Q2 Funding Committee Outlook: Is the e

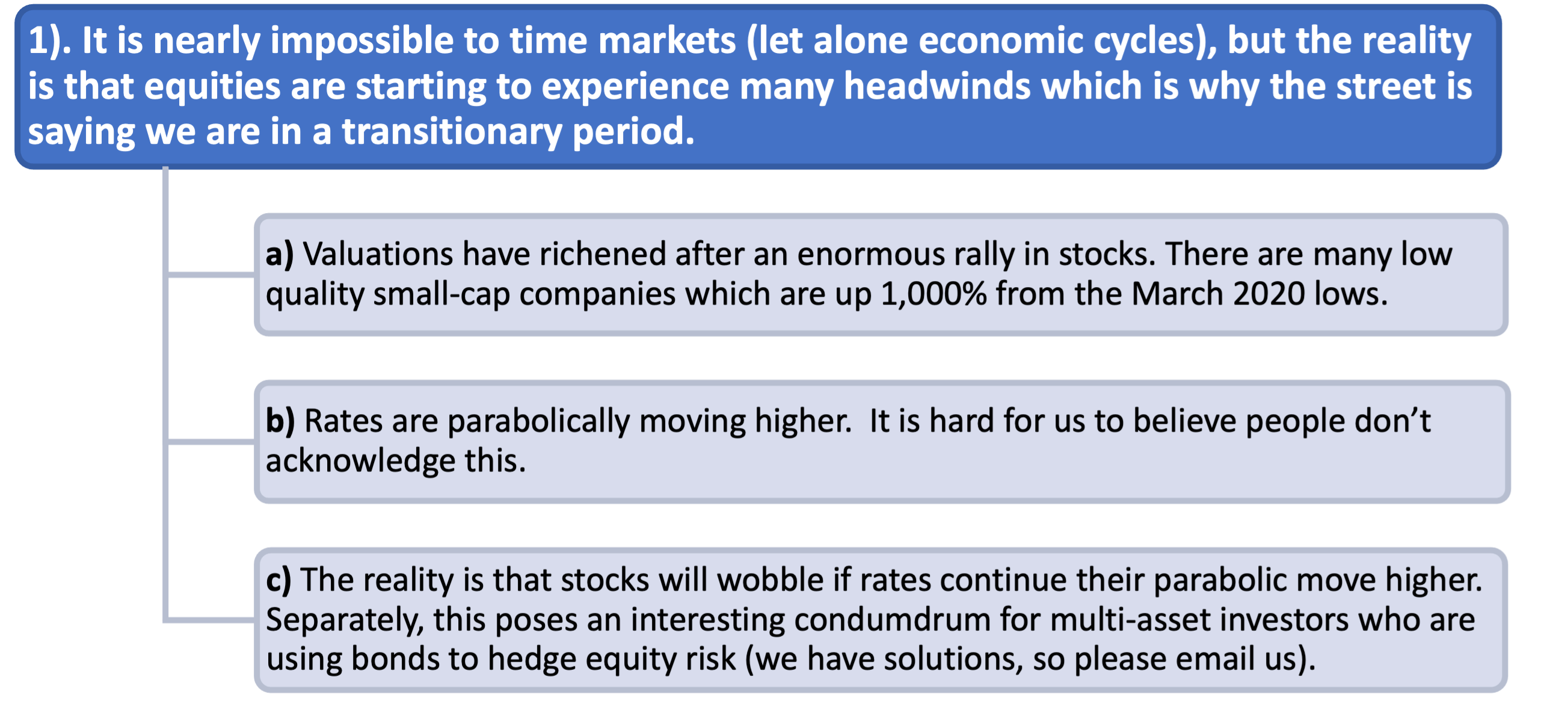

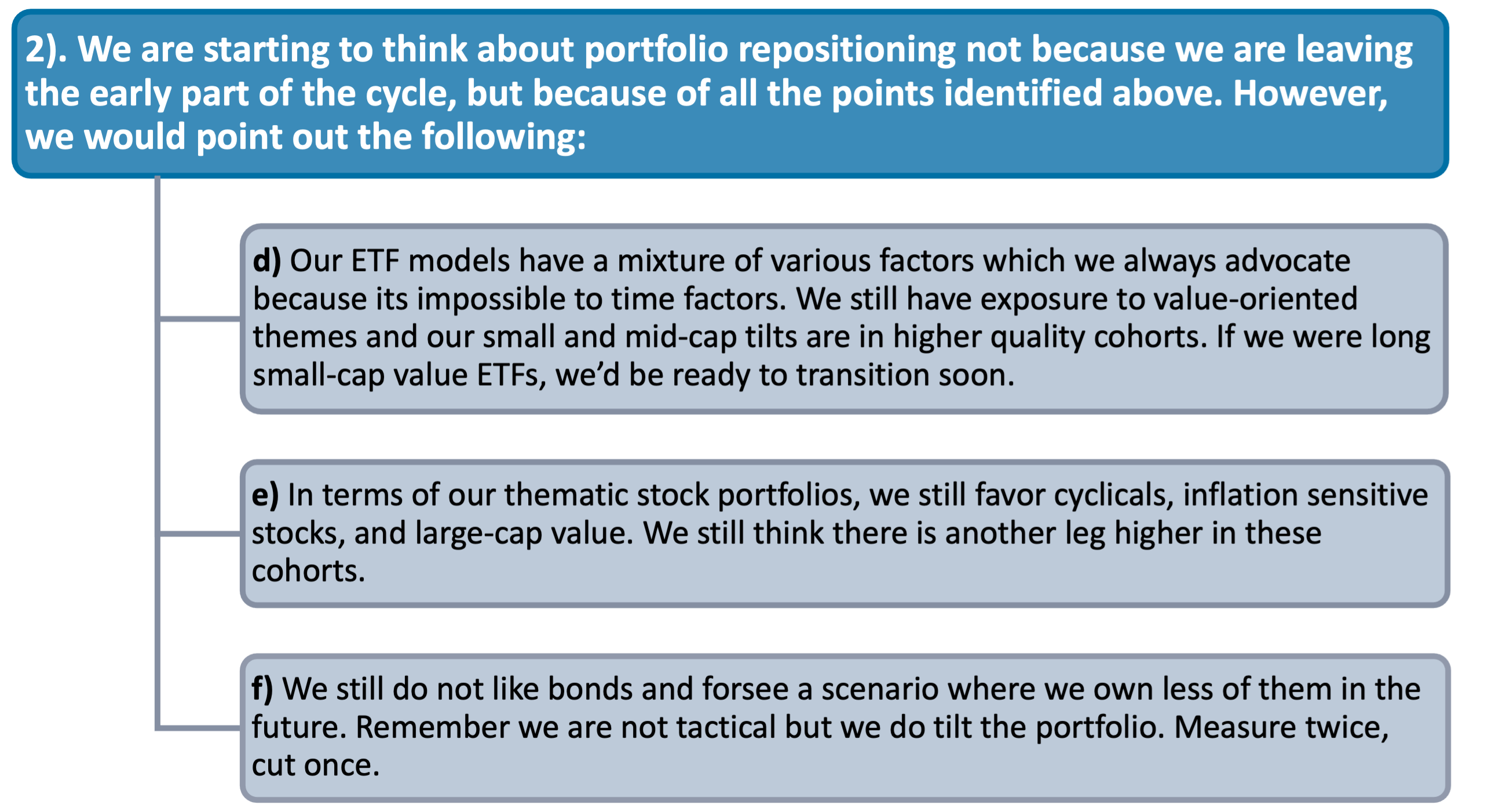

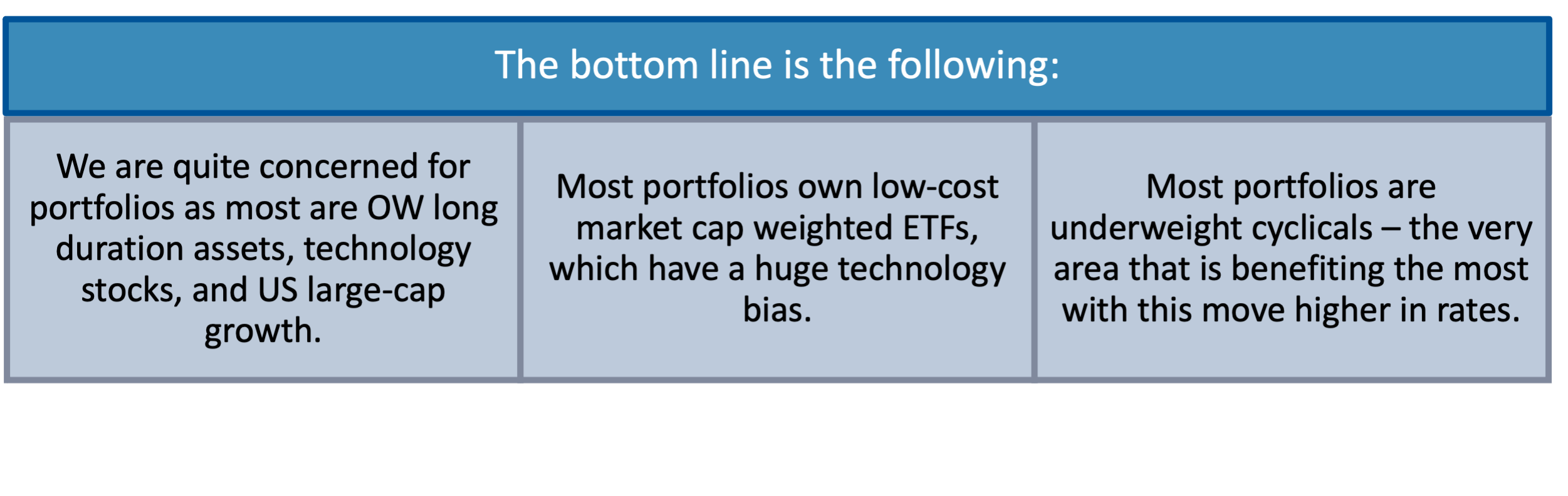

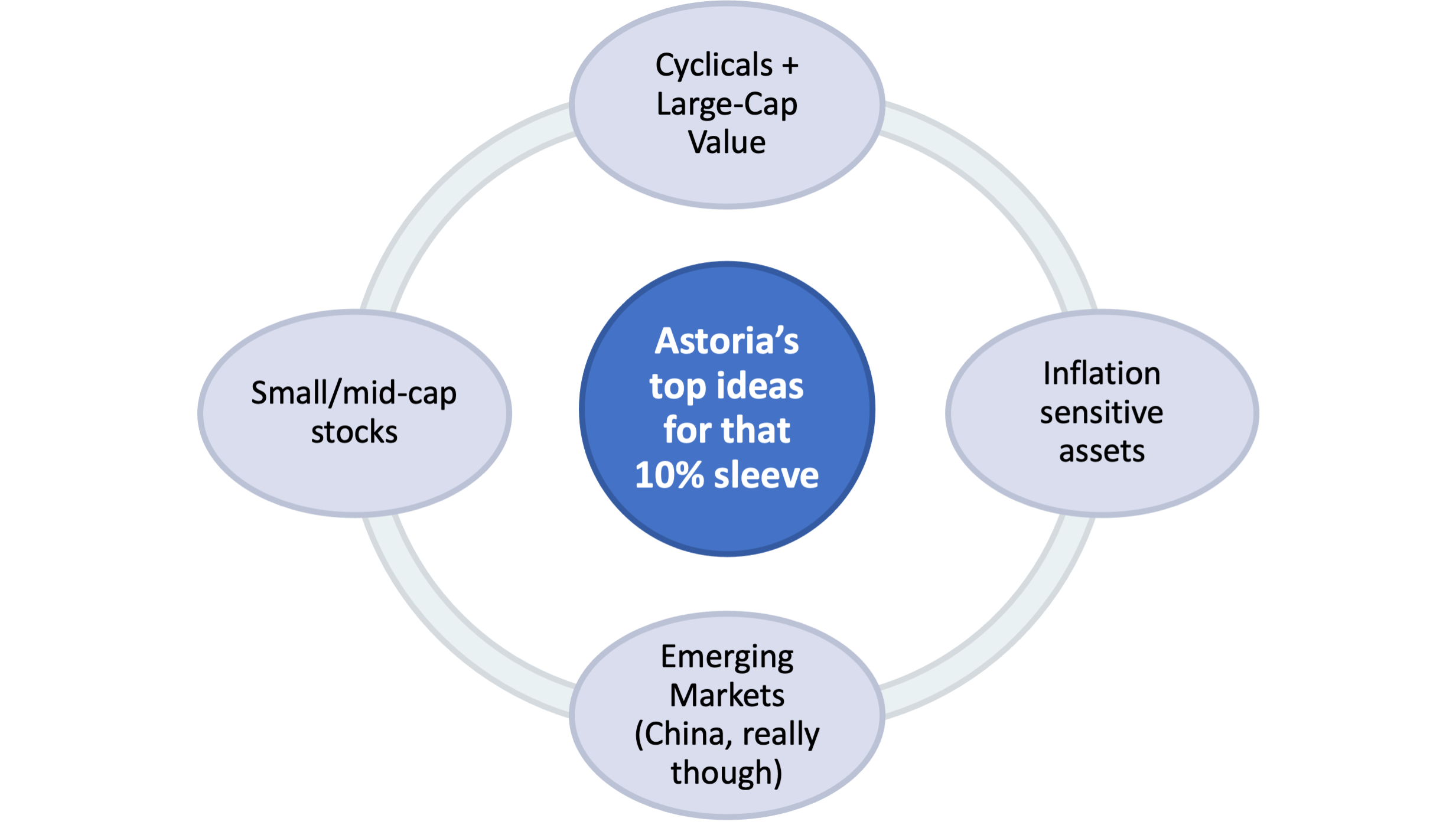

Q2 Funding Committee Outlook: Is the early cycle section over? No, however headwinds are mounting. Start to allocate to digital property as a substitute portfolio hedge. Proceed to tilt in direction of cyclicals & worth shares, fade bonds, and hedge inflation danger.

