Dividend shares steadied late final 12 months after a turbulent first half. With that steadiness co

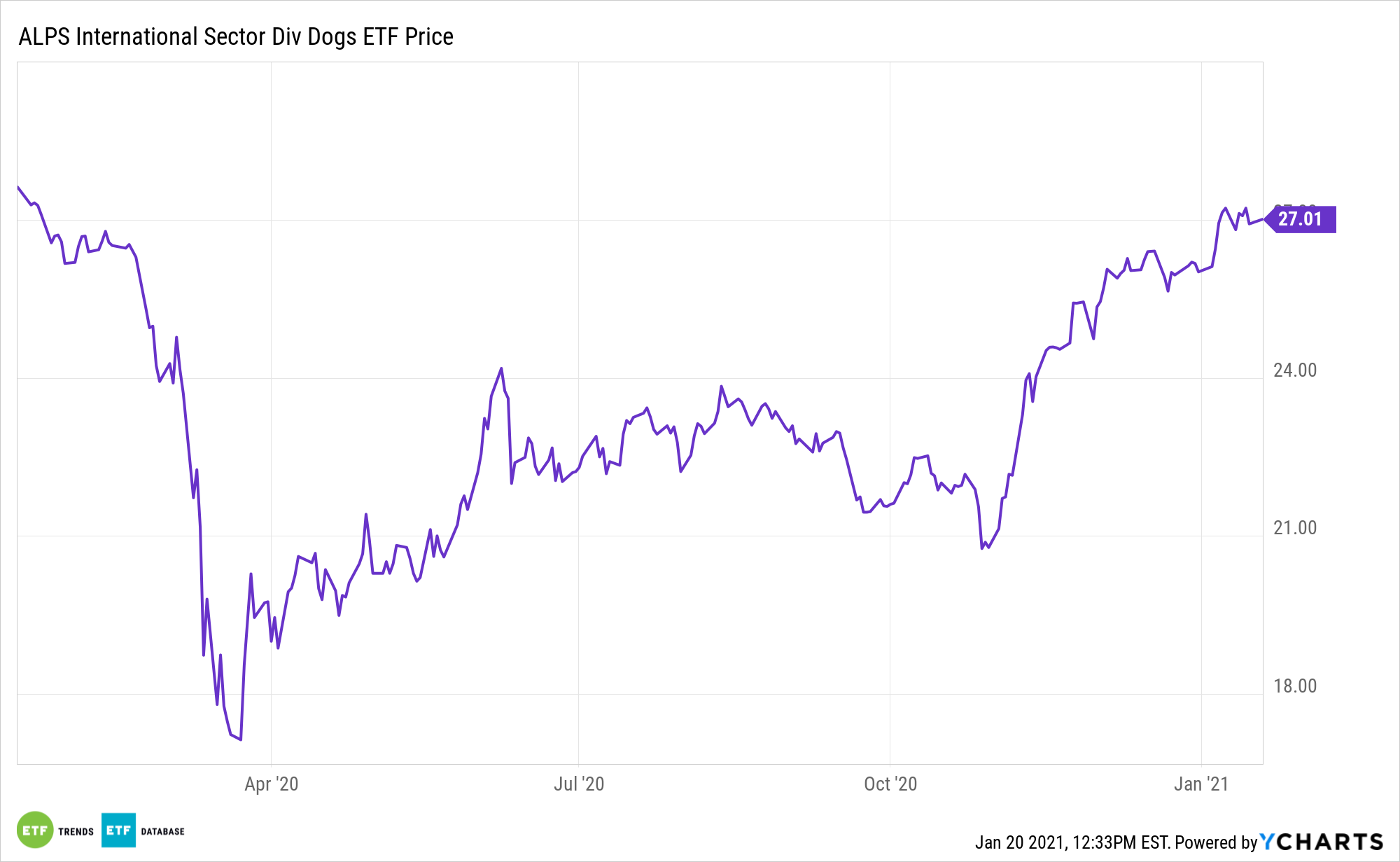

Dividend shares steadied late final 12 months after a turbulent first half. With that steadiness comes expectations that development will resume this 12 months. These sentiments apply to worldwide dividend payers too, enhancing the attraction of the ALPS Worldwide Sector Dividend Canine ETF (NYSEArca: IDOG).

ALPS identifies the 5 highest-yielding securities within the 10 GICS sectors on the final buying and selling day of November. From there, IDOG is rebalanced quarterly in an effort to maintain sector weights within the space of 10% and particular person holdings at round 2%.

With extra seeking to overseas markets as a method to diversify away from U.S. equities, buyers will face sure dangers related to worldwide publicity. However, there are a selection of sensible beta world trade traded fund methods that may assist buyers higher handle dangers.

“We count on the Brexit deal, the conclusion of US elections and the provision of the vaccine to cut back uncertainty and encourage extra corporations to renew funds or develop dividends in 2021,” writes IHS Markit.

The right way to Safely Seize the World Markets

Most buyers would sometimes flip to a standard, beta index fund technique to garner world market publicity. Nonetheless, these market cap-weighted indexing methodologies could trigger buyers to change into uncovered to a few of the largest corporations which have grown probably the most or change into too centered on solely a handful of nations. For its half, IDOG gives a extra bespoke strategy to trimming worldwide fairness danger than its rival cap-weighted beta funds. IDOG additionally incorporates a worth tilt.

IDOG could assist buyers acquire improved risk-adjusted returns to European markets by diminishing draw back danger whereas nonetheless collaborating in upside potential. Moreover, its dividend focus additionally helps buyers concentrate on high quality corporations with a historical past of rising dividends. There are good causes to think about IDOG over a standard, broad developed markets ETF.

“IHS Markit expects dividends declared this 12 months to strategy $1.78 trillion, up about 7% from $1.67 trillion in 2020. In compiling the report, IHS Markit relied on dividend forecasts for greater than 12,500 world corporations, together with the constituents of all the most important fairness indexes,” stories Lawrence Strauss for Barron’s.

Different worldwide developed market dividend ETFs embody the FlexShares Worldwide High quality Dividend Dynamic Index Fund (NYSEArca: IQDY), ProShares MSCI EAFE Dividend Growers ETF (CBOE: EFAD), and the SPDR S&P Worldwide Dividend ETF (NYSEArca: DWX).

For extra on cornerstone methods, go to our ETF Constructing Blocks Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.