By Frank Holmes, U.S. Funds America, and the world, acquire

By Frank Holmes, U.S. Funds

America, and the world, acquired one other big shot of hope this week.

Biotech agency Moderna introduced right this moment that its coronavirus vaccine is 94.5% efficient at stopping COVID-19. This information comes after the $210 billion drugmaker Pfizer mentioned final Monday that its vaccine is 90% efficient.

Right this moment on the open, journey and hospitality shares led a broad-based rally, with Carnival, Norwegian Cruise Strains and United Airways buying and selling close to the highest. In the meantime, stay-at-home shares like Clorox, Domino’s Pizza and Amazon.com bought off.

The story was the identical final Monday, following Pfizer’s announcement. The most effective performing S&P 500 inventory for the day was Carnival, up almost 40%. Hawaiian Airways cruised the best amongst airline shares, up an unbelievable 50%. Solely three airline shares —Singapore Airways, Air Transport Providers and Cargojet—had been down for the day.

Goldman Sachs was fast to regulate its market forecast for the subsequent 12 months. The funding financial institution sees the S&P hitting 4300 by the tip of 2021, which is a rise of 20% from Friday’s shut.

Buyers’ enthusiasm was tempered final week by the belief that Pfizer’s vaccine, though efficient, has a few critical drawbacks which will forestall it from having a large attain globally. One, the vaccine requires two doses a month aside, and it’s affordable to anticipate that a big proportion of people that confirmed up for the primary shot is not going to return for the second shot, for varied causes.

And two, the vaccine should be saved at an extremely frigid -94° Fahrenheit. That’s colder than the typical temperature noticed at increased elevations in Antarctica’s icy inside. Most international locations on earth, together with some developed international locations, merely would not have the suitable chilly storage, to not point out the provision chain infrastructure, to move and deploy the vaccine to everybody who wants it.

In response to CLSA’s estimate, as a lot as 50% to 60% of the inhabitants must be inoculated to cease the pandemic, although some estimates are even increased at between 70% to 75%. “Reaching this stage of immunization is not going to be straightforward,” the funding group says.

By comparability, Moderna’s vaccine, whereas it additionally requires two doses, stays secure at 36° to 46°F, “the temperature of normal dwelling or medical fridge, for 30 days” in response to a press launch.

LVMH’s Arnault Now Solely Fifth Particular person on Earth to Be Price Extra Than $100 Billion

It wasn’t simply cruise traces and airways that jumped on the Pfizer information final week. Luxurious shares like Burberry, Kering and Christian Dior all made robust features on the hope that worldwide vacationers—significantly big-spending Chinese language vacationers—will quickly return to airports and make the most of duty-free procuring between flights.

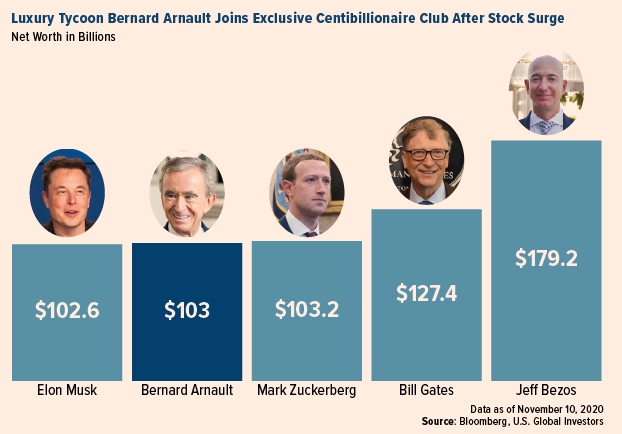

Final Monday’s inventory surge was sufficient to push French luxurious titan Bernard Arnault’s wealth above $100 billion for the primary time. He joins solely 4 different individuals—Jeff Bezos, Invoice Gates, Mark Zuckerberg and Elon Musk—within the extremely unique centibillionaire membership.

Arnault’s LVMH—the world’s largest luxurious items firm, with manufacturers starting from Louis Vuitton to Sephora to Tag Heur—has proven nice resilience throughout the pandemic. Third-quarter income, the truth is, elevated 12% in comparison with the identical interval final 12 months.

The identical goes for opponents Hermes and Kering, each of which delivered forecast-beating gross sales within the third quarter, thanks largely to Asian customers.

1.2 Billion Chinese language in Center Class by 2027

Retailers are proper to court docket Asian customers, significantly Chinese language customers. For proof, look no additional than Alibaba’s monster Singles Day gross sales occasion final week. Within the first 30 minutes on November 11, the enormous Chinese language retailers did a jaw-dropping $56.Three billion in gross sales, greater than final 12 months’s complete haul of $38 billion over a 24-hour interval.