Key Takeaways for Astoria’s Q2 Funding Committee Outlook

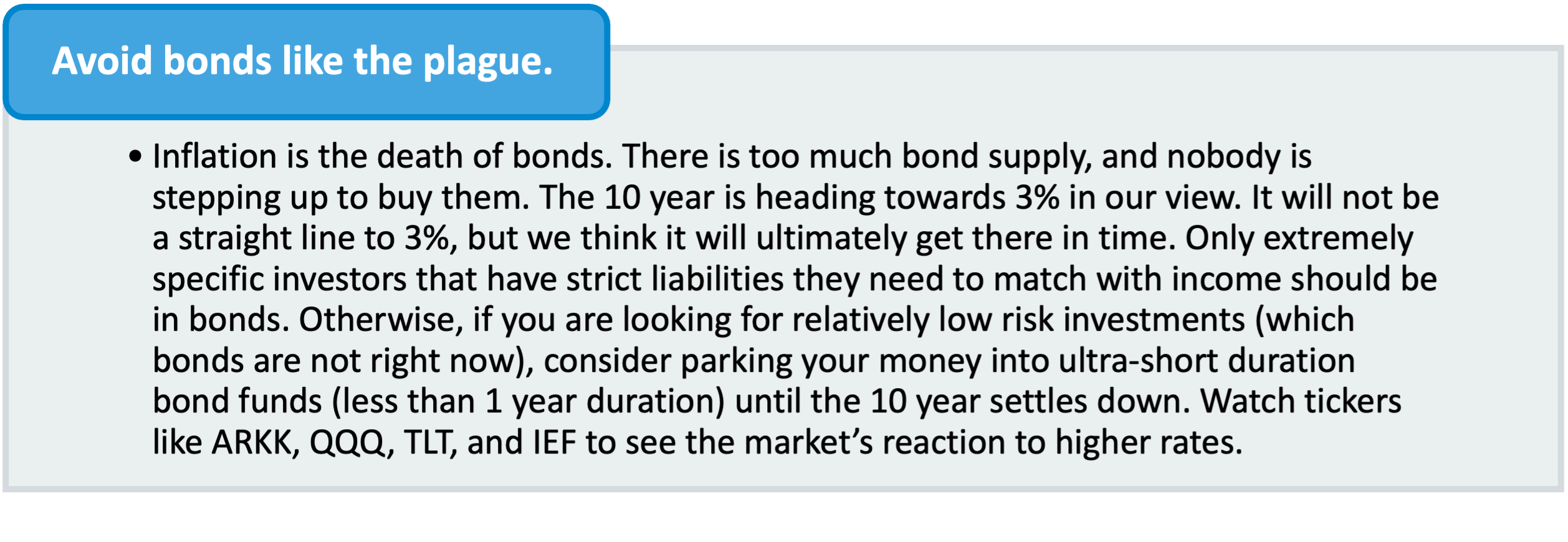

- Keep away from bonds just like the plague

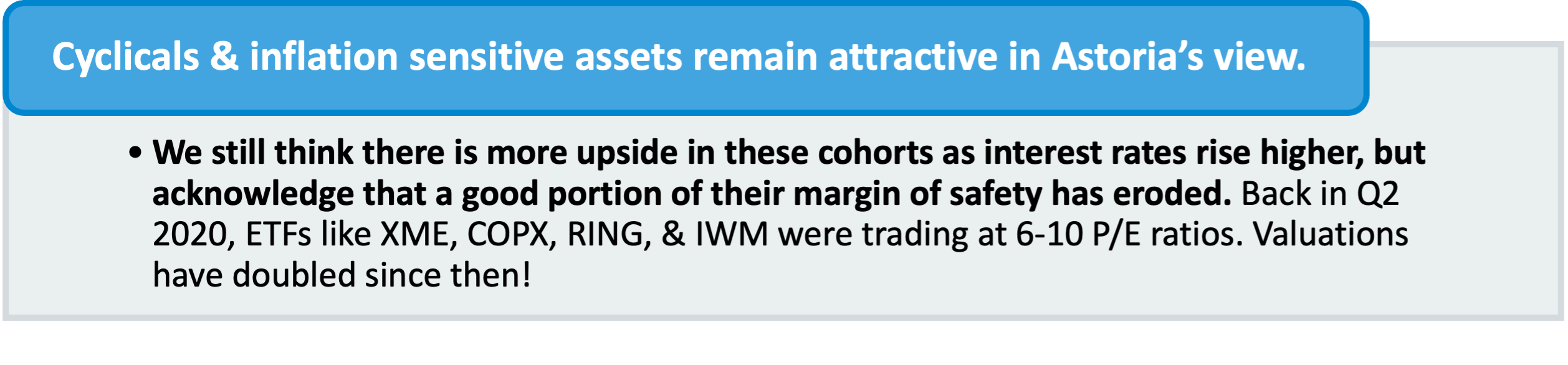

- We persist with the pro-cyclical tilt we’ve had since June 2020 however acknowledge headwinds which are beginning to seem (larger taxes, charge hikes)

- Charge hikes are on the horizon in 2022 if the financial system prospers as everybody expects

