The ProShares Nasdaq-100 Dorsey Wright Momentum ETF (QQQA) is a brilliant beta ETF that, regardless of solely holding 21 securities, is extra diversified than the broader Nasdaq-100, based on Todd Rosenbluth, Head of ETF and Mutual Fund Analysis for CFRA.

The Nasdaq-100 Index tracks the most important home and worldwide non-financial mega-cap progress shares of the tech-heavy Nasdaq. It serves because the benchmark for the Invesco QQQ Belief (QQQ), one of the vital broadly traded ETFs on the earth.

QQQA, in the meantime, makes use of a momentum technique to pick out top-performers throughout the Nasdaq-100 Index.

To construct the portfolio, Dorsey Wright, a frontrunner in momentum investing, makes use of a “relative energy” sign to pick out the highest 21 corporations throughout the Nasdaq-100 primarily based on their highest value momentum on the time of rebalance.

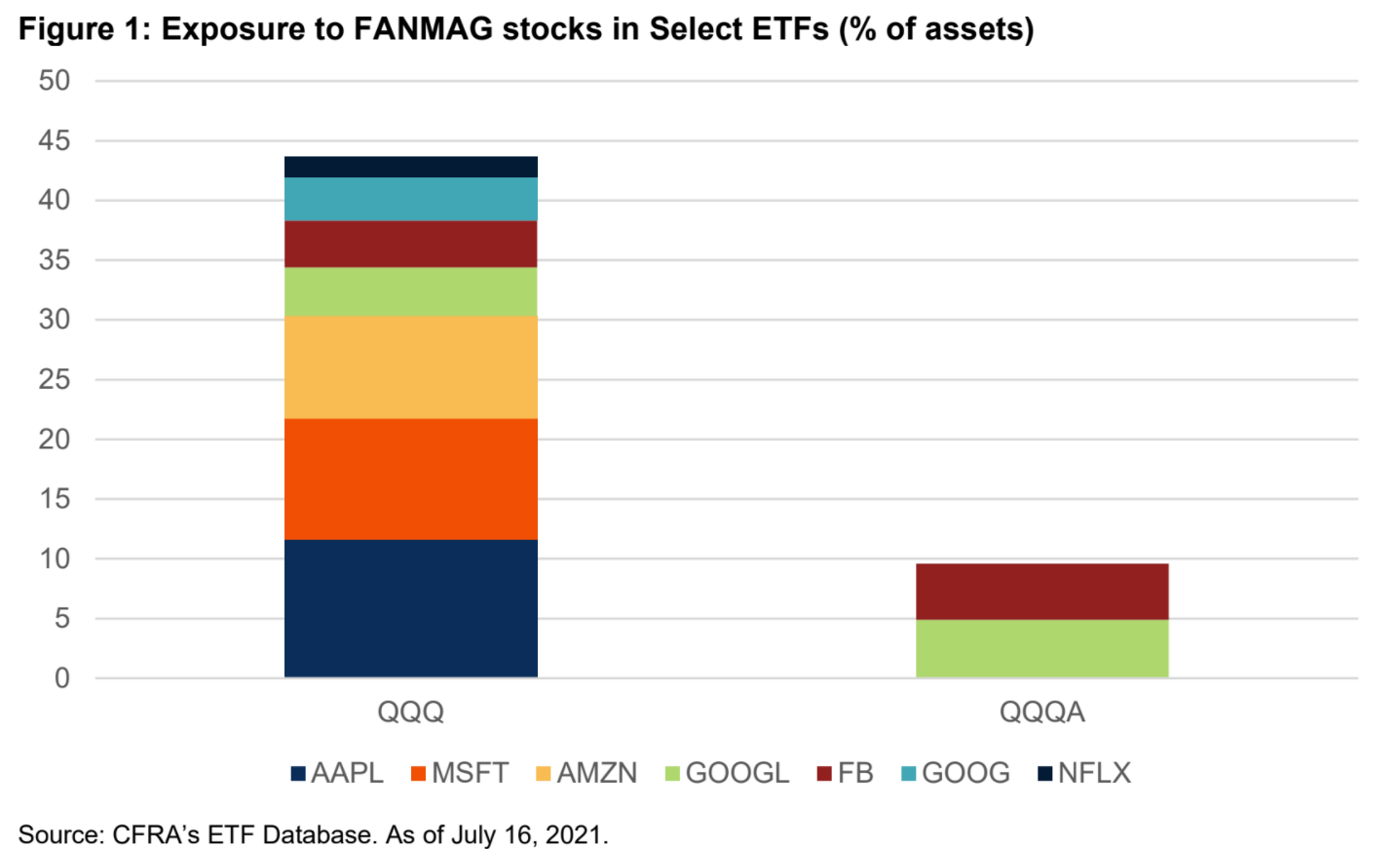

In contrast to the cap-weighted QQQ, QQQA is equal-weighted, and that makes all of the distinction. As of its most up-to-date quarterly rebalance, QQQA’s accommodates solely a part of the FANMAG corporations: tts positions in Fb (FB) and Alphabet (GOOGL) collectively complete 9.6% of the property throughout the fund.

Compared, QQQ accommodates all six of the most important FANMAG gamers, which compromise 44% of that fund’s holdings.

As of its July rebalance, QQQA had a extra diversified unfold throughout sectors than QQQ and different ETFs just like the iShares MSCI USA Momentum Issue ETF (MTUM).

“By fishing throughout the Nasdaq-100 universe, QQQA’s maintained a hefty stake in data expertise,” Rosenbluth said.

Whereas MTUM rebalanced in Could and decreased its allocation to data expertise shares, QQQA maintained its concentrate on progress corporations. At present, the fund has a 42% allocation in data expertise.

As well as, by including positions in Biogen (BIIB), Illumina (ILMN), and Moderna (MRNA), the fund now holds a 25% allocation in healthcare – superb timing because it occurs, as fears of Delta and different Covid variants have traders as soon as once more searching for alternatives within the sector.

QQQA has an expense ratio of 0.58%.

For extra information, data, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.