The most up-to-date

The most up-to-date Federal Open Market Committee (FOMC) assembly triggered a response in each fairness and glued earnings markets reversing the inflation commerce that has pushed long run rates of interest up and put worth in favor over development shares. The U.S. Federal Reserve hinted that inflationary pressures is probably not as transitory as first thought resulting in expectations of a possible taper in asset purchases and a possible shift of their timeline relating to fee will increase. Whereas the extra hawkish tone pushed long-term charges down, we count on to see charges resume an upward path over the near-term.

There was a number of debate regarding whether or not or not inflation is transitory. This is a crucial idea and has been utilized by extra dovish Fed members to justify an accommodative financial coverage into 2023. Inflation may be cost-push or demand-pull. Within the present atmosphere, we’re seeing each in play. For instance, provide chain disruptions and dislocations created by COVID have lowered the availability of products and providers, due to this fact, inserting upward stress on costs.

[wce_code id=192]

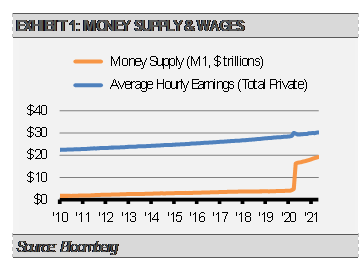

Couple this with pent up demand, a number of liquidity (exhibit 1), stimulus, low rates of interest, and better wage pressures, and it makes it exhausting to not count on rates of interest to renew an upward trajectory from their current lows. The extent and length of this may largely rely upon which components are literally transitory and if the Fed reacts promptly with fee hikes whereas abandoning their present rate of interest hike expectations.

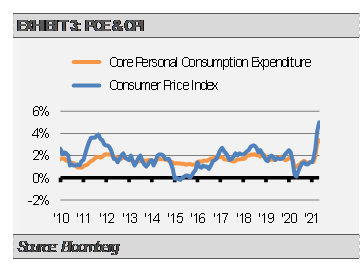

The Fed to this point has taken the place that inflation is transitory for probably the most half and has proven a willingness to disregard inflation by permitting it to float larger than their goal as a substitute of remaining extra targeted on employment ranges as a set off. Of concern is that some parts impacting inflation is probably not as momentary. For instance, wage charges are usually sticky, and this coupled with enhancements within the unemployment fee in addition to rate of interest hikes off the desk till 2023 as deliberate, may imply demand-pull inflation stays. One other consideration is the Fed’s inflation goal is the Core Private Consumption Expenditures (PCE) deflator, which excludes meals and vitality, reasonably than the Shopper Value Index (CPI), which is inclusive of meals and vitality and tends to run larger.

This leaves a number of room for inflation expectations to maneuver rates of interest larger a minimum of over the near-term and probably set off a shift in Fed coverage impacting each the lengthy and quick finish of the yield curve.

The present atmosphere creates complexities for fastened earnings buyers. The dangers to each the lengthy and quick ends of the yield curve make variable fee and inflation-linked methods enticing. Variable fee bonds, preferreds, and financial institution loans have coupons that reset based mostly on a reference fee, which is correlated with the Fed Funds Goal Fee or the markets expectations with respect to the speed. This offers buyers with a hedge from a shock shift in Fed coverage because of inflation.

Inflation-linked bonds can even present safety from rising charges because of inflation expectations and are supplied in various length ranges. These securities alter the principal with strikes in inflation. Coupon funds, due to this fact, can be calculated on the inflation adjusted principal.

DISCLOSURES

Any forecasts, figures, opinions or funding methods and methods defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought of to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to vary with out reference or notification. The views contained herein are to not be taken as recommendation or a suggestion to purchase or promote any funding and the fabric shouldn’t be relied upon as containing enough data to help an funding choice. It needs to be famous that the worth of investments and the earnings from them could fluctuate in accordance with market situations and taxation agreements and buyers could not get again the complete quantity invested.

Previous efficiency and yield is probably not a dependable information to future efficiency. Present efficiency could also be larger or decrease than the efficiency quoted.

The securities recognized and described could not signify the entire securities bought, bought or really helpful for consumer accounts. The reader mustn’t assume that an funding within the securities recognized was or can be worthwhile.

Knowledge is offered by varied sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an impartial accountant.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.