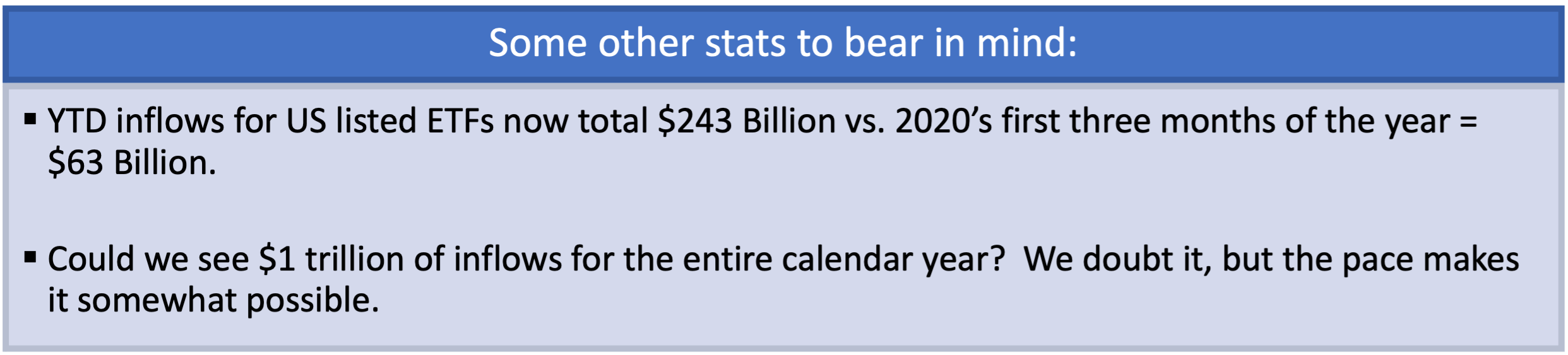

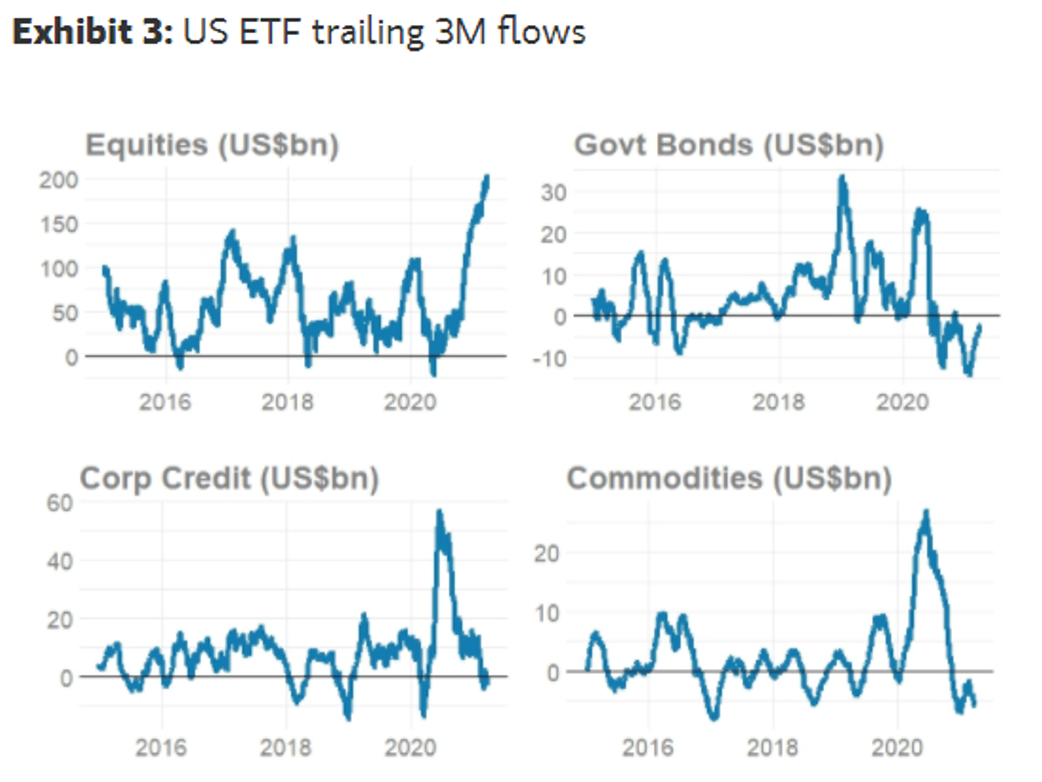

- Huge ETF flows proceed. Wow!

- The increase in digital property is barely beginning. Their volatility is kind of massive, so measurement it accordingly in your portfolio.

[wce_code id=192]

![]()

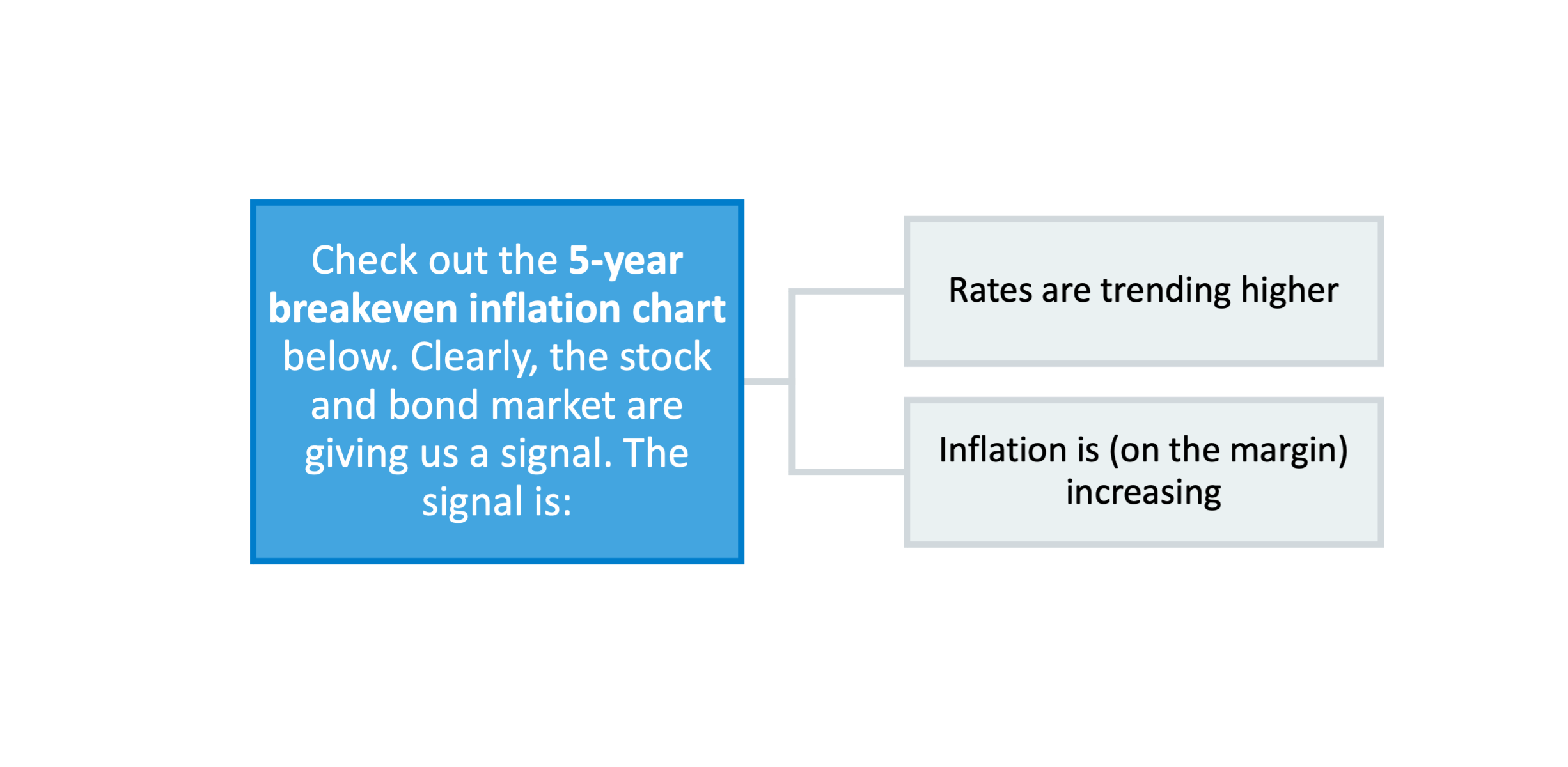

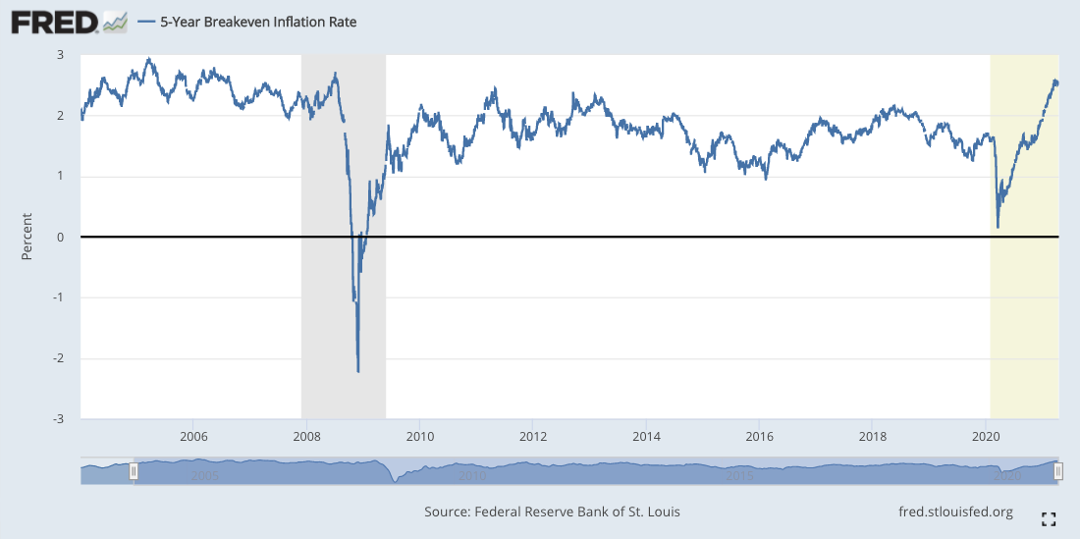

The market is beginning to worth in charge hikes…

And the yield curve continues to steepen…

![]()

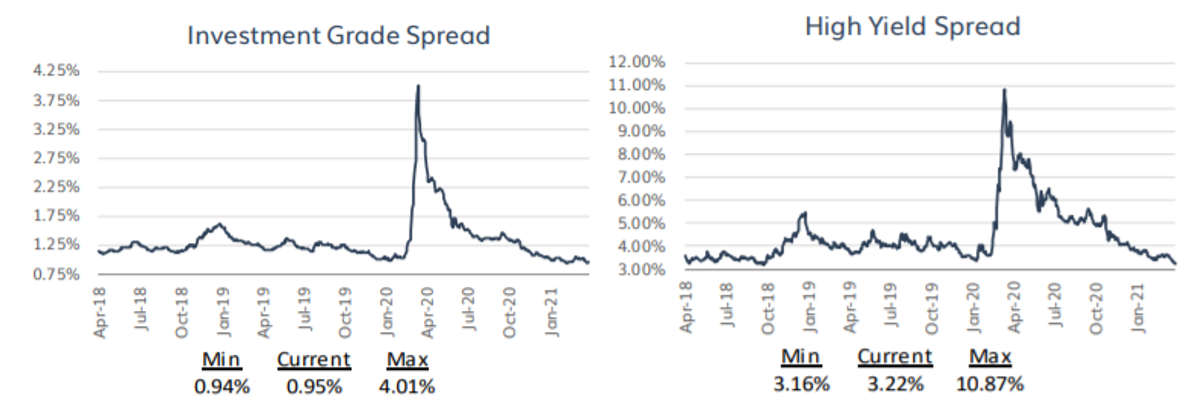

Credit score spreads are extremely tight. No bargains right here in any respect.

Supply: ETFAction.com

Over 90% of S&P 500 firms are buying and selling above their 50-DMA. That is the best studying since June of final 12 months.

Supply: ETFAction.com. Information accessed on April 19, 2021.

