By Liqian Ren, Director of Fashionable Alpha, WisdomTree O

By Liqian Ren, Director of Fashionable Alpha, WisdomTree

On December 2, 2020, the Home of Representatives voted to go the Holding International Firms Accountable Act, which handed the Senate in Might. President Trump is anticipated to signal it into legislation.

Again in August, I broke down six the reason why I imagine the influence of Chinese language equities delisting is insignificant and secondary to the elemental earnings components that drive the efficiency of Chinese language equities. The danger to Chinese language equities from delisting—notably the non-state-owned phase—is minimal.

The aggressive panorama between of the U.S. and China nonetheless exists. The U.S.’s market effectivity, work ethic, freedom of speech and well-tested authorized system continues to be a formidable benefit and attraction to overseas corporations. However whether or not, and the way, this subject is resolved is an efficient sign to observe concerning U.S.-China financial dynamics over the subsequent 4 years.

To reply my query from the title, briefly: no. Right here are some things to bear in mind round these latest bulletins.

1. The Invoice Gives a Three-12 months Window for U.S.-China Negotiations.

The invoice provides corporations three years to grow to be compliant. That is essential, as a result of in absence of a U.S.-China compromise, the pure dwelling for delisted corporations similar to Alibaba Group Holding and Baidu is the Hong Kong Inventory Trade (HKSE), which has actively courted them to dual-list their shares.

Bigger corporations similar to Alibaba, JD.com and NetEase have already completed dual-listing in Hong Kong and New York, and a number of other different corporations are making ready to do the identical. HKSE has relaxed its guidelines to permit corporations similar to Alibaba and JD.com to dual-list, nevertheless it nonetheless has extra stringent itemizing guidelines than U.S.-based exchanges.

Itemizing on HKSE requires a minimal market cap of HK$40 billion ($5.16 billion), or HK$10 billion ($1.29 billion) with income of greater than HK$1 billion ($130 million).

Even now that the delisting legislation is forecast to grow to be official, Chinese language corporations proceed to listing within the U.S., exhibiting the attractiveness of the U.S. monetary and authorized system.

For instance, Chinese language courting app firm BlueCity had its IPO within the U.S. in July. It gave traders renewed hope and confidence that this subject could be resolved.

The dispute is now centered on who has the ability to audit the auditors similar to Ernst&Younger-China, Public Firm Accounting Oversight Board (PCAOB) or China’s equal group.

Earlier than the commerce battle in 2017, China and the U.S. have been already testing a possible resolution that may enable each regulators to have authority. PCAOB did an audit take a look at run in tandem with its Chinese language equal, although was not fully happy with the method. With a brand new administration within the U.S. in 2021, this subject is extremely prone to obtain passable compromises on each side.

2. ETFs Are Impacted In another way Than Particular person Shares, and WisdomTree Is Already Buying and selling HK shares The place Liquidity Is Adequate

That brings us to the second level. If these corporations have already got twin listings by the point the legislation passes, traders in exchange-traded funds (ETFs) that search to trace indexes—such because the WisdomTree China ex-State-Owned Enterprises Index (CHXSOE)—wouldn’t even discover the influence on their portfolios.

A swap of New York Inventory Trade (NYSE) shares for Hong Kong shares would most certainly be handled as a company motion, which portfolio managers take care of day by day. For traders who instantly personal these shares, it might be a bit extra sophisticated, relying on how their brokerages deal with company actions.

WisdomTree has already began buying and selling the HK shares of dual-listed corporations the place liquidity is enough. For an ETF investor, that is already taking place within the background. For particular person traders, swapping the U.S. share for a Hong Kong share shall be a taxable capital positive aspects occasion in common accounts. The tax benefit of the ETF construction shines by in occasions like this.

3. The Position of the PCAOB

The historical past of the PCAOB is as a lot about regulatory energy as defending traders from fraud; it was created in response to the 2001 Enron scandal. Enron’s auditor is believed to have colluded with the corporate to govern and falsify its accounting information.

The PCAOB is meant to be the auditor’s auditor, regulating accounting corporations similar to Ernst &Younger (EY) and PricewaterhouseCoopers (PwC).

The present subject is that this: does a Chinese language firm similar to Alibaba fall beneath the regulatory jurisdiction of the U.S. PCAOB as a result of it’s listed on the NYSE, or beneath the Chinese language equal of the PCAOB as a result of it’s a Chinese language firm?

Many of the Chinese language corporations listed on the NYSE use the Chinese language branches of the Large 4 U.S. auditors. Chinese language agency Luckin Espresso—which has been accused of committing accounting fraud—used EY as its auditor. However most information articles missed the truth that EY didn’t certify Luckin’s latest annual report, which is believed to have lined the interval when the fraud allegedly occurred. Presumably for authorized causes, EY has been silent on whether or not its auditing independently uncovered fraud. Rising markets corporations usually carry a valuation low cost for the opportunity of accounting fraud, so it isn’t evident that delisting would assist defend U.S. traders.

4. Different Regulatory Dangers in Chinese language Equities (Moreover Delisting)

Chinese language equities produce other dangers past delisting. If U.S. public opinion have been to show sharply in opposition to China—if, for instance, an funding in any Chinese language inventory was seen as analogous to investing in South Africa throughout the apartheid period—then there could be substantial divestment, which may result in decrease valuations.

To date, that sort of opinion has not translated into mainstream funding actions. Primarily based on a lot of the sanctions imposed thus far, the non-state-owned phase of the Chinese language fairness market is prone to be much less politically controversial than banks or state-owned power corporations. The newest White Home government order forbidding funding in some Chinese language equities with navy ties was additionally primarily directed towards state-owned corporations.