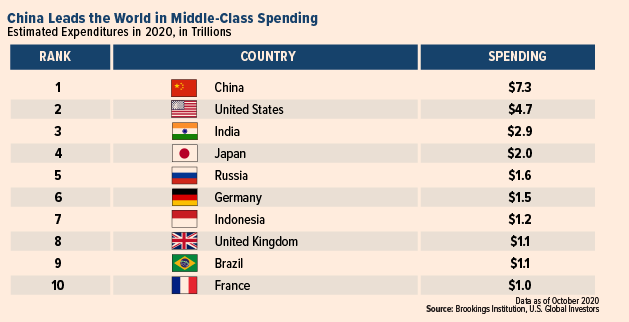

Certainly, China has the world’s largest share of individuals on-line, and that share is accelerating. As of October, the nation represented 40% of worldwide ecommerce transactions, in response to a report by the Brookings Establishment.

Brookings’ report additionally supplies startling new knowledge on the scale of China’s (rising) center class, one thing I’ve written about earlier than. Yearly, the nation has been including a median of 60 million individuals to its center class—outlined as those that spend between $11 to $110 per individual per day—and by 2027, Brookings believes the full measurement of China’s center class may prime 1.2 billion individuals. That’s roughly 3.5 occasions as many individuals residing within the U.S. proper now.

With the mixed spending energy of $41 trillion, the Chinese language center class is on monitor to spend an astonishing $7.Three trillion this 12 months alone, Brookings says. To assist put that determine in perspective, 7.Three trillion seconds is the equal of greater than 230,000 years. That way back is round when scientists imagine Neanderthals appeared in Eurasia.

Foot Site visitors Information Proves House Enchancment Growth

As I’ve mentioned earlier than, I’m pleasantly shocked with how effectively some luxurious retailers have executed throughout the pandemic. Again in July, I mentioned how gross sales at dwelling enchancment shops had been rising as high-net price people (HNWIs) had been spending their lockdowns on do-it-yourself (DIY) tasks, renovating their houses, constructing again patios and putting in swimming swimming pools.

Final week we obtained much more proof of dwelling enchancment’s retail dominance. Placer.ai is a startup that gives retailers with foot visitors analytics and predictive client conduct. In a weblog publish titled “Kings of 2020: House Enchancment,” the group shared findings displaying that foot visitors in House Depot and Lowe’s has really grown most months throughout the pandemic in comparison with the identical months final 12 months.

Have a look at the month of Could. Lowe’s noticed an nearly 50% improve in retailer visits versus Could 2019. House Depot had 26% extra. Though there’s been some slowdown, foot visitors continues to be considerably up year-over-year. Visits additionally accelerated from September to October as we head into “what could possibly be an infinite vacation season for these chains,” as Placer.ai’s Ethan Chernofsky writes.

Gold Briefs: Glad Diwali; Judy Shelton Strikes Nearer to Fed Affirmation

The value of gold fell 4.5% final Monday, its greatest one-day drop since August. However don’t fear—gold’s day by day DNA of volatility is simply ±1%. The decline was a pretty shopping for alternative I hope you took benefit of.

This previous weekend marked the beginning of India’s five-day Diwali celebration. Also referred to as the Pageant of Lights, Diwali is taken into account an auspicious time for gold shopping for.

Indian gold demand fell 30% year-over-year within the September quarter as excessive costs discouraged customers. The excellent news is that 2020 was the second straight 12 months of excellent monsoon rains, which is supportive of India’s rural economic system, accountable for about 60% of annual gold demand, in response to the World Gold Council (WGC).

Additionally in gold-related information, Judy Shelton moved one step nearer to getting a seat on the Federal Reserve Board. The previous financial advisor to Trump helps each longer-for-longer rates of interest in addition to a return to a gold commonplace. Nevertheless unlikely that could be, it’s good to know somebody on the Fed has gold in thoughts.

Shelton could possibly be confirmed by the total Senate as early as this week.

Initially revealed by U.S. Funds, 11/16/20

The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 frequent inventory costs in U.S. firms.

Holdings might change day by day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. International Buyers as of (09/30/2020): United Airline Holdings Inc., Azul SA, Alaska Air Group Inc., Gol Linhas Aereas Inteligentes, Air France KLM, Air Canada, Copa Holdings SA, easyJet PLC, Singapore Airways Ltd., JetBlue Airways Corp., Air Transport Providers Group Inc., Cargojet Inc., Hawaiian Holdings Inc., LVMH Moet Hennessy Louis Vuitton SA, Burberry Group PLC, Kering SA, Christian Dior SE, Hermes Worldwide, Alibaba Group Holding Ltd., The House Depot Co., Lowe’s Cos. Inc., The Clorox Co., Domino’s Pizza Inc., Amazon.com Inc.

All opinions expressed and knowledge supplied are topic to vary with out discover. A few of these opinions might not be applicable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data provided by this/these web site(s) and isn’t accountable for its/their content material.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.