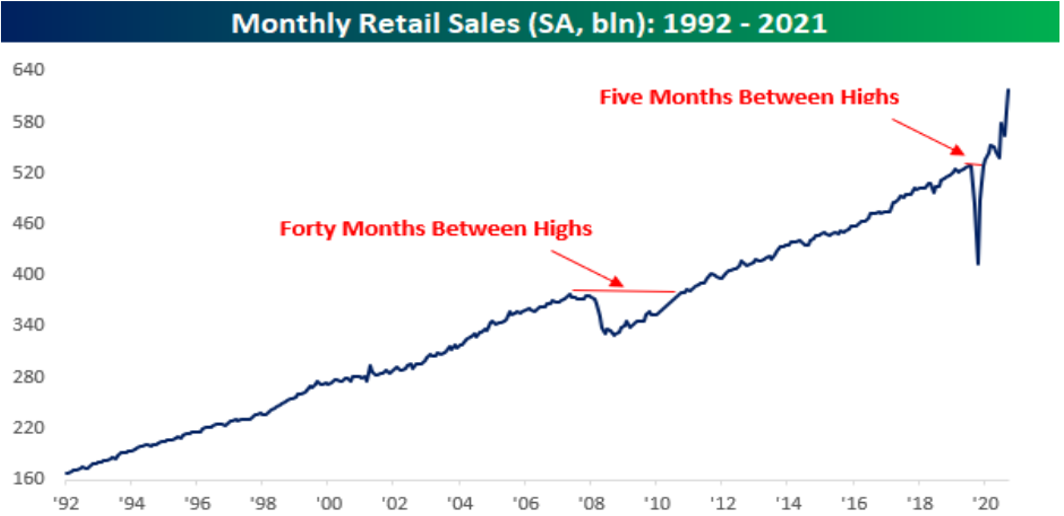

Per Bespoke Funding Group: “Not solely are complete Retail Gross sales above their pre-COVID peak, however they’re greater than 17% above that peak simply 14 months in the past.”

Supply: Bespoke Funding Group

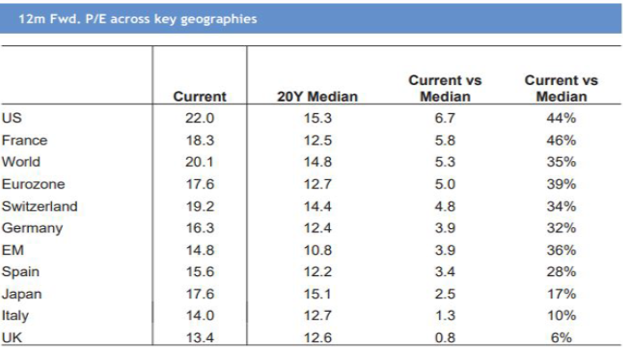

Developed Europe is the one low-cost cohort.

Supply: JP Morgan

Not even US worth shares are a discount anymore.

Not even US worth shares are a discount anymore.

Supply: ETFAction.com. Information accessed on April 15, 2021.

The ETF increase continues!

Supply: Bloomberg, Morgan Stanley Analysis. Information as of April 2, 2021.

The chart beneath was compiled by Financial institution of America Analysis. It exhibits the efficiency of deflationary property vs. these that are inflationary.

Supply: BofA World Funding Technique, World Monetary Dara, Bloomberg; Word: Inflation property: Commodities, actual property, TIPS, EAFE, US Banks, Worth and Money; Deflation property = Govt bonds, US IG, S&P 500, US Cons. Disc, Progress and US HY.

