Let’s take a fast dive into the markets. For the previous 3+ months, the story has been “the bigger the inventory, the higher it’s performing.” If we take a look at the power of enormous cap shares (greater corporations) versus mid cap and small cap shares, the management traces up in sequential order: massive caps lead mid-caps, and mid-caps lead small caps. Bigger corporations have been outperforming the remainder of market. As massive cap shares rise, like those within the S&P 500, mid cap and small cap indexes have been in a sideways buying and selling vary for many of this yr.

[wce_code id=192]

Present danger adjusted rankings for the US Model Indexes (based mostly on Canterbury’s Volatility-Weighted-Relative-Power):

| Danger-Adjusted Rank | US Model Index |

| 1 | Massive Cap Development |

| 2 | Massive Cap Mix |

| 3 | Massive Cap Worth |

| 4 | Mid Cap Worth |

| 5 | Mid Cap Mix |

| 6 | Mid Cap Development |

| 7 | Small Cap Worth |

| 8 | Small Cap Mix |

| 9 | Small Cap Development |

Supply: Canterbury Funding Administration, utilizing State Avenue Model Index ETFs

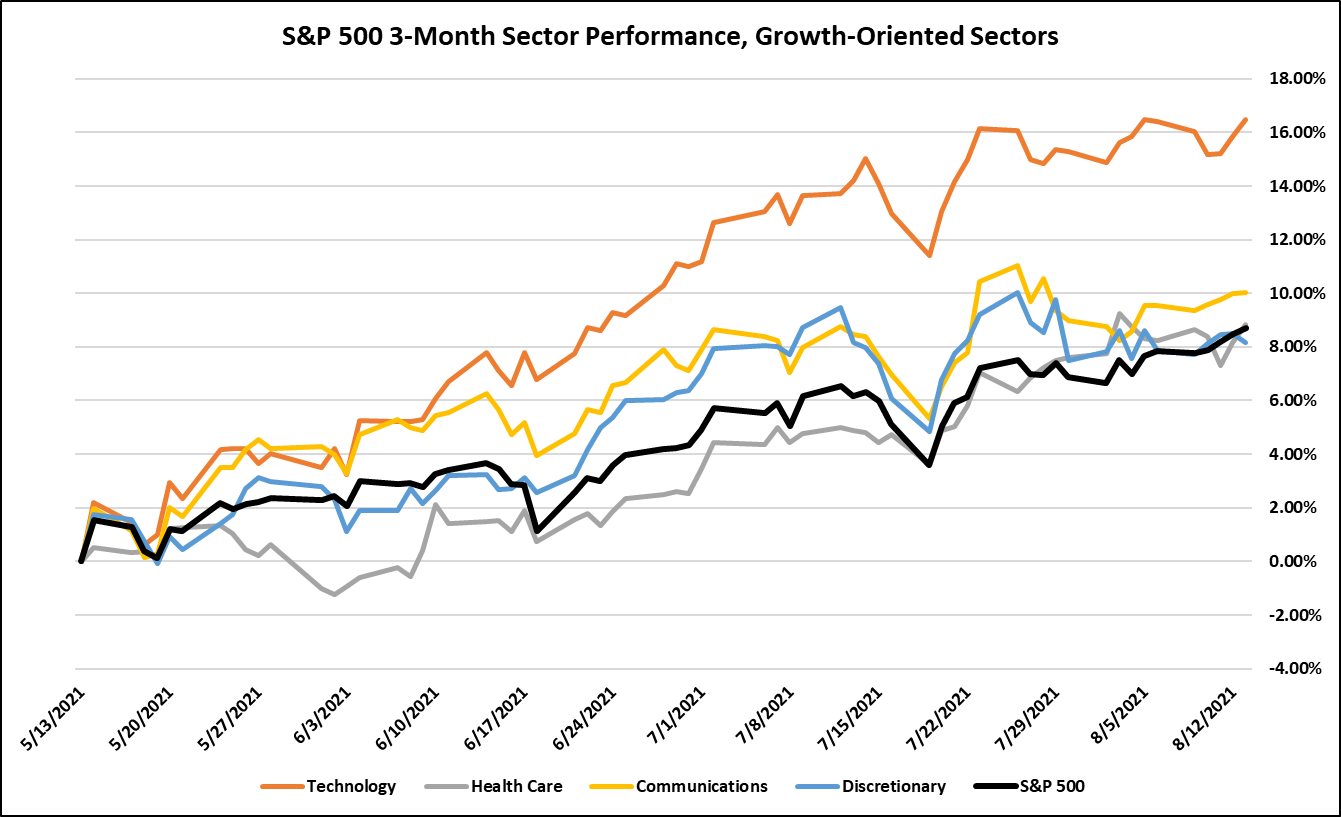

If we look at simply massive caps, the identical theme has utilized. Bigger securities inside the S&P 500 have dominated the markets during the last Three months. As a matter of truth, the S&P 500 is up 8% over the at time, whereas the know-how sector is up 16.5% and Discretionary, Communications, and Healthcare are within the 8-10% vary. These sectors, proven within the chart under, have largely growth-stocks carrying them. Collectively, the sectors account for about two-thirds of the inventory market’s total motion.

Supply: Canterbury Funding Administration, utilizing State Avenue Sector ETFs

In the meantime, as for the opposite seven sectors, excluding Actual Property, none of them are up greater than 5% within the final Three months. The purpose right here is to not give attention to the proportion returns, however to point out simply how a lot the market has been led by bigger sectors and lagged by smaller ones.

Supply: Canterbury Funding Administration, utilizing State Avenue Sector ETFs

Sector Rotation- Backside Line

We simply mentioned how for the final Three months the markets have been led by bigger parts. Massive cap shares lead mid cap shares, which lead small cap shares. The large query is, “the place will the markets go from right here?” Will this pattern proceed? Possibly, however we’re seeing some smaller sectors begin to take some management. Take a look at the chart that includes the S&P 500 and the 6 sectors exterior of the tech/well being care shares. Discover that sectors akin to Utilities, Client staples, and financials have began having a little bit of relative outperformance over the previous couple of weeks.

To start the month of August, Utilities and Staples had been ranked #10 and #6. At the moment, Utilities has risen all the best way to #Four and Staples is #3. These are historically regarded as extra “defensive” sectors, so it’s fascinating to see them rising in our risk-adjusted ranks. However, know-how and communications have slipped just a few spots. That is fascinating for the markets, and it does enhance the market’s breadth. There may be extra participation amongst securities.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.