By Jun Zhu, The Leuthold Group

By Jun Zhu, The Leuthold Group

We’ve seen a small phase of fairness ETFs, designated as “thematic,” that’s more and more gaining reputation. Thematic ETFs put money into baskets of shares that share narrowly outlined enterprise enterprises outdoors of the standardized GICS methodology.

These baskets are collections of shares which will differ so far as conventional {industry} illustration however have commonalities which will equally profit from an rising pattern, technological developments, or evolving political/financial panorama, amongst others. Almost all thematic ETFs observe a custom-made benchmark.

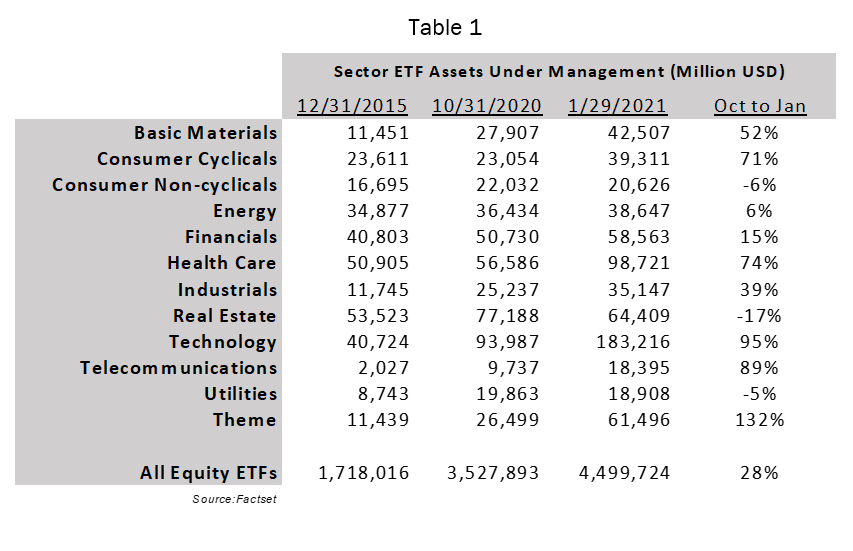

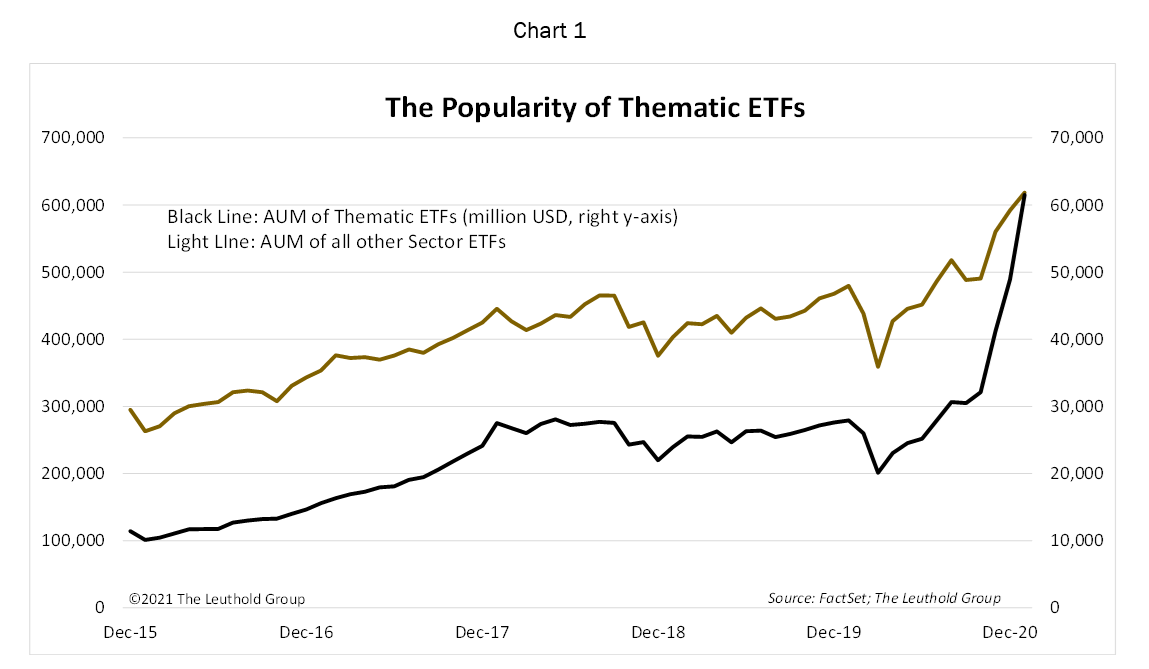

Though the sector division has misplaced belongings, the thematic subset has taken heart stage, notably in simply the final 4 months. Since October 2020, AUM for thematic ETFs have grown by 132% they usually now comprise greater than $61 billion (Desk 1).

On the whole, fairness ETFs will be broadly grouped into three classes primarily based on FactSet definitions: sector, issue/fashion, and excessive yield. Thematic ETFs fall below the sector grouping. Among the many three segments, sector ETFs are on the decline by way of proportion of complete belongings below administration. On the finish of 2015, sector ETFs accounted for 17.8% of all fairness ETF AUM; it has declined to 15.1% as of the tip of January 2021.