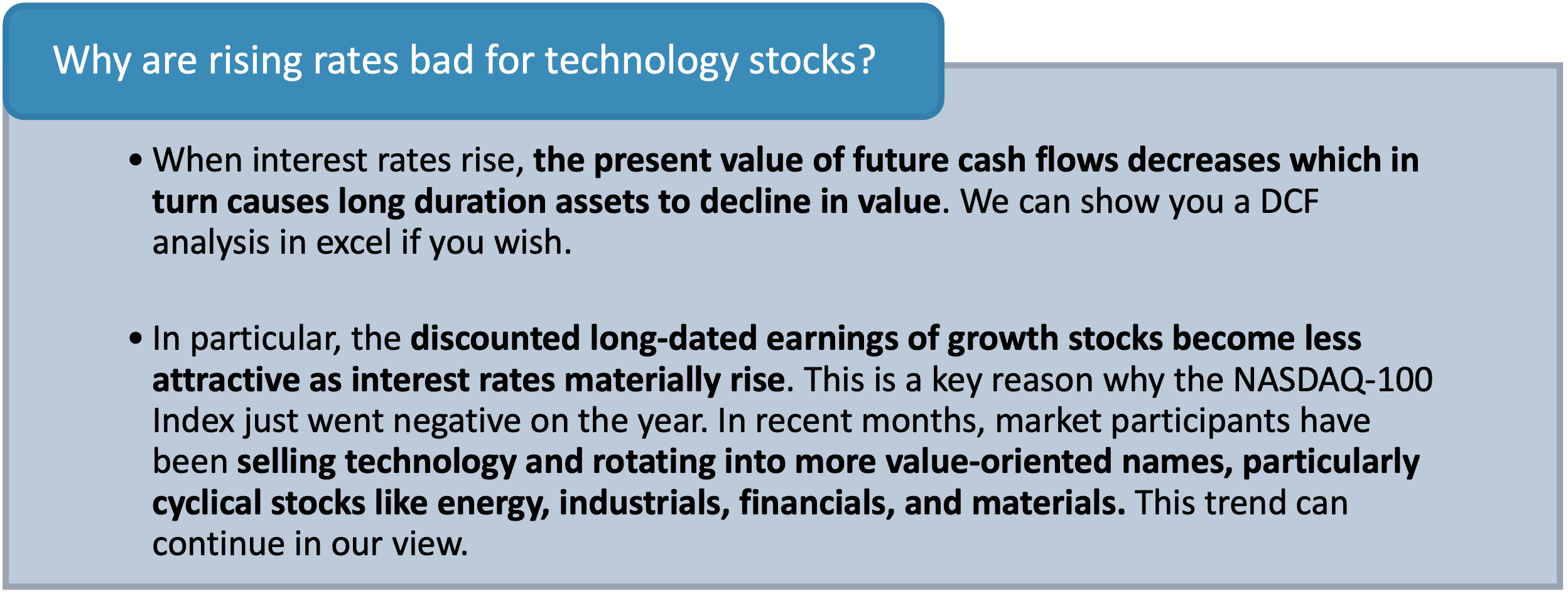

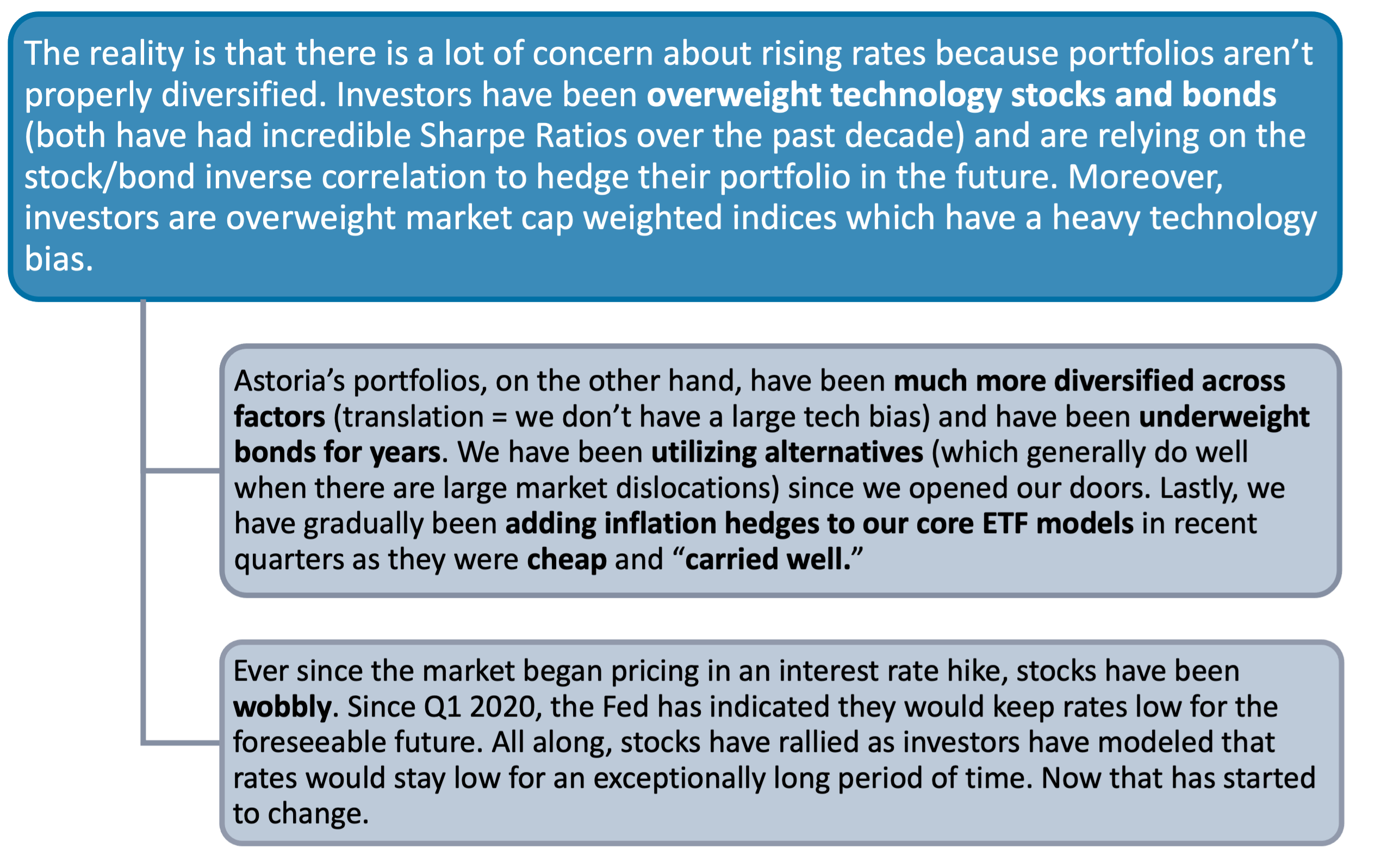

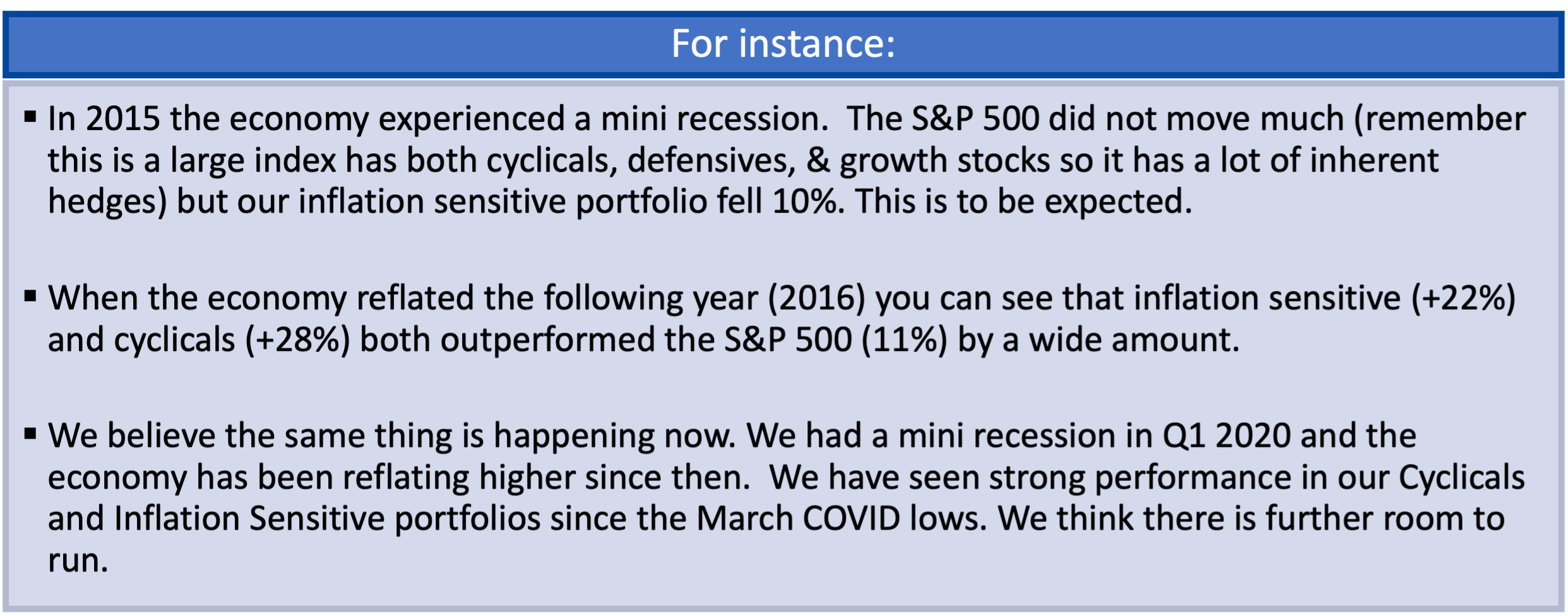

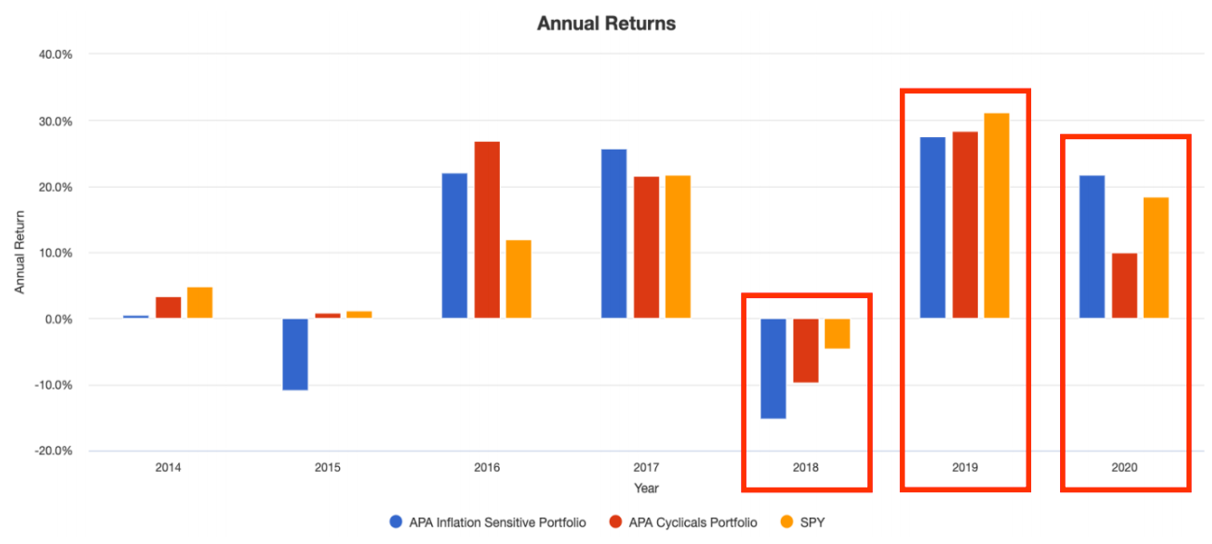

For many of the previous decade when expertise firms elevated our productiveness and China exported deflation to the Western hemisphere, inflationary pressures have been suppressed. Therefore, deflationary property outperformed inflationary property. That’s beginning to change. Right here is why:

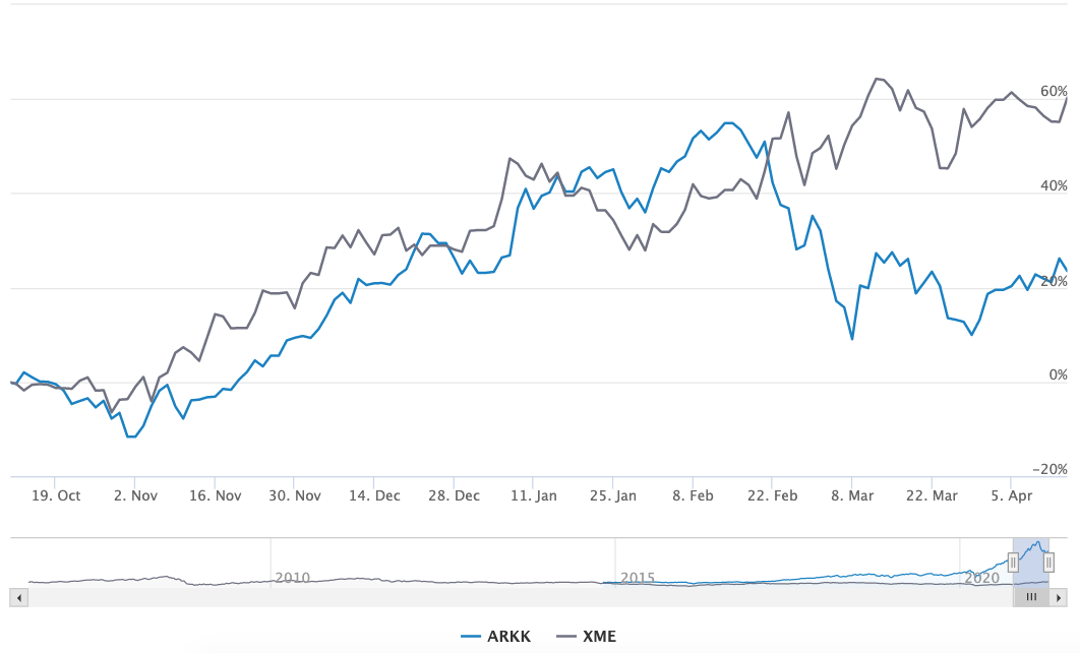

Astoria has been tweeting for a while (observe us @AstoriaAdvisors) that we thought commodity equities would have a comparatively good 12 months. We went so far as stating we thought commodity equities would outperform disruptive development shares on a danger adjusted foundation in 2021.

Supply: ETFAction.com. Information accessed on April 15, 2021.

