This submit goes to cowl what I

This submit goes to cowl what I consider is crucial query for portfolio diversification right now: are bonds dropping their function as the popular hedge asset and portfolio diversifier that they’ve held for the final 20 years?

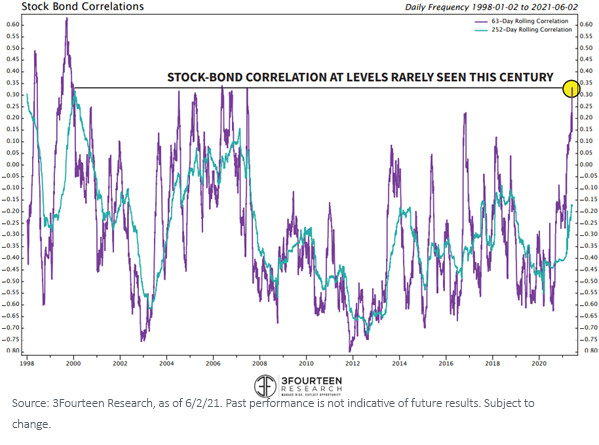

Based mostly on 63-day rolling correlation window evaluation carried out by Warren Pies, founding father of 3Fourteen Analysis, equity-bond correlation ranges have spiked to ranges not often seen within the final 20 years. These rising correlations—in the event that they persist or rise even larger—would suggest that bonds are beginning to lose their diversification advantages, and there could possibly be a time within the close to future when shares and bonds decline collectively.

Previously, we’ve assumed that on unfavourable days for fairness markets there can be bids within the U.S. Treasury bond market that will trigger bond yields to fall and their costs to rise.

With the market beginning to concern the results of rising inflation pressures—a story voiced by our Senior Funding Technique Advisor, Wharton Professor Jeremy Siegel—it could possibly be elevated for numerous years to return.

Rising charges may put some strain on the inventory market, and also you’d lose this diversification property that bonds have traditionally offered.

3Fourteen Analysis highlights the significance of actual belongings like commodities, gold and oil for his or her inflation hedging properties—and 3Fourteen at the moment runs a dynamic, actual asset mannequin that’s closely allocating to all these belongings in proportions that will be unusual in conventional 60% fairness/40% fastened earnings portfolio frameworks.

Worst Day Analytics

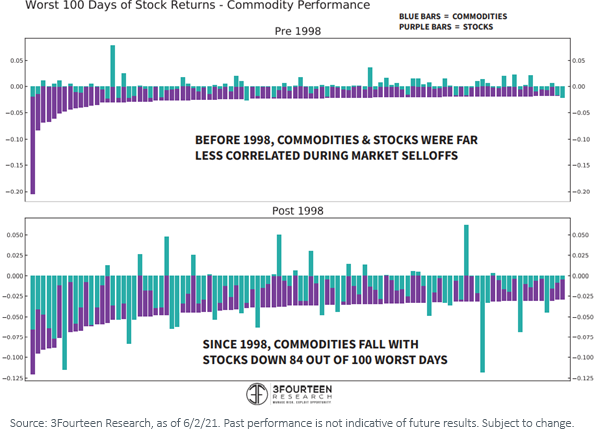

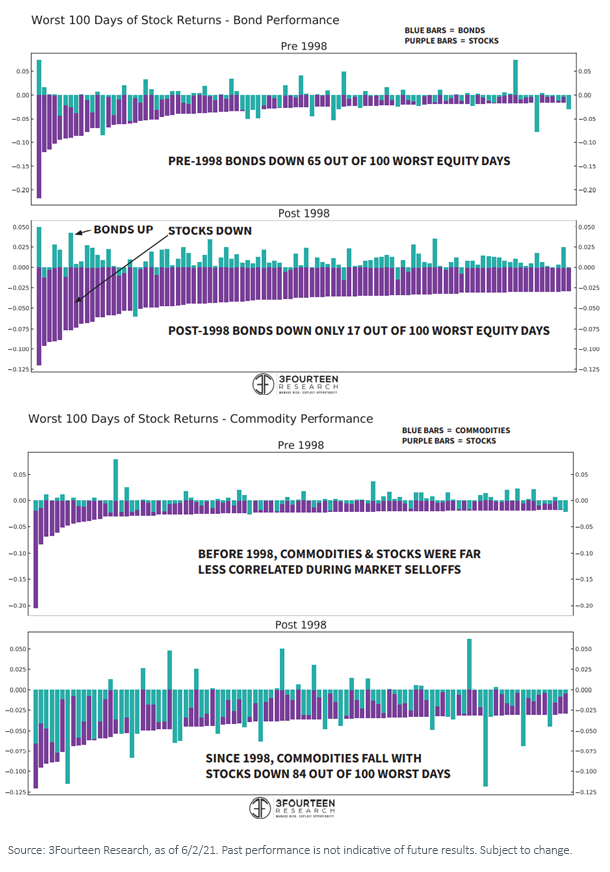

Evaluating efficiency on a few of the worst buying and selling days for equities can make clear the worth of diversifiers.

