Watch sufficient media and congressional appearances by Federal Reserve Chairman Jerome Powell and also you could not be blamed for pondering every of these occasions sounds an identical.

Not less than Powell is constant. In his testimony earlier than Congress final week, Powell reiterated his view that the world’s largest financial system remains to be in stable form and that inflation is more likely to show transitory.

Nonetheless, advisors nonetheless face headwinds on the subject of purchasers’ fastened revenue allocations. They will make life a bit simpler with the with the WisdomTree Fastened Revenue Mannequin Portfolio. WisdomTree head of fastened revenue Kevin Flanagan has some concepts for a way advisors and traders can take care of bland Fed communicate and a difficult fastened revenue setting.

“I discover myself returning to this query fairly steadily in varied discussions,” he stated in a latest word. “Regardless of Chair Powell’s unchanged stance, I proceed to give attention to two overarching themes for the second half of this 12 months and into 2022: maintaining length brief and credit score over charges.”

Fastened Revenue Funds to Take into account

One fund Flanagan references is the WisdomTree Yield Enhanced U.S. Brief-Time period Mixture Bond Fund (SHAG). SHAG is not a member of the aforementioned mannequin portfolio, however it’s the short-term counterpart to the favored WisdomTree Barclays U.S. Mixture Bond Enhanced Yield Fund (NYSEArca: AGGY). AGGY is the highest holding within the mannequin portfolio.

“Following the identical technique as AGGY, SHAG reweights the sectors of the one- to five-year section of the Brief Agg Composite whereas adhering to 2 predominant guardrails: the load of main and minor sectors can’t deviate by greater than 30% from their weights within the Brief Agg Composite and length usually won’t be greater than half a 12 months of this benchmark,” stated Flanagan.

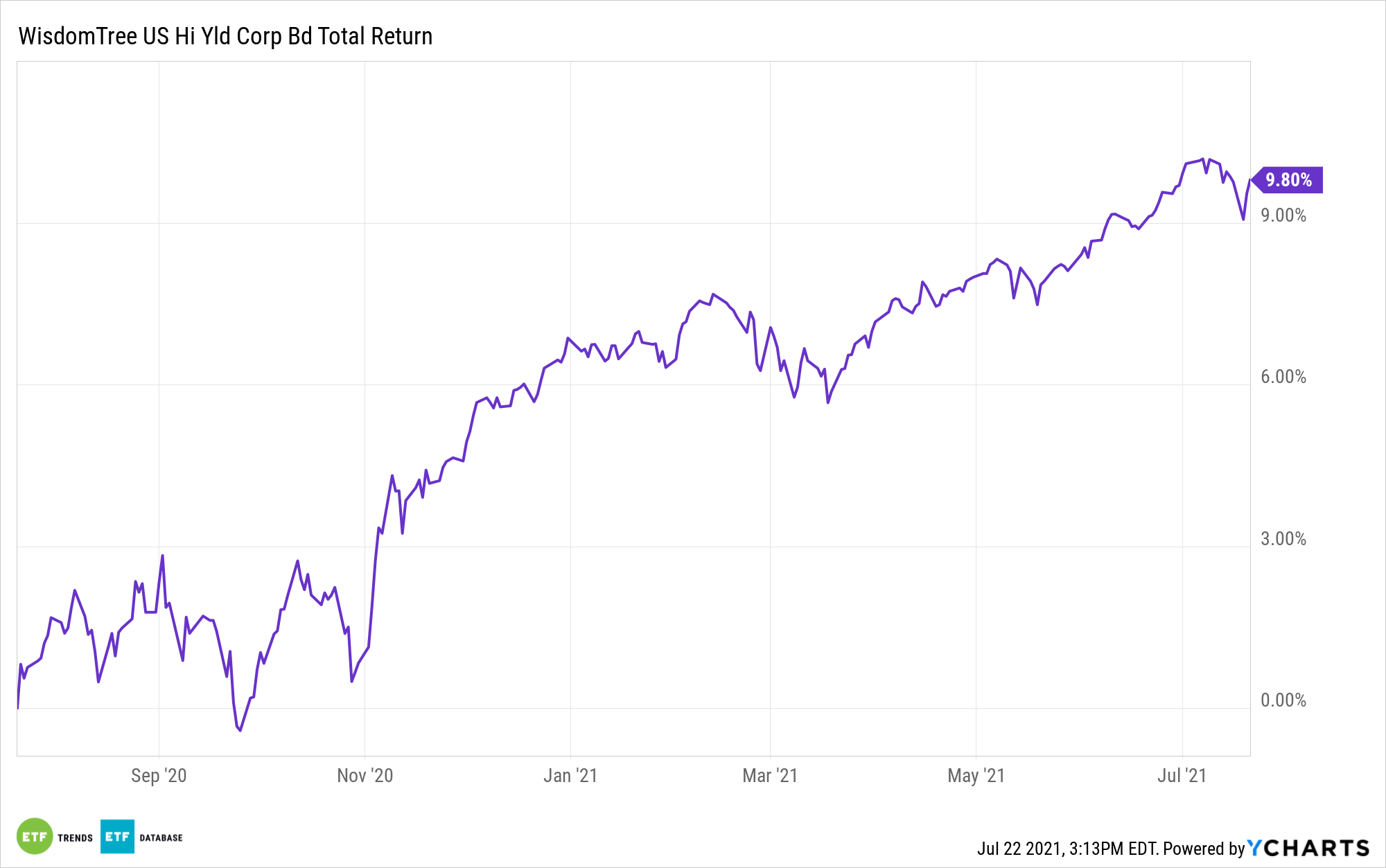

For advisors searching for credit score alternatives, the WisdomTree U.S. Excessive Yield Company Bond Fund (CBOE: WFHY) is one other thought to contemplate. WFHY contains a high quality method designed to mitigate default danger whereas maintaining revenue elevated.

“The method behind WFHY is to display for high quality to probably mitigate the potential of future default danger. This technique focuses on solely public issuers domiciled within the U.S. and eliminates these with a adverse money stream. We then reweight this remaining universe to tilt weights towards bonds with extra favorable revenue traits,” added Flanagan.

For extra on learn how to implement mannequin portfolios, go to our Mannequin Portfolio Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.