Supply: Company Finance Institute

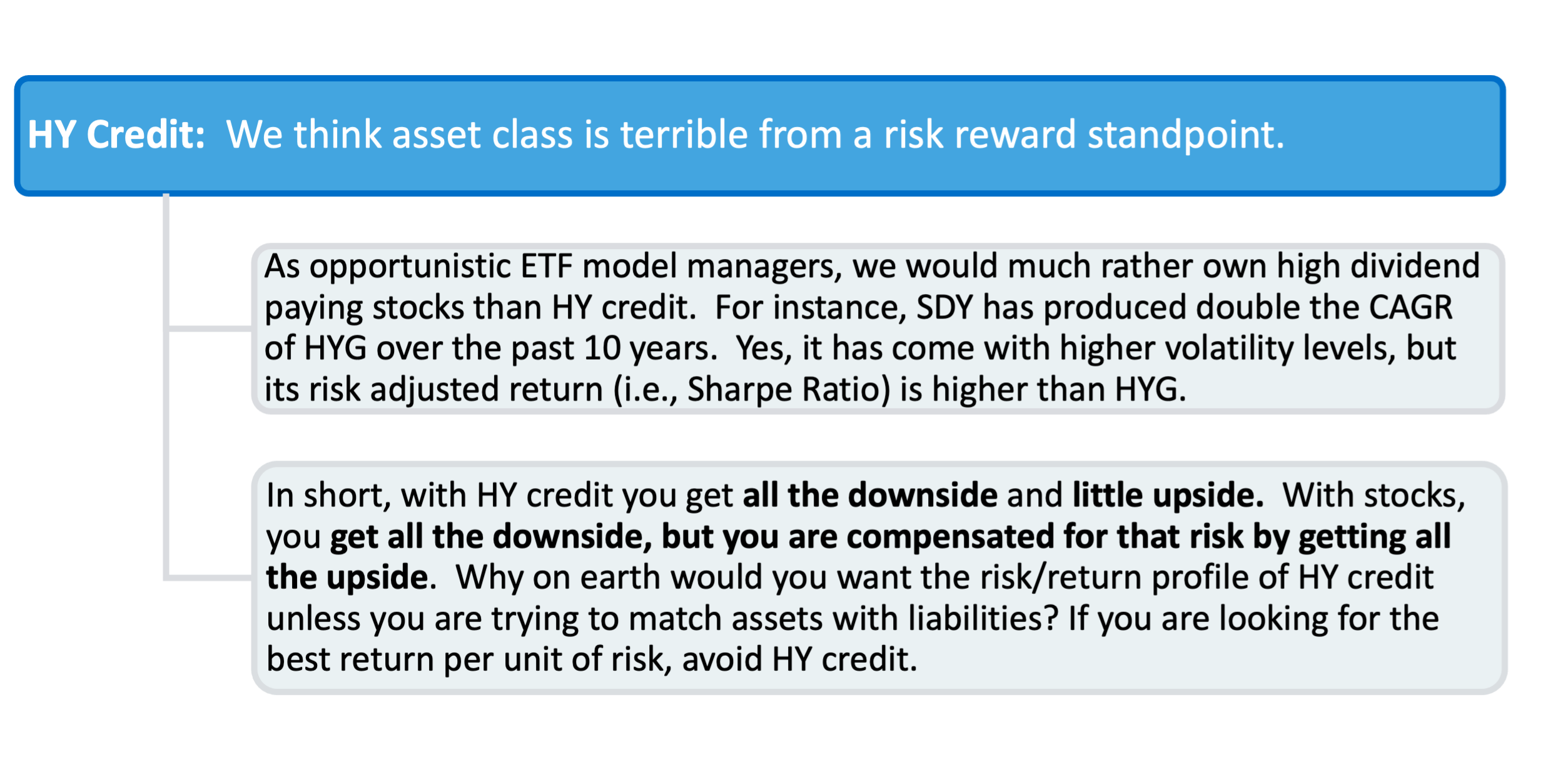

Astoria is lucky to be a contributor to main media retailers reminiscent of CNBC. Astoria’s CIO, John Davi, not too long ago appeared on CNBC to debate HY Credit score and Bitcoin. You possibly can watch the varied interviews by clicking beneath:

A part of my job as a CIO for Astoria Portfolio Advisors is to:

Supply: Federal Reserve Financial institution of St. Louis. Information accessed on April 16, 2021.

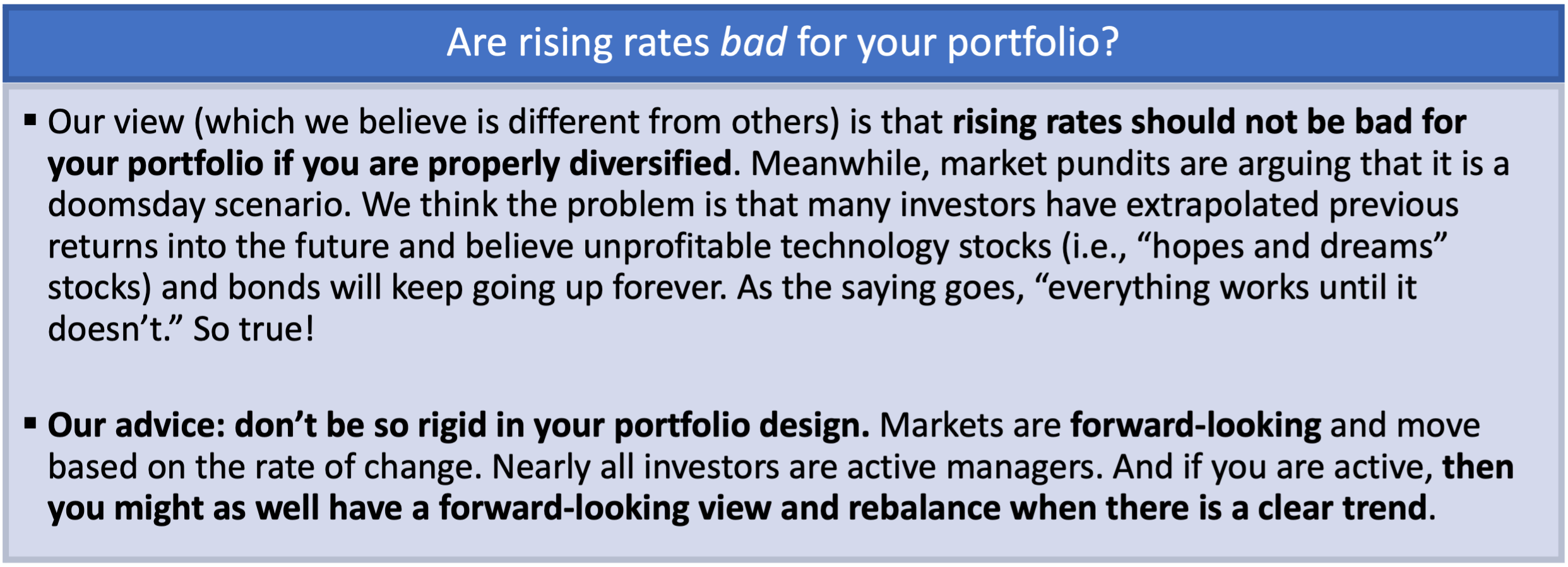

The yield on the 10-year US Treasury not too long ago touched 1.75%, its highest stage because the COVID-19 shutdown.

