For many earnings traders, closed-end funds are an alluring asset class. These funds sometimes lob off above-average yields, and there are various cases when close-ended funds commerce at reductions to web asset values (NAVs), providing one thing of a price proposition.

Nonetheless, choosing the right closed-end fund is not any much less difficult than deciding on particular person shares. Luckily, the Invesco CEF Earnings Composite ETF (NYSEARCA: PCEF) makes venturing into this asset class simpler on traders.

PCEF, which is about 11.5 years previous, tracks the S-Community Composite Closed-Finish Fund Index (CEFX). That benchmark is a basket of closed-end funds, which means PCEF employs a fund of funds construction. Along with the month-to-month earnings delivered by closed-end funds and PCEF, there are extra advantages to investing within the Invesco fund.

“To start with, closed-end funds are exempt from company taxes on the situation that they cross by web funding earnings (curiosity and dividends) to shareholders,” says Alerian analyst Roxanna Islam. “Most CEFs pay these distributions month-to-month—though some additionally pay quarterly—in comparison with conventional mounted earnings devices, which pay coupons semiannually.”

A Potent Earnings Answer

With a 30-day SEC yield of 6.46%, the $932.1 million PCEF lives as much as its billing as a reputable earnings concept, significantly in at the moment’s low-yield atmosphere. As enticing as that yield and the month-to-month distribution are, there are extra advantages than meet the attention with PCEF, together with some tax-related perks.

“CEFs additionally pay web realized capital acquire distributions sometimes on the finish of the 12 months. Some fairness and different technique funds, nonetheless, anticipate to earn a big portion of their return by capital beneficial properties, reasonably than dividends or curiosity,” provides Islam.

One other benefit supplied by closed-end funds seems on the mounted earnings facet, which makes up about 64% of PCEF’s lineup. Many closed-end fund managers use leverage – borrowing at decrease, short-term charges and reinvesting the proceeds at increased yield long-term charges. That income-boosting technique is employed by about two-thirds of closed-end funds. As Alerian’s Islam notes, the present local weather can be conducive to that technique.

“Decrease rate of interest environments, like our present atmosphere, are significantly useful for funds that use leverage. As short-term rates of interest lower, the price of leverage (i.e., the fee to borrow) decreases and the fund’s earnings enhance because the unfold between borrowing value and funding charge widens,” mentioned the analyst.

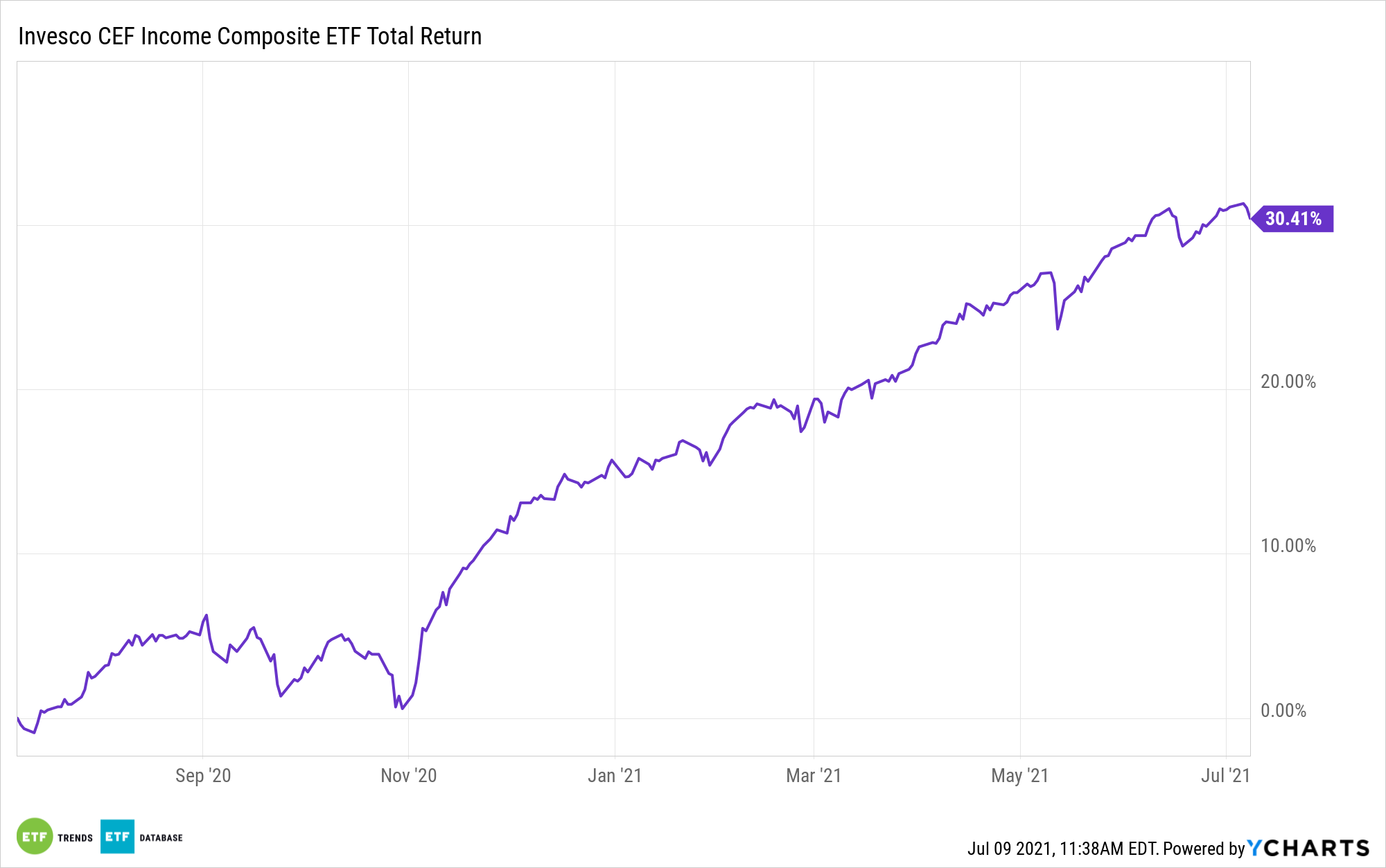

PCEF, which allocates 36.32% of its weight to choices earnings methods, is up nearly 13% year-to-date.

For extra information, data, and technique, go to the ETF Schooling Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.