This progress is larger than fund circulate of general fairness ETFs. For comparability, between October 2020 and January 2021, AUM for all fairness ETFs grew by 28%.

On the finish of 2015, about 3.7% of all sector ETFs have been thought of “thematic,” they now embody greater than 9% (Chart 1).

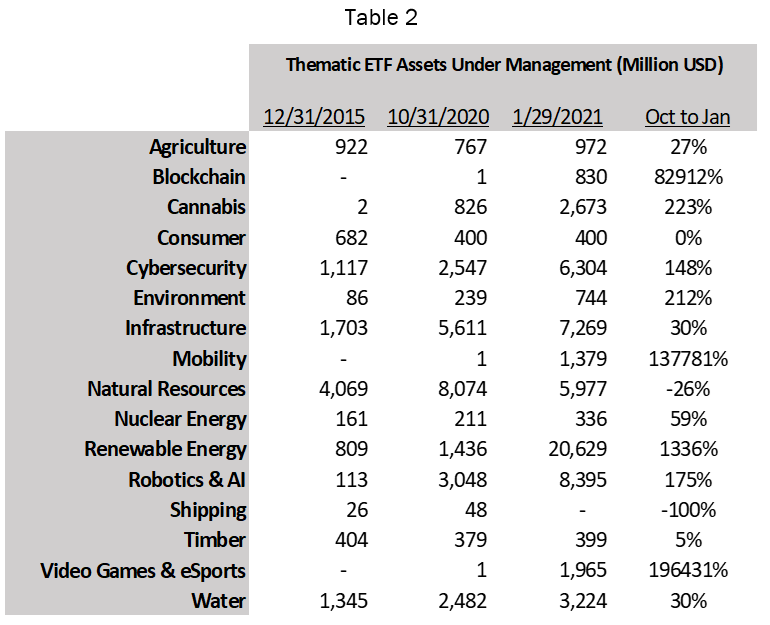

Desk 2 breaks down some particular themes these ETFs are monitoring. There are sixteen themes at current, though one doesn’t have any inventory constituents (“Delivery”). Three of the ideas are more moderen phenomena and are characterised by new know-how developments: Blockchain, Mobility (suppose EV), and Video Video games & eSports.

Different notions which have attracted investor curiosity are primarily based on modifications within the political panorama, together with Hashish, Environmental, Nuclear, and Renewable Power.

On the opposite aspect of the coin are Pure Assets and Timber, which may face future political headwinds. These types of ETFs haven’t benefited from the latest progress growth.

Sizzling investments all the time include elevated threat. We check out three potential dangers for these thematic ETFs and their underlying portfolio constituents.

ETF Fund Flows And Future Returns

Naturally, the primary query is whether or not we’ll see a reversal of investor enthusiasm for these scorching themes, and in flip, adverse developments for fund circulate and efficiency.

