with numerous dangers, together with unstable market value swings or flash crashes, market manipulation, and cybersecurity dangers. As well as, cryptocurrency markets and exchanges aren’t regulated with the identical controls or buyer protections obtainable in fairness, possibility, futures, or overseas trade investing. There isn’t any assurance that an individual who accepts a cryptocurrency as cost as we speak will proceed to take action sooner or later.

Buyers ought to conduct in depth analysis into the legitimacy of every particular person cryptocurrency, together with its platform, earlier than investing. The options, capabilities, traits, operation, use and different properties of the precise cryptocurrency could also be complicated, technical, or obscure or consider. The cryptocurrency could also be susceptible to assaults on the safety, integrity or operation, together with assaults utilizing computing energy adequate to overwhelm the conventional operation of the cryptocurrency’s blockchain or different underlying know-how. Some cryptocurrency transactions will likely be deemed to be made when recorded on a public ledger, which isn’t essentially the date or time {that a} transaction could have been initiated.

- Buyers will need to have the monetary means, sophistication and willingness to bear the dangers of an funding and a possible complete lack of their whole funding in cryptocurrency.

- An funding in cryptocurrency shouldn’t be appropriate or fascinating for all traders.

- Cryptocurrency has restricted working historical past or efficiency.

- Charges and bills related to a cryptocurrency funding could also be substantial.

There could also be dangers posed by the dearth of regulation for cryptocurrencies and any future regulatory developments may have an effect on the viability and enlargement of using cryptocurrencies. Buyers ought to conduct in depth analysis earlier than investing in cryptocurrencies.

Data supplied by Van Eck shouldn’t be meant to be, nor ought to it’s construed as monetary, tax or authorized recommendation. It isn’t a advice to purchase or promote an curiosity in cryptocurrencies.

All investing is topic to danger, together with the doable lack of the cash you make investments. As with all funding technique, there isn’t any assure that funding aims will likely be met and traders could lose cash. Diversification doesn’t guarantee a revenue or shield in opposition to a loss in a declining market. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.