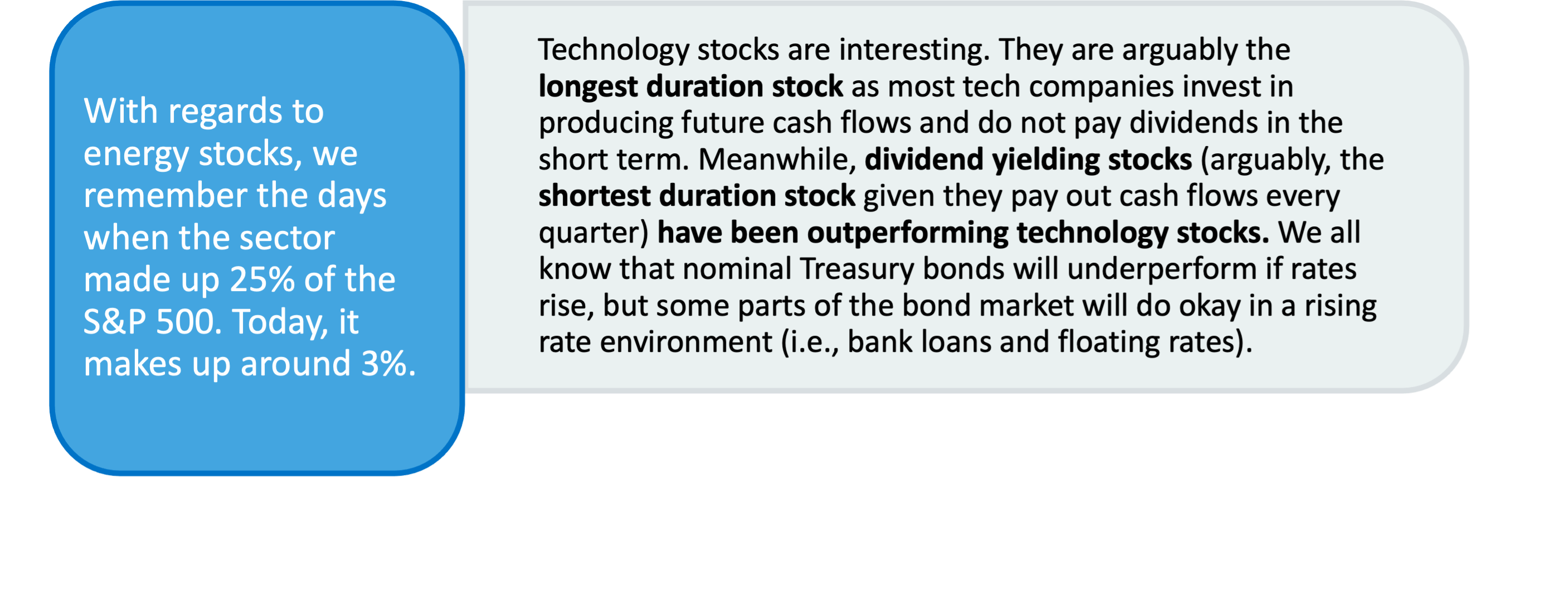

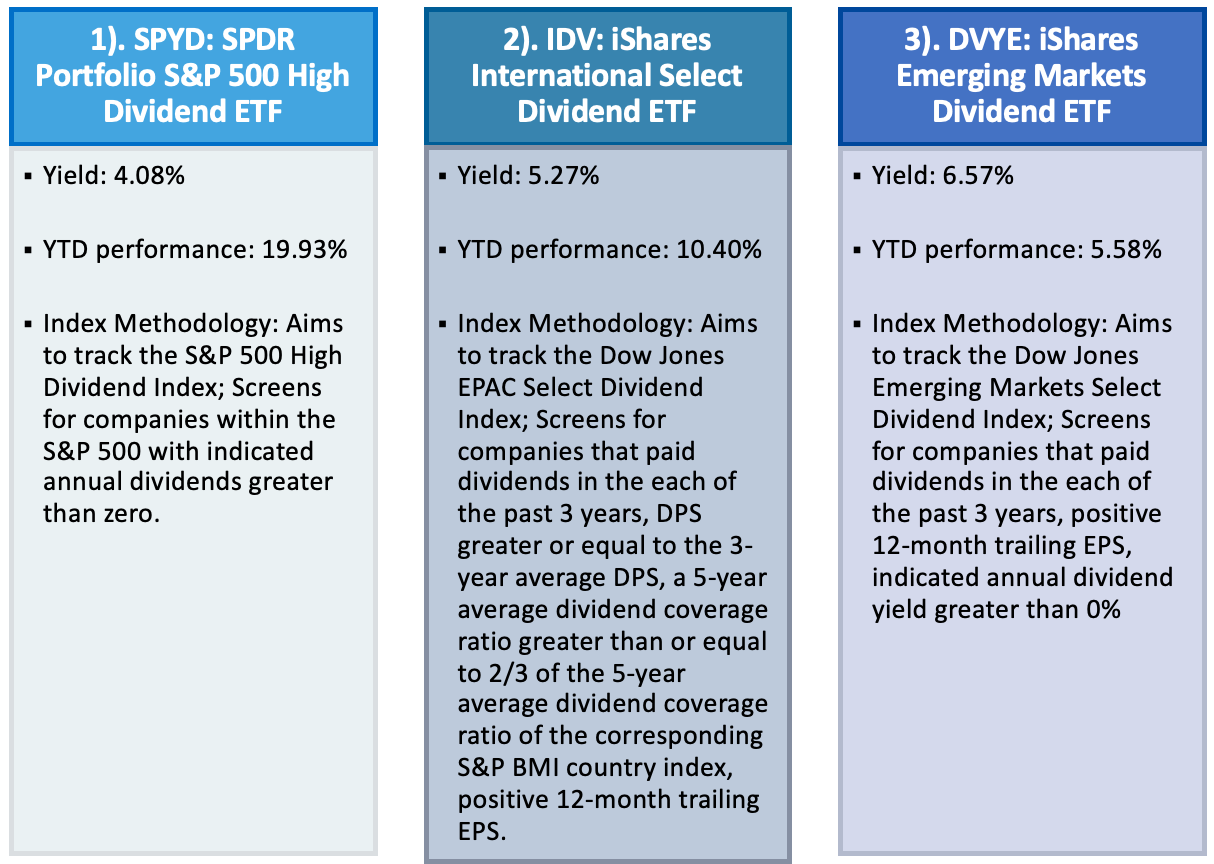

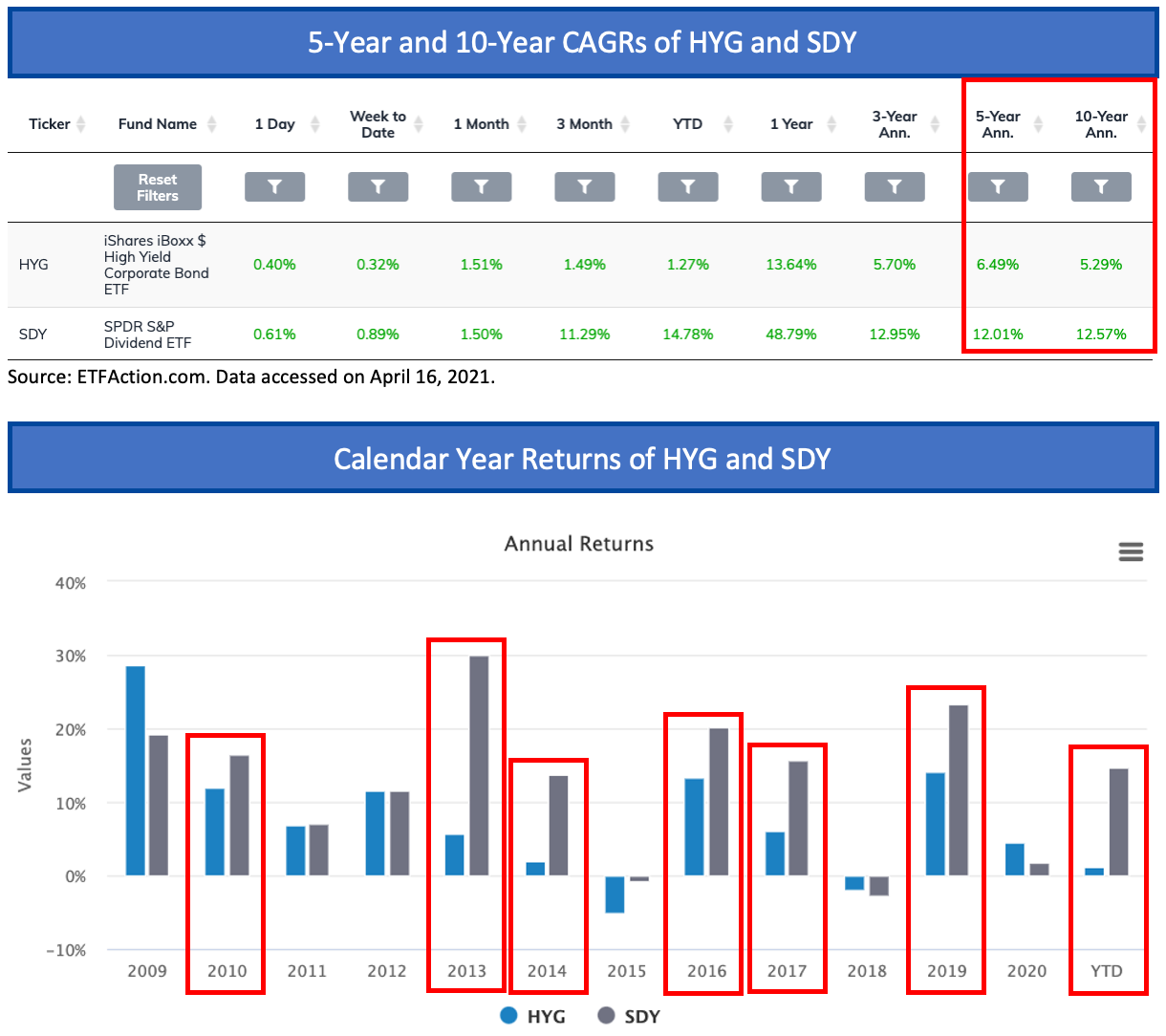

Do you know that the SPYD (SPDR S&P 500 Excessive Dividend ETF) is up 21.5% as of April 19, 2021?

Supply: ETFAction.com. Information accessed on April 9, 2021.

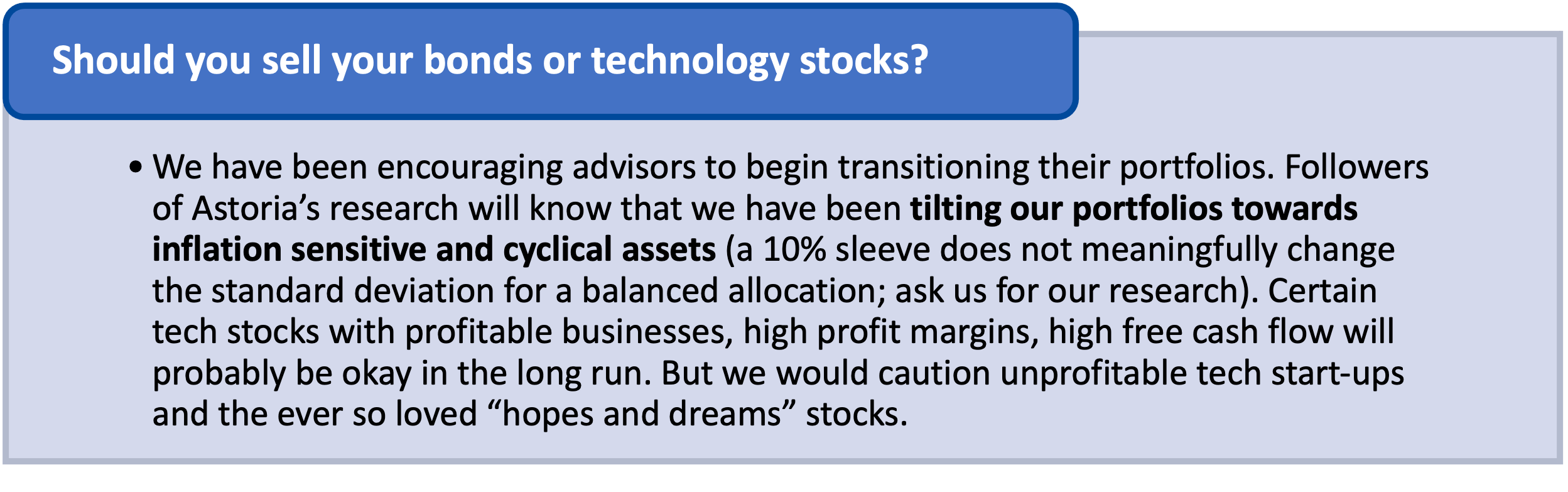

As talked about all through our report, we don’t like bonds. 10 12 months is heading in direction of 3% in our view. It is not going to be a straight line to three% however we predict it finally will get there with time. Solely extraordinarily particular buyers which have strict liabilities they should match with revenue needs to be in bonds.

Supply: ETFAction.com. Information accessed on April 16, 2021

Supply: ETFAction.com. Information accessed on April 16, 2021. Calculations primarily based on month-to-month returns between 2011-04-29 and 2021-03-31.

Supply: ETFAction.com. Information accessed on April 16, 2021.

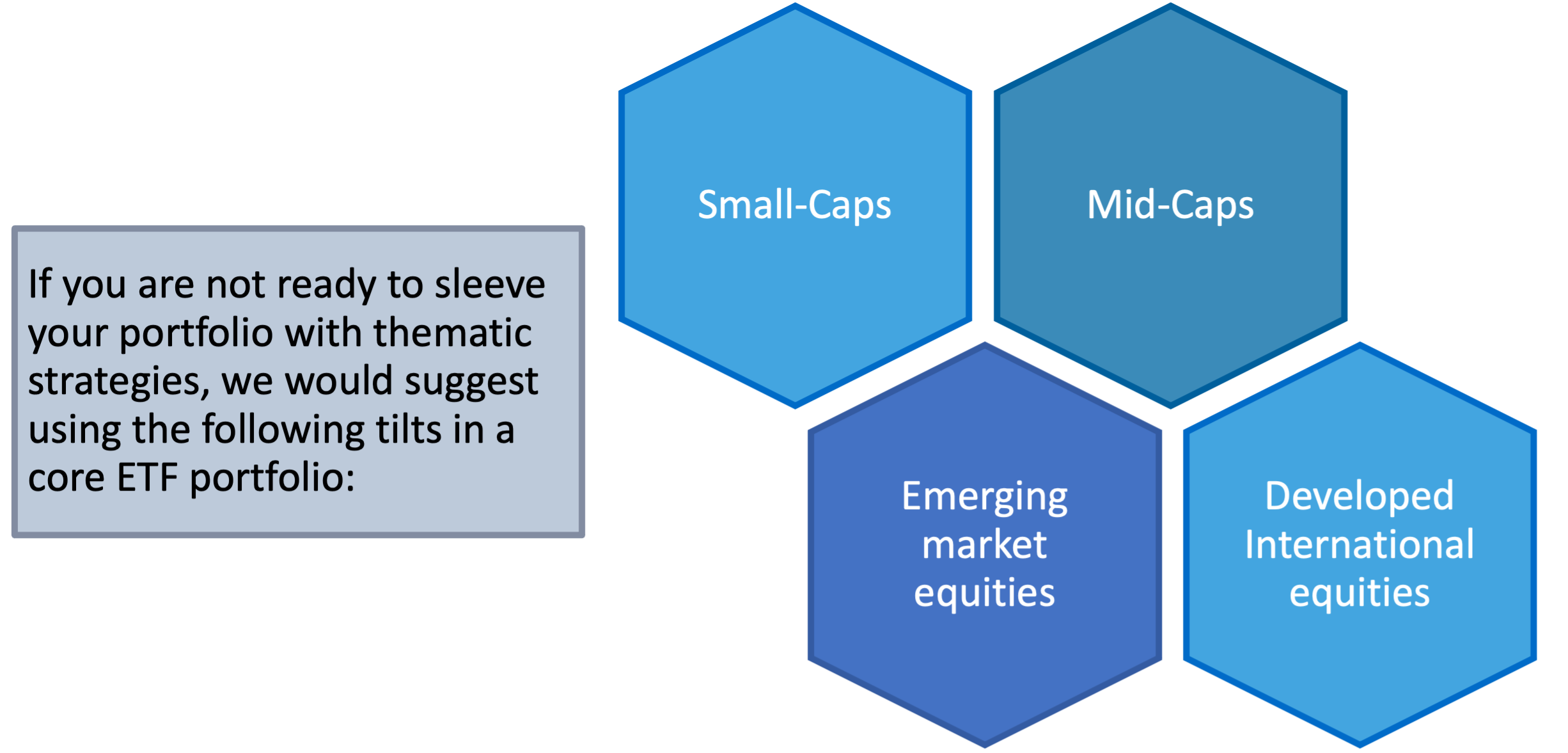

In Astoria’s view, the brief reply is sure if you’re trying to:

