Violent protests have erupted within the streets of Bogota, Cali and different cities in Colombia. The rapid trigger? Proposed reforms to the South American nation’s tax system, which might have lifted taxes on every thing from salaries and dividends to fossil fuels, single-use plastic gadgets and extra.

In line with reviews, the protests have concerned residents of all walks of life, together with truckers, taxi drivers and well being care employees. Overworked medical doctors, nurses and paramedics have walked off the job to carry consideration to wage delays.

In response to the unrest, Colombian President Ivan Duque introduced on Sunday that he was withdrawing the tax reform proposal. The nation’s finance minister resigned the next day.

However the protests proceed, simply as they did in Hong Kong in 2019 and 2020 after a controversial extradition invoice was canceled. A minimum of 24 Colombians are believed to have misplaced their lives thus far throughout clashes with police.

Cash Flows The place It’s Revered Most

It’s in opposition to this incendiary backdrop that U.S. lawmakers are having their very own tax reform debate.

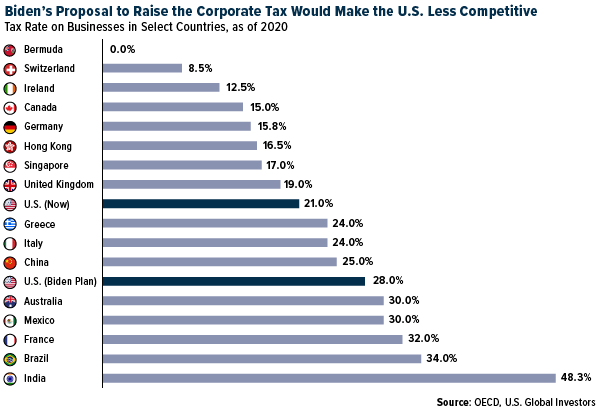

President Joe Biden seeks to make numerous changes to the tax code, together with elevating the highest earnings charge to 39.6%. The tax on capital features, at the moment at 20%, could be doubled. And company taxes, which had been lowered to 21% within the Tax Cuts and Jobs Act of 2017, would improve to between 25% and 28%.

click on to enlarge

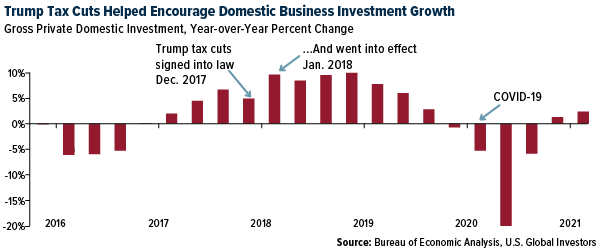

Earlier than 2017, the highest U.S. charge on company earnings was 35%, making it one of many highest charges on the earth—larger, even, than Mexico, France and Brazil. I and most different executives celebrated the change as a result of it made the U.S. much more aggressive as a spot to do enterprise in. As I’ve mentioned many occasions earlier than, cash flows the place it’s revered most. Across the time of the tax invoice’s signing, personal enterprise funding within the U.S. got here speeding again, earlier than stalling in late 2019 as the worldwide financial system slowed and articles of impeachment in opposition to President Donald Trump seemed increasingly doubtless.

Now, as home funding is lastly beginning to trickle again following the worst of the pandemic, the U.S. dangers scaring cash away once more by elevating company taxes.

click on to enlarge

To make issues worse, Treasury Secretary Janet Yellen mentioned final week that she and numerous different finance ministers are actively negotiating a worldwide minimal tax on company earnings. If applied, the choice would stand as yet one more instance of unelected bureaucrats imposing anti-capital, anti-competition insurance policies on the remainder of us. Clearly I don’t condone the violence we’re seeing in Colombia proper now, however I view it as a cautionary story of what might occur when persons are confronted with the actual risk of getting much more of their hard-earned cash withheld from them.

Certainly one of my all-time favourite quotes comes from Winston Churchill, who was simply as witty as he was an incredible chief: “We contend that for a nation to attempt to tax itself into prosperity is sort of a man standing in a bucket and attempting to elevate himself up by the deal with.”

Quite the opposite, international locations have discovered prosperity by eliminating taxes. Take China. In 1978, Deng Xiaoping created particular financial zones (SEZs) alongside the shoreline, in cities reminiscent of Shenzhen, which invited hundreds of thousands of {dollars} in overseas funding to pour in. It’s laborious to think about China changing into the second largest financial system had this determination not been made.

Web Brief Bets on the Greenback Improve. Time to Scoop Up Gold?

It could be no coincidence that the worth of the U.S. greenback decreased greater than a full p.c final week in opposition to a basket of worldwide currencies. This comes as hedge funds and different speculative traders have elevated their web brief positions in opposition to the dollar in current weeks. What’s extra, the Worldwide Financial Fund (IMF) reported that the share of U.S. greenback reserves held by international central banks fell to 59% within the fourth quarter of 2020, a 25-year low that’s down from 71% because the euro made its debut in 1999.

What does this imply for property which might be priced in U.S. {dollars} reminiscent of gold? As you might need anticipated, the yellow metallic jumped again above $1,800 an oz. for the primary time since late February. Gold rose greater than 3.5% for the week, beating its digital counterpart Bitcoin, which remained largely flat.

The U.S. Greenback Index is at the moment at 90.2. I imagine if it traded beneath 90, it might set off some technical gold shopping for as inflation considerations mount.

That’s exactly the rationale why legendary investor Sam Zell finds gold enticing proper now. The Fairness Group Investments founder informed Bloomberg Tv final week that he was seeing inflation “in every single place.”

“You examine lumber costs, however we’re seeing it in all of our companies,” Zell mentioned. “The apparent bottlenecks within the provide chain area are pushing up costs. It’s very paying homage to the ‘70s.”

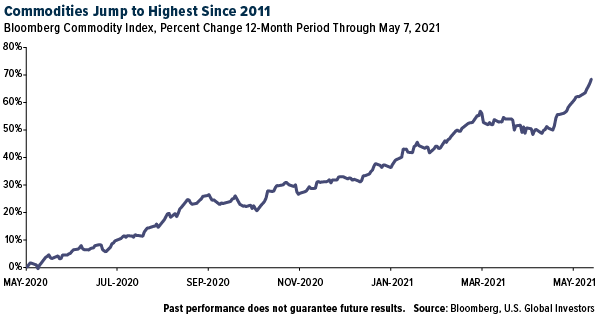

Commodities at Six-12 months Excessive, Copper at All-Time Excessive

Certainly, one of the apparent indicators of inflation is quickly increasing commodity costs, which rose to their highest since 2011 final week. For the 12-month interval, the Bloomberg Commodity Index has returned near 70%, among the finest runs for uncooked supplies in current reminiscence. In the meantime, copper, a bellwether of financial progress, touched a brand new document excessive of over $10,400 a metric ton.

click on to enlarge

I don’t see asset costs pulling again within the brief time period, given the continuing threat of inflation and debasement of the U.S. greenback. Copper might very properly be headed for $13,000 or extra, so keep lengthy.

Initially printed by Frank Holmes, 5/10/21

All opinions expressed and knowledge offered are topic to alter with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. International Traders doesn’t endorse all data equipped by this/these web site(s) and isn’t answerable for its/their content material. Beta is a measure of the volatility, or systematic threat, of a safety or portfolio compared to the market as a complete.

The U.S. Greenback Index is an index of the worth of the USA greenback relative to a basket of foreign currency echange, also known as a basket of U.S. commerce companions’ currencies. The Bloomberg Commodity Index is a broadly diversified commodity value index distributed by Bloomberg Indexes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.