Trying on the 100 worst buying and selling days for equities since 1998, bonds had a unfavourable return on solely 17 of them, displaying that bonds served as a productive hedge asset over 80% of the time.

However if you happen to look again earlier than 1998, that relationship was extra precarious. It was extra possible that bonds additionally had a unfavourable return on down days for shares, as bonds had been down on 65 of these 100 worst days for equities.

Curiously, commodities had the alternative expertise.

Since 1998, commodities returns had been in sync with equities, declining on 84 of the 100 worst buying and selling days for shares. However earlier than 1998, commodities had been solely down on 53 of these worst buying and selling days for equities, in some methods being even higher diversifiers than bonds.

Commodities had been in a brutal bear marketplace for a lot of the final decade. There was not a lot inflation, and the construction of the commodities futures market was in contango such that the associated fee to roll futures eroded any features to be made in spot costs.

Over the last six to seven months, and significantly in 2021 so far, commodity costs have rebounded considerably, with each provide constraints and reopening demand creating this good mixture of upward strain on commodity costs.

The market dynamics look to be shifting such that bonds could possibly be dropping a few of their historic dominance as the popular portfolio diversifier. Commodities and managed futures methods that rely closely on commodity exposures are two locations buyers may search for new diversifiers inside this altering macro regime. For 2 attainable options, think about the WisdomTree Enhanced Commodity Technique Fund (GCC) and the WisdomTree Managed Futures Technique Fund (WTMF).

Initially printed by WisdomTree, 6/21/21

Vital Dangers Associated to this Article

No degree of diversification or non-correlation can guarantee income or assure in opposition to losses. GCC: There are dangers related to investing, together with the attainable lack of principal. An funding on this Fund is speculative, includes a considerable diploma of threat, and shouldn’t represent an investor’s complete portfolio. One of many dangers related to the Fund is the complexity of the various factors which contribute to the Fund’s efficiency. These elements embody using commodity futures contracts. Derivatives may be risky and could also be much less liquid than different securities and extra delicate to the results of assorted financial situations. The worth of the shares of the Fund relate on to the worth of the futures contracts and different belongings held by the Fund and any fluctuation within the worth of those belongings may adversely have an effect on an funding within the Fund’s shares. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

Commodities and futures are typically risky and are usually not appropriate for all buyers. Investments in commodities could also be affected by general market actions, modifications in rates of interest and different elements resembling climate, illness, embargoes and worldwide financial and political developments.

WTMF: There are dangers related to investing, together with the attainable lack of principal. An funding on this Fund is speculative, includes a considerable diploma of threat, and shouldn’t represent an investor’s complete portfolio. One of many dangers related to the Fund is the complexity of the various factors which contribute to the Fund’s efficiency, in addition to its correlation (or non-correlation) to different asset lessons. These elements embody using lengthy and brief positions in commodity futures contracts, forex ahead contracts, swaps and different derivatives. Derivatives may be risky and could also be much less liquid than different securities and extra delicate to the results of assorted financial situations. The Fund shouldn’t be used as a proxy for taking lengthy solely (or brief solely) positions in commodities or currencies. The Fund may lose important worth in periods when lengthy solely indexes rise (or brief solely) indexes decline. The Fund’s funding goal relies on historic worth traits. There may be no assurance that such traits can be mirrored in future market actions. The Fund typically doesn’t make intra-month changes and subsequently is topic to substantial losses if the market strikes in opposition to the Fund’s established positions on an intra-month foundation. In markets with out sustained worth traits or markets that shortly reverse or “whipsaw,” the Fund could undergo important losses. The Fund is actively managed thus the power of the Fund to realize its aims will depend upon the effectiveness of the portfolio supervisor. Because of the funding technique of this Fund it might make larger capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which incorporates funding aims, dangers, prices, bills, and different info; learn and think about fastidiously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. Overseas investing includes forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms could expertise larger worth volatility. Investments in rising markets, forex, fastened earnings and various investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency shouldn’t be indicative of future outcomes. This materials incorporates the opinions of the writer, that are topic to alter, and will to not be thought-about or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a proposal or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work underneath all market situations. This materials represents an evaluation of the market setting at a selected time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety specifically. The person of this info assumes the whole threat of any use product of the data offered herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Buyers searching for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially symbolize the views of WisdomTree or any of its associates.

The MSCI info could solely be used to your inner use, will not be reproduced or re-disseminated in any kind and will not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding choice and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is offered on an “as is” foundation and the person of this info assumes the whole threat of any use product of this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Social gathering have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or every other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can’t make investments instantly in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.