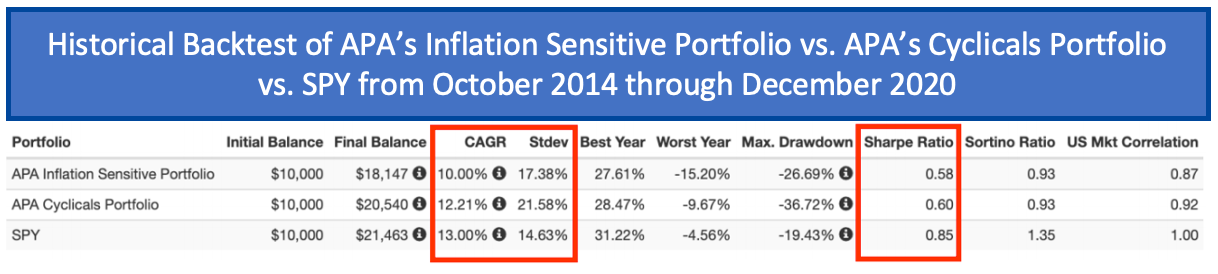

Supply: Portfolio Visualizer. Information as of December 31, 2020. Backtest makes use of constituents going again in time. Previous efficiency just isn’t indicative of future outcomes. The next tickers have been changed to additional the portfolio backtest: GLDM with GLD.

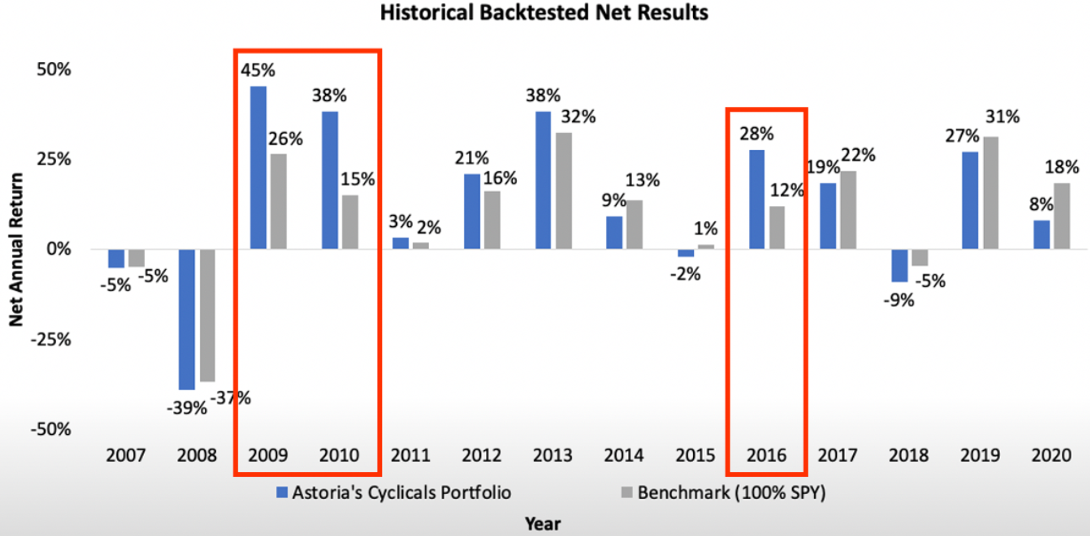

Supply: Astoria Portfolio Advisors. The historic backtest is calculated from October 31, 2007 to December 31, 2020. Internet Returns incorporate 50bps annualized administration payment. The load of every inventory was rebalanced again to equal weight on a quarterly foundation. The benchmark for the Cyclicals Portfolio is 100% SPDR® S&P 500® ETF Belief (SPY).

We went on CNBC to debate Bitcoin and the potential for an ETF. Our view on digital asset is that when sized appropriately, an allocation to them will help hedge some distinctive portfolio dangers.

Supply: Twitter @AstoriaAdvisors

Warranties & Disclaimers

Disclaimers | Not FDIC/NCUA Insured | Not a Deposit | Could Lose Worth | No Financial institution Assure | Not Insured | Previous Efficiency is Not Indicative of Future Returns

There aren’t any warranties implied. Astoria Portfolio Advisors LLC is a registered funding adviser situated in New York. Astoria Portfolio Advisors LLC might solely transact enterprise in these states by which it’s registered or qualifies for an exemption or exclusion from registration necessities. Astoria Portfolio Advisors LLC’s website online is restricted to the dissemination of basic data pertaining to its advisory providers, along with entry to further investment-related data, publications, and hyperlinks. Accordingly, the publication of Astoria Portfolio Advisors LLC’s website online on the Web shouldn’t be construed by any shopper and/or potential consumer as Astoria Portfolio Advisors LLC’s solicitation to impact, or try to impact transactions in securities, or the rendering of customized funding recommendation for compensation, over the Web. Any subsequent, direct communication by Astoria Portfolio Advisors LLC with a potential consumer shall be performed by a consultant that’s both registered or qualifies for an exemption or exclusion from registration within the state the place the possible consumer resides.

A duplicate of Astoria Portfolio Advisors LLC’s present written disclosure assertion discussing Astoria Portfolio Advisors LLC’s enterprise operations, providers, and costs is obtainable on the SEC’s funding adviser public data web site – www.adviserinfo.sec.gov or from Astoria Portfolio Advisors LLC upon written request. Astoria Portfolio Advisors LLC doesn’t make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any data ready by any unaffiliated third get together, whether or not linked to Astoria Portfolio Advisors LLC’s website online or included herein and takes no duty therefor. All such data is offered solely for comfort functions solely and all customers thereof needs to be guided accordingly. Astoria’s web site and the knowledge offered on this report is for academic functions solely and doesn’t intend to make a proposal or solicitation for the sale or buy of any particular securities, investments, or funding methods. Investments contain danger and until in any other case said, will not be assured. Be sure you first seek the advice of with a professional monetary adviser and/or tax skilled earlier than implementing any technique. Our web site and the knowledge on our web site will not be meant to offer funding, tax, or authorized recommendation.

Previous efficiency just isn’t indicative of future efficiency. Indices are usually not obtainable for direct funding, are unmanaged, and don’t incur charges or bills. This data contained herein has been ready by Astoria Portfolio Advisors LLC on the premise of publicly obtainable data, internally developed information and different third-party sources believed to be dependable. Astoria Portfolio Advisors LLC has not sought to independently confirm data obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such data. All opinions and views represent judgments as of the date of writing with out regard to the date on which the reader might obtain or entry the knowledge and are topic to alter at any time with out discover and with no obligation to replace.

As of the time this writing, Astoria held positions on behalf of consumer accounts or through our mannequin supply providers within the following ETFs: XME, COPX, RING, SPYD, DVYE, IDV, SPY, QQQ, and IVE. Word that this isn’t an exhaustive record of holdings throughout Astoria’s dynamic or strategic ETF portfolios. Any ETF holdings proven are for illustrative functions solely and are topic to alter at any time. This materials is for informational and illustrative functions solely and is meant solely for the knowledge of these to whom it’s distributed by Astoria Portfolio Advisors LLC. No a part of this materials could also be reproduced or retransmitted in any method with out the prior written permission of Astoria Portfolio Advisors LLC.

Investing entails dangers, together with potential loss or some or the entire investor’s principal. The funding views and market opinions/analyses expressed herein might not mirror these of Astoria Portfolio Advisors LLC as a complete and totally different views could also be expressed primarily based on totally different funding types, targets, views or philosophies. To the extent that these supplies comprise statements concerning the future, such statements are ahead wanting and topic to plenty of dangers and uncertainties. Any third-party web sites offered on www.astoriaadvisors.com or on this report are strictly for informational functions and for comfort. These third-party web sites are publicly obtainable and don’t belong to Astoria Portfolio Advisors LLC. We don’t administer the content material or management it. We can’t be held responsible for the accuracy, time delicate nature, or viability of any data proven on these websites. The fabric in these hyperlinks will not be meant to be relied upon as a forecast or funding recommendation by Astoria Portfolio Advisors LLC, and doesn’t represent a advice, supply, or solicitation for any safety or any funding technique. The looks of such third-party materials on our web site doesn’t indicate our endorsement of the third-party web site. We’re not liable for your use of the linked web site or its content material. As soon as you allow Astoria Portfolio Advisors LLC’s web site, you may be topic to the phrases of use and privateness insurance policies of the third-party web site.

Astoria Portfolio Advisors is a registered funding adviser. Info offered herein is for academic functions solely and doesn’t intend to make a proposal or solicitation for the sale or buy of any particular securities, investments, or funding methods. Investments contain danger and until in any other case said, will not be assured. Readers of the knowledge contained on this Efficiency Abstract, needs to be conscious that any motion taken by the viewer/reader primarily based on this data is taken at their very own danger. This data doesn’t handle particular person conditions and shouldn’t be construed or considered as any typed of particular person or group advice. The mannequin supply efficiency proven represents solely the outcomes of Astoria Portfolio Advisors mannequin portfolios for the related time interval and don’t symbolize the outcomes of precise buying and selling of investor property until in any other case indicated. Mannequin portfolio efficiency is the results of the appliance of the Astoria Portfolio Advisors proprietary funding course of. Mannequin efficiency has inherent limitations. The outcomes are theoretical and don’t mirror any investor’s precise expertise with proudly owning, buying and selling or managing an precise funding account. Thus, the efficiency proven doesn’t mirror the impression that materials financial and market elements had or may need had on choice making if precise investor cash had been managed.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.