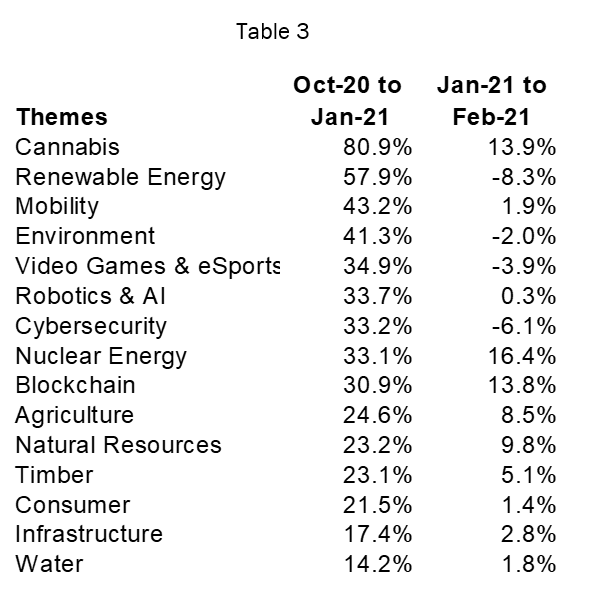

Desk Three ranks ETF common returns inside every theme primarily based on outcomes from October 31st via January 31st—the latest three-month interval thematic ETFs acquired noteworthy fund influx. Throughout that point, all 16 themes beat the S&P 500, with 9 doubling that of the broader benchmark. This efficiency correlates with fund-flow information proven in Desk 2—these with the very best returns attracted probably the most belongings.

We’ve already seen a reversal on this area throughout February. Aside from the continued power of the #1 performer, Hashish, the subsequent six-best performing themes trailed the S&P 500 for the month.