Chinese language expertise corporations additionally face relentless headwinds from Chinese language regulators, similar to Ant Group’s IPO debacle and China’s platform antitrust laws launched in November for feedback. On December 14, subsidiaries of Alibaba and Tencent have been fined the utmost quantity allowed of 500,000 RMB (about $77,000) for not submitting for his or her acquisitions. Across the similar time, Alibaba, JD, Meituan, Pinduoduo, and many others., have been sternly warned by the Folks’s Every day in opposition to entering into the neighborhood grocery group buying enterprise , with the implication that these tech giants are threatening jobs of usually decrease expert native grocery staff.

In a separate, extra detailed, Market Perception article, I lay out the authorized and social historical past behind the antitrust subject and proceed to argue that these headwinds are headline grabbing, however not of great threat to China’s tech and client discretionary sectors. A part of doing enterprise in China is the problem of whether or not/how a lot to simply accept and handle the constraints of opaque regulatory threat.

5. Potential Outcomes of a Reciprocity-Primarily based Technique

Primarily based on the U.S. response to Chinese language restrictions on airline journey between the 2 nations this 12 months, in addition to government actions and authorized challenges in opposition to TikTok and WeChat, a theme of reciprocity in market entry appears to be driving financial conflicts.

This reciprocity-based technique doesn’t recommend a dramatic escalation of U.S.-China monetary battle over the subsequent 4 years or so, similar to forbidding U.S. traders from investing in any Chinese language fairness, whether or not listed on the HKSE or the Chinese language mainland.

The hope—the assumption—continues to be that the U.S. and China will work out some points based mostly on mutual advantages and customary floor, with a whack-a-mole sport of broad financial and political conflicts persisting a long time down the street.

We are able to solely comply with Winston Churchill’s recommendation: “It’s a mistake to attempt to look too far forward. The chain of future can solely be grasped one hyperlink at a time.”

6. The Main Issue (Anticipated Earnings Progress Price) Driving Chinese language Equities Has Not Modified

The ultimate level is that the first issue driving Chinese language equities is their anticipated earnings progress price and whether or not precise progress helps present valuations.

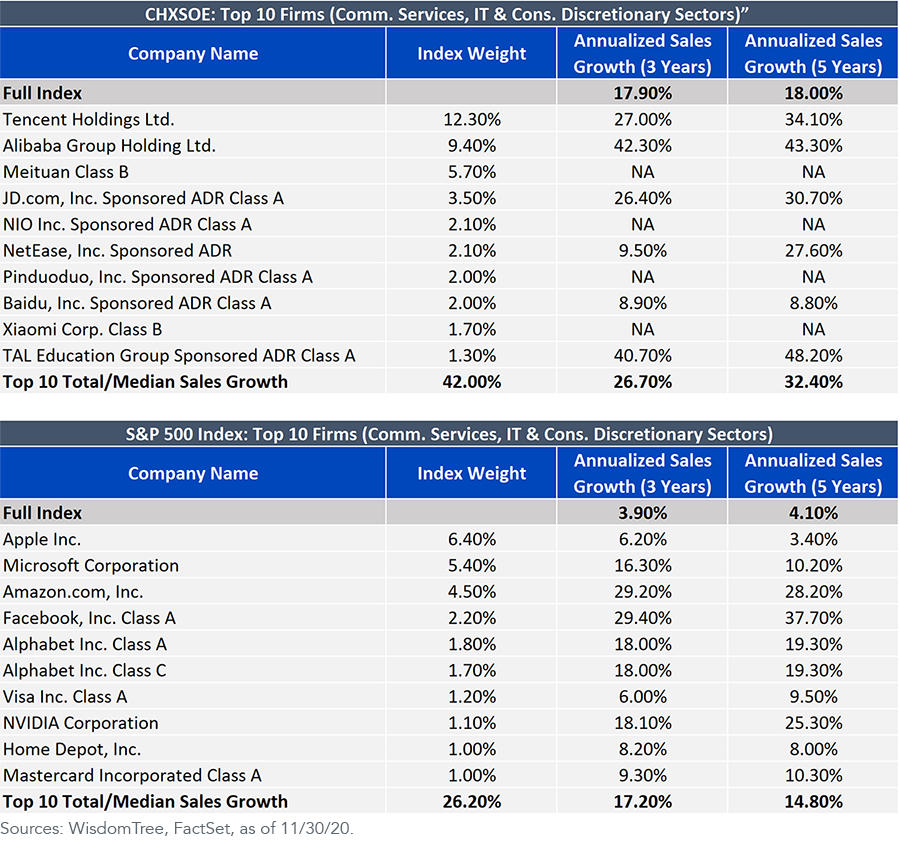

Pinduoduo, an e-commerce firm that instantly competes with Alibaba and JD.com, has seen heavy volatility lately. It delivered excessive progress, however typically not as a lot because the Road had hoped given its wealthy valuation. The highest non-state-owned Chinese language corporations, that are probably the most vibrant phase of the Chinese language financial system, have delivered vital gross sales progress in comparison with prime U.S. corporations within the S&P 500.

Future earnings and inventory worth will increase of those corporations will come from each U.S. and Chinese language financial progress persevering with to help international progress.

Initially revealed by WisdomTree, 12/17/20

1 https://www.scmp.com/tech/e-commerce/article/3113892/community-group-buying-groceries-surges-china-vast-market-size

Vital Dangers Associated to this Article

Neither WisdomTree Investments, Inc., nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax recommendation. All references to tax issues or data offered on this materials are for illustrative functions solely and shouldn’t be thought of tax recommendation and can’t be used for the aim of avoiding tax penalties. Traders in search of tax recommendation ought to seek the advice of an impartial tax advisor.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.