Palladium is approaching a $3,0

Palladium is approaching a $3,000 value and buying and selling close to report highs. With demand trying to stay excessive for the steel, and provide remaining low, the long-term elementary for palladium look sturdy, writes Sprott’s Shree Kargutkar in a brand new report.

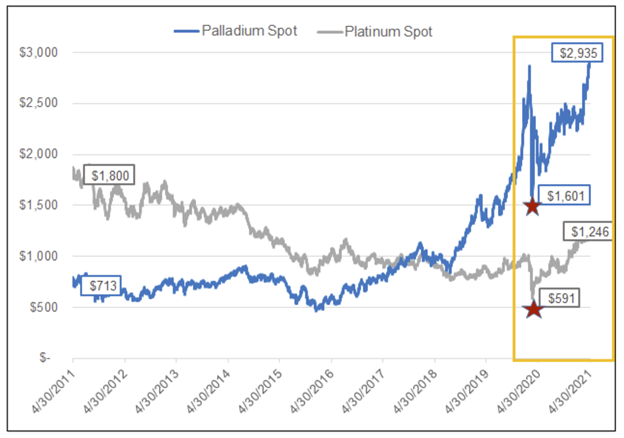

The pandemic low for palladium got here in March 2020, when the steel’s value dropped to $1,601/oz. Since then, it has rebounded as much as $2,935/ouncesas of April 30, 2021, a lot greater than its sister steel, platinum:

Supply: Sprott Asset Administration

In truth, palladium has outperformed each platinum and the S&P 500 Index for the 1-, 3-, and 5-year intervals ending April 30th, 2021.

Automotive Demand Drives Palladium Costs

One of many most important drivers of palladium’s ongoing power is the automotive trade, the place the steel, together with platinum, is a vital part within the manufacturing of catalytic converters, also called autocatalysts. These converters assist scale back poisonous emissions from automobile exhaust. Consequently, 9.6 million ounces of palladium—or 84% of complete demand—are utilized in automotive manufacturing yearly.

Though the COVID-19 pandemic crimped automotive manufacturing demand for palladium, auto demand is anticipated to considerably rebound in 2021.

In flip, that’s meant palladium’s costs are more and more guided by longer-term fundamentals, resembling local weather change and the push for extra energy-efficient autos. As coverage turns greener and emission requirements proceed to tighten in North America, Europe, and China, the significance of catalytic converters will solely proceed to extend.

Analysts notice that prime palladium costs are driving producers to take a look at platinum as an alternative and by 2025, about 1.5 million ounces of palladium use might convert to platinum use. However ought to that happen, the swap would take a while and may very well be offset by different calls for for the steel. For instance, as China modernizes its trade infrastructure, it would require extra palladium for industrial processes, such because the manufacturing of sure chemical compounds.

Sourcing Palladium Stays a Problem

Palladium additionally has vital sourcing issues that hold its provide restricted regardless of ever-increasing calls for. Regardless of a pointy manufacturing uptick from South Africa and a report quantity of palladium recycled in 2020, demand continues to be hovering over the availability.

2021 will seemingly mark the 10th consecutive 12 months that palladium has maintained a provide deficit. This comes even with ETF traders returning 2.5 million ounces of palladium to money in on funding beneficial properties between 2015 and 2020.

Palladium is scarce within the earth’s crust and arduous to mine. 75% of all mined palladium comes from South Africa and Russia. South Africa was hit notably arduous within the COVID disaster, however manufacturing is more likely to rebound strongly this 12 months.

Inflation Considerations

Many traders marvel how inflation and a commodity “supercycle” may impression the value of palladium. However Kargutkar argues that as a result of palladium is an industrial steel and never an funding steel, inflation is probably going not as related to pricing as a lot as automotive manufacturing is.

“In our view, the longer-term elementary tendencies stay firmly supportive for palladium,” he writes.

For extra information, info, and technique, go to the Gold & Silver Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.