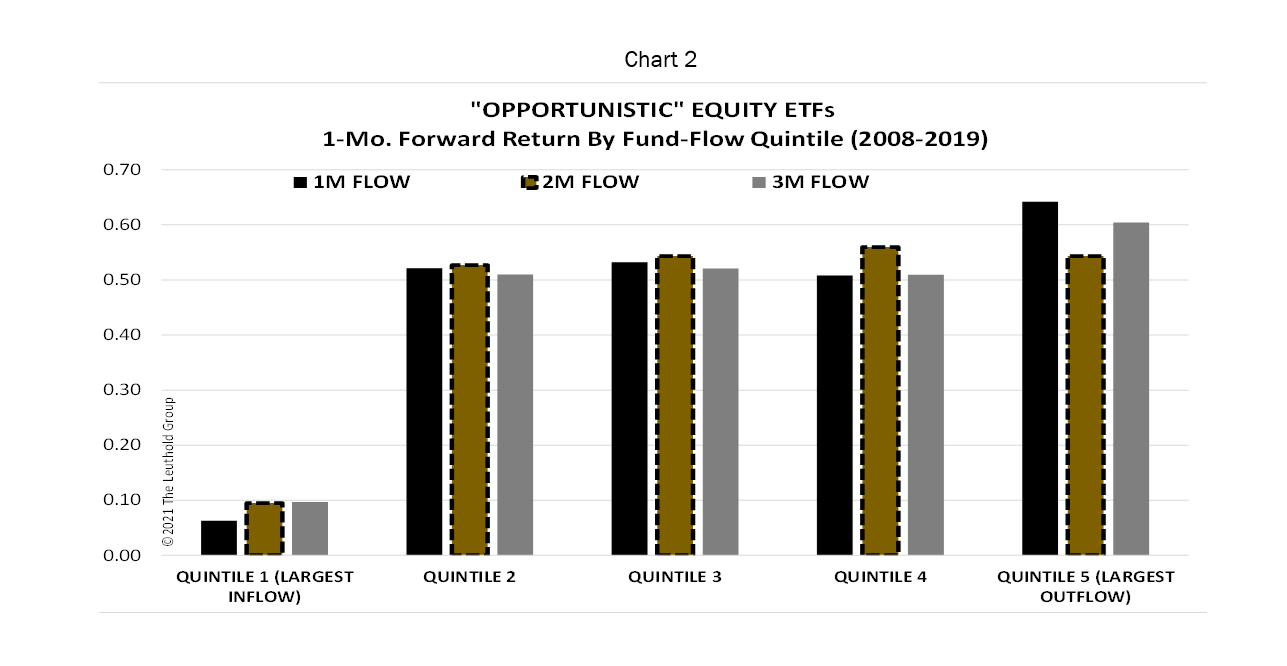

Prior to now, we discovered the inverse relationship between ETF fund circulate and future efficiency existed each within the core and opportunistic fairness ETFs (Chart 2). We classify FactSet’s fairness ETF segments of high-dividend yield, sector, and small cap as “opportunistic,” which buyers are likely to commerce in-and-out, quite than treating them as mainstay holdings.

The 12 months of 2020 broke this historic relationship. ETFs with the very best influx outperformed. We suspect loads of that’s as a result of efficiency of the thematic ETFs. Nevertheless, it’s arduous to think about the flow-fueled outperformance can persist, and reversion to the historic relationship may not bode properly for these high-flyers.

The Impact Of Thematic ETFs’ Concentrated Holdings On Particular person Positions

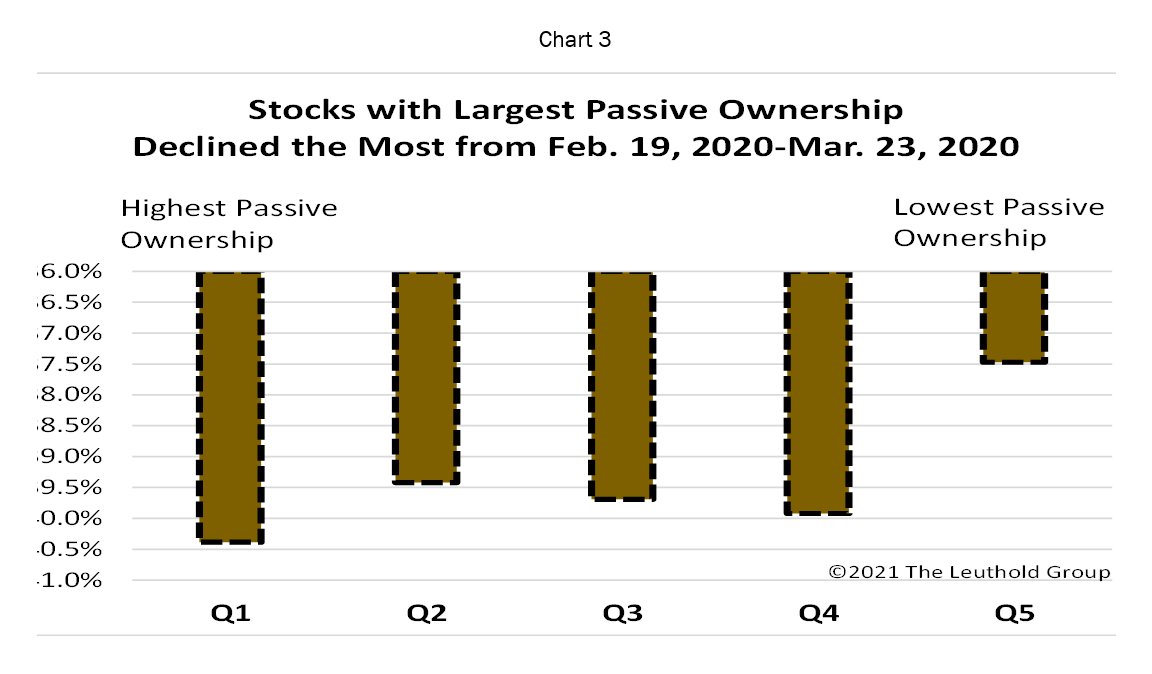

We surprise if the efficiency of particular person shares which are extensively held by the fashionable ETF themes are moreover topic to the affect of fund flows. Final 12 months, when the pandemic intensified the market rout, we discovered that shares with the biggest passive possession fared worse than these with the bottom (Chart 3).

That evaluation was primarily based on the biggest 500 shares, and we suspect that the impact may be much more prevalent amongst smaller firms.

