By Indexology; Jason Ye, Affiliate Director, Technique Indices, S&P Dow Jones Indices

In our earlier weblog, we’ve proven that SPACs are usually small- and micro-cap firms which have low liquidity. Following the identical framework, on this weblog we’ll analyze SPACs’ efficiency. We discovered that relative to S&P SmallCap 600®, energetic SPACs underperformed when in search of the goal, delivered irregular returns through the deal announcement interval, and underperformed once more post-merger.

SPACs’ Efficiency Peaks Main As much as Announcement Day

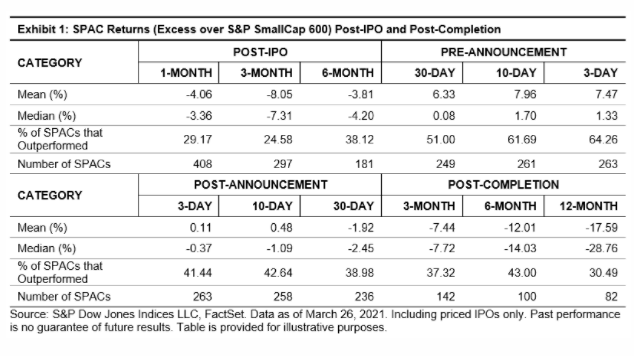

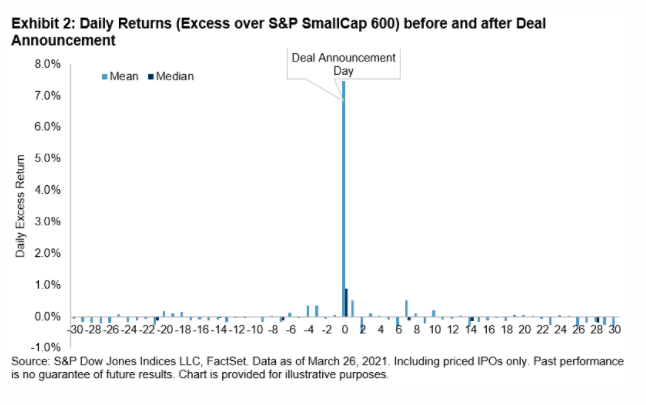

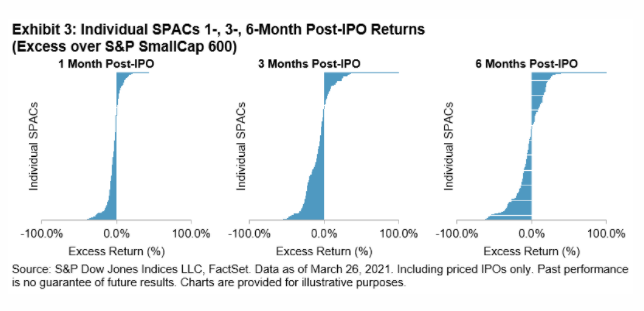

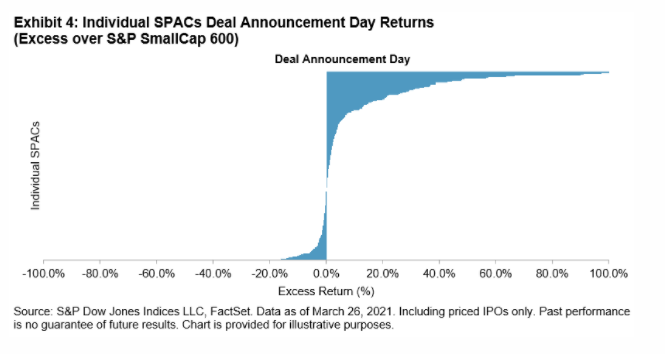

Exhibit 1 summarizes SPACs’ extra return over the S&P SmallCap 600 post-IPO and post-completion. Exhibit 2 exhibits how each day extra returns modified 30 days earlier than and 30 days after the deal announcement. Lastly, Reveals 3-6 present the distribution of extra returns. The information highlights the next:

- Publish-IPO, SPACs underperformed the S&P SmallCap 600 (see Exhibit 1). The distribution of the surplus return was closely skewed (see Exhibit 3).

- SPACs outperformed the S&P SmallCap 600 dramatically upon deal announcement (see Reveals 2 and 4). Reflecting the market’s basic constructive sentiment, the share of SPACs that outperformed elevated towards the deal announcement (see Exhibit 1). The irregular return statement through the announcement day is in keeping with earlier analysis.1

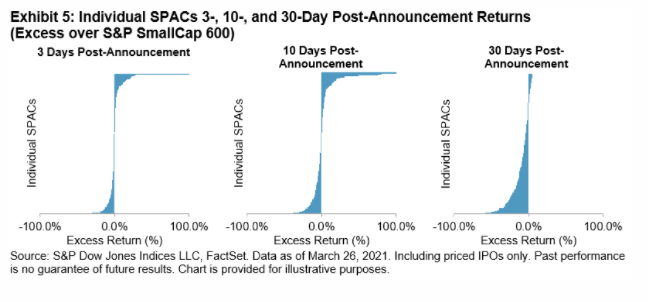

- After the deal announcement, the surplus return distribution was pushed to extremes, with giant constructive and unfavourable extra returns noticed. The imply extra return, nevertheless, was about 0. Holding SPACs 30 days post-deal announcement, generally, led to underperformance versus the S&P SmallCap 600 (see Exhibit 5).

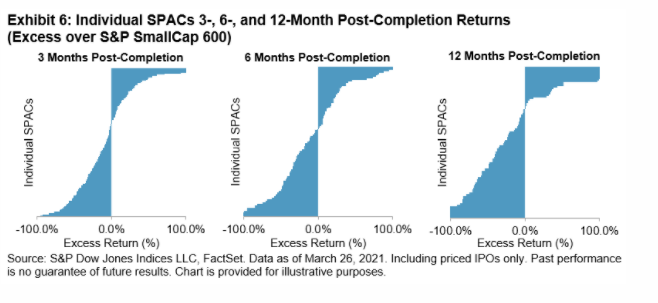

- Publish-deal completion, we observe a closely skewed distribution of extra returns, with an rising unfavourable skewness, the additional away from completion (see Exhibit 6). This statement can also be in keeping with earlier research documented that post-merger SPACs are value-destroying to buyers.2

We stay cautious in assessing post-merger efficiency as a result of most SPACs listed in 2020 and 2021 are nonetheless in search of targets. Because the variety of SPACs proliferate, how they carry out post-merger will probably be value monitoring going ahead.

Initially revealed by Indexology, 4/15/21

1 Rodrigues, U., & Stegemoller, M. (2014). What all-cash firms inform us about IPOs and acquisitions? Journal of Company Finance, 29, 111-121.

2 Lakicevic, M., & Vulanovic, M. (2013). A Story on SPACs. Managerial Finance, 39(4), 384-403. Dimitrova, L. (2017). “Perverse incentives of particular function acquisition firms, the “poor man’s personal fairness funds.” Journal of Accounting & Economics (JAE), Vol. 63, No.1, 2017. Klausner, Michael D. and Ohlrogge, Michael, A Sober Have a look at SPACs (October 28, 2020). Stanford Regulation and Economics Olin Working Paper No. 559, NYU Regulation and Economics Analysis Paper No. 20-48

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.