By Stephen McBride

By Stephen McBride

Think about handing half one million bucks to a 19-year previous faculty child. That’s what Silicon Valley billionaire Peter Thiel did in the summertime of 2004.

Thiel backed Mark Zuckerberg when he was simply an conceited child who wore flip-flops to enterprise conferences. “Zuck” based thefacebook.com earlier that 12 months, and he was begging for money to develop the dorm-room startup.

Thiel reduce Zuck a examine for $500,000. Inside 5 years, it grew 2,000 fold to $1 billion as thefacebook.com grew to become Fb (FB).

Peter Thiel constructed his fortune on one enterprise secret. Thiel based cash disruptor PayPal (PYPL) within the ‘90s. And he was an early investor in world-changers like Airbnb, SpaceX, and Palantir. His greatest “wins” all tie again to a Wall Avenue Journal article he wrote titled: Competitors Is for Losers.

Within the Article, Thiel Factors Out Many Of The Biggest Firms Share One Distinctive Trait

They’re thus far forward of the sport, they don’t have any rivals. PayPal is the right instance. Shopping for stuff on-line via websites like eBay was “sketchy” within the early days. You often needed to pay by examine, which might take as much as 10 days to clear.

Patrons needed to blindly belief sellers to ship the product. Sellers needed to belief the examine to not bounce after they handed over the products. PayPal solved this huge downside by linking e-mail and cash, inventing the digital funds trade. And it achieved this breakthrough years earlier than Apple Pay, Google Pay, or Sq. bought concerned in digital finance.

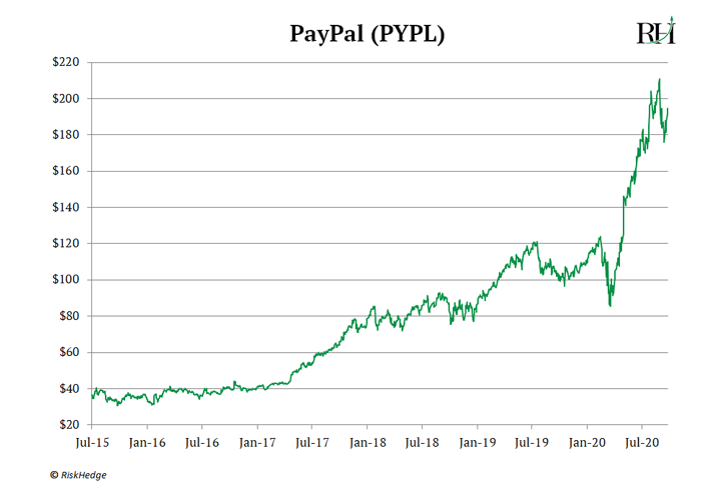

PayPal is now 5 instances extra helpful than each US airline mixed. Airways are a giant, necessary trade. But, regardless of a long time of rising passenger numbers, US airways have misplaced extra money than they’ve revamped the previous 30 years.

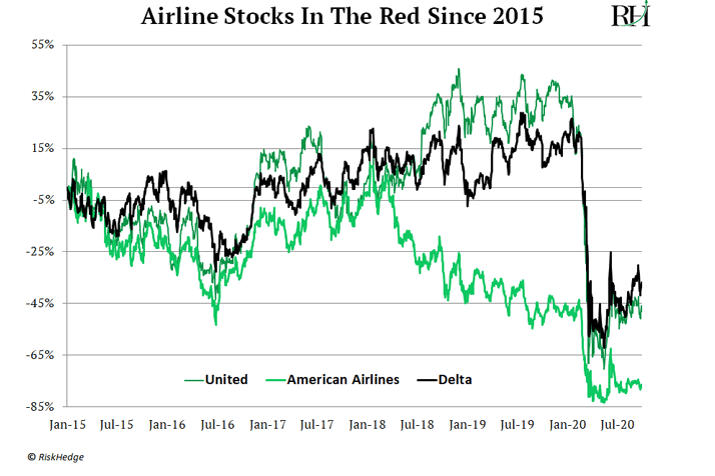

What’s unsuitable with airline CEOs? Are they horrible businessmen? Air journey is an previous trade with plenty of ferocious competitors. There’s not a lot distinction between flying American Airways, Delta, or United. In order that they’re at all times making an attempt to undercut one another on airfares. Airline shares have been a complete dumpster hearth for buyers:

Examine this with PayPal, which carved out the fully new “digital funds” trade for itself. Its inventory has shot up 450% since 2015:

You Need To Purchase Firms Creating New Industries

Thiel constructed his fortune by founding the first digital funds agency. He cemented his legacy betting on the first profitable social community. In the present day, dozens of corporations are creating new industries within the inventory market.

I’m positive you’ve heard of “linked health” sensation Peloton (PTON). Its inventory has shot up 280% because it debuted final 12 months:

Peloton sells internet-connected stationary bikes with a 22-inch touchscreen hooked up to them. This permits customers to participate in live-streamed train courses—from their lounge. The bike prices roughly $2,000. And people pay $40 a month, in perpetuity, to entry the net courses with a digital coach.

You is perhaps asking, “What’s new about Peloton? Getting sweaty on a stationary bike is an previous concept.” Many of us suppose it’s a health “fad” that’ll die off fast.

They’re unsuitable. Peloton created a wholly NEW method for America to work out. Peloton’s indoor bike comes with a large display screen, which lets you observe together with an actual coach. There’s additionally a leaderboard on-screen, so you possibly can compete towards fellow “riders” in real-time.

Peloton sells internet-connected stationary bikes with a 22-inch touchscreen hooked up to them. This permits customers to participate in live-streamed train courses—from their lounge. The bike prices roughly $2,000. And people pay $40 a month, in perpetuity, to entry the net courses with a digital coach.

You is perhaps asking, “What’s new about Peloton? Getting sweaty on a stationary bike is an previous concept.” Many of us suppose it’s a health “fad” that’ll die off fast.

They’re unsuitable. Peloton created a wholly NEW method for America to work out. Peloton’s indoor bike comes with a large display screen, which lets you observe together with an actual coach. There’s additionally a leaderboard on-screen, so you possibly can compete towards fellow “riders” in real-time.

This distinctive combo unlocked one thing fully new: People can take a top-notch “spinning” class with different individuals… however from the consolation of their lounge. In brief, this distinctive mix minted a complete new trade, and it has made buyers massive beneficial properties in a matter of months.

“However Stephen, Isn’t Coronavirus The Cause Peloton Surged?”

It’s true coronavirus has moved all the pieces on-line and the lockdowns have helped Peloton promote extra bikes. However the actual key to its 277% achieve in simply 12 months is linked health is NEW. And a “new trade” means little or no competitors.

This concept of racing somebody half a world away on a stationary bike wasn’t a “factor.” There weren’t dozens of “linked health” corporations making an attempt to outlive on penny margins like airways.

As an alternative, Peloton’s resolution was completely new and distinctive. This newness gave it a blue sky of alternative to develop quickly, with no rivals. Peloton’s gross sales have jumped 983% over the previous three years… And it now has over three million paying subscribers!

And Peloton is way from the one firm carving out a brand new trade within the inventory market at present. You’ve bought telehealth, edge computing, artificial biology, genomics, area shares, and dozens of different new sectors being born proper now.

And extra importantly, dozens of recent and thrilling “hypergrowth” shares can be found to play this new phenomenon. We’ve by no means seen something just like the variety of new enterprise fashions being born at present. And it’s opened up what might be the most important money-making alternative I’ve seen in my complete profession. Now’s the time to take benefit.

The Nice Disruptors: three Breakthrough Shares Set to Double Your Cash”

Get my newest report the place I reveal my three favourite shares that can hand you 100% beneficial properties as they disrupt complete industries. Get your free copy right here.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.