Oil costs have been unstable of late and the decline on July 19 was the worst since September 2020. Consequently, the power sector shed its standing because the best-performing sector within the S&P 500 this yr with actual property passing it by.

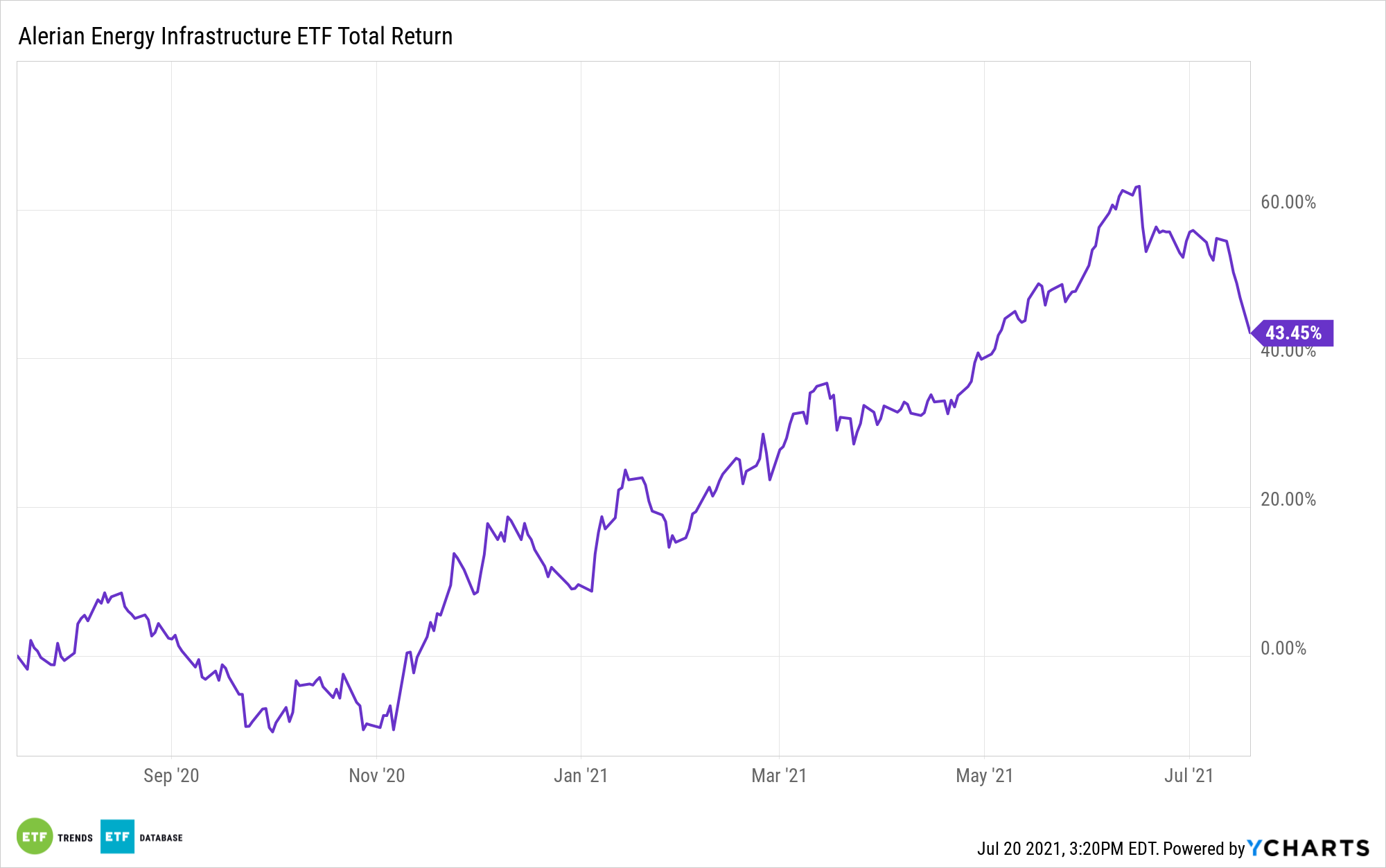

That seems like hassle for property just like the Alerian Power Infrastructure ETF (ENFR), however latest weak point within the power patch could possibly be a possibility to look at funds like ENFR. One cause that sentiment may show correct is the more and more favorable elementary image for power firms, together with midstream operators.

Imagine it or not, latest debt gross sales by power firms, lots of which came about final yr, are literally a optimistic signal buyers could not cross by. Power corporations are utilizing that debt to repay older, increased curiosity obligations and solidify their steadiness sheets. With the renewable power transition nicely underway, strikes to cut back and eradicate increased curiosity debt may show prudent for conventional power firms.

“The 2014 oil worth collapse, in hindsight, could have been the final ‘regular’ disaster. Oil costs fell, funding dried up, provide tightened, costs went up, banks had been keen to lend once more, and producers poured the cash into boosting manufacturing,” studies Irina Slav for OilPrice.com.

Why It Issues to ENFR

Nonetheless unbeknownst to many buyers, midstream firms, are enjoying more and more distinguished roles within the aforementioned renewable power transition. For instance, pipeline operators are seen as enjoying pivotal roles within the transfer to carbon neutrality.

Firmer steadiness sheets and diminished debt burdens can allow these firms to satisfy inexperienced power wants extra quickly. Plus, lenders like the truth that power firms aren’t borrowing to develop output of fossil fuels.

“Now banks have mellowed in the direction of oil considerably, however it’s an fascinating twist that the present loans include the situation of not boosting output,” in response to OilPrice. “Once more, it is smart. For years, the shareholders of U.S. shale oil firms have been complaining about poor returns as the businesses put all the things into output development. Now it’s payback time, and shareholders need their returns.”

One other good thing about midstream names borrowing to cut back increased curiosity debt is that it offers credit score buyers renewed religion in debt reimbursement, doubtlessly boosting the attract of power bonds and maybe paving the way in which to credit score rankings upgrades.

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.