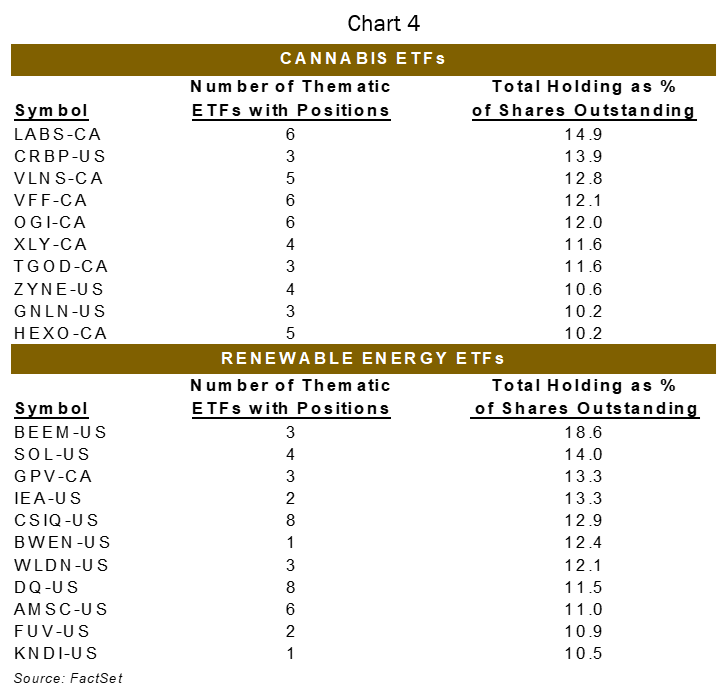

Right here we glance extra intently on the top-three performing thematic ETFs since final October (Hashish, Renewable Power, and Mobility) to determine the shares with appreciable shares excellent being held by these ETFs.

Hashish and Renewable subsets have extraordinarily concentrated holdings. ETF positions symbolize greater than 10% of shares excellent for ten completely different Hashish shares, and for eleven positions held by Renewable Power ETFs (Chart 4).

These shares actually profit from new buyers shopping for the thematic ETFs. Nevertheless, with such a big chunk of shares excellent being held by these thematic ETFs, it is going to be a detriment when the market sells off or the theme loses attraction.

Are Thematic ETFs Pure Performs?

A better have a look at the holdings results in one other potential threat or pitfall for buyers.

We discovered that the majority Mobility and Blockchain ETFs primarily maintain massive know-how firms, like Google, Baidu, Microsoft, and Apple, for instance. Their efficiency is intently correlated with conventional ETFs that observe these similar corporations, akin to QQQ.

In different phrases, buyers would possibly suppose they’re shopping for right into a scorching theme however find yourself getting the normal mega-caps via higher-fee ETFs, because the thematic selection usually cost two- to a few instances that of conventional ETFs. With shut to three,000 ETFs now obtainable, the names of methods could also be deceptive.

Takeaways

Steve Leuthold was a pioneer with “thematic” fashion fairness investing. He first designed the industry-group sphere and thought course of almost 60-years in the past and we’ve practiced that method to fairness investing at The Leuthold Group since Steve based the agency over 40 years in the past. As we’ve present in our in depth expertise with industry-group concentrations and sector rotation, thematic investing will be an distinctive tactical software to achieve publicity to very particularly focused and narrowly-defined concepts.

As thematic ETFs now acquire a foothold in reputation, there are hurdles to think about. This consists of important asset influx/outflow that may destabilize underlying inventory positions the place an ETF holds a big proportion of shares excellent. One other severe downside is that ETFs could diversify past the area of interest idea, both to mute the impact of asset flows or as a result of there’s a lack of eligible pure-plays to assemble a significant basket of shares for investing, which, in fact, leads to a dilution of the supposed publicity. In these circumstances, it turns into a matter of whether or not the hefty charges are justified.

Primarily based our research, we advise not chasing a scorching ETF, perceive precisely which shares the ETFs holds, and be careful in case you have investments in shares that occur to be main holdings of the new thematic ETFs.

Initially printed by The Leuthold Group

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.