With President Biden's large infrastructure pitch l

With President Biden’s large infrastructure pitch looming, buyers can put together for an uptick in authorities spending in a wide range of methods. The FlexShares STOXX World Broad Infrastructure Index Fund (NYSEArca: NFRA) is among the finest concepts.

NFRA tries to mirror the efficiency of the STOXX World Broad Infrastructure Index, which identifies equities that derive the vast majority of income from the infrastructure enterprise, offering publicity to each conventional and non-traditional infrastructure sectors.

“Biden is predicted to unveil the primary of a two-part spending proposal Wednesday, centered on infrastructure upgrades. That subject has been a serious theme of Biden’s marketing campaign and early presidency and the ‘Construct Again Higher’ method,” experiences Jesse Pound for CNBC.

The infrastructure class has traditionally supplied greater dividend yields than international fastened earnings and international equities, together with better predictability of long-term money flows. NFRA might be able to seize the rising calls for of financial growth which might be driving extra funding into transport, energy, and different techniques.

NFRA Reclaims the Highlight

Infrastructure publicity also can assist defend towards long-term inflationary dangers since most infrastructure operators go by means of the fee will increase of inflation to customers by means of the long-term contracts that sometimes underpin the infrastructure enterprise fashions.

“One key to constructing out U.S. infrastructure can be rising the manufacturing of semiconductors domestically, as a worldwide scarcity and tensions with China have made policymakers cautious of counting on worldwide manufacturing,” in accordance with CNBC.

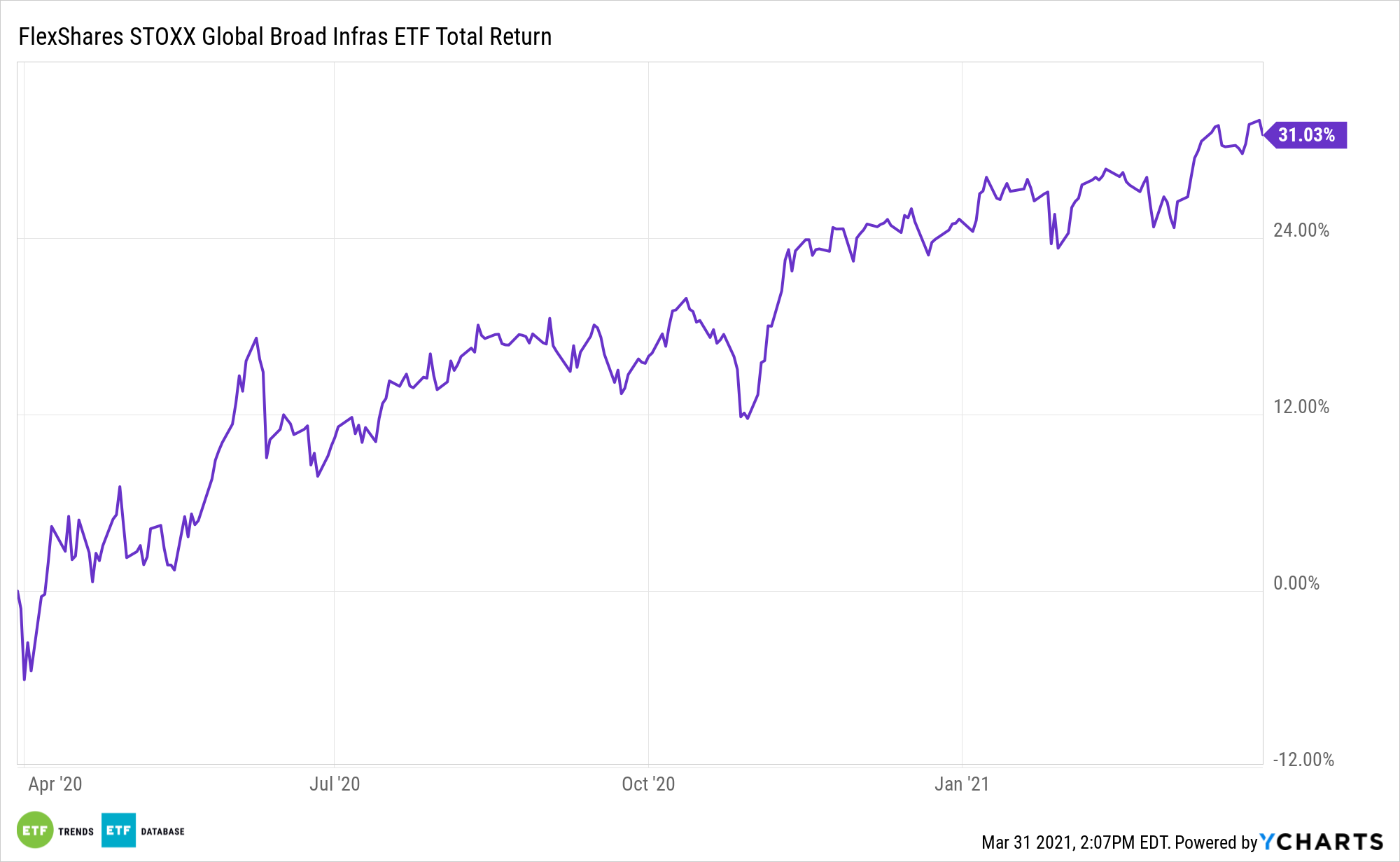

Information verify there are good causes for buyers to think about infrastructure over the approaching months.

NFRA’s index focuses on long-lived belongings in industries with very excessive limitations to entry, with not less than 50% of their income from key sectors with a 3-month common every day trending quantity of not less than $1 million. The portfolio is weighted based mostly on a free-float market cap with sure constraints to restrict publicity in anybody safety, sub-sector, or nation. The fund is rebalanced yearly.

For extra on multi-asset methods, go to our